Unit 2: Ledgers Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Introduction |

|

| Specimen of Ledger Accounts |

|

| Posting |

|

| Balancing an Account |

|

| Summary |

|

Introduction

Once the initial transactions are recorded in the journal, these entries are classified and arranged by preparing accounts. The book that encompasses all categories of accounts (including personal, real, and nominal accounts) is known as the Ledger. It is acknowledged as the primary book of accounts where the balance for each account is determined.

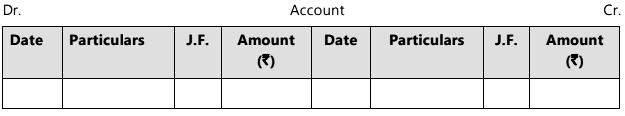

Specimen of Ledger Accounts

A ledger account consists of two sides: the debit side (left) and the credit side (right). Each side contains four columns: (i) Date, (ii) Particulars, (iii) Journal folio, which indicates the page from which the entries are sourced for posting, and (iv) Amount.

Posting

The act of moving debit and credit entries from the journal to categorized accounts in the ledger is referred to as posting.

|

Test: Ledgers - 2

|

Start Test |

Rules regarding Posting of Entries in the Ledger

- A separate account is created in the ledger book for each unique account, and entries from the Journal are transferred to the corresponding account accordingly. It is customary to use the terms ‘To’ and ‘By’ when recording transactions in the ledger.

- The term ‘To’ is found in the specific column for accounts listed on the debit side, while ‘By’ appears with accounts noted in the credit column.

- These terms ‘To’ and ‘By’ do not carry intrinsic meanings but are used to indicate the account that is debited and credited. The account that is debited in the journal must also be debited in the ledger, referencing the respective credit account.

Balancing an Account

- At the conclusion of each month, year, or designated reporting period, it may be necessary to determine the balance in an account. For instance, if an individual has purchased goods worth ₹1,000 but has only paid ₹850, they owe ₹150, which represents the balance in their account. To find the balance in any account, both sides of the account are totaled, and the smaller amount is subtracted from the larger amount to find the difference. If the credit side exceeds the debit side, it indicates a credit balance, and vice versa. The credit balance is recorded on the debit side as "To Balance c/d"; "c/d" signifies "carried down."

- This adjustment ensures that both sides are equal. The totals are then displayed on both sides opposite one another. The credit balance is noted on the credit side as "By balance b/d" (meaning brought down). This signifies the opening balance for the new period. Similarly, a debit balance is recorded on the credit side as "By Balance c/d," with the totals written on both sides as previously mentioned, and then the debit balance is placed on the debit side as "To Balance b/d," marking the opening balance for the new period. It is important to note that nominal accounts do not carry a balance; their end balances are transferred to the profit and loss account.

- Only the balances of personal and real accounts are ultimately reflected in the balance sheet at the end of the accounting period. The capital account is adjusted for profit or loss (i.e., net of nominal accounts) at the period's end.

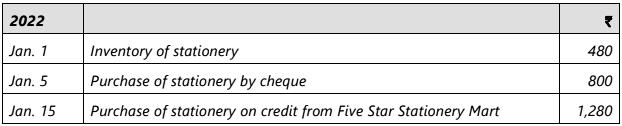

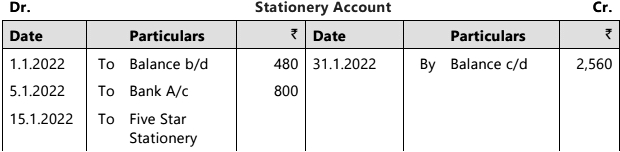

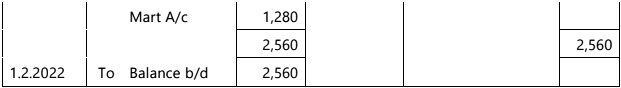

Illustration 1: Prepare the Stationery Account of a firm for the month of Jan. 2022 duly balanced off, from the following details:

Sol:

