Economic Development: November 2023 UPSC Current Affairs | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

CAFRAL Raises Concerns Over NBFC and Digital Lending Practices

Context

The Reserve Bank of India (RBI)-established Centre for Advanced Financial Research and Learning (CAFRAL) has highlighted a growing concern related to the increasing risk in bank financing for Non-Banking Finance Companies (NBFCs). Moreover, CAFRAL has raised an alarm about potential hazards within the digital lending sector. The research institution also advises against fraudulent or unauthorized lending applications, underscoring the peril of such apps gathering personal information and posing potential risks of misuse and safety issues for users.

Major Concerns Highlighted By CAFRAL

Inter-Dependency in NBFC Sector

- Banks primarily lend to larger NBFCs, creating a network of inter-dependencies.

- Cross-lending within the NBFC sector amplifies shocks and transmits them across the financial system.

- Instances like the IL&FS default in 2018 and DHFL collapse in 2019 triggered a liquidity crisis and affected banks’ asset quality and profitability.

Impact of Contractionary Monetary Policy on NBFCs

- Contractionary monetary policy results in risk accumulation in NBFC portfolios.

- Tightening policy rates by RBI leads to higher borrowing costs and lower profitability for NBFCs.

- To maintain margins, NBFCs shift lending to riskier segments, increasing exposure to unsecured loans and subprime borrowers.

- Increased exposure to capital markets through equity and mutual fund investments exposes them to higher credit, market, and liquidity risks.

Risks Associated with Digital Lending Apps

- Warning about illegitimate digital lending apps gathering personal data for potential misuse.

- Difficulty in verifying the legality of these apps poses risks to consumer safety and privacy.

- Concerns about potential losses from online lending impacting traditional banking if linkages between the sectors strengthen.

- Fake/illegal apps request extensive personal information, raising privacy and safety concerns for users.

- FinTech growth has led to approximately 1100 lending apps available for Indian Android users across 80 app stores, increasing product diversity.

What are NBFCs?

- An NBFC, registered under the Companies Act, 1956, engages in various financial activities, including loans, securities investments, leasing, and insurance.

- Excludes institutions primarily involved in agriculture, industry, goods trading, services, or immovable property trading.

Criteria for Registration

- A company is registered as an NBFC by the RBI if over 50% of its assets are financial assets and more than 50% of its income is derived from these financial assets.

Regulatory Authority

- The Reserve Bank, under the RBI Act 1934, has the authority to register, lay down policy, issue directions, inspect, regulate, supervise, and exercise surveillance over NBFCs.

Differences from Banks

- NBFCs cannot accept demand deposits from the public, unlike banks.

- NBFCs are not part of the payment and settlement system, and they cannot issue cheques like banks.

- Deposit insurance facilities, available to bank depositors, are not extended to NBFC depositors.

Funding

- NBFCs primarily finance operations through a combination of market borrowing and bank loans.

