Unit 3: Trial Balance Chapter Notes | Accounting for CA Foundation PDF Download

Overview

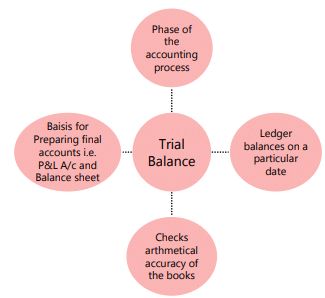

The trial balance includes different ledger balances as of a specific date. It serves as the foundation for creating financial statements, such as the profit and loss account and the balance sheet. A balanced trial balance indicates that the accounts are mathematically correct; however, some errors may still go unnoticed. Hence, it is crucial to accurately journalize and post entries while adhering to accounting principles.

Introduction

- The trial balance is the third phase in the accounting process. After accounts are posted in the ledger, a statement is created to display the debit and credit balances separately. This statement is referred to as the trial balance. It can be prepared by listing each account and entering the totals of the debit and credit sides in separate columns. Regardless of the method used, the totals of the two columns must match. An agreement signifies the arithmetic accuracy of the accounting work; if the two sides do not match, it indicates errors in arithmetic.

- This principle derives from the Double Entry System, where the amounts recorded on the debit sides of various accounts equal the amounts entered on the credit sides of other accounts and vice versa. Therefore, the totals of the debit sides must match the totals of the credit sides. Additionally, the total of the debit balances will equal the total of the credit balances. Once this agreement is confirmed, there is reasonable confidence that the accounting work is free from clerical errors; however, it does not guarantee complete accuracy, as errors in principle and compensating errors may still occur.

- Typically, to verify the arithmetic accuracy of accounts, a trial balance is prepared monthly. However, due to the double entry system, a trial balance can be prepared at any time. Although it can be done at any moment, it is advisable to prepare it at the end of the reporting period, such as month-end, quarter-end, or year-end, to ensure the arithmetic accuracy of all accounts before creating the financial statements. It is important to note that a trial balance is a statement, not an account.

Objectives of Preparing the Trial Balance

The preparation of trial balance has the following objectives:- The trial balance helps to verify whether the posting and other accounting activities have been executed without making arithmetic errors. In other words, it assists in confirming the arithmetic accuracy of the accounting records.

- Financial statements are typically generated based on the agreed trial balance; otherwise, the financial statements may not accurately reflect the financial transactions.

- The trial balance acts as a summary of the information contained in the ledger; the ledger may only need to be consulted when specific details about an account are necessary.

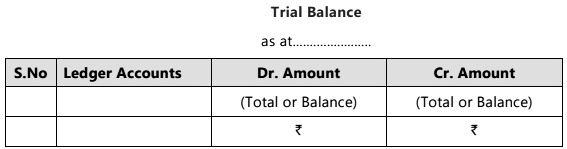

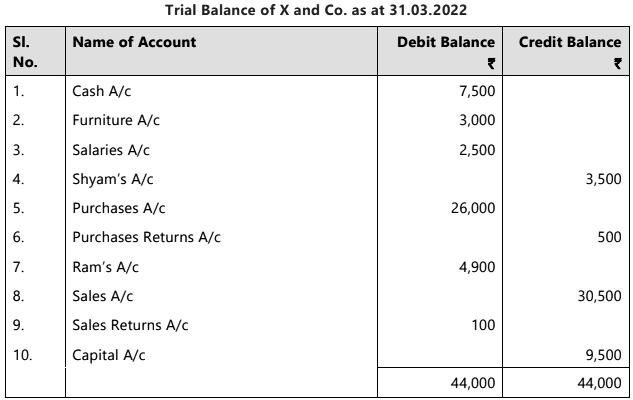

The form of the trial balance is simple as shown below:

- A trial balance is created as of a specific date, which should be indicated at the top.

- The name of the account is listed in the second column.

- The third column contains the total of the account's debit side or any debit balance.

- The fourth column shows the total of the account's credit side or credit balance.

- The totals for the third and fourth columns are summed at the end.

Limitations of Trial Balance

It is important to recognize that the agreement of a Trial Balance does not serve as definitive proof of accuracy. This means that even if the Trial Balance balances, some errors may still exist. These errors can include the following types:(i) A transaction may not have been recorded in the journal at all.

(ii) An incorrect amount may have been entered in both columns of the journal.

(iii) A wrong account may have been referenced in the journal.

(iv) An entry may not have been posted to the ledger.

(v) An entry may have been posted more than once in the ledger.

Nonetheless, preparing the Trial Balance is very beneficial; without it, creating financial statements would be challenging.

