UPSC Daily Current Affairs- 7th October 2023 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS-I

Tribes in news: Hakki- Pikki

Subject: Indian Society

Why in News?

Thirty-one tribals belonging to the ‘Hakki-Pikki’ community from Karnataka are stranded in Sudan due to violent clashes between a paramilitary force and the country’s armed forces.

Who are the Hakki-Pikkis?

| Description | |

| Origin | Migrated from northern India to Karnataka. |

| Traditional Occupation | Traditionally known for bird hunting, which was later outlawed. |

| Language | Indo-Aryan language called ‘Vaagri’ and use Kannada for daily business. |

| Location | Predominantly found in Shivamogga, Davanagere, and Mysuru districts of Karnataka |

| Lineage | A matriarchal community, where women have an important role in decision-making. |

| Traditional Knowledge | Known for selling indigenous medicines developed based on their knowledge of plants and herbs. |

Language and UNESCO Listing

- ‘Vaagri’ has been listed as one of the endangered languages by UNESCO.

- This indicates that the language is at risk of becoming extinct in the future, highlighting the importance of preserving and promoting it.

Source: Indian Express

Battle of Colachel: How an accidental shot ended Dutch plans for India

Subject: Modern History

Why in News?

The Battle of Colachel in 1741, where King Marthanda Varma led the Travancore army against the Dutch East India Company, marked a significant turning point in India’s history.

- It was the first instance of an Asian kingdom defeating a European power, effectively halting Dutch colonial ambitions in India.

- This battle also had profound implications for the formation of the unified Travancore state.

Travancore’s Complex Landscape Before 1741

- Fragmented Territories: Travancore, formerly known as Thiruvithamcode, was not a unified state but a network of south Malabar temple states and settlements, characterized by fragmented territories and chieftaincies.

- Marthanda Varma’s Leadership: Born in 1705, Marthanda Varma ascended to power and set his sights on unifying the kingdom by annexing neighboring regions and eliminating internal opposition.

- Territorial Expansion: His ambition to expand threatened neighboring rulers in Kayamukulam, Kollam, Attingal, and others, leading them to seek Dutch intervention against Varma.

- English Connection: Varma’s military relations with the English, who supplied weaponry, further strained Dutch-Travancore relations.

Factors Leading to the Battle

- Dutch Resistance: The Dutch, perturbed by Varma’s expansion and territorial disputes, prepared their forces in Colachel to counter Travancore.

- Internal Conflicts: Some Dutch officials, including Carl August Duijvenschot, defected to Travancore due to internal conflicts within the Dutch ranks.

- Neighboring Rulers’ Instigation: Cochin and Kayamukulam rulers instigated the Dutch against Varma to safeguard their borders.

Battle of Colachel: Unfolds

- Dutch Aggression: In February 1741, the Dutch initiated attacks on several villages and the Travancore army, committing atrocities and plundering the region.

- Varma’s Response: Marthanda Varma deployed his military commander, Rama Iyer Dalawah, to confront the Dutch and protect his kingdom.

- International Support: The French supported Varma against the Dutch, and even the English participated in the siege of Colachel alongside Varma’s forces.

Siege and Surrender

- Long Siege: The continuous attacks and siege depleted Dutch supplies and manpower, leading to a dire situation.

- Explosion and Surrender: On August 5, 1741, a gunpowder explosion occurred in Colachel, devastating the Dutch. Two days later, they surrendered.

- Outcome: Only 24 Dutchmen survived, and Travancore captured 389 muskets, cannons, and swords.

- Mukkuvar Community: The Mukkuvar fishermen community, by refusing to assist the Dutch with fortifications and supplies, played a crucial role in Travancore’s victory.

Aftermath and Legacy

- Resilience to Colonial Rule: The victory at Colachel bolstered Varma’s expansion plans and resistance to colonial rule.

- Dutch Retreat: The Dutch never fully recovered from their defeat and signed the Treaty of Mavelikkara in 1753, ending their dominance on the Kerala coast.

- De Lannoy’s Contribution: Eustachius De Lannoy, captured during the battle, played a vital role in training Travancore’s army and fortifying the region. He was conferred the title ‘Valia Kappithan’ (senior admiral) and served Travancore for 36 years.

