Approaches to Employment Income and Interest Rate Determination | Economics Optional for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Functions of Interest Rate |

|

| The Keynesian Approach and the IS-LM Curve |

|

| Neoclassical Synthesis |

|

| Classical Theory of Interest Rate |

|

| New Classical Economics |

|

Introduction

The interest rate in a layman’s language is what ties together the acts of saving and lending, of borrowing and investing. Some authorities also refer to the interest rate as the ‘ price of credit ‘.

Functions of Interest Rate

- The interest rate inculcates the habit of saving. A rise in the interest rate induces the people to save more as it will help them make more money out of money.

- With an increase in savings, investments also increase. With the help of the investments, the productive capacity of the country can increase.

- It promotes the efficient allocation of credit.

- It brings money into balance with the public demand for money.

- The supply of money can be regulated with the help of increasing or decreasing the interest rate. Therefore, it works as a tool for the government of the country.

The Keynesian Approach and the IS-LM Curve

- The aggregate demand, which consists of the consumption and investment expenditure, helps in determining the equilibrium level of National Income.

- The Keynesian system involves investment function, labor function, demand function for money, demand function for labor, aggregate production function, and supply function of labor.

- The IS-LM analysis or a neo- Keynesian analysis helps in explaining the Keynesian macroeconomic system, which takes into account the goods market and the money market, simultaneously.

Goods Market Equilibrium: The IS Curve

Due to the inadequacy of the Keynesian theory of aggregate demand, to explain the macroeconomic system, about when the market is introduced. Therefore, one needs to establish a link between the money market and the goods market through the rate of interest.

The interest is a variable, whose equilibrium value is determined with the help of the level of income.

In the goods market, there are –

- Savings function

- Investment function

- Equilibrium condition

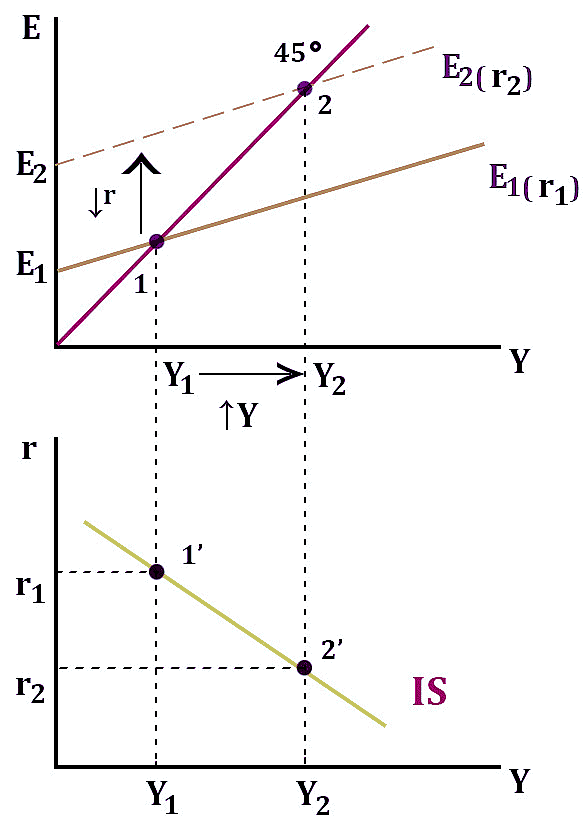

Deriving the IS Curve

- In the first graph, the red line, that is, E1(r1), represents the aggregate expenditure. An increase in the aggregate expenditure will shift the curve upwards. The curve, which was previously cutting the 45-degree line at 1, will now cut it at 2.

- National income is at a point where the aggregate expenditure cuts the 45-degree line. If we join the point of intersection in both the cases at a graph beneath the first one, the IS curve is formed.

- The IS curve is a downward sloping curve from left to right. Its slope is negative. The slope of the IS curve depends on the investment and the savings function. If the investment is less sensitive to the interest rate changes, the IS curve will be comparatively steep.

In case, the investment is completely inelastic to the interest, the curve will be vertical to the y-axis. An increase in the investment expenditure will curve to the right.

