Types of Taxes in India - 1 | Economics Optional for UPSC PDF Download

Introduction

- Tax in India refers to the additional charges imposed by the government on various transactions, goods, and services. This includes taxes on corporate profits and individual income, among other expenses. The purpose of taxation is to generate funds for economic development initiatives and improve the overall well-being of citizens.

- The authority for taxation in India is derived from the Constitution, which grants both the State and Central governments the power to levy different types of taxes. Any tax imposed must be supported by legislation passed by either the State Legislature or the Parliament. These taxes play a crucial role in funding government activities and initiatives aimed at enhancing the country's economy and the quality of life for its citizens.

Types of Taxes in India

Direct Taxes

Direct taxes are levied directly on the taxpayer and are collected by the government. The Central Board of Direct Taxes is responsible for formulating and implementing regulations related to direct taxes.

Examples of Direct Taxes:

- Income Tax: Applicable to individuals, Hindu undivided families, unregistered firms, and other groups. The system is progressive, with different tax rates based on income brackets.

- Corporation Tax: Imposed on the earnings of businesses and corporations, separate from the owner's income tax. All registered domestic enterprises are obligated to pay this tax.

- Minimum Alternate Tax (MAT): Applied to businesses with significant profits and dividends, ensuring a minimum tax payment even if they utilize exemptions and incentives.

- Capital Gain Tax: Taxation on profits from the sale of capital assets, with distinctions between short-term and long-term assets based on the holding period.

- Securities Transaction Tax (STT): Levied on gains from securities traded on the domestic stock exchange.

- Commodities Transaction Tax (CTT): Applicable to buyers and sellers of exchange-traded non-agricultural commodity derivatives, determined by the contract size.

- Alternate Minimum Tax (AMT): Comparable to MAT but applicable to limited liability partnerships.

- Estate Duty: Imposed on a person's entire estate after their demise, though it hasn't been in effect since 1985.

- Wealth Tax: Abolished in 2015, previously imposed on individuals, Hindu undivided families, and companies with a surplus of net value.

- Gift Tax: Abolished in 1998, except for donations made by public and private organizations supporting charitable institutions.

- Fringe Benefits Tax (FBT): Eliminated in 2009, it was introduced to counteract companies providing employee benefits to reduce taxable profits.

Direct taxes contribute significantly to the government's annual revenue, fulfilling around half of its financial requirements. The rates and regulations are set annually, aiming to achieve specific fiscal goals.

Advantages of Direct Tax

- Economic Balance: The government establishes tax brackets based on an individual's income and age, aiming to achieve economic and social balance. Tax rates are determined in response to the nation's economic conditions, and exceptions are provided to address economic inequalities.

- Ensures Equality: Higher taxes on individuals and enterprises with greater profits enable the government to support the less affluent members of society, contributing to economic equilibrium.

- Certainty: Direct taxes provide both the government and taxpayers with confidence, as the exact amount of tax to be paid and collected is known by both parties.

- Addresses Inflation Issues: During periods of high inflation, the government can increase taxes to curb the demand for goods and services, thereby helping to alleviate inflationary pressures.

- Government Accountability: The awareness that paying taxes is essential encourages people to be actively involved in monitoring the government's use of taxes and being aware of their rights, promoting accountability.

Disadvantages of Direct Tax

- Easily Evaded: Some individuals resort to filing false tax returns to avoid paying taxes, and evasion is facilitated as they can conceal their income outside the purview of state law.

- Arbitrary Tax Slabs: Progressive or proportional tax slabs are set at the discretion of the Finance Minister, potentially burdening the less privileged if not designed judiciously.

- Obstructs Growth: High taxes can discourage investment and saving, negatively impacting the nation's economy by hindering the expansion of businesses and industries.

- Inconvenience: A notable drawback of direct taxes is the inconvenience felt by taxpayers who perceive a significant deduction from their hard-earned income, leading to a sense of loss.

Indirect Tax

Indirect taxes are imposed on a party that ultimately bears the financial burden of the tax through an intermediary, and the taxpayer has the option to transfer it to another party. The intermediary processes a tax return and remits the government's tax revenue. In contrast to direct taxes, which are paid directly by the government to the individuals or entities subject to them, indirect taxes are calculated based on expenses rather than income. Suppliers of products and services are subject to these taxes, but consumers are ultimately responsible for payment.