Source: Indian Express

GS-II

When can a bill be designated as a money bill

Subject: Polity and Governance

Why in News?

Chief Justice of India said that a seven-judge bench will soon be set up to hear a batch of pleas challenging the Centre’s use of the money bill route to pass certain key legislations.

- CJI’s observation about setting up a seven-judge bench came during the hearing challenging set of amendments to the Prevention of Money Laundering Act (PMLA).

Finance Bill

- In a general sense, any Bill that relates to revenue or expenditure is a financial Bill.

- A money Bill is also a specific type of financial Bill, that must deal only with matters specified in Article 110 (1) (a) to (g).

- Financial bills are responsible for the fiscal matters such as government spending or revenue.

- It specifies the amount of money to be spent by the government and the way it is to be spent.

- More specifically, Article 117 of the Constitution deals with the special provisions relating to financial Bills.

- Financial bills are a component of the constitution and the union budget.

Money Bill

- Article 110 defines a money Bill as one containing provisions dealing with taxes, regulation of the government’s borrowing of money, and expenditure or receipt of money from the Consolidated Fund of India, among others.

- Article 109 delineates the procedure for the passage of such a Bill and confers an overriding authority on the Lok Sabha in the passage of money Bills.

- The Speaker certifies a Bill as a Money Bill, and the Speaker’s decision is final.

- Over the last seven years, the government has introduced multiple legislations through the money Bill route, the most notable of which are the Aadhaar Act, 2016, and the Finance Act, 2017.

What is the difference between money Bills and financial Bills?

- While all Money Bills are Financial Bills, all Financial Bills are not Money Bills.

- E.g., the Finance Bill which only contains provisions related to tax proposals would be a Money Bill.

- However, a Bill that contains some provisions related to taxation or expenditure, but also covers other matters would be considered as a Financial Bill.

- The Compensatory Afforestation Fund Bill, 2015, which establishes funds under the Public Account of India and states, was introduced as a Financial Bill.

- The procedure for the passage of the two bills varies significantly.

- The Rajya Sabha has no power to reject or amend a Money Bill.

- After being passed by the Lok Sabha, money Bills are sent to the Rajya Sabha for its recommendations.

- Within 14 days, the Upper House must submit the Bill back to the Lower House with its non-binding recommendations.

- If the Lok Sabha rejects the recommendations, the Bill is deemed to have passed by both Houses in the form in which it was passed by the Lok Sabha without the recommendations of the Rajya Sabha.

- Even if the Rajya Sabha doesn’t respond with its recommendations within 14 days, the same consequences would follow.

- However, a Financial Bill must be passed by both Houses of Parliament.

- The Rajya Sabha has no power to reject or amend a Money Bill.

- While an ordinary Bill can originate in either house, a money Bill can only be introduced in the Lok Sabha, as laid down in Article 117 (1).

- Additionally, no one can introduce or move money Bills in the Lok Sabha, except on the President’s recommendation.

- Amendments relating to the reduction or abolition of any tax are exempt from the requirement of the President’s recommendation.

- The two prerequisites for any financial Bill to become a money Bill are that

- It must only be introduced in the Lok Sabha and not the Rajya Sabha.

- These bills can only be introduced on the President’s recommendation.

Background of the present case

- Question regarding the validity of PMLA

- In July 2022, a three-judge bench had upheld the PMLA and the vast powers of the ED.

- However, the bench had left the validity of amendments to the PMLA through the Money Bill route open for a larger Constitution bench to hear.

- The Finance Acts passed in 2015, 2016, 2018 and 2019 brought in crucial amendments to the PMLA.

- Finance Bills passed during the budget are introduced as money bills under Article 110 of the Constitution.

- Aadhaar as money bill

- The first major challenge on whether a bill qualified to be a money bill under the Constitution was in the Aadhaar case.

- In a 4:1 majority, the Supreme Court in 2018, had ruled in favour of the government and had cleared the Aadhaar Act as a valid money bill under Article 110 of the Constitution.

- Incidentally, Justice Chandrachud had been the lone dissenter in the Aadhaar ruling of 2018.

