Comptroller and Auditor General of India | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year PDF Download

Introduction

The Comptroller and Auditor General of India (CAG), an independent authority mandated by Article 148 of the Constitution, serves as the Head of Indian Audit and Accounts. This position makes the CAG the guardian of the public purse and gives them the responsibility to supervise the entire financial system of the country at both the Central and state levels. As one of the essential pillars of India's democratic system, the CAG, along with institutions like the Supreme Court, the Election Commission, and the Union Public Service Commission, plays a crucial role in ensuring transparency, accountability, and effective financial management.

Background

- Article 148 Establishment:

- Independent office established by Article 148 for the Comptroller and Auditor General (CAG).

- Leadership Role:

- CAG serves as the head of the Indian Audit and Accounts Department.

- Guardian of Public Purse:

- Designated as the "guardian of Public Purse," with a primary duty to uphold the constitution and parliamentary laws related to finance administration.

- Role with Parliament:

- Crucial role as a guide to the Public Accounts Committee of the Parliament.

- Emphasis by B.R. Ambedkar:

- B.R. Ambedkar highlighted the significance of the CAG, considering it the most important officer under the Indian Constitution.

- Key Pillar in Democracy:

- CAG is regarded as a key pillar of India's democratic system, alongside the Supreme Court, the Election Commission, and the Union Public Service Commission.

Appointment and Terms

- Appointment by the President:

- CAG is appointed by the PRESIDENT OF INDIA under his warrant and seal.

- Tenure:

- Holds office for a period of 6 years or 65 years, whichever comes earlier.

- Resignation Process:

- Resignation is tendered by submitting a resignation letter to the President.

- Removal Procedure:

- Removal process mirrors that of a Supreme Court Judge.

- Removal requires a special majority resolution passed by both Houses of Parliament, based on proved misbehavior or incapacity.

Oath or Affirmation

Girish Chandra Murmu

- Subscribes before the President to an oath or affirmation:

- To bear true faith and allegiance to the Constitution of India.

- To uphold the sovereignty and integrity of India.

- To perform the duties of the office without fear or favor, affection or ill-will, to the best of ability, knowledge, and judgment.

- To uphold the Constitution and the laws.

Independence

Subscribes before the President to an oath or affirmation:

- To bear true faith and allegiance to the Constitution of India.

- To uphold the sovereignty and integrity of India.

- To perform the duties of the office without fear or favor, affection or ill-will, to the best of ability, knowledge, and judgment.

- To uphold the Constitution and the laws.

.

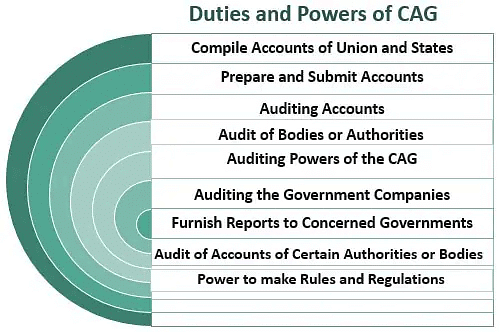

Duties and Powers

- Article 149 Responsibilities:

- Article 149 delineates the duties and powers of the CAG.

- Legislatively Defined Duties:

- Duties are legislatively defined by laws enacted by Parliament.

- CAG Act Amendments:

- The CAG Act of 1971 underwent a 1976 amendment, segregating accounts from audits in the Central Government.

- Audits and Examinations:

- Audits accounts of the Consolidated Fund of India, each state, and each Union Territory.

- Examines the expenditure of the Contingency Fund of each state and the Public Account of each state.

- Audits subsidiary accounts of state and central governments, including receipts and expenditures.

- Audits receipts and expenditures of bodies financed by Central and State revenues, government companies, and other entities mandated by laws.

- Advisory Role and Reporting:

- Advises the president on the form in which center and state accounts should be maintained.

- Submits audit reports to the President, who places them before both houses of Parliament.