Methods of Preparation of Trial Balance

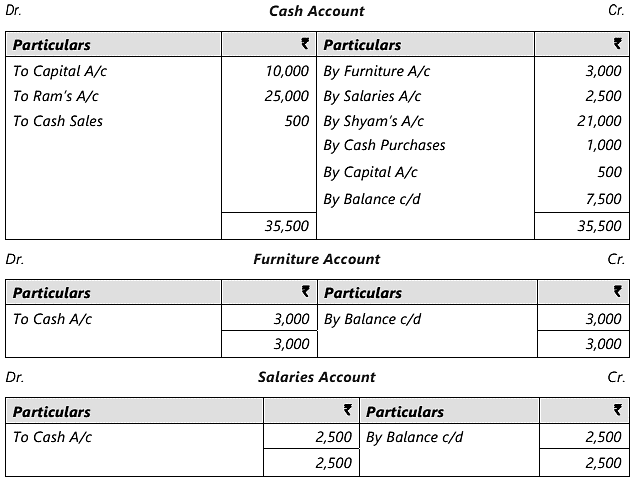

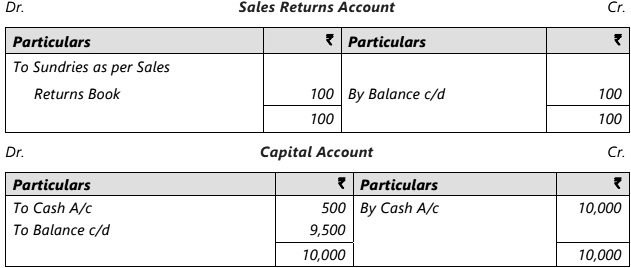

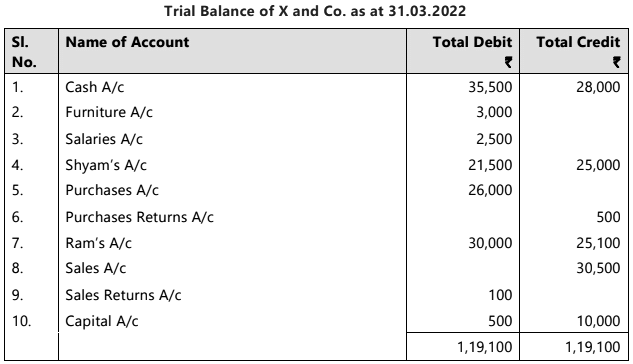

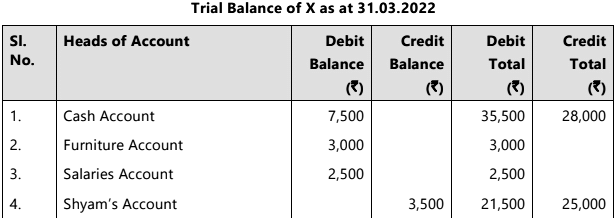

Total Method

Under this approach, each ledger account is totaled, and the total amounts (for both debit and credit sides) are transferred to the trial balance. This allows the trial balance to be prepared immediately after totaling the ledger accounts, saving time in determining the balance, as it can be found directly in the trial balance. The difference between the totals of each ledger account represents the balance of that specific account. However, this method is rarely used because only the net balance of the ledger account is needed for the preparation of financial statements. Consequently, the trial balance generated by this method is not suitable for direct use in creating financial statements.

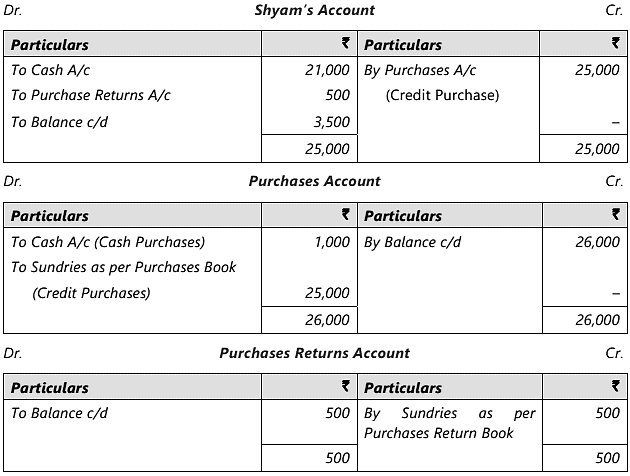

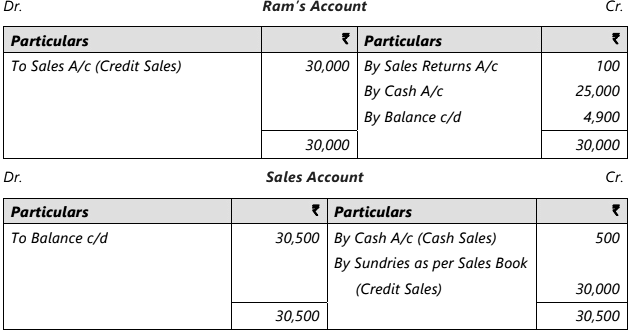

Illustration 1 : Given below is a ledger extract relating to the business of X and Co. as on March, 31, 2022. You are required to prepare the Trial Balance by the Total Amount Method.