- He had called it a “fraud on the Constitution” and “subterfuge”.

- Tribunal reform

- In November 2019, in Roger Matthew vs Union of India, the SC heard the challenge against tweaks in the service conditions of tribunal members which was also introduced as a money bill in the Finance Act, 2017.

- While a five judge bench of the court struck down the law as unconstitutional for interfering with judicial independence, it referred the money bill aspect to a larger constitution bench.

- In doing so, the court also expressed doubts over the correctness of a five-judge Constitution Bench’s 2018 verdict upholding the Aadhaar Act which had been passed as a money Bill.

Source: Indian Express

TRAI can’t regulate OTT platforms: TDSAT

Subject: Governance

Why in News?

The Telecom Disputes Settlement and Appellate Tribunal (TDSAT) has issued an interim order clarifying that Over the Top (OTT) platforms, such as Hotstar, fall outside the jurisdiction of the Telecom Regulatory Authority of India (TRAI).

- Instead, they are governed by the Information Technology Rules, 2021, established by the Ministry of Electronics and Information Technology (MeitY).

Context for TDSAT’s Decision

- The All India Digital Cable Federation (AIDCF) initiated the petition, alleging that Star India’s free streaming of ICC Cricket World Cup matches on mobile devices through Disney+ Hotstar is discriminatory under TRAI regulations.

- This is because viewers can only access matches on Star Sports TV channels by subscribing and making monthly payments.

Diverging Opinions on OTT Regulation

- IT Ministry vs. DoT: The IT Ministry contends that internet-based communication services, including OTT platforms, do not fall under the jurisdiction of the DoT, citing the Allocation of Business Rules.

- DoT’s Draft Telecom Bill: The DoT proposed a draft telecom Bill that classifies OTT platforms as telecommunications services and seeks to regulate them as telecom operators. This move has encountered objections from MeitY.

TRAI’s Attempt at OTT Regulation

- Changing Stance: TRAI, after three years of maintaining that no specific regulatory framework was required for OTT communication services, began consultations on regulating these services.

- Consultation Paper: In June, TRAI released a consultation paper seeking input on regulating OTT services and exploring whether selective banning of OTT services could be considered as an alternative to complete Internet shutdowns.

- Telecom Operators’ Demand: Telecom operators have long advocated for “same service, same rules” and have pushed for regulatory intervention for OTT platforms.

Significance of TDSAT’s Order

- TDSAT decision holds significance due to ongoing debates over the regulation of OTT services.

- TRAI and the Department of Telecommunications (DoT) have been attempting to regulate OTT platforms, while the Ministry of Electronics and Information Technology opposes these efforts.

Recommendations and Monitoring

- In September 2020, TRAI recommended against regulatory intervention for OTT platforms, suggesting that market forces should govern the sector.

- However, it also emphasized the need for monitoring and intervention at an “appropriate time.”

Conclusion

- The recent TDSAT ruling on OTT platform jurisdiction adds complexity to the ongoing debate over the regulation of these services in India.

- While TRAI and the DoT seek regulatory measures, the IT Ministry contends that such services fall outside the purview of telecommunications regulation.

- The evolving landscape highlights the need for a nuanced approach to balance the interests of various stakeholders, including telecom operators, government authorities, and the broader public.

Source: Indian Express

GS-III

Monetary Policy: RBI’s status quo and an indication that rate cuts would have to wait

Subject: Economics

Why in News?

With retail inflation remaining a major risk to macroeconomic stability and sustainable growth, the 6-member Monetary Policy Committee (MPC) of the RB) has decided to keep the key interest rates unchanged for the 4th consecutive time.

- As a result, banks will not raise their lending rates, which means that the equated monthly instalments (EMIs) on home, vehicle and personal loans will remain steady.

What is Monetary Policy?

- Meaning: It is the demand side economic policy used to achieve macroeconomic objectives like inflation, consumption, growth and liquidity.

- Monetary policy in India:

- In India, the monetary policy of the RBI is aimed at managing the quantity of money in order to meet the requirements of different sectors of the economy and to increase the pace of economic growth.

- For example, liquidity is crucial to stimulate growth for an economy. The RBI depends on monetary policy to maintain liquidity.