Examples of Indirect Tax:

- Customs Duty: Customs duties are tariffs or fees imposed when goods cross international borders. Various types of duties, including Basic Duty, Countervailing Duty, Protective Duty, Anti-Dumping Duty, and Export Duty, are levied under customs regulations to protect the national economy and generate revenue.

- Sales Tax: A tax on the sale or purchase of specific goods within the nation, imposed by both the federal and state governments. The Integrated Goods and Services Tax (IGST) has replaced it.

- Excise Duty: A commodities tax levied on the production of goods in India, excluding alcoholic beverages and illegal drugs. Central Goods and Services Tax (CGST) has taken its place.

- Service Tax: Imposed on all services rendered in India, with its scope expanding since its introduction in 1994–1995. The Goods and Services Tax (GST) has replaced it.

- Value Added Tax (VAT): Implemented across all states and union territories (except Andaman Nicobar and Lakshadweep), VAT is determined by the state and levied on a range of goods sold within the state. State Goods and Services Tax (SGST) has replaced it.

- Dividend Distribution Tax (DDT): Initially governed under Section 115 O of the Income Tax Act in 1997, DDT was eliminated in Budget 2020. Now, corporations are no longer required to pay dividend taxes, and individuals are responsible for them. Dividends, considered income for shareholders, form the basis for the tax imposed by the Indian government on Indian firms.

Advantages of Indirect Tax

- Universal Contribution: Indirect taxes apply to everyone purchasing a product, ensuring a broad contribution base. Unlike income taxes, which are specific to certain income groups, indirect taxes are paid by tourists, individuals from lower socioeconomic backgrounds, and anyone making a purchase in India.

- Convenience in Collection: Indirect taxes are practical to collect, as customers do not feel burdened by small amounts. These taxes are included in the cost of goods sold, making them an affordable and straightforward fee.

- Inevitability: Indirect taxes cannot be avoided as they are inherent in the product's price. Anyone purchasing the goods becomes liable for the associated tax.

- Wide Coverage: Indirect taxes, when applied to a variety of products in smaller amounts, prevent significant impact on consumers. This wide coverage is advantageous, as heavy taxation on a single characteristic could be more noticeable and burdensome.

Disadvantages of Indirect Taxes

- Potential Regressiveness: The uniform application of indirect taxes may be deemed unfair, especially to the poor, as everyone pays the same percentage. While the wealthy may absorb the impact, the poor are equally responsible for these taxes, making them potentially regressive.

- Inflationary Effect: Calculating and collecting the precise percentage of tax on each item might not always be feasible, leading sellers to charge more than the tax amount. Over time, this practice contributes to rising commodity costs, creating an inflationary effect.

- Lack of Civic Consciousness: Indirect taxes, being embedded in the product price, often go unnoticed by millions of people paying them. This lack of awareness diminishes civic consciousness among taxpayers.

|

66 videos|222 docs|73 tests

|

FAQs on Types of Taxes in India - 1 - Economics Optional for UPSC

| 1. What are the different types of taxes in India? |  |

| 2. How is income tax calculated in India? |  |

| 3. How does the Goods and Services Tax (GST) work in India? |  |

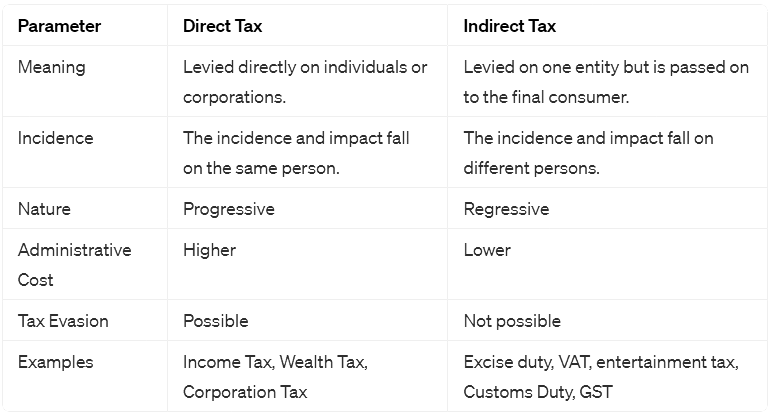

| 4. What is the difference between direct and indirect taxes in India? |  |

| 5. What is the purpose of property tax in India? |  |