Sol:

Sol:

Balance Method

Under this approach, each ledger account is balanced, and only those balances are transferred to the trial balance. This method is frequently utilized by accountants and assists in the creation of financial statements. Financial statements are developed based on the balances of the ledger accounts.Illustration 2: Taking the same information as given in Illustration 1, prepare the Trial Balance by Balance Method.

Sol:

|

Download the notes

Chapter Notes- Unit 3: Trial Balance

|

Download as PDF |

Total and Balance Method

Under this method, the above two explained methods are combined. This has been explained with the help of the following example:

Adjusted Trial Balance (Through Suspense Account)

If the trial balance remains unbalanced after transferring the balances of all ledger accounts, including cash and bank balances, and errors are not found promptly, the trial balance is adjusted by transferring the difference between the debit and credit sides to an account called a suspense account. This temporary account is created to allow for further progress and timely preparation of financial statements.

Rules of Preparing The Trial Balance

When preparing the trial balance from the provided list of ledger balances, the following rules should be observed:

- The balances of all (i) asset accounts (ii) expense accounts (iii) losses (iv) drawings are recorded in the debit column of the trial balance.

- The balances of all (i) liability accounts (ii) income accounts (iii) gains (iv) capital are recorded in the credit column of the trial balance.

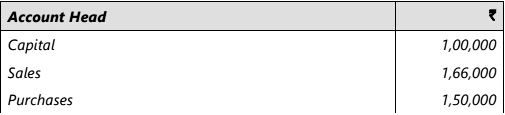

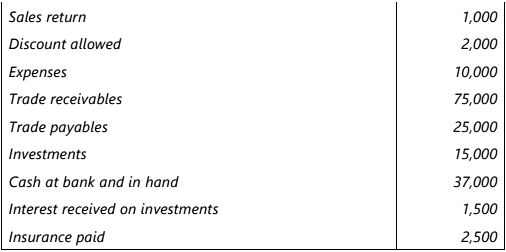

Illustration 3: From the following ledger balances, prepare a trial balance of Anuradha Traders as on 31st March, 2022:

Sol:

Sol:

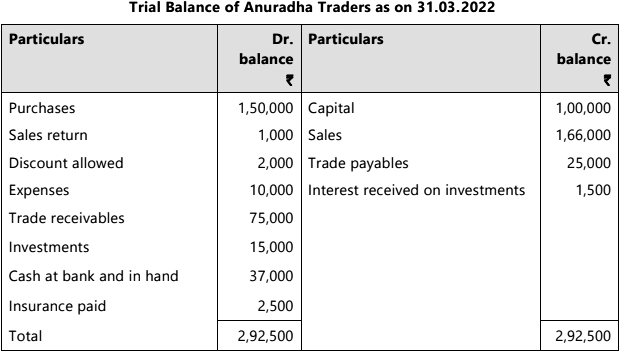

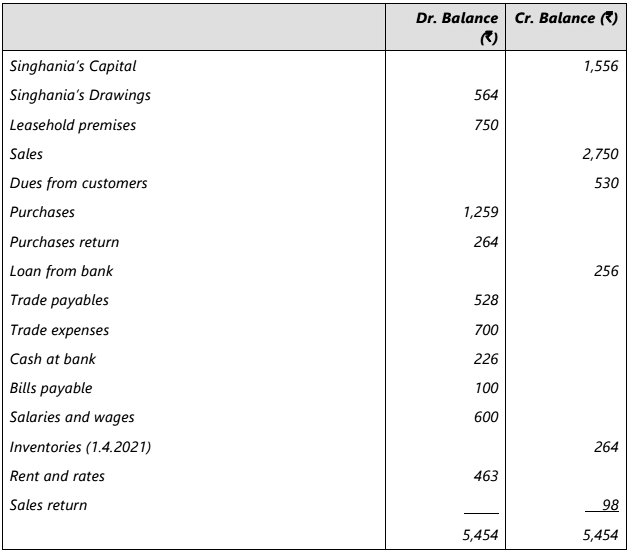

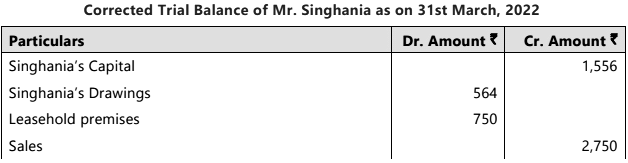

Illustration 4: One of your clients, Mr. Singhania has asked you to finalise his accounts for the year ended 31st March, 2022. Till date, he himself has recorded the transactions in books of accounts. As a basis for audit, Mr. Singhania furnished you with the following statement.

