Bank Reconciliation Statement - 1 Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Overview |

|

| Introduction |

|

| Background |

|

| Bank Pass Book |

|

| Bank Reconciliation Statement |

|

| Importance of Bank Reconciliation Statement |

|

Overview

Introduction

Banks are vital institutions in contemporary society. With the growth in trade, commerce, and business, enterprises have encountered challenges in managing cash transactions for every business activity. They realized that regular dealings through banks would be a more efficient and secure option, leading large business entities to transition to banking transactions instead of cash dealings. Nowadays, the majority of business transactions—whether receipts or payments—are conducted via banks. In fact, after a certain threshold, it is legally required to execute transactions through banks. A bank accepts deposits from the public in various forms and lends money to those in need; it also invests some of the funds in profitable ventures. This process ensures that money, which would otherwise remain idle, is utilized and made accessible to those requiring it. Depositors can withdraw their funds according to agreed terms and conditions. In addition to receiving deposits and managing cash transactions for customers, banks offer several other valuable services, including:

- The bank discounts promissory notes or hundies, allowing customers to receive cash before the due date for a small fee known as a discount.

- The bank provides overdraft facilities to reliable customers, enabling them to make payments even without sufficient balance, although these overdrafts are typically secured and must be repaid later.

- The bank offers various types of loans (e.g., working capital, term loans) for specific periods, such as a year, to assist customers in operating smoothly when self-funding is inadequate. This financial support is crucial for businesses.

- The bank collects dividends or interest on securities on behalf of customers.

- At the customer's request, the bank makes payments for insurance premiums, rent, etc., on due dates.

- The bank buys and sells shares, debentures, or government securities for its customers.

- Money can be transferred to different locations or individuals through the bank at a low cost.

- The bank provides security or guarantees for its customers with good credit in exchange for a fee.

- The bank issues letters of credit or travelers' cheques to facilitate commerce or travel.

- The bank delivers international banking services, including currency exchange, remittance from abroad, cross-border payments, foreign letters of credit, and export/import credit.

Background

Historically, numerous corporate frauds have arisen from companies manipulating entries in either bank statements or cash books. For instance, a company's financial statement might display an inaccurate bank balance to deceive stakeholders. These occurrences have made the reconciliation of bank and cash balances a crucial aspect of the internal controls implemented by management. Over time, reconciling accounts has become a vital task for businesses, as it provides an opportunity to detect fraudulent activities within the organization and aids in preventing errors in financial statements. Reconciliation is typically performed at regular intervals, such as monthly or quarterly, as part of standard accounting practices; however, the frequency largely depends on the organization's size and the volume of transactions that take place.Bank Pass Book

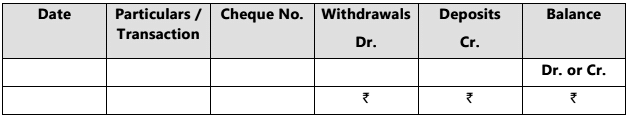

A bank passbook is essentially a duplicate of the customer's account as recorded by the bank. The bank provides periodic account statements or a passbook that documents all customer deposits and withdrawals over a specified time. Both documents serve as a record of the customer's ledger account within the bank's records. Therefore, it is the bank's method of keeping the customer updated on their account activities. It is the responsibility of the customer to review the entries and promptly notify the bank of any discrepancies. Nowadays, customers can conveniently access their bank statements online through Net Banking.Pass Book

Messers.........................................

in account with

Punjab National Bank

Daryaganj, New Delhi-110002

Account number –

Transaction Period -

The bank statement of an account typically comes in a similar format, often presented on loose sheets or available online. The bank is responsible for sending these statements to customers. However, if a customer opts for a passbook, they must periodically submit it to the bank for updates. Nowadays, many ATMs feature automated machines that allow users to update their passbooks without needing to visit a bank branch or require manual assistance.