- Submits audit reports to state governors.

- Certification and Compilation:

- Certifies the net proceeds of any tax or duty.

- Compiles and maintains state government accounts.

- Audit Reports:

- Submits audit reports on appropriation, finance, and public undertakings.

Role of CAG

- Executive Accountability:

- Ensures executive accountability in financial administration.

- Agent of Parliament:

- Acts as an agent of Parliament, conducting audits on Parliament's behalf and answering solely to Parliament.

- Audit Freedom:

- Enjoys more freedom in auditing expenditures compared to receipts, stores, and stock.

- Verification of Disbursed Money:

- Verifies the legality of disbursed money.

- Proprietary Audit:

- Conducts Proprietary audit (discretionary) assessing the wisdom, faithfulness, and economy of government expenditure.

- Limitations in Auditing:

- Faces limitations in auditing secret service expenditures.

- Control Limitations:

- Lacks control over the issuance of money from the consolidated funds of India.

- Role and Membership:

- In India, the CAG is only an Auditor and General and is not a member of Parliament.

- Comparison with Britain:

- In Britain, the CAG holds a more central role.

- Mandatory approval of CAG is required to appropriate money from the Public exchequer.

- CAG is a member of the House of Commons.

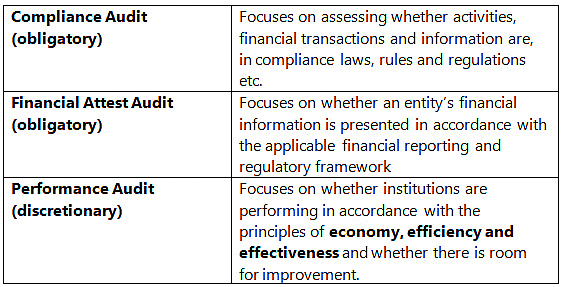

Types of AUDI

- Compliance Audit

- Financial Audit

- Performance Audit

CAG and Corporations

- Auditing of Public Corporations:

- CAG's involvement in auditing public corporations is constrained.

- Three Categories of Interaction:

- Certain corporations undergo comprehensive and direct audits by the CAG, exemplified by entities like DVC and ONGC.

- Another set of corporations are audited by private professional auditors, selected by the Central Government in consultation with the CAG. Notable examples include the Central Warehousing Corporation and the Industrial Finance Corporation.

- Some corporations are entirely subject to private audits, as seen in the cases of LIC and RBI.

Relation between CAG and Public Accounts Committee (PAC)

- PAC Establishment:

- PAC is a Parliamentary Standing Committee created under GOI Act, 1919.

- Examination of CAG Reports:

- CAG audit reports are handed over to the PACs at the centre and at the state.

- Three CAG reports, i.e., audit report on appropriation accounts, audit report on finance accounts, and audit report on public sector undertakings, are examined by PAC.

- Submission of Reports:

- At the central level, these reports are submitted by CAG to the President, who makes them be laid in Parliament.

- Assistance to PAC:

- CAG also assists the committee in its deliberations by preparing a list of the most urgent matters which deserve the attention of the PAC.

- He also helps in making the actions of the committee clear to the witnesses and in making the action of the government clear to the committee.

- Interpreter and Translator Role:

- CAG's position is sometimes one of an interpreter and translator, explaining the officials’ views to the politicians and vice-versa.

- Responsibility Continuation:

- The responsibility of the CAG does not end here.

- He has to watch whether the corrective action suggested by him has been taken or not.

- In cases where it has not been taken, he reports the matter to the PAC, which will take up the matter.

Concerns Regarding the Audit of Rafale Deal

- Questions raised about potential lapses and deviations in the Rafale deal.

- The audit report is unlikely to provide a conclusive resolution to the controversy surrounding the deal, as it fails to address all doubts.

- The original issue of reducing the total acquisition from 126 to 36 aircraft received insufficient attention.