India’s Falling Farm Exports

Context

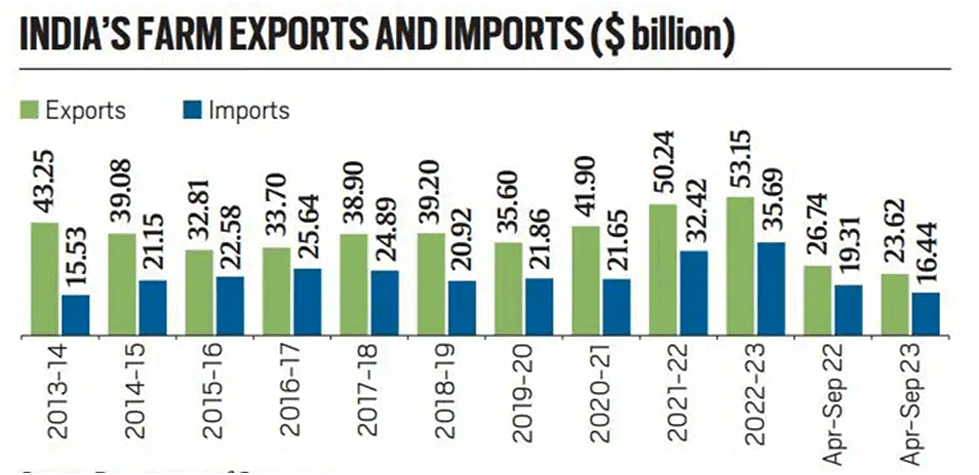

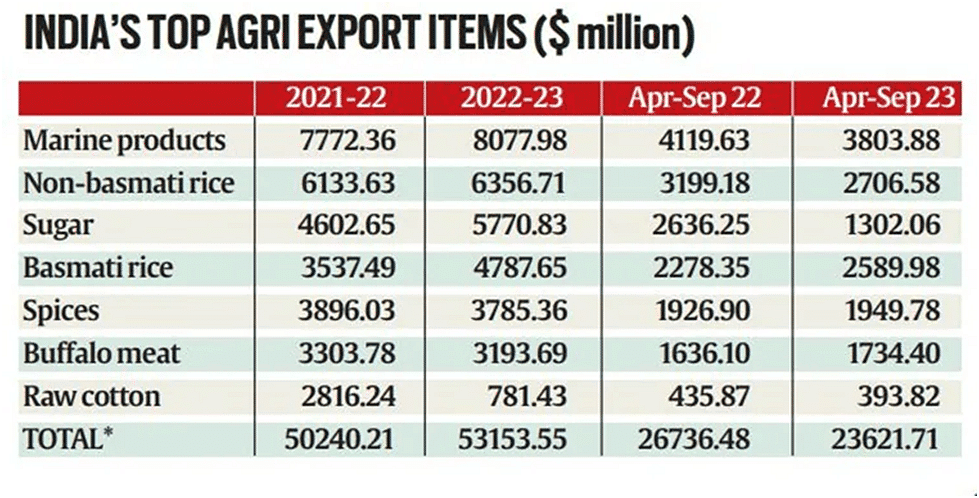

According to recent Department of Commerce data, exports of farm commodities, at USD 23.6 billion in April-September 2023, were below the USD 26.7 billion for April-September 2022.

- There has been a drop in imports as well, from USD 19.3 billion to USD 16.2 billion resulting in a marginal dip in the agricultural trade surplus.

What are the Reasons Behind Falling Farm Exports?

- Government’s Restrictions on Exports:

- In the April-September 2023 period, India's agricultural exports declined by 11.6% compared to the previous year. This drop can be attributed to the government's implementation of bans and restrictions on the export of several commodities, including wheat, rice, and sugar.

- In September 2022, exports of broken rice were prohibited and a 20% duty levied on all white (non-parboiled) non-basmati grain shipments. In July 2023, exports of white non-basmati rice were banned altogether. Henceforth, only exports of parboiled non-basmati and basmati rice were allowed.

- The government of India , in May 2022, moved sugar exports from the “free” to “restricted” category and capped the total quantity of the sweetener that could go out during any year.

- Easing Global Prices:

- Additionally, global prices have softened after reaching their highest levels in the aftermath of Russia's invasion of Ukraine.

What is the Impact of Global Prices on Declining Food Export?

- India's Farm Trade and Its Connection to World Prices:

- India's agricultural trade, particularly its exports, exhibits a strong correlation with global price trends. This relationship is closely tied to the fluctuations in the UN Food and Agriculture Organization's Food Price Index (FFPI).

- FFPI Trends Impacting India's Agricultural Exports:

- The FFPI, reflecting international prices for a range of food commodities, has seen notable changes in recent years. India's agricultural exports tend to follow the FFPI's movements, declining from USD 43.3 billion in 2013-14 to USD 35.6 billion in 2019-20, along with the FFPI (from 119.1 to 96.5 points), and subsequently rising as the index reached unprecedented levels in 2022-23.