At the end of the year, businesses should obtain a stamped and signed certificate from the bank, confirming the balance held in the bank as of that date. The balance reflected in the passbook is referred to as the passbook balance for reconciliation purposes. The credit balance according to the passbook at a specific time represents the deposits made by the customer, while the debit balance signifies the overdraft balance, indicating what the customer owes to the bank. It is important for students to understand that the nature of the balance shown in the passbook (from the bank's perspective) and the cash book (from the customer's perspective) differs. A debit balance in the passbook corresponds to a credit balance in the cash book and vice versa, as the business views the bank as a debtor/Trade receivable, while the bank regards the business as a creditor/Trade payable.

Bank Reconciliation Statement

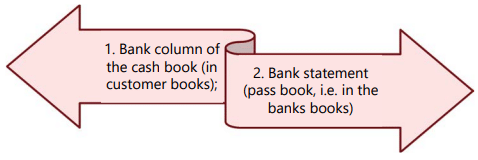

To reconcile means to identify or find out the difference between two different sources and eliminating that difference. Whenever we deposit or withdraws money from banks, it is always recorded at two places:-

The cash book is maintained by the individual who holds the bank account, while the bank statement is generated by the bank. Consequently, the balances in both records should ideally be equal but opposite. For instance, when Mr. A deposits ₹ 1,00,000 into his bank account, it is recorded as a debit in his cash book, but for the bank, it is treated as a credit entry in the bank statement or passbook. However, it is common for these two balances not to align. Various factors can cause discrepancies, which will be discussed later in this chapter. The differences can be reconciled by matching the details from both statements. The process of correcting these differences to align the two records is referred to as “Reconciliation,” and the document that reconciles the cash book balance with the passbook balance, outlining all the reasons for the discrepancies, is known as the “Bank Reconciliation Statement.”

Importance of Bank Reconciliation Statement

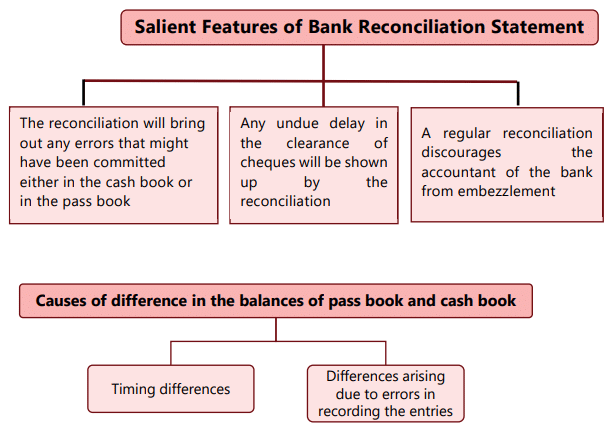

Bank reconciliation statement is an essential tool for the internal control of cash flows. It aids in identifying errors, fraud, and discrepancies that may occur during the entry process in either the cash book or the passbook, whether these are intentional or unintentional. Given that fraud can be uncovered through the preparation of a bank reconciliation statement, accountants exercise caution when preparing and maintaining business records. Thus, it serves as a crucial mechanism for internal control. The key features of a bank reconciliation statement include:

- The reconciliation highlights any errors made in either the cash book or the pass book.

- Any undue delays in cheque clearance will be revealed through reconciliation.

- Regular reconciliation deters bank accountants from embezzling funds. There have been instances where cashiers recorded entries in the cash book but failed to deposit the cash in the bank; they often got away with this due to a lack of reconciliation.

- It assists in determining the actual bank balance by considering the impact of any uncleared funds.

- It ensures that all financial transactions incurred by the company within a specific financial year are accounted for.

