WTO Agreement on Agriculture | Economics Optional for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Salient Features |

|

| India’s Commitments |

|

| Mandated Negotiations |

|

Introduction

- After over 7 years of negotiations the Uruguay Round multilateral trade negotiations were concluded on December 15, 1993 and were formally ratified in April 1994 at Marrakesh, Morocco. The WTO Agreement on Agriculture was one of the many agreements which were negotiated during the Uruguay Round.

- The implementation of the Agreement on Agriculture started with effect from 1.1.1995. As per the provisions of the Agreement, the developed countries were to complete their reduction commitments within 6 years, i.e., by the year 2000, whereas the commitments of the developing countries were to be completed within 10 years, i.e., by the year 2004. The least developed countries were not required to make any reductions.

- The products which are included within the purview of this agreement are what are normally considered as part of agriculture except that it excludes fishery and forestry products as well as rubber, jute, sisal, abaca and coir.

Salient Features

The WTO Agreement on Agriculture contains provisions in 3 broad areas of agriculture and trade policy : market access, domestic support and export subsidies

Market Access

- This includes tariffication, tariff reduction and access opportunities. Tariffication means that all non-tariff barriers such as quotas, variable levies, minimum import prices, discretionary licensing, state trading measures, voluntary restraint agreements etc. need to be abolished and converted into an equivalent tariff. Ordinary tariffs including those resulting from their tariffication were to be reduced by an average of 36% with minimum rate of reduction of 15% for each tariff item over a 6 year period. Developing countries were required to reduce tariffs by 24% in 10 years. Developing countries as were maintaining Quantitative Restrictions due to balance of payment problems, were allowed to offer ceiling bindings instead of tariffication.

- Special safeguard provision allows the imposition of additional duties when there are either import surges above a particular level or particularly low import prices as compared to 1986-88 levels.

- It has also been stipulated that minimum access equal to 3% of domestic consumption in 1986-88 will have to be established for the year 1995 rising to 5% at the end of the implementation period.

Domestic Support

- For domestic support policies, subject to reduction commitments, the total support given in 1986-88, measured by the Total Aggregate Measure of Support (total AMS), should be reduced by 20% in developed countries (13.3% in developing countries). Reduction commitments refer to total levels of support and not to individual commodities. Policies which amount to domestic support both under the product specific and non product specific categories at less than 5% of the value of production for developed countries and less than 10% for developing countries also excluded from any reduction commitments.

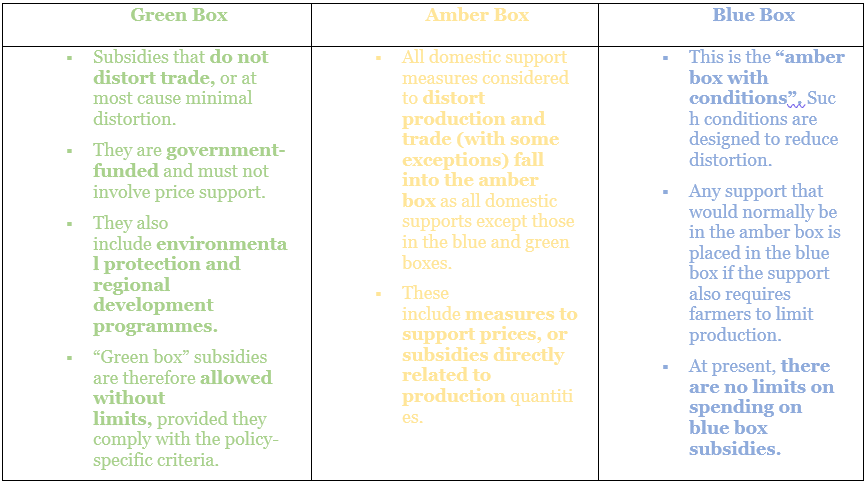

- Policies which have no or at most minimal, trade distorting effects on production are excluded from any reduction commitments (‘Green Box’-Annex 2 of the Agreement on Agriculture www.wto.org. The list of exempted green box policies includes such policies which provide services or benefits to agriculture or the rural community, public stock-holding for food security purposes, domestic food aid and certain de-coupled payments to producers including direct payments to production limiting programmes, provided certain conditions are met.

- Special and Differential Treatment provisions are also available for developing country members. These include purchases for and sales from food security stocks at administered prices provided that the subsidy to producers is included in calculation of AMS. Developing countries are permitted untargeted subsidised food distribution to meet requirements of the urban and rural poor. Also excluded for developing countries are investment subsidies that are generally available to agriculture and agricultural input subsidies generally available to low income and resource poor farmers in these countries.

