Key Notes: Recording of Transactions - II | Accountancy Class 11 - Commerce PDF Download

A small business may be able to record all its transactions in one book only, i.e., the journal. But as the business expands and the number of transactions becomes large, it may become cumbersome to journalize each transaction. For the quick, efficient, and accurate recording of business transactions, Journal is sub-divided into special journals. These special journals are also called day books or subsidiary books. A transaction that cannot be recorded in any special journal is recorded in a journal called the Journal Proper.

Following are the subsidiary books for special purposes:

- Cash Book

- Purchase Book

- Purchases Return Book,

- Sales Book

- Sales Return Book

- Journal Proper, etc.

1. Cash Book: Cash Book is a special Journal that is used for recording all cash receipts and cash payments. It starts with the cash or bank balances at the beginning of the period. The Cash Book is both a journal and a ledger. It is also called the book of original entry.

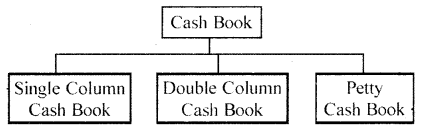

Types of Cash Book

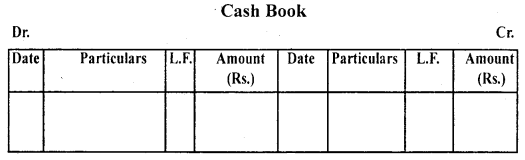

- Single Column Cash Book: Single Column Cash Book records all cash transactions of the business in chronological order. It has one amount column on each side. All cash receipts are recorded on the debit side and all cash payments are recorded on the credit side.

Format of Single Column Cash Book:

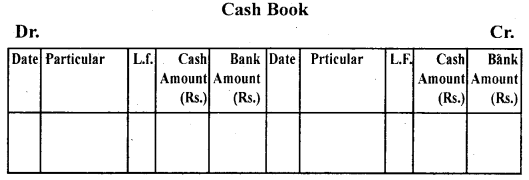

- Double Column Cash Book: Double Column Cash Book has two amount columns (One for Cash and one for Bank) on each side when the number of bank transactions is large, it is convenient to have a separate amount column for bank transactions in the cash book itself instead of recording them in the journal. This helps in getting information about the position of the bank account from time to time. All cash receipts, deposits into the bank are recorded on the debit side and all cash payments and withdrawals from the bank are recorded on the credit side.

Contra Entry: When cash is deposited into the bank, and when cash is withdrawn from the bank for use1 in the office, each such transaction affects both ‘Cash column’ as well as ‘Bank column’, and the transaction is, therefore, recorded on both sides of the cash book. Such entries, the double-entry of which is complete in the cash book itself, are called contra entries’.

Format of Double Column Cash Book:

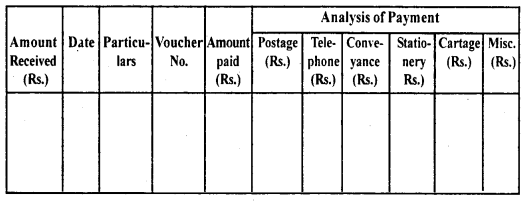

- Petty Cash Book: In every organization, a large number of small payments such as conveyance, cartage, postage, telegrams, and other expenses are made. These are generally repetitive in nature. If all these payments are handled by the cashier and are recorded in the main cash book, the procedure is found to be very cumbersome. To avoid this large organizations normally appoint one more cashier (petty cashier) and maintain a separate cash book to record these transactions such a cash book maintained by the petty cashier is called a petty cash book. The petty cashier works on the imprest system.

Format of Petty Cash Book:

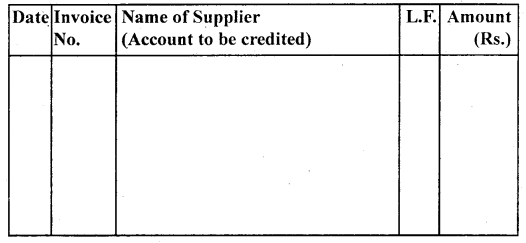

2. Purchases (Journal) Book: All credit purchases of goods are recorded in the Purchases (Journal) Book. It records neither the cash purchase of the goods nor the purchase of any assets other than the good. The source documents for recording entries in the books are invoices or bills received by the firm from the supplies of the goods. Entries are made with the net amount of the invoice. The monthly total of the purchases book is posted to the debit of purchases account in the ledger.