- Impact of Decreasing World Prices on India's Farm Trade:

- As global prices have receded, the value of both agricultural exports and imports in India is expected to decrease in 2023-24. This trend occurs despite the easing of supply disruptions resulting from the Russia-Ukraine conflict. The latest supply and demand brief from the Food and Agriculture Organisation (FAO) projects global ending cereal stocks for 2023-24.

What are the Consequences of Declining International Prices for Indian Agriculture?

- Reduces Farmers’ Incomes:

- Declining international prices not only lower the cost competitiveness of the country’s agricultural exports, but also make its farmers more vulnerable to imports. This is being witnessed in cotton and edible oils.

- The price crash has led to India’s cotton exports not only plummeting, but also imports surging 2.5 times between 2021-22 to 2022-23.

- Impact on Edible Oil:

- The value of India’s edible oil imports more than doubled between 2019-20 and 2022-23. This was primarily due to skyrocketing global prices, particularly post the war in Ukraine.

- What is more concerning is prices have since collapsed, but imports of crude palm, soybean and sunflower oil are still coming in at a low 5.5% duty.

- Procedural Concerns:

- The government’s focus on controlling food inflation ahead of national elections – and prioritizing the interests of consumers over producers – means that imports of edible oil and pulses will continue unhindered, alongside restrictions on exports of cereals, sugar and even onion.

- This amounts to neglecting concerns of manufacturers and producers, which will impact GDP growth negatively.

Direct Listing on Foreign Exchanges

Context

- The Government recently permitted certain Indian companies to directly list on select foreign stock exchanges, which will allow these companies to access global capital and boost capital outflows.

Direct listing on foreign exchanges: What does it mean for Indian Companies

According to the Ministry of Corporate Affairs (MCA), the provision was announced in the Companies (Amendment) Bill, 2020, and came into effect on October 30, 2023.

In July 2023 government enabled listed and unlisted domestic companies to directly list their equity shares on the International Financial Services Centre (IFSC), Ahmedabad.

- How do companies currently list on foreign Stock Markets?

- Domestic listed companies would use depository receipts — American Depository Receipts (ADR) or Global Depository Receipts (GDR) — to list in the overseas market.

- Under this route, Indian companies wanting to get listed on foreign stock exchanges would give their shares to an Indian custodian, and depository receipts would be issued to foreign investors.

- Benefits

- Better valuation & Global Exposure: It will offer them better valuation and exposure to trade in foreign currency such as the dollar,

- Fundraising: It may also benefit the startup and unicorn community as another avenue to raise funds and increase their profile globally.

- Enhanced Foreign Exchange: It will also add to India’s foreign exchange kitty.

- Challenges

- Market valuations of these listings by global investors

- Uncertainty of the commercial benefits of these listings

- Volatility of Foreign exchange

Aquaculture Crop Insurance

Context

The Ministry of Fisheries, Animal Husbandry & Dairying has recently deliberated on the technical hurdles associated with implementing the Aquaculture Crop Insurance scheme for Shrimp and Fish farming as part of the Pradhan Mantri Matsya Sampada Yojana (PMMSY) initiative.

- To mitigate the risks faced by aqua farmers, NFDB (National Fisheries Development Board), which is the nodal agency for implementation of PMMSY, proposeed to implement the Aquaculture Crop Insurance scheme.

- The Scheme aims to provide basic cover for brackish water shrimp and fish on pilot basis for one year in the selected States of Andhra Pradesh, Bihar, Gujarat, Madhya Pradesh and Odisha.

What is Aquaculture?

- About:

- The term aquaculture broadly refers to the cultivation of aquatic organisms in controlled aquatic environments for any commercial, recreational or public purpose.

- The breeding, rearing and harvesting of plants and animals takes place in all types of water environments including ponds, rivers, lakes, the ocean and man-made “closed” systems on land.

- Purposes:

- Food production for human consumption,

- Rebuilding of populations of threatened and endangered species,

- Habitat restoration,

- Wild stock enhancement,

- Production of baitfish, and

- Fish culture for zoos and aquariums.

What is the Need for Aquaculture Insurance?