Properties of IS Curve

- It is downward sloping.

- It depends on the savings and investment functions.

- The curve will shift due to an autonomous change in investment spending.

- The curve will be steeper if the investment is less sensitive to interest rate changes.

- Any point that is off the IS curve shows either excess supply of goods (ESG) or an excess demand for goods (EDG).

Money Market Equilibrium: The LM Curve

A money market experiences equilibrium at the point where the money demand equals money supply. According to the Keynesian approach, the money demand for transaction purposes depends on the income level. The money demand for speculative purposes depends on the interest rate.

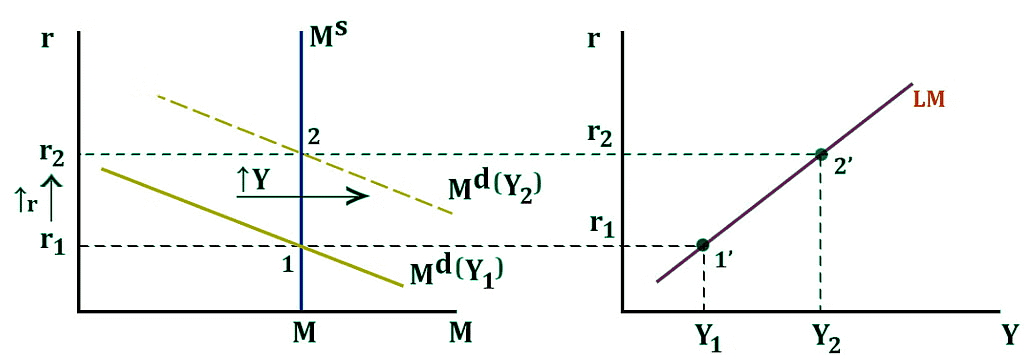

Deriving LM Curve

- The first graph depicts the money market equilibrium. The market equilibrium is achieved at a point where the Market demand curve intersects the market supply curve.

- An increase in the market demand will shift the market demand curve to the right. With this, where earlier the intersection was at point 1, now the intersection is at point 2.

- The point on the LM curve is the locus of all the combinations of the income and equilibrium interest rates on the money market.

Properties of LM Curve

- The curve is upward sloping, from left to right.

- It is an equilibrium combination of income and interest rate for the money market.

- The slope of the curve depends on the elasticity of interest in the money demand.

- The changes in the money demand and supply shift the curve.

- Any point that is off the LM curve exhibits either EDM or ESM.

Neoclassical Synthesis

- The neo-classical synthesis is a post-war macroeconomic development. It combined the elements of Keynesian macroeconomics and classical microeconomic theory. The synthesis says that Keynes and classical economists were right in the short term and long term, respectively.

- It believes that the government’s intervention should be concentrated in the short run, dealing with rigidities in the labor market, and stimulating demand in a recession.

Key Elements of the Neoclassical Synthesis

1. Possibility of Full Employment

- It believes that due to the intervention of the government, the economy has a chance of facing full employment. For suppose, during an economic downturn, the government can choose to pursue an expansionary fiscal policy to boost the demand.

2. Monetary and Fiscal Policy

- Keynes concentrated on the role of fiscal policy in managing the economy. But, with that, it also considered that monetary policy can be used to monitor demand at the rate of economic growth.

Classical Theory of Interest Rate

The classical theory believes that the rate of interest is determined by two major factors, which are –

The supply of the savings that are derived from the household.

- Current household savings is the difference between the current income and the current consumption expenditures. Individuals prefer current over the future consumption and the payment of the interest is the reward for waiting.

- With a high-interest rate, the substitution of saving for the current consumption is encouraged. Businesses also hold savings balances in the form of retained earnings, which are determined by the business profits and also by the interest rates.