Format of Purchases (Journal) Book:

Purchase (Journal) Book

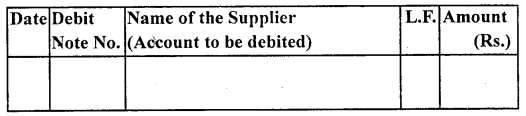

3. Purchases Return (Journal) Book: Purchases Returns Book (Return Outward Book) is used for the purposes of recording the returns of goods purchased on credit. It records neither the returns of goods purchased on a cash basis nor the returns of any assets other than the goods. The entries in the purchases return book are usually made on the basis of debit notes issued to the suppliers or credit notes received from the suppliers.

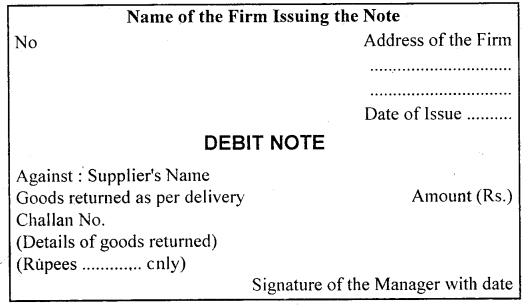

A debit note is a document prepared by the purchaser to inform the supplier that his account has been debited with the amount mentioned and for the reasons stated therein. The debit note contains the date of return, name of the supplier to whom the goods have been returned, details of the goods returned, reasons for returning the goods. Each debit note is serially numbered.

Format of Purchases Return (Journal) Book:

Purchases Return (Journal) Book

Format of Debit Note:

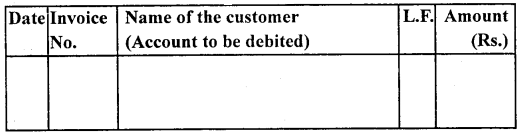

4. Sales (Journal) Book: All credit sales of goods are recorded in the sales journal. It records neither the cash sale of the goods nor the sale of any assets other than goods. The source document for recording entries in the sales journal is a sales invoice or bill issued by the firm to the customer.

Format of Sales (Journal) Book:

Sales (Journal) Book

The sales journal is totaled periodically (generally monthly), and this total is credited to the sales account in the ledger.

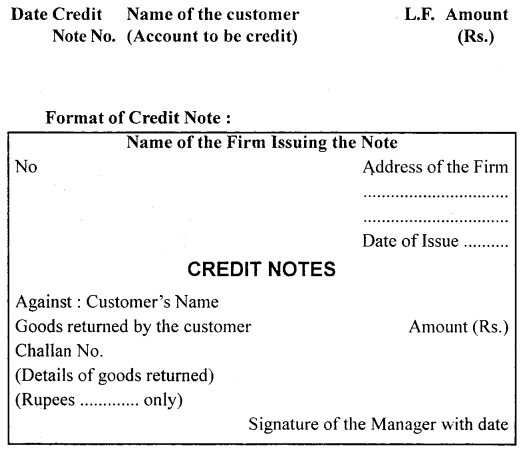

5. Sales Return (Journal) Book: This journal is used to record the return of goods by customers to them on credit. On receipt of goods from the customer, a credit note is prepared. The source document for recording entries in the sales return book is generally the credit note.

A credit note is a document prepared by the seller to inform the buyer that his account has been credited with the amount mentioned and for the reasons stated therein. Credit does not contain the date of return of goods, the name of the customer who has returned the goods, detail Is of goods received back, and the number of such goods. Each credit r/ote is serially numbered.

Format of Sales Return (Journal) Book:

Sales Return (Journal) Book

6. Journal Proper: Journal proper is a residuary book in which those transactions are recorded which cannot be recorded in any other subsidiary book. The various examples of transactions entered in a journal proper are opening entry, Adjustment Entries, Rectification Entries, Transfer Entries, Closing Entries, etc.

|

61 videos|227 docs|39 tests

|