Aquaculture Insurance:

- Aquaculture insurance is a type of insurance specifically designed to provide coverage and financial protection to individuals or entities involved in aquaculture, which is the farming of aquatic organisms, such as fish, shrimp, and other aquatic species, for commercial purposes.

- This type of insurance is tailored to address the unique risks and challenges faced by aquaculture operations.

Need for Aquaculture Insurance:

- Risk Management:

- Aquaculture is susceptible to various risks, including diseases, adverse weather conditions, water quality issues, and natural disasters.

- These risks can lead to significant financial losses for aquaculture farmers. Insurance helps manage and mitigate these risks by providing financial compensation in the event of such adverse events.

- Investment Protection:

- Insurance safeguards substantial investments in infrastructure, ensuring that the financial resources put into the operation are protected against unforeseen events.

- Market Confidence:

- The availability of aquaculture insurance can boost investor and farmer confidence in the industry and encourage individuals to invest in aquaculture and expand their operations.

- Sustainability:

- Insurance can promote the sustainability of aquaculture operations by providing a means to recover from unexpected setbacks, this, in turn, can encourage responsible and sustainable practices in aquaculture to reduce risks and insurance premiums.

What are the Challenges in Implementing the Aquaculture Crop Insurance Scheme?

- Data Collection and Assessment:

- Accurate and current data is crucial for evaluating risks and determining suitable insurance premiums.

- Collecting data for aquaculture poses challenges due to intricate environmental and biological factors.

- Awareness and Education:

- Many fishers and farmers may lack a full understanding of insurance concepts.

- Successful implementation of the insurance scheme requires raising awareness and providing education on its benefits and processes.

- Adverse Selection:

- A risk of adverse selection exists, where only those with high risks may choose to participate, resulting in unsustainable premium levels.

- Balancing the participant pool to include diverse risk levels poses a challenge for the insurance scheme.

- Insurance Scheme Administration:

- Administering the insurance scheme, including timely claims processing and premium payments, is operationally complex.

- Effectively managing the various aspects of the scheme's administration requires careful attention to operational intricacies.

Way Forward

- The Aquaculture Crop Insurance scheme under PMSSY aims to reduce risks for fishers and aquaculture farmers, promote investment, and enhance food security. However, it faces challenges related to data, awareness, adverse selection, and administration.

- The involvement of key stakeholders and the establishment of a governing structure are critical for its successful implementation and sustainability.

- A governing structure is essential to ensure the successful implementation of the Aquaculture Crop Insurance scheme for shrimp and fish farming.

Seven Years of the Insolvency and Bankruptcy Code

Context

The Insolvency and Bankruptcy Code (IBC), introduced in 2016, has been a transformative tool in resolving stressed assets and improving the credit culture in India.

- However, a recent report by CRISIL Rating highlights certain challenges that are impacting the success of the IBC as it completes seven years.

What's Hampering the IBC's Success?

- Falling Recovery Rates:

- Recovery rates have witnessed a significant decline from 43% to 32% between March 2019 and September 2023.

- The recovery rate is the percentage of the admitted claims that the creditors recover from the resolution or liquidation of the corporate debtor under the IBC.

- Root Causes:

- Limited Judicial Bench Strength: The IBC resolution process is impeded by a shortage of judges, resulting in a deceleration of case processing. This, in turn, contributes to prolonged resolution times.

- Delays in Default Identification: Time-consuming processes for identifying and acknowledging defaults contribute to reduced recovery rates. It hampers the timely initiation of resolution proceedings, contributing to reduced recovery rates.

- Impact:

- Diminution in asset values.

- Sub-optimal recoveries, affecting creditors and stakeholders.

- Increased Resolution Time:

- The average resolution time has surged from 324 to 653 days, well beyond the stipulated 330 days.

- Resolution time is the duration between the admission of the insolvency application and the approval of the resolution plan or the order of liquidation by the National Company Law Tribunal (NCLT).

- Root Causes:

- Prolonged Pre-IBC Admission Stage: Significant delays in this stage, lasting 650 days in fiscal 2022 (up from about 450 days in fiscal 2019).