- The CAG's assessment, indicating a savings of approximately 17% in India Specific Enhancements (ISE), lacks comprehensive documentation and necessitates further scrutiny.

- In summary, the report emphasizes the need for reforms and streamlining in India's defence acquisition processes.

CAG Report on Rafael Deal

- CAG Report Overview:

- The CAG report scrutinizes the €7.87-billion agreement for 36 Rafael aircraft between India and France in 2016.

- Objectives of Evaluation:

- The objective is to evaluate the attainment of goals outlined in the Indo-French joint statement and those set for the Indian Negotiating Team (INT) by the Defence Acquisition Council (DAC).

- Comparison with 2007 Deal:

- The CAG compares the 2016 deal with Dassault's 2007 price bid for 126 jets, converting the earlier deal into an equivalent cost for 36 aircraft in 2016.

- Offsets Controversy:

- The contentious issue of 50% offsets in the deal is not addressed in this CAG report but will be covered in a separate report on offsets for all deals.

- CAG's Conclusion on 2016 Agreement:

- The CAG's conclusion is that the 2016 agreement is marginally superior in both pricing and delivery compared to the 2007 deal.

- Price Comparison:

- The 2016 deal, facilitated through an Inter-Governmental Agreement (IGA), is 2.86% more economical than the prior United Progressive Alliance (UPA) regime deal.

- ISE Savings:

- Regarding Rafael's India Specific Enhancements (ISE), accounting for over €1.3 billion in the €7.87 billion deal, the CAG notes a 17.08% saving.

- Delivery Schedule Improvement:

- The 2016 contract sees an improvement of one month (71 months instead of 72) compared to the earlier bid.

- Absence of Bank Guarantee:

- Unlike the 2007 offer, the 2016 contract lacks a bank guarantee, deemed a "saving" for Dassault, and the audit suggests this sum should have been passed on to the Indian government.

- Reduction from 126 to 36 Aircraft:

- The decision to reduce the aircraft from 126 to 36 raises concerns about the operational preparedness of the Indian Air Force, with no proposal found by the CAG to address this gap.

- Ministry of Defence's Response:

- The Ministry of Defence reportedly informed the CAG that it issued a fresh Request for Information (RFI) for new fighter aircraft to address the operational gap.

- Government Claims:

- Contrary to government assertions of a 9% reduction in the cost of each basic aircraft (without enhancements) in the 2016 deal, the audit concludes that there is no difference between the 2007 and 2016 offers in this regard.

Reports by CAG

- Appropriation Account

- Finance Account

- PSU Report

Redactive Audit

Context

- In an audit report presented to the President under Article 151 of the Indian Constitution, the Comptroller & Auditor General of India (CAG) employed the concept of "redactive pricing."

- The CAG, in the preface of the report, noted that redactive pricing was unprecedented but was compelled to accept it due to the Ministry's insistence, citing security concerns.

What is Redactive Audit?

- Redaction involves selectively removing sensitive information from a document before publication.

- Under redactive pricing, the CAG withheld complete commercial details, blacking out figures in the procurement deal, based on security concerns raised by the Ministry of Defence.

- The acceptance of the Ministry's insistence, considering security concerns, raises questions that may be examined by the Supreme Court.

- This aligns with constitutional provisions on the CAG's duties and parliamentary privileges.

Implications of Redactive Audit

Deficiency in Audit Rationale:

- Performance audits aim to assess whether procurement activities align with principles of economy, efficiency, effectiveness, ethics, and equity.

Accountability Implications:

- Lack of Further Scrutiny to uphold accountability:

- In cases like the Rafale deal, redactive pricing hinders complete, accurate, and reliable information accessibility for the Parliament, its committees, the media, and other stakeholders relying on CAG reports.

- Lack of Further Scrutiny to uphold accountability:

Gap in Anti-Corruption Efforts:

- Loophole in Anti-Corruption Efforts:

- CAG reports often serve as sources for further investigations by anti-corruption bodies like the Central Vigilance Commission and the Central Bureau of Investigation. The redactive approach introduces a potential gap in anti-corruption efforts.

