SSC CGL Exam > SSC CGL Notes > SSC CGL Tier 2 - Study Material, Online Tests, Previous Year > Money – Indian Economy

Money – Indian Economy | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year PDF Download

| Table of contents |

|

| What exactly is Money? |

|

| Historical Background – How the Concept of Money Evolved? |

|

| Types of Money |

|

| Properties of Money |

|

| Significance of Money |

|

What exactly is Money?

- Widely accepted in transactions for purchasing goods, services, or settling debts, money functions as a crucial medium of exchange.

- It assumes the roles of a unit of account, a store of value, and a standard of deferred payment, adding versatility to its utility.

- The fundamental role of money in economies is underscored by its ability to facilitate trade and stimulate financial growth.

- Functioning as a currency, money stands as the primary indicator of wealth, circulating anonymously across individuals and nations.

- In essence, money plays a pivotal role in modern economies, fostering economic activities, trade, and financial transactions.

- Available in diverse forms, money encompasses physical currency as well as digital representations.

Historical Background – How the Concept of Money Evolved?

Barter System

- Money as a medium of exchange was not used in early human history since households were self-sufficient and there was little exchange of goods.

- Whatever exchange occurred between the households was done through barter or the exchange of goods for other goods.

- As there was no common unit of account and medium of exchange, the barter system did not allow for direct purchases of goods.

- The problem with a barter system is that in order to obtain a specific good or service from a supplier, one must also have a good or service of equal value that the supplier desires.

- In other words, in a barter system, the exchange can occur only if two transacting parties have a double coincidence of wants.

- The likelihood of a double coincidence of wants is quite low making the exchange of goods and services rather difficult.

- To solve the problems of barter trade, early humans devised a payment and exchange system that allowed the direct purchase of goods using any instrument that has the following characteristics:

- Unit of account

- High Liquidity

- Possible to store

- It must be desired by all (It should have high demand)

- It is easily exchangeable (Medium of Exchange)

Commodity Money

- In the beginning, there were only a few commodities that were required by everyone.

- Commodities such as arrows, bows, and seashells, which are mostly used for hunting, became the first form of medium of exchange and thus acted as money.

- When early humans transitioned from hunting to agriculture in the second stage of evolution, animals such as cattle, goats, and sheep became a medium of exchange and acted as money.

- Since commodities have limitations such as a lack of a standard unit of account, limited supply, natural factors, etc. their use was limited and was eventually replaced by other forms of money.

Metallic Money

- Commodity money evolved into metallic money as human civilization progressed.

- Metals such as gold, silver, copper, and others were used because they could be easily handled and quantified. It was the primary form of money for the majority of recorded history.

- With the passage of time and technological advancements, the hard form of gold and silver was replaced by a coinage system (gold and silver coins) that was widely used as money.

Paper Money

- It was discovered that transporting gold and silver coins was both inconvenient and dangerous. As a result, the invention of paper money marked a watershed moment in the evolution of money.

- The country's central bank regulates and controls paper money (RBI in India).

- At the moment, a large portion of the money is made up of currency notes or paper money issued by the central bank.

Credit Money

- The emergence of credit money occurred almost concurrently with the emergence of paper money.

- People keep a portion of their cash in bank deposits, which they can withdraw at their leisure via cheques.

- The cheque (also known as credit money or bank money) is not money in and of itself, but it serves the same functions as money.

Plastic Money

- Plastic money, such as credit and debit cards, is the most recent type of money.

- They intend to do away with the need to carry cash when conducting transactions.

Mobile Payments

- Mobile payments are payments made for goods or services using a portable electronic device such as a cell phone, smartphone, or tablet.

- Money can also be sent to friends and family members using mobile payment technology.

- Paytm, PhonePe, Google Pay, and so on are increasingly competing for retailers to accept their platforms for point-of-sale payments.