- Impact:

- Slower resolution processes.

- Suppression of recovery rates due to delays in initiating proceedings.

What is the Insolvency and Bankruptcy Code (IBC), 2016?

- About:

- The IBC, 2016 is the bankruptcy law of India that consolidates and amends the existing laws relating to insolvency and bankruptcy of corporate persons, partnership firms, and individuals.

- Insolvency is a state where the liabilities of an individual or an organization exceeds its asset and that entity is unable to raise enough cash to meet its obligations or debts as they become due for payment.

- Bankruptcy is when a person or company is legally declared incapable of paying their due and payable bills.

- The IBC aims to provide a time-bound and creditor-driven process for insolvency resolution and to improve the credit culture and business environment in the country.

- IBC resolves claims involving insolvent companies. This was intended to tackle the bad loan problems that were affecting the banking system.

- Regulating Authority:

- The Insolvency and Bankruptcy Board of India (IBBI) was established under the Insolvency and Bankruptcy Code, 2016.

- It is a statutory body, responsible for making and implementing rules and regulations for insolvency and bankruptcy resolution of corporate persons, partnership firms, and individuals in India.

- The IBBI has 10 members, representing the Ministry of Finance, the Ministry of Corporate Affairs,and the Reserve Bank of India.

- Adjudicating Authority:

- National Company Law Tribunal (NCLT) has jurisdiction over companies, other limited liability entities.

- Debt Recovery Tribunal (DRT) has jurisdiction over individuals and partnership firms other than Limited Liability Partnerships.

- Amendments in the IBC:

- The IBC has undergone significant amendments in the past 12 months to address emerging challenges and enhance its effectiveness.

- These amendments include the approval for the sale of assets or resolution plans on a segregated basis, an increase in the number of NCLT benches to 16, and extended timelines for filing claims.

- Sector-specific amendments, provisions for the audit of corporate debtors, and modifications in Form G2 have been introduced to address unique challenges.

- Achievements:

- Since its inception in 2016, IBC has resolved Rs. 3.16 lakh crore of debt stuck in 808 cases in seven years, according to CRISIL.

- It has resolved a significant amount of stressed assets with better recovery rates compared to previous mechanisms like the Debt Recovery Tribunal, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and Lok Adalat.

- IBC has achieved higher recovery rates, with creditors realizing 32% of admitted claims on average and 169% of the liquidation value.

- In contrast, other mechanisms had recovery rates ranging from 5-20%.

- IBC's deterrent effect is evident as borrowers, fearing the loss of companies, have proactively settled over Rs. 9 lakh crore in debt before cases entered the insolvency process.

- This highlights a significant behavioral change among borrowers, showcasing the efficacy of the Insolvency and Bankruptcy Code in encouraging timely settlements.

How Can the IBC Overcome Challenges?

- CRISIL Rating suggested a CDE approach to enhance the IBC’s performance, where C stands for Capacity augmentation, D for Digitalisation and E for Expansion of pre-pack resolutions to large corporates.

- Capacity augmentation involves enhancing the infrastructure and human resources of key institutions like the NCLT, responsible for IBC implementation.

- This aims to boost case throughput, mitigating the backlog of 13,000 cases in different stages of resolution.

- Digitalisation refers to creating a digital platform for connecting all the stakeholders involved in the IBC process.

- This will help eliminate data asymmetry, enhance transparency, and facilitate faster decision-making.

- Expansion of the pre-packaged insolvency resolution process (PPIRP) to large corporates will help in preventing value erosion due to time.