- The RBI implements the monetary policy through open market operations (OMOs), bank rate policy, reserve system, credit control policy, moral persuasion, etc.

- For example, the RBI introduces the money in the economy and cuts the interest rate by buying bonds through OMOs.

- The use of any of these tools will result in adjustments in interest rate or the money supply in the economy.

- In India, the monetary policy of the RBI is aimed at managing the quantity of money in order to meet the requirements of different sectors of the economy and to increase the pace of economic growth.

- Classification of monetary policy:

- Monetary policy can be classified as expansionary (or accommodative) and contractionary (or tight) in nature.

- Accommodative monetary policy is triggered to encourage more spending from consumers and businesses by increasing money supply and reducing interest rates.

- When firms can easily borrow money, they have more funds to expand operations and hire more workers, resulting in a lower unemployment rate.

- On the other hand, if the money supply is loosened over an extended period of time, there will be too much money chasing too few goods and services, resulting in inflation.

- To avoid inflation, most central banks rotate between accommodating and tight monetary policy (decreasing the money supply and raising interest rates) to varied degrees in order to promote growth while keeping inflation under control.

What is the Monetary Policy Committee (MPC)?

- The Reserve Bank of India (RBI) Act, 1934 was amended by the Finance Act, 2016 to constitute MPC.

- MPC is responsible for fixing the benchmark interest rate in India, bringing more transparency and accountability in fixing India's Monetary Policy.

- The committee comprises six members - three officials of the RBI and three external members nominated by the Government of India (GoI). The RBI Governor is the chairperson (ex officio) of the committee.

- The current mandate of the committee is to maintain 4% (+/- 2%) annual consumer price index-based inflation (CPI) rate and the committee is answerable to the GoI if the inflation exceeds the range prescribed for three consecutive quarters.

Why is the RBI in Pause Mode?

- While the MPC has retained the policy stance as ‘withdrawal of accommodation’ in a majority 5:1 decision, it has also retained the inflation projection at 5.4% for FY2024 in the wake of the high food inflation

- While retaining the GDP growth at 6.50% for FY2024, the policy panel signals that a rate cut is unlikely in the near future.

- The RBI has focused on its stance of ‘withdrawal of accommodation’ until all risks to inflation dissipate.

- Withdrawal of accommodation will mean reducing the money supply in the system which will rein in inflation further.

- The pause in the Repo rate - the rate at which RBI lends money to banks to meet their short-term funding needs - is because the overall inflation outlook is clouded by uncertainty by

- The fall in kharif sowing,

- Lower reservoir levels,

- Volatile global food and energy prices.

What will Happen to Lending, Deposit Rates?

- As the RBI has kept the policy rate unchanged, all external benchmark lending rates (EBLR) linked to the repo rate will not rise.

- Notably, EBLRs - 81% of which are linked to the benchmark repo rate - now dominate the mix of outstanding floating rate loans.

- It will provide some relief to borrowers as their equated monthly instalments (EMIs) will not increase.

- Banks will also not increase fixed deposit rates in the wake of the pause in Repo rate.

- The decision to hold deposit rates at the current levels will be driven by surplus liquidity in the banking system.

- This is due to improvement in low-cost current account and savings account (CASA) balance (Rs 3.42 lakh crore) following the deposit of Rs 2000 banknotes.

What are the Risks Ahead?

- The RBI panel met against a backdrop of growing domestic as well as external economic challenges.

- These domestic challenges encompass growing risks to consumption demand amid high food inflation, an uneven monsoon adversely affecting kharif crops and higher interest rates.

- Retail inflation eased to 6.83% in August from a 15-month high of 7.44% in July, however, it continues to remain above the RBI’s comfort zone of ± 2%.

- The recent spike in crude oil prices (sitting above $85 per barrel) and global bond yields will keep MPC vigilant on inflation-growth dynamics.

Source: Indian Express

Indian-Built ARTIP Technology Revolutionizes Astronomy

Subject: Science and Technology

Why in News?

India’s Automated Radio Telescope Image Processing Pipeline (ARTIP) technology has been instrumental in facilitating remarkable discoveries from distant galaxies observed by South Africa’s MeerKAT Telescope.