Causes of Difference

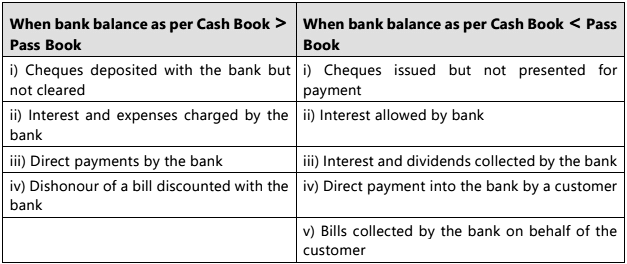

The discrepancy between the balances (bank balance according to the cash book and the pass book) may arise for the following reasons:

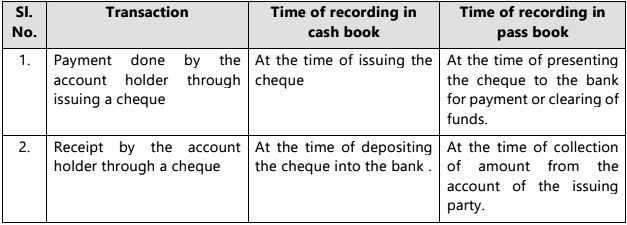

- Timing: Occasionally, a transaction may be recorded at different times in the cash book and the pass book. For instance, if Mr. A issues a cheque to PQR Ltd., it will be recorded in his cash book immediately, but the bank will acknowledge this transaction only when PQR Ltd. presents the cheque. Conversely, PQR Ltd. will record the entry in its cash book as soon as it receives the cheque, but the bank account will be credited only when the bank collects the funds.

- Transactions: Various transactions are executed by the bank without notifying the customer. For example, interest received on a savings bank account is credited by the bank immediately, but the cash book entry will only be made when the customer becomes aware of it, which typically occurs later. The same applies to bank charges that are debited from the customer's account by the bank.

- Errors: Mistakes or errors in account preparation by either the bank or the customer can lead to discrepancies between the two statements. For example, the omission of issued cheques can cause such differences. Therefore, rectifying errors in both statements is essential before preparing any Bank Reconciliation Statement.

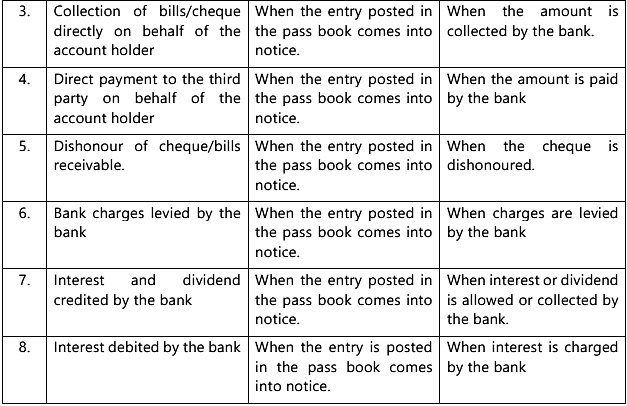

Some of the Items that Frequently Cause a Difference:

Above each scenario is explained in detail below along with examples:

(i) Cheques issued but not presented for payment: The entry in the cash book is made immediately on issue of cheque but naturally entry will be made by the bank only when the cheque is presented for payment. Thus there will be a gap of some days between the entry in the cash book and in the pass book.

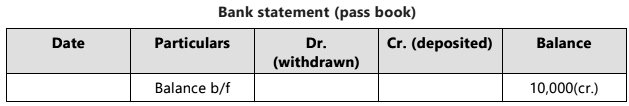

Example 1: The balance as per Cash Book and Pass Book are ₹10,000. Cheque of ₹ 2,000 is issued but not presented for payment. Then the balances as per cash book and pass book will be as follows:

On the issue of aforesaid cheque, the bank account in Cash Book is credited by ₹2,000 and so balance is reduced to ₹ 8,000. Whereas balance in the Pass Book remains ₹10,000 until the cheque is presented for payment.