The closing inventory on 31st March, 2022 was valued at ` 574. Mr. Singhania claims that he has recorded every transaction correctly as the trial balance is tallied. Check the accuracy of the above trial balance.

Sol:

Notes:

- Dues from customers are classified as an asset, resulting in a debit balance.

- The purchases return account consistently displays a credit balance since assets are being reduced.

- The balance in trade payables is a liability, thus it will show a credit balance.

- Bills payable is also a liability, leading to a credit balance.

- Opening inventory signifies assets, so it will have a debit balance.

- The sales return account always reflects a debit balance because it indicates an influx of assets.

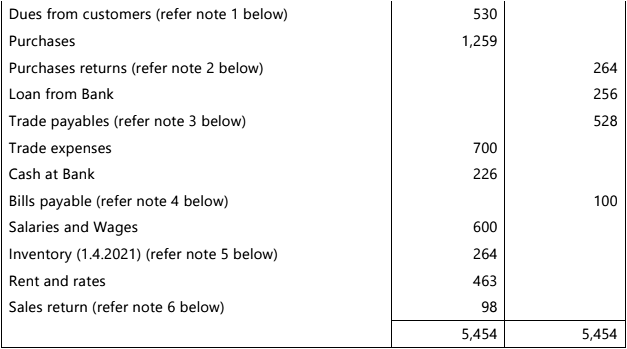

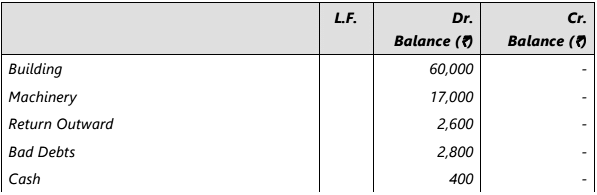

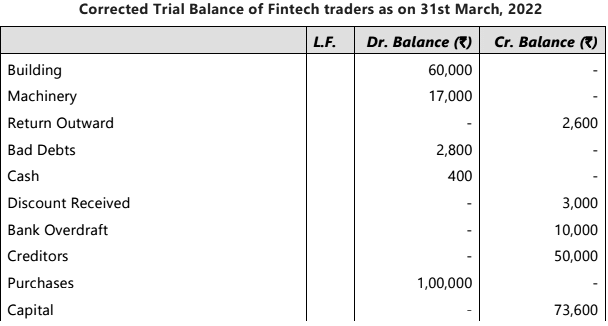

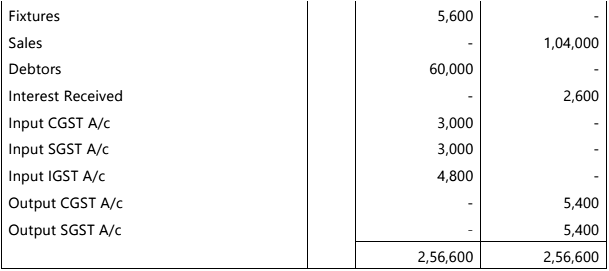

Illustration 5: The following trail balance as on 31st March, 2022 was drawn from the books of fintech traders:

Even though the debit and credit sides agree, the trial Balance contains certain errors. Check the accuracy of trial balance.

Even though the debit and credit sides agree, the trial Balance contains certain errors. Check the accuracy of trial balance.

Sol:

Summary

- The trial balance includes different ledger balances as of a specific date.

- It serves as the foundation for creating financial statements such as the profit and loss account and balance sheet.

- A balanced trial balance indicates that the accounts are mathematically correct; however, some errors may still go unnoticed.

- It is crucial to accurately journalize and post entries, adhering to accounting principles.

|

68 videos|160 docs|83 tests

|

FAQs on Unit 3: Trial Balance Chapter Notes - Accounting for CA Foundation

| 1. What is the purpose of preparing a trial balance in accounting? |  |

| 2. What are the limitations of a trial balance? |  |

| 3. What methods can be used to prepare a trial balance? |  |

| 4. What rules should be followed when preparing a trial balance? |  |

| 5. How does an adjusted trial balance differ from a regular trial balance? |  |