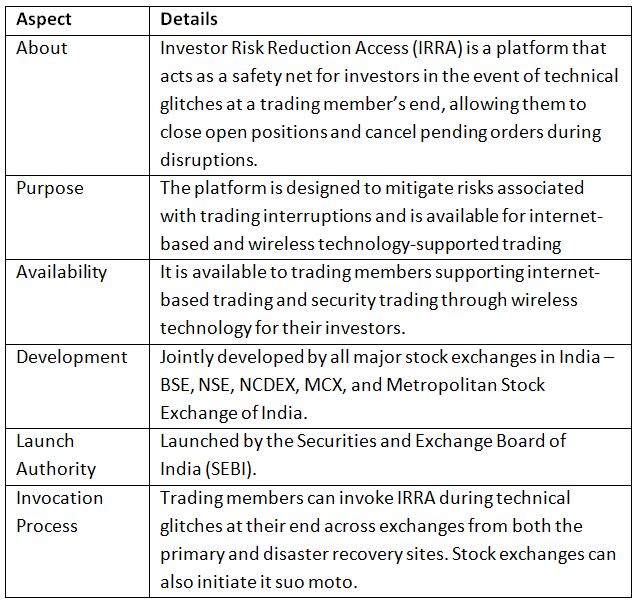

Investor Risk Reduction Access Platform

Context

The Investor Risk Reduction Access (IRRA) platform has been jointly developed by major stock exchanges in India, including BSE, NSE, NCDEX, MCX, and MSE.

India Grants Record Patents in 2023-34

Context

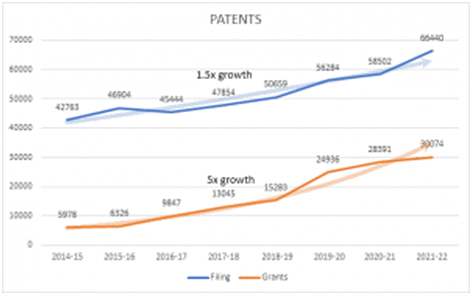

The Prime Minister has acknowledged the highest ever number of patents granted so far in 2023-24.

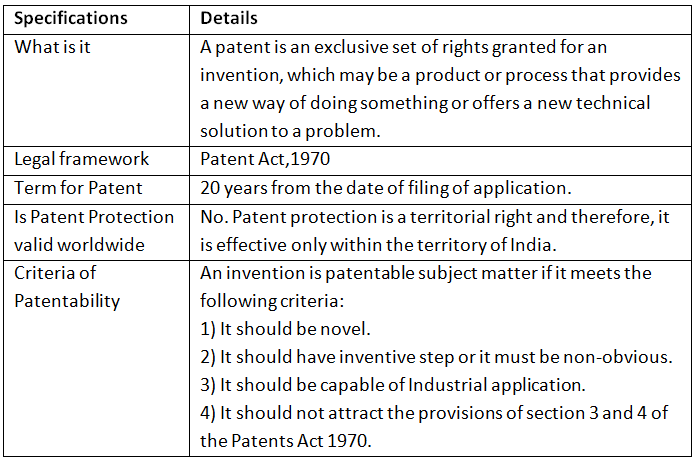

What is Patent?

What is the current status of patents in India?

- Indian Patents Granted:

- In 2023, a remarkable 41,010 patents were granted by the Indian patent office, marking a substantial increase from the 4,227 patents granted in the fiscal year 2013-14.

- Rise in Indian Patent Applications:

- According to a report by the World Intellectual Property Organization, there was a notable 31.6% increase in patent applications from Indians in 2022.

- This consistent growth in patent applications has persisted for 11 years, positioning India prominently among the top 10 filing countries.

Rural Wage Disparities

Context

Recent data from the Reserve Bank of India highlights stark differences in rural wages across different states in India, showcasing significant disparities in earnings for farm and non-agricultural workers.

- The stark contrast in rural wages across states underscores the need for equitable distribution and policies that bridge this disparity, ensuring a more balanced livelihood for agricultural and non-agricultural workers nationwide.

What are the Major Highlights of the Rural Wages Data by RBI?

- Fiscal Year 2021-22 Challenges:

- The rural economy grappled with difficulties during the fiscal year 2021-22, primarily stemming from the Covid-19 pandemic, resulting in adverse effects on employment and income levels.

- Fiscal Year 2022-23 Disruptions:

- In the subsequent fiscal year, 2022-23, rural areas experienced disruptions caused by heightened inflation rates and increased interest rates. These factors significantly impacted rural demand, leading to a notable decline in job opportunities and income stability nationwide.