(ii) Cheques deposited with the bank but not cleared: As soon as cheques are sent to the bank (i.e. deposited with bank), entries are made on the debit side of the bank column of the cash book. But usually banks credit the customer’s account only when they have received the payment from the bank concerned- in other words, when the cheques have been cleared. Again, there will be some time gap between the deposit of the cheques and the credit given by the bank.

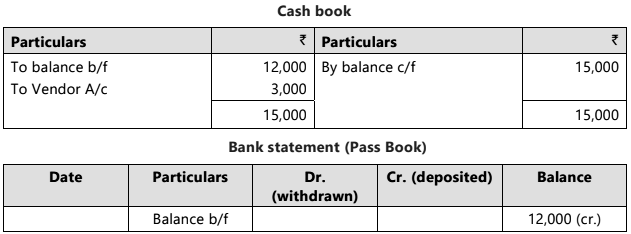

Example 2: The balance as per Cash book and Pass Book are ₹ 12,000. Cheque of ₹ 3,000 is deposited but not cleared.

When cheque is deposited into bank, the bank account in Cash Book is increased to ₹ 15,000, but the balance in the Pass Book remains ₹ 12,000 until the cheque is cleared.

(iii) Interest permitted by the bank: When the bank grants interest to the customer, the entry is typically recorded in the customer's account and subsequently reflected in the passbook. The customer usually learns the interest amount by reviewing the passbook, at which point they make the corresponding entry in the cash book.

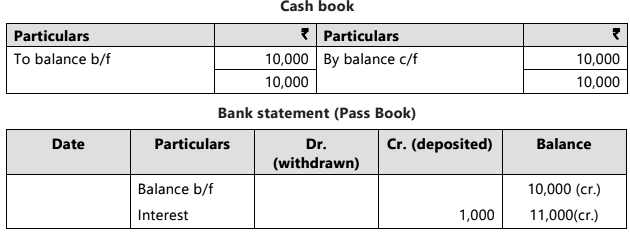

Example 3: The balance as per Cash Book and Pass Book are ₹ 10,000. The bank has allowed ₹ 1,000 interest on saving account to customer.

Because of such interest, balance of Pass Book is increased to ₹11,000. Whereas balance in the Cash Book remains ₹10,000 until information reaches to the customer and he records such transaction.

(iv) Interest and expenses charged by the bank: Like (iii) above, the interest charged by the bank and the amount of the bank charges are entered in the customer account and later in the pass book. The customer makes the required entries only after he sees the pass book or bank statement. These are debited to customer account by bank therefore till such entry is passed in cash book, bank balance as per pass book is less than bank balance as per cash book.

(v) Interest and dividends collected by the bank: Sometimes investments are left with the bank in the safe custody; the bank itself sees to it that the interest or the dividend is collected on the due dates. Entries are made as indicated in (iii) above.

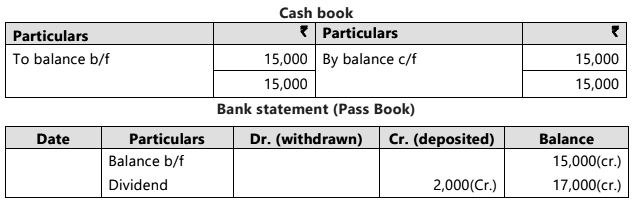

Example 4: The balance as per Cash Book and Pass Book are ₹15,000. The bank has collected dividend of ₹ 2,000.

On collection of dividend bank credits the amount to customer’s account, so balance in Pass Book is increased to ₹ 17,000. Whereas balance in the Cash Book remains ₹ 15,000 until the information of such dividend collection reaches to the customer and he records such transaction.

(vi) Direct payments by the bank: The bank may be given standing instructions for certain payments such as insurance premium, equated monthly installments of loan (EMIs). In these cases also, the customer comes to know of the payment only after viewing the pass book or bank statement. The entries in the pass book and in the cash book may thus be on different dates.