- Loophole in Anti-Corruption Efforts:

Audit of PM – CARES and PMNRF

- Earlier, the Comptroller and Auditor General’s (CAG) office had clarified that it wouldn’t audit the PM-CARES Fund as it is ‘a charitable organisation’ and is also based on donations from individuals and organisations.

- The PMNRF too is not audited by CAG but it is audited by an independent auditor outside of the government.

Criticisms of CAG

- Post-Facto Reports:

- Reports by the CAG are post-facto, providing prospective value only in enhancing systems and procedures after expenditure has been incurred.

- Limited Auditing Role:

- The CAG has a limited auditing role concerning secret services expenditure, with an inability to call for specific particulars.

- PPP Investments and NGOs:

- The CAG lacks the authority to audit Public-Private Partnership (PPP) investments. There is also an inability to audit funds allocated to NGOs, which often serve as conduits for various government schemes.

- PRIs and ULBs:

- There is an inadequate authority to audit Panchayati Raj Institutions (PRIs) and Urban Local Bodies (ULBs), often audited by Examiners under the Finance Department.

- DRDAs Beyond Audit Scope:

- District Rural Development Authorities (DRDAs) managing significant funds for rural development are currently beyond the scope of CAG audits.

- Human Resource Limitations:

- The CAG faces a high auditing spread with limited human resources.

- Appointment Concerns:

- CAG appointments are not consistently made from the revenue or financial stream, leading to instances of potential conflict of interest, such as former Secretary (IAS) appointments as CAG.

- Lack of Parliamentary Membership:

- The CAG in India lacks membership in Parliament, contrasting with the British system.

- Appointment Criteria and Procedures:

- There is a lack of specified criteria and procedures for CAG appointment, with the President making appointments based on the Prime Minister's recommendations.

- Timeliness of Reports:

- Reports are not submitted in a timely manner to the legislature, diminishing institutional effectiveness.

- Contempt and Summoning Powers:

- There is an absence of contempt or summoning powers.

Solutions

- Ensure timely submission of reports in the legislature.

- Divest the power of appointment from the exclusive executive domain, following the recommendation of the National Commission to Review the Working of the Constitution (NCRWC).

- Explore the possibility of making CAG a part of the Public Accounts Committee (PAC), similar to the UK model.

- Grant summoning and contempt powers to the CAG.

- Amend the CAG Act to align with changes in governance, as suggested by former CAG Vinod Rai.

- Expand coverage to include government-funded societies, Panchayats, and PPP projects in audits.

- Adopt the British model of a prior approval system in India.

- Embrace technological upgrades, including data analytics, Big Data, AI, and machine learning.

- Prior consultation with the PAC chairperson and the establishment of a collegium-type mechanism for selecting the CAG, following the Central Vigilance Commission (CVC) model.

Way Forward

- In 2016, the CAG embraced a Big Data management policy to confront emerging challenges.

- Auditors should be granted priority access to records within a defined timeframe; if delayed, heads of departments must provide explanations for the delay.

- The CAG plays a pivotal role in deterring, detecting, and addressing issues to promote good governance.

- In fulfilling its mandated duties, the CAG sheds light on deficiencies in internal controls, power segregation, flawed planning, implementation, and insufficient monitoring.

|

1335 videos|1436 docs|834 tests

|

FAQs on Comptroller and Auditor General of India - SSC CGL Tier 2 - Study Material, Online Tests, Previous Year

| 1. What is the role of the Comptroller and Auditor General of India? |  |

| 2. How is the CAG appointed and for how long is the term? |  |

| 3. What are the duties and powers of the CAG? |  |

| 4. What is the relation between the CAG and the Public Accounts Committee (PAC)? |  |

| 5. What were the concerns raised regarding the audit of the Rafale deal? |  |