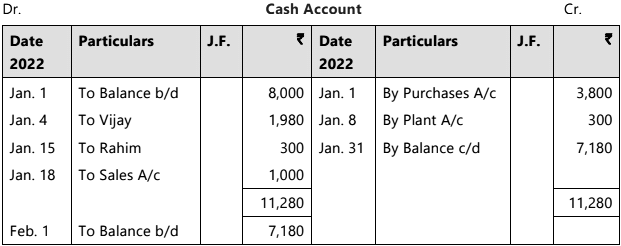

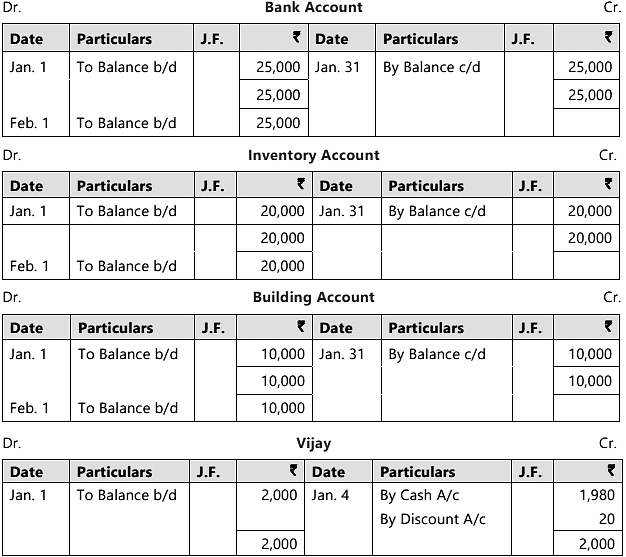

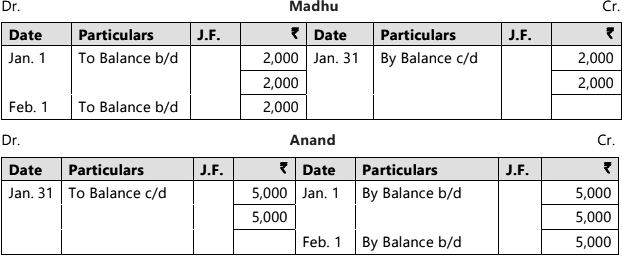

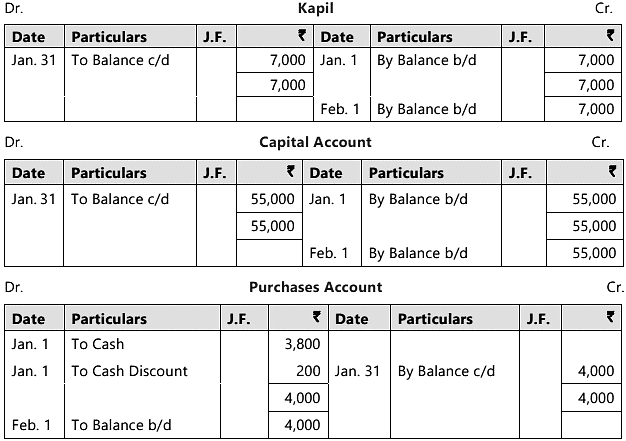

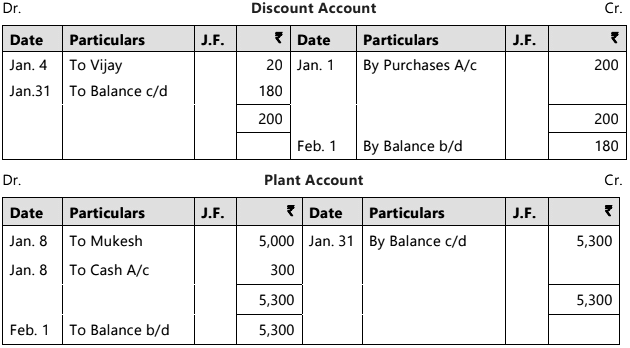

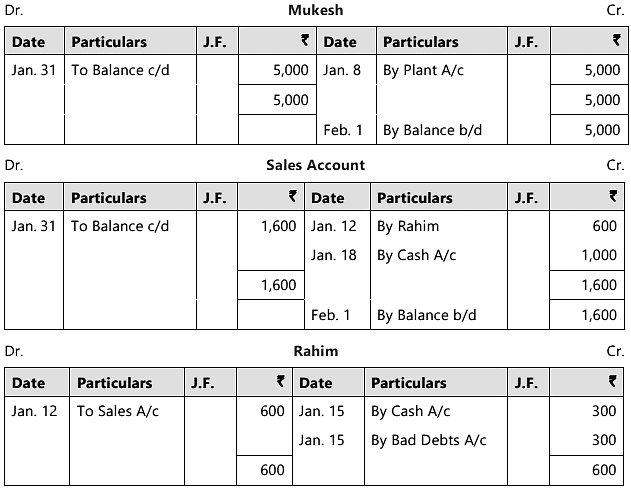

Illustration 2: Prepare the ledger accounts on the basis of following transactions in the books of a trader.

Debit Balances on January 1, 2022:

Cash in Hand ₹ 8,000, Cash at Bank ₹ 25,000, inventory of Goods ₹ 20,000, Building ₹ 10,000. Trade receivables: Vijay ₹ 2,000 and Madhu ₹ 2,000.