Export Subsidies

- The Agreement contains provisions regarding members commitment to reduce Export Subsidies. Developed countries are required to reduce their export subsidy expenditure by 36% and volume by 21% in 6 years, in equal installment (from 1986 –1990 levels). For developing countries, the percentage cuts are 24% and 14% respectively in equal annual installment over 10 years. The Agreement also specifies that for products not subject to export subsidy reduction commitments, no such subsidies can be granted in the future.

India’s Commitments

Market Access

- As India was maintaining Quantitative Restrictions due to balance of payments reasons(which is a GATT consistent measure), it did not have to undertake any commitments in regard to market access. The only commitment India has undertaken is to bind its primary agricultural products at 100%; processed foods at 150% and edible oils at 300%. Of course, for some agricultural products like skimmed milk powder, maize, rice, spelt wheat, millets etc. which had been bound at zero or at low bound rates, negotiations under Article XXVIII of GATT were successfully completed in December, 1999, and the bound rates have been raised substantially.

Domestic Support

- India does not provide any product specific support other than market price support. During the reference period (1986-88 ), India had market price support programmes for 22 products, out of which 19 are included in our list of commitments filed under GATT. The products are – rice, wheat, bajra, jawar, maize, barley, gram, groundnut, rapeseed, toria, cotton, Soyabean (yellow), Soyabean (black), urad, moong, tur, tobacco, jute, and sugarcane. The total product specific AMS was (-) Rs.24,442 crores during the base period. The negative figure arises from the fact that during the base period, except for tobacco and sugarcane, international prices of all products was higher than domestic prices, and the product specific AMS is to be calculated by subtracting the domestic price from the international price and then multiplying the resultant figure by the quantity of production.

- Non-product specific subsidy is calculated by taking into account subsidies given for fertilizers, water, seeds, credit and electricity. During the reference period, the total non-product specific AMS was Rs.4581 crores. Taking both product specific and non-product specific AMS into account, the total AMS was (-) Rs.19,869 crores i.e. about (-) 18% of the value of total agricultural output.

- Since our total AMS is negative and that too by a huge magnitude, the question of our undertaking reduction commitments did not arise. As such, we have not undertaken any commitment in our schedule filed under GATT. The calculations for the marketing year 1995-96 show the product specific AMS figure as (-) 38.47% and non-product specific AMS as 7.52% of the total value of production. We can further deduct from these calculations the domestic support extended to low income and resource poor farmers provided under Article 6 of the Agreement on Agriculture. This still keeps our aggregate AMS below the de minimis level of 10%.

- India’s notifications on AMS are available at web site address www.agims.wto.org

Export Subsidies

- In In India, exporters of agricultural commodities are not entitled to export subsidies except as those provided under Article 9.1 (d) and (e) of the WTO Agreement on Agriculture under Special and Differential Treatment provisions of the WTO. This flexibility has been provided up to the end of the year 2023 after which all export subsidies will be required to be eliminated as per the Nairobi Ministerial Decision on Export Competition of 2015.

Mandated Negotiations

Article 20 of the Agreement on Agriculture (AoA) mandates that negotiations for continuing the reform process in agriculture will be initiated one year before the end of the implementation period. As the implementation period for developed countries culminated at the end of the year 2000, the negotiations on the Agreement on Agriculture began in January 2000.

- These negotiations are being conducted in special sessions of the WTO Committee on Agriculture (COA) at Geneva. The following are the broad parameters for carrying out negotiations:

- Experience of member countries in implementation of reduction commitments till date;

- The effects of reduction commitments on World Trade in Agriculture;

- Non trade concerns, special and differential treatment to developing country members and the objective of establishing a fair and market oriented agricultural trading system; and

- Identifying further commitments necessary to achieve the long-term objectives of the Agreement.

|

66 videos|222 docs|73 tests

|

FAQs on WTO Agreement on Agriculture - Economics Optional for UPSC

| 1. What are the salient features of India's commitments under the WTO Agreement on Agriculture? |  |

| 2. What is the significance of the WTO Agreement on Agriculture for India? |  |

| 3. What are mandated negotiations under the WTO Agreement on Agriculture? |  |

| 4. What commitments has India made regarding reducing agricultural subsidies under the WTO Agreement on Agriculture? |  |

| 5. How does the WTO Agreement on Agriculture address the concerns of developing countries like India? |  |