- MeerKAT acts as a precursor to the Square Kilometre Array (SKA) Telescope, known for its outstanding sensitivity and sky survey capabilities.

- ARTIP’s cutting-edge image data processing is vital for harnessing MeerKAT’s potential for groundbreaking research.

What is ARTIP?

- Development by Thoughtworks: ARTIP was developed by global technology consultancy firm Thoughtworks at its India offices in Bengaluru and Pune.

- Automation of Data Processing: Since 2017, this collaboration has aimed to automate various critical processes, including data processing, flagging, calibration, and imaging.

How ARTIP operates?

- Configurability: ARTIP is highly configurable and customizable, designed to process MeerKAT-generated data. While initially configured for MeerKAT, its adaptability allows it to process data from uGMRT and VLA class telescopes.

- Pipeline Components: It consists of four individual sub-pipelines, including calibration, cube imaging, continuum imaging, and diagnostics, each serving different stages of the data processing workflow.

- Calibration (ARTIP-CAL): This component calibrates data against known astronomical sources and extracts the target source of interest.

- Cube Imaging (ARTIP-CUBE): The calibrated target is then used to generate sky images using this component.

- Continuum Imaging (ARTIP-CONT): This pipeline focuses on generating images from the calibrated data.

- Diagnostics (ARTIP-DIAGNOSTICS): Providing analysis insights into data processing and quality, it functions as a quality assurance pipeline.

Impactful Discoveries by ARTIP

- Hydroxyl Radical (OH) Detection: ARTIP has contributed to significant discoveries, including the detection of the hydroxyl radical (OH), an essential chemical species found throughout the atmosphere in a distant galaxy.

- Identification of Hydrogen Atoms: It has also played a crucial role in identifying massive hydrogen atoms (Rydberg atoms) in another distant galaxy.

- Scientific Recognition: The MALS data processing with ARTIP has received recognition in the international astronomical journal, Proceedings of Science, for its contributions to these discoveries.

Source: Indian Express

Fischer – Tropsch (FT) process

Subject: Science and Technology

Why in News?

Researchers recently discovered previously unknown self-sustained oscillations in the Fischer-Tropsch process that could someday allow for more efficient fuel production.

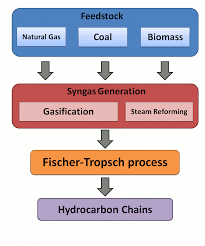

About Fischer – Tropsch (FT) process:

- FT process is the process where synthesis gas (H2 and CO) is converted into a mixture of hydrocarbons, oxygenates, water, and carbon dioxide.

- It was first developed in the 1920s and was named after its discoverers, Franz Fischer and Hans Tropsch.

- It involves the reaction of carbon monoxide (CO) and hydrogen (H2) gases. These gases are typically derived from various sources, including coal, natural gas, or biomass, through the process of gasification.

- FT process:

- Synthesis gas (syngas) is the feed material for a FT process.

- The FT reaction is usually a catalytic reaction at high temperatures and high pressure and the typical catalysts used are based on iron or cobalt.

- FT process is the catalytic polymerization and hydrogenation of CO, which produces a synthetic crude oil (syncrude).

- Syncrude is a multiphase mixture of hydrocarbons, oxygenates, and water.

- The next step is the refining of the syncrude into products that are traditionally produced from conventional crude oil, such as transportation fuels and petrochemicals.

- Applications:

- It has several important applications, including the production of synthetic fuels and chemicals.

- The hydrocarbons produced by the FT process can be refined and used in place of more conventional liquid fuels derived from crude oil.

- Generally, these products are of higher quality than those derived through conventional means, having no sulphur or aromatics.

Source: The Hindu

|

38 videos|5275 docs|1115 tests

|

FAQs on UPSC Daily Current Affairs- 7th October 2023 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is the significance of the Battle of Colachel in Dutch plans for India? |  |

| 2. When can a bill be designated as a money bill? |  |

| 3. Why can't TRAI regulate OTT platforms? |  |

| 4. What does RBI's status quo on monetary policy mean? |  |

| 5. How does the Indian-Built ARTIP technology revolutionize astronomy? |  |