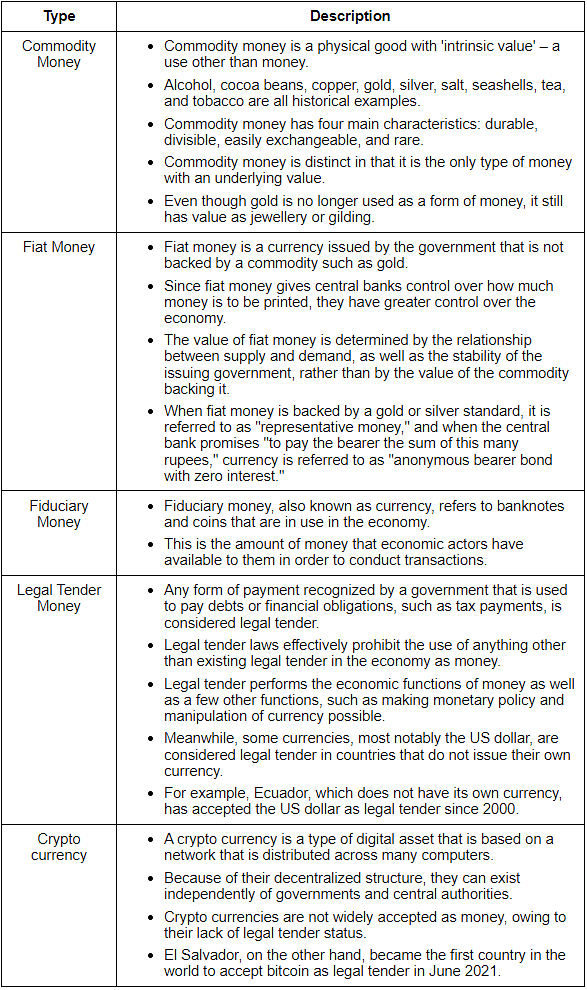

Types of Money

Properties of Money

The properties of money are as follows

- Fungible (interchangeability): To be fungible, each unit must be capable of being replaced by another.

- Durable: Money must be able to resist repeated usage.

- Divisible: It should be capable of being divisible to smaller units.

- Portable: Money should be easily carried and transported.

- Acceptable: The majority of people must accept money as a mode of payment.

- Scarce: Its available supply must be restricted.

Significance of Money

- It serves as a medium of exchange; it can be used to purchase any commodity.

- It serves as a measure of value or account of a unit. Every commodity has a monetary value that can be expressed in terms of money.

- It acts as a store of value.

- It serves as a standard mode for deferred payments. It can be used to settle future monetary obligations. As an example, a loan obtained today is paid back in installments.

- It is the most liquid of all assets because it is universally accepted and thus easily exchanged for other commodities.

- It also has an opportunity cost. Instead of keeping a specific cash balance, you can earn interest on it by putting it in a fixed deposit with a bank.

- Money provides consumers and businesses with some very basic and practical advantages.

- Money's main advantage is that it increases an economy's efficiency by lowering transaction costs.

- When people can use money instead of bartering, the economy becomes more specialized and has a better division of labor.

- Money facilitates exchange and promotes trade.

- Money provides incentives for people to work hard and satisfy their wants.

- Money helps producers to earn profits and reinvest the profit to generate more income and employment.

- Money in the form of wages increases the productivity of labor in the economy.

Conclusion

While the forms of currency have evolved from shells and skins, the fundamental purpose of money has endured. Irrespective of its physical manifestation, money continues to serve as a medium of exchange for goods and services, fostering economic growth by expediting transaction processes.

The document Money – Indian Economy | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year is a part of the SSC CGL Course SSC CGL Tier 2 - Study Material, Online Tests, Previous Year.

All you need of SSC CGL at this link: SSC CGL

|

1335 videos|1432 docs|834 tests

|

FAQs on Money – Indian Economy - SSC CGL Tier 2 - Study Material, Online Tests, Previous Year

| 1. What is money? |  |

Ans. Money is a medium of exchange that is widely accepted in transactions for goods and services. It serves as a unit of account, store of value, and standard of deferred payment.

| 2. How did the concept of money evolve? |  |

Ans. The concept of money evolved over time from the barter system, where goods were exchanged directly for other goods. As societies grew and trade increased, the need for a more efficient and standardized medium of exchange arose, leading to the development of various forms of money.

| 3. What are the types of money? |  |

Ans. There are different types of money including commodity money, such as gold and silver coins, fiat money, which is backed by the trust and confidence of the people, and digital or virtual money, like cryptocurrencies.

| 4. What are the properties of money? |  |

Ans. Money has several properties, including durability (it should withstand wear and tear), divisibility (it should be easily divisible into smaller units), portability (it should be easy to carry), uniformity (each unit should be the same), limited supply (to maintain its value), and acceptability (people should be willing to accept it as payment).

| 5. What is the significance of money in the Indian economy? |  |

Ans. Money plays a crucial role in the Indian economy as it facilitates economic transactions, encourages savings and investment, and acts as a medium for the exchange of goods and services. It also helps in measuring and comparing the value of different goods and services, contributing to economic growth and development.

Related Searches