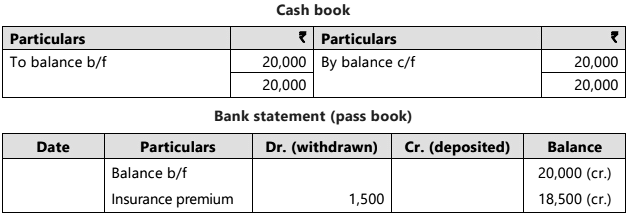

Example 5: The balance as per Cash Book and Pass Book of Mr. X are ₹ 20,000. The bank has instruction to pay insurance premium of ₹ 1,500 directly to insurance company at the end of each month.

On payment of insurance premium bank debits the customer’s account by ₹ 1,500 so balance in Pass Book is decreased to ₹ 18,500. Whereas balance in the Cash Book remains ₹ 20,000 until the information of such payment reaches to the customer and he records such transaction.

(vii) Direct payment into the bank by a customer: When a customer makes a direct payment to the bank, it will be recorded in the customer's account and reflected in the passbook. The account holder will only be aware of the amount upon reviewing the passbook. (e.g. Nowadays, customers prefer using banking services like NEFT and RTGS for online fund transfers.)

(viii) Dishonour of a bill discounted with the bank: If the bank is unable to collect payment on promissory notes it has discounted, it will debit the customer's account along with any associated charges. The customer will typically make the corresponding entry only after checking the passbook.

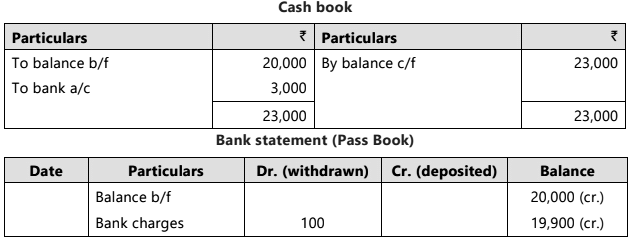

Example 6: The balances as per Cash Book and Pass Book of Mr. X are ₹ 20,000. Mr. X deposited a cheque of ₹ 3,000 and debited to his bank account ₹ 3,000 immediately. But bank will credit X’s account on realization of amount. Now the cheque is dishonoured for nonpayment. Bank charges ₹ 100 in this connection. Thus, balance of Mr. X’s account in Pass Book stands ₹ 19,900 after this transaction while balance as per Cash Book stand ₹ 23,000. So Mr. X should deduct ₹ 3,000 the amount of dishonoured cheque, plus ₹ 100 the amount of bank charges for reconciliation.

Thus, balance of Mr. X’s account in Pass Book stands ₹ 19,900 after this transaction while balance as per Cash Book stand ₹ 23,000. So Mr. X should deduct ₹ 3,000 the amount of dishonoured cheque, plus ₹ 100 the amount of bank charges for reconciliation.

(ix) Bills collected by the bank on behalf of the customer: In cases where goods are sold, the relevant documents may be forwarded via the bank. If the bank successfully collects the payment, it will deposit the amount into the customer's account. The customer should only record this transaction upon receiving their passbook. These timing discrepancies can result in differences in balances reflected in the cash book and the passbook.

Following is the table summarising in brief the timings of different transactions:

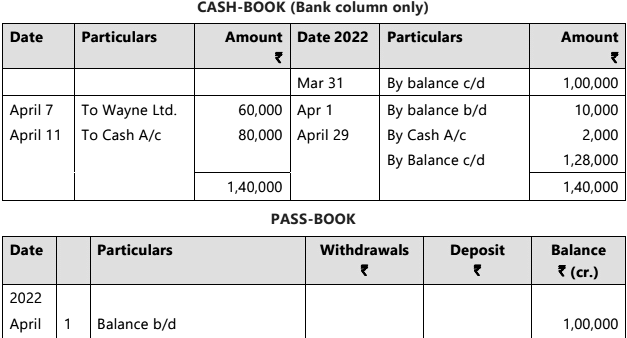

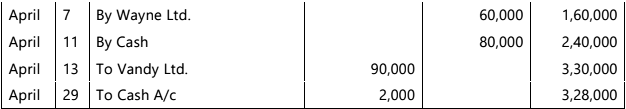

To illustrate this, we give below an extract from a pass book and the bank column of the cash book in Illustration 1:

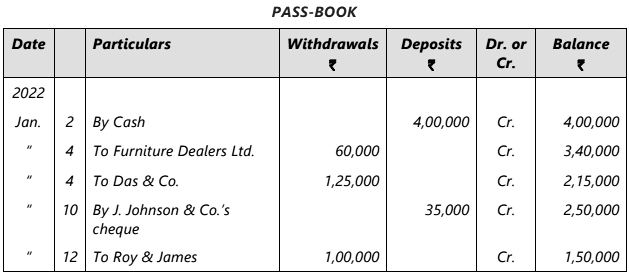

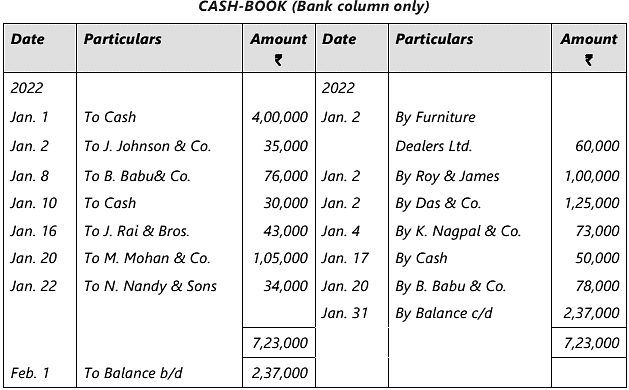

Illustration 1: Messer’s Tall & Short, Faiz Bazar, New Delhi-110002 in account with Punjab National Bank, Daryaganj, New Delhi-110002

It will be seen that whereas the pass book shows a credit balance of ₹ 2,43,000, the cash-book shows a debit balance of ₹ 2,37,000. We shall compare the two to establish the reasons for the difference. The reconciliation of the two statements can be done in two ways:-

It will be seen that whereas the pass book shows a credit balance of ₹ 2,43,000, the cash-book shows a debit balance of ₹ 2,37,000. We shall compare the two to establish the reasons for the difference. The reconciliation of the two statements can be done in two ways:-

- Arrive at pass book balance from cash book.

- Arrive at cash book balance from pass book.

Let us start with the pass book balance and arrive at the balance as per cash book.

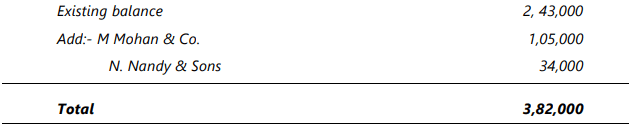

Step: 1. Compare the debit side of cash book with the deposits column of pass book:-

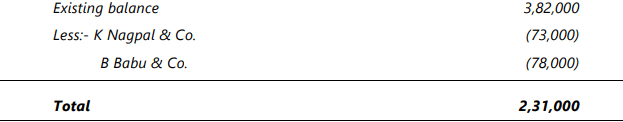

We find that the following cheques are recorded in the cash book but not in the pass book. Therefore if we enter these two cheques in the deposit side of the pass book the balance becomes:- Step: 2. Compare the credit side of the cash book with the withdrawal column of the pass book We find that the following cheques are not recorded. Therefore, if we enter these two cheques on the withdrawal side of the pass book the balance becomes: -

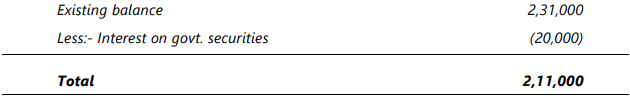

Step: 2. Compare the credit side of the cash book with the withdrawal column of the pass book We find that the following cheques are not recorded. Therefore, if we enter these two cheques on the withdrawal side of the pass book the balance becomes: - There is an item ‘Interest on Government Securities’ which appears on the deposit side of the pass book but not in the debit side of the cash book, so this item should be deducted from pass book balance:-