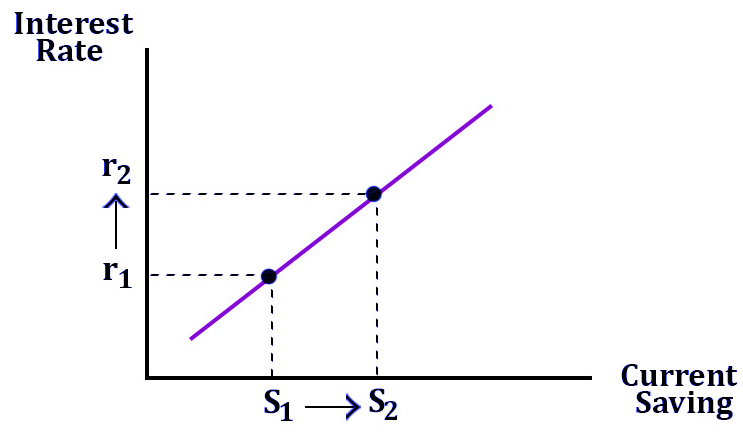

- The graph below shows the relationship between savings and interest rates –

- We can see that the relation between the interest rate and the savings is directly proportional. This means, an increase in interest rate, will lead to an increase in the savings.

2. The demand for investment capital, which comes mainly from the business sector.

- The investment demand is a derived demand. Economists believe that the point where the investment is not profitable for us is when the marginal productivity of capital is less than the interest rate. Therefore, one should stop investing when such a point arrives.

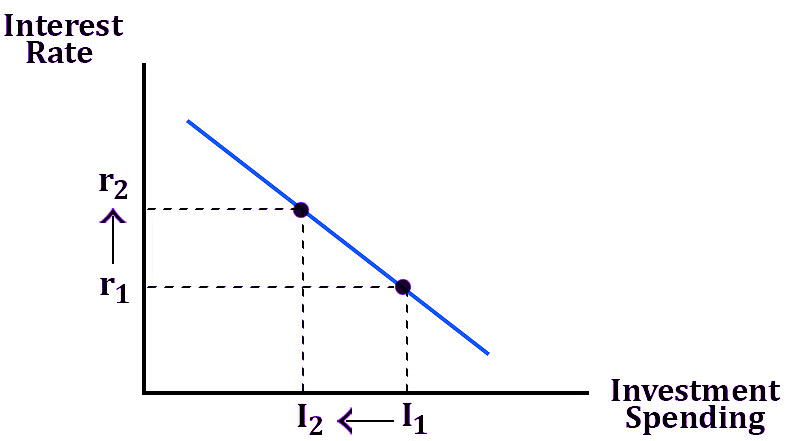

- The graph below depicts the relationship between the interest rate and investment spending –

Here, we can see that the relationship between the interest rate and investment spending is inversely proportional. This means that an increase in the investment rate will lead to a fall in investment spending.

Limitations of the Classical Model

- The critics argue that other than savings and investment, other factors may affect the interest rate, which is not put into consideration under the classical model.

- Adding to that, in today’s world, economists believe that income is a more significant factor than interest rates in determining the volume of savings.

New Classical Economics

- It was during the 1980s that the mainstream economic theory rejected the Keynesian model and returned to its Classical market roots. New-classical theorists denied the Keynesian view which dominated the 1970s.

- However, despite the differences in emphasis, they have tended to agree that development is the best left in the markets.

- The New-classical economists believe that countries must liberate their markets, encourage entrepreneurship, privatize state-owned industries, and reform labor markets, such as by reducing the powers of trade unions, to develop.

- Economists focussed on the determination of long-run aggregate supply and the economy’s ability to reach a higher level of output quickly.

- Since the new classical approach implies that the economy will remain at or near its potential output. it means that the changes we observe in economic activity results are not from changes in aggregate demand but the changes in the long-run aggregate supply.

|

66 videos|222 docs|73 tests

|

FAQs on Approaches to Employment Income and Interest Rate Determination - Economics Optional for UPSC

| 1. What is the function of interest rates? |  |

| 2. What is the Keynesian approach to interest rate determination? |  |

| 3. What is the neoclassical synthesis in relation to interest rates? |  |

| 4. What is the classical theory of interest rate? |  |

| 5. How do new classical economists approach the determination of employment, income, and interest rates? |  |