Credit Balances on January 1, 2022:

Trade payables: Anand ₹ 5,000 and Kapil ₹7,000, Capital ₹ 55,000

Following were further transactions in the month of January, 2022:

Jan. 1 Purchased goods worth ₹ 5,000 (payable at later date) for cash less 20% trade discount and 5% cash discount.

Jan. 4 Received ₹ 1,980 from Vijay and allowed him ₹ 20 as discount.

Jan. 8 Purchased plant from Mukesh for ₹5,000 and paid ₹100 as cartage for bringing the plant to the factory and another ₹200 as installation charges.

Jan. 12 Sold goods to Rahim on credit ₹600.

Jan. 15 Rahim became insolvent and could pay only 50 paise in a rupee.

Jan. 18 Sold goods to Ram for cash ₹1,000.

Sol:

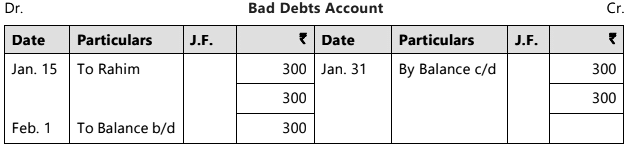

Illustration 3: The following data is given by Mr. S, the owner, with a request to compile only the two personal accounts of Mr. H and Mr. R, in his ledger, for the month of April, 2022.

1 Mr. S owes Mr. R ₹ 15,000; Mr. H owes Mr. S ₹ 20,000.

4 Mr. R sold goods worth ₹ 60,000 @ 10% trade discount to Mr. S.

5 Mr. S sold to Mr. H goods prices at ₹ 30,000.

17 Record a purchase of ₹ 25,000 net from R, which were sold to H at a profit of ₹15,000.

18 Mr. S rejected 10% of Mr. R’s goods of 4th April.

19 Mr. S issued a cash memo for ₹10,000 to Mr. H who came personally for this consignment of goods, urgently needed by him.

22 Mr. H cleared half his total dues to Mr. S, enjoying a ½% cash discount (of the payment received, ₹ 20,000 was by cheque).

26 R’s total dues (less ₹10,000 held back) were cleared by cheque, enjoying a cash discount of ₹1,000 on the payment made.

29 Close H’s Account to record the fact that all but ₹ 5,000 was cleared by him, by a cheque, because he was declared bankrupt.

30 Balance R’s Account.

Sol:

Working Notes:

- Sale of ₹ 10,000 on 19th April is a cash sales, therefore, it will not be recorded in the Personal Account of Mr. H; and

- On 22nd April, Mr. H owes Mr. S ₹ 90,000, amount paid by Mr. H ½ of ₹ 90,000 less½% discount i.e., ₹ 45,000– ₹ 225 = ₹ 44,775. Out of this amount, ₹ 20,000 paid by cheque and the balance of ₹ 24,775 in cash.

Note:

The balances of all nominal accounts are shifted to the Profit and Loss account during the preparation of financial statements, as nominal accounts represent revenues/incomes/gains or expenses/losses. Consequently, the overall outcome of all nominal accounts is represented in the Profit and Loss account for an accounting period, which is then transferred to the Capital Account. The balances of all accounts related to assets and liabilities (both personal and real) are shown in the Balance Sheet at the conclusion of the accounting period.

|

Download the notes

Chapter Notes- Unit 2: Ledgers

|

Download as PDF |

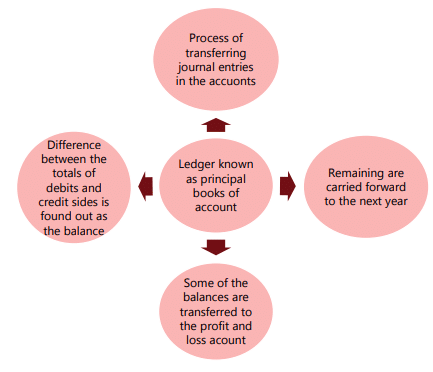

Summary

- The process of moving journal entries to the accounts opened in the Ledger is referred to as posting.

- The Ledger serves as the primary accounting book and offers comprehensive details about all financial transactions related to each individual account.

- The balance is determined by calculating the difference between the totals of the debit and credit sides. Some of these balances (specifically nominal accounts) are transferred to the profit and loss account, while others are carried over to the next period/year, as reflected in the balance sheet, depending on the type of account.

|

68 videos|160 docs|83 tests

|

FAQs on Unit 2: Ledgers Chapter Notes - Accounting for CA Foundation

| 1. What is a ledger account in accounting? |  |

| 2. How do you post transactions to a ledger account? |  |

| 3. What is the process of balancing a ledger account? |  |

| 4. Why is it important to maintain accurate ledger accounts? |  |

| 5. What are the key components of a ledger account format? |  |