There is an item ‘Interest on Government Securities’ which appears on the deposit side of the pass book but not in the debit side of the cash book, so this item should be deducted from pass book balance:-

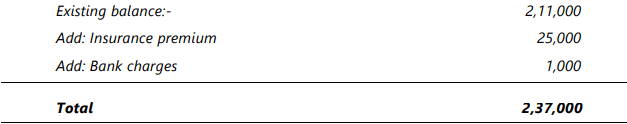

Further, there are two items which appear on the withdrawal side of the pass book i.e. they have been deducted from the bank balance but not on the credit side of the cash book, so these items should be added in order to reconcile the balance:- Therefore, we have arrived at the balance as per the cash book from the pass book.

Therefore, we have arrived at the balance as per the cash book from the pass book.

This process illustrates that the differences between the two balances arise from certain entries recorded in the cash book but not in the pass book, and vice versa. A comparison of both books highlights these discrepancies, which forms the basis for the reconciliation. To demonstrate, let’s start with a cash book balance of ₹ 2,37,000. If cheques amounting to ₹ 1,39,000 are not recorded in the pass book (and are assumed to be omitted from the cash book as well), this will lower the cash book balance to ₹ 98,000. Conversely, if cheques totaling ₹ 1,51,000 are recorded on the credit side of the cash book but not in the pass book, their exclusion from the cash book will raise the cash book balance to ₹ 2,49,000. Additionally, amounts totaling ₹ 26,000 entered in the withdrawals column of the pass book but missing from the cash book will result in a credit entry in the cash book, reducing the balance to ₹ 2,23,000. Lastly, there is a deposit entry of ₹ 20,000 not found on the debit side of the cash book; making this entry in the cash book will increase the balance to ₹ 2,43,000, as reflected in the pass book.

(x) Errors: During the recording of entries, mistakes can happen in both the cash book and the pass book. Although banks seldom make errors, if they do, the balance in the pass book will differ from the cash book. Likewise, if an error occurs in the cash book, its balance will not match that of the pass book. Some common errors include incorrect entry commission, wrong amount recording, entries placed on the incorrect side of the book, incorrect totaling of the account, erroneous balancing of the book, and transactions recorded for another party.

Example 7: Mr. A’s cash book shows following transactions:

Here there are several errors made by accountant:

Here there are several errors made by accountant:

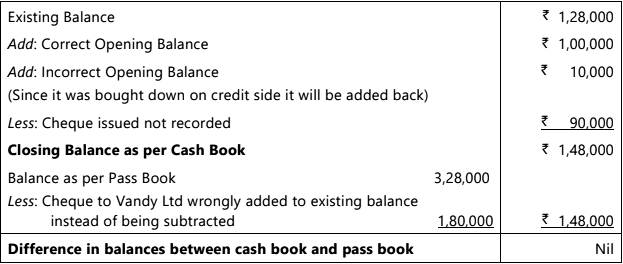

April 1: Balance should be have bought down in debit side as ₹ 1,00,000

April 13: Also a cheque issued to Vandy Ltd. has been omitted in the books of ₹ 90,000

So, on correcting these entries balance as per Cash Book will be:

|

68 videos|160 docs|83 tests

|

FAQs on Bank Reconciliation Statement - 1 Chapter Notes - Accounting for CA Foundation

| 1. What is a bank pass book and how is it used in financial management? |  |

| 2. What is a bank reconciliation statement and why is it important? |  |

| 3. How often should a bank reconciliation statement be prepared? |  |

| 4. What are common reasons for discrepancies in bank reconciliation? |  |

| 5. How does the bank reconciliation statement contribute to financial accuracy and accountability? |  |