- Rural Wage Disparities in Madhya Pradesh:

- Rural wages in Madhya Pradesh for both agricultural and non-agricultural workers were notably below the national average, standing at Rs 229.2 and Rs 246.3 daily, respectively. This wage scenario adversely affected the livelihoods of rural families.

- Contrasting Wages in Kerala:

- Kerala stood out with the highest wages across various sectors. Rural farm workers in Kerala earned Rs 764.3 per day, showcasing a stark contrast to the wages in Madhya Pradesh.

- Construction Worker Wage Disparities:

- Wages for rural construction workers revealed a significant gap between Kerala and Madhya Pradesh, with daily earnings of Rs 852.5 and Rs 278.7, respectively.

- National Average Wages:

- National average wages for different categories were as follows: Rs 345.7 for agricultural workers, Rs 348 for non-agricultural workers, and Rs 393.3 for construction workers.

- Stagnation in Rural Income Growth:

- Despite intermittent peaks in wage growth during 2022-23, rural income prospects remained subdued, indicating stagnant real rural wage growth. The incomplete recovery, especially in the unorganized sector, was evident as MGNREGA job demand, while dipping, still surpassed pre-pandemic levels in 2022-23.

What are the Major Factors Responsible for Wage Inequality in India?

- Economic Development Disparities: Regions or states with varying levels of economic development showcase substantial wage differences.

- Advanced industrial regions tend to offer higher-paying non-agricultural jobs compared to agrarian-centric areas.

- Policy Interventions: Diverse state-level policies regarding minimum wages, labor regulations, and social security schemes also create wage disparities. States with stringent labor laws may offer higher wages but could also face fewer job opportunities.

- Market Forces and Demand-Supply Dynamics: Wage rates often align with market demand for specific skills or labor. Regions with higher demand and limited workforce supply in certain sectors tend to offer higher wages.

- Cost of Living and Standard of Living: Variations in the cost of living, housing expenses, and other essential amenities directly impact wage disparities. Areas with higher living standards or higher costs of necessities often offer higher wages to compensate.

- Geographical Factors and Agricultural Cycles: Weather conditions and agricultural cycles influence the availability of work in rural areas. Seasonal fluctuations and dependence on agricultural activities can lead to seasonal wage variations.

- Migration and Labor Mobility: Labor mobility from low-wage regions to high-paying areas creates imbalances in wages, impacting both source and destination regions' wage structures.

Way Forward

- Agricultural Diversification: Encouraging diversification in rural economies by promoting allied sectors such as animal husbandry, fisheries, and agro-processing.

- This could generate supplementary income sources, reducing dependence solely on agriculture and improving overall earnings.

- Technology Adoption and Innovation: Integrating technological advancements into agricultural practices to enhance productivity. Access to modern farming techniques, machinery, and market linkages can elevate rural incomes.

- Infrastructure Development: Investing in rural infrastructure, including better roads, irrigation systems, and connectivity.

- Improved infrastructure can stimulate economic activities, create job opportunities, and attract industries to rural areas, boosting wages.

- Focus on Migrant Workers' Welfare: Implementing policies safeguarding the rights and livelihoods of migrant workers. Ensuring fair wages, adequate living conditions, and social security benefits for this workforce can incentivize a balanced distribution of labor across states.

- Promotion of Agri-Entrepreneurship: Encourage and support rural entrepreneurship by providing incentives, mentorship, and market access to aspiring agripreneurs.

- This could create a ripple effect, generating jobs and augmenting rural incomes.

|

38 videos|5275 docs|1115 tests

|

FAQs on Economic Development: November 2023 UPSC Current Affairs - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What concerns has CAFRAL raised over NBFC and digital lending practices? |  |

| 2. What is the current status of India's farm exports? |  |

| 3. What is direct listing on foreign exchanges? |  |

| 4. What is aquaculture crop insurance? |  |

| 5. What is the Investor Risk Reduction Access Platform? |  |