Ramesh Singh Summary: Introduction to Economics- 2 | Indian Economy for UPSC CSE PDF Download

Economics Overview

- Economics is often called the "dismal science" or a "failed science," criticized for being hard to understand, especially for those without a background in it.

- Despite criticisms, economics plays a crucial role in improving the world, and understanding it is essential.

- Many university-educated individuals in economics face challenges as they often know less about its practical applications.

- Simplifying economic concepts while keeping their essence intact and addressing contemporary economic issues is a challenging task.

Understanding Economics

- Economics, in simple terms, studies the economic activities of human beings.

- Humanities, which explore diverse human activities, often take an interdisciplinary approach.

- Economic activities involve any actions where money is involved, such as working, buying, selling, or conducting business.

- Defining economics has been challenging; it's not just about money but also resource use and distribution.

- Traditional definitions highlight economics as the study of how societies use resources to produce and distribute valuable commodities.

- Another widely used definition sees economics as the study of how individuals, firms, governments, and organizations make choices that determine resource use in society.

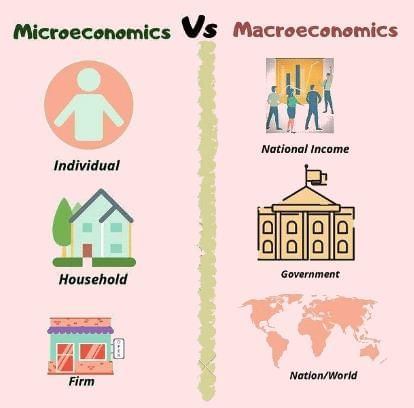

Micro And Macro

After the Great Depression in the 1930s, the field of economics was divided into two primary branches: microeconomics and macroeconomics.

John Maynard Keynes is acknowledged as the father of macroeconomics, a branch that emerged with the publication of his influential work, "The General Theory of Employment, Interest, and Money," in 1936.

- Macroeconomics looks at the big picture of the economy, like the entire forest, while microeconomics focuses on specific details, like individual trees. Microeconomics studies individual choices, consumer incomes, and specific market dynamics, taking a bottom-up approach. On the other hand, macroeconomics studies overall economic trends with a top-down approach.

- Despite seeming different, microeconomics and macroeconomics are connected and work together, dealing with similar issues in the economy. For example, if inflation rises (a macro effect), it can impact the cost of raw materials, affecting what consumers pay (a micro effect).

- Microeconomic theory started by understanding how prices are set, while macroeconomics is based on real-world observations that existing theories couldn't fully explain. Unlike microeconomics, macroeconomics includes different schools of thought, like New Keynesian or New Classical.

- There's also another essential part of economics called econometrics, which uses statistics and math to analyze economic phenomena. Progress in econometrics has been crucial for advanced analyses in both micro and macroeconomics over the last century.

What is the Economy?

The term "economy" refers to the practical implementation of economic principles. Every country, company, and family has its own economy. We often talk about economies in relation to nations, such as the Indian economy, the US economy, or the Japanese economy.

While the fundamental principles of economics are consistent, the economies of different countries can vary significantly due to their unique social and economic conditions.

Sectors and Types of Economies

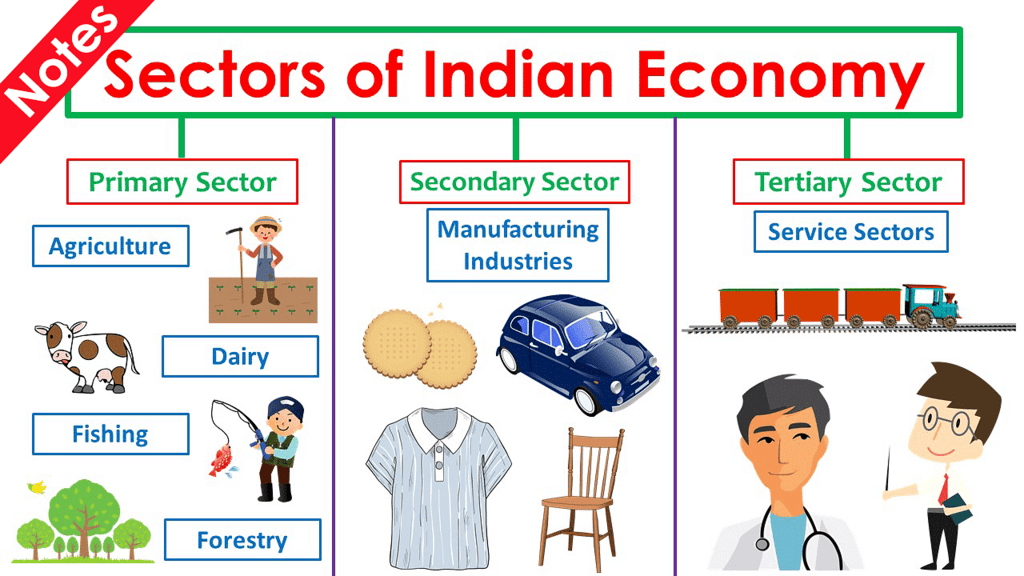

Economic activities in a country are divided into three main sectors, each with different types based on their dominant form of operation.

Sectors of Indian Economy

Sectors of Indian Economy

Primary Sector: This involves activities that exploit natural resources, like mining, agriculture, and oil exploration. If agriculture contributes significantly to the national income, it's called an agrarian economy.

Secondary Sector: This sector processes raw materials from the primary sector, also known as the industrial sector. Manufacturing, a sub-sector, is a major employer in developed economies. When this sector contributes significantly to national income, it's referred to as an industrial economy.

Tertiary Sector: This includes activities where services are produced, such as education, healthcare, banking, and communication. If this sector contributes a large part to the national income, it's known as a service economy. There are two additional sectors—quaternary and quinary—considered sub-sectors of the tertiary sector.

Quaternary Sector: Known as the 'knowledge' sector, it involves activities related to education, research, and development, crucial for defining the quality of human resources in an economy.

Quinary Sector: This is where top-level decisions are made, involving high-level decision-makers in government and private corporations. It's considered the 'brain' behind socio-economic performance, with a small number of people involved.

Stages of Growth

- W.W. Rostow, in 1960, proposed a theory about how economies grow by observing developed countries.

- According to him, economic growth happens in five stages, moving through the main sectors—agriculture, industry, and services.

- However, some countries, including India and several in Southeast Asia like Indonesia, the Philippines, Thailand, and Vietnam, didn't exactly follow this pattern.

- Instead of a balanced growth of all sectors, they shifted from an agrarian economy directly to a service economy, skipping a more significant expansion in their industrial sector.

Economic Systems

- Human life depends on using certain things, like goods and services, and some of these are essential for survival, such as food, water, shelter, and clothing.

- The first challenge for humanity was figuring out how to make sure people have these necessities. This challenge involves two aspects: creating (producing) these things and ensuring they reach those who need them (distribution/supply).

- To produce these necessities, you need to set up productive assets, and this requires spending money, which is known as investment. The question is, who will invest, and why? In addressing this challenge, different types of economic systems, or ways of organizing an economy, have evolved. While there are many economic systems, three major ones stand out. Let's take a brief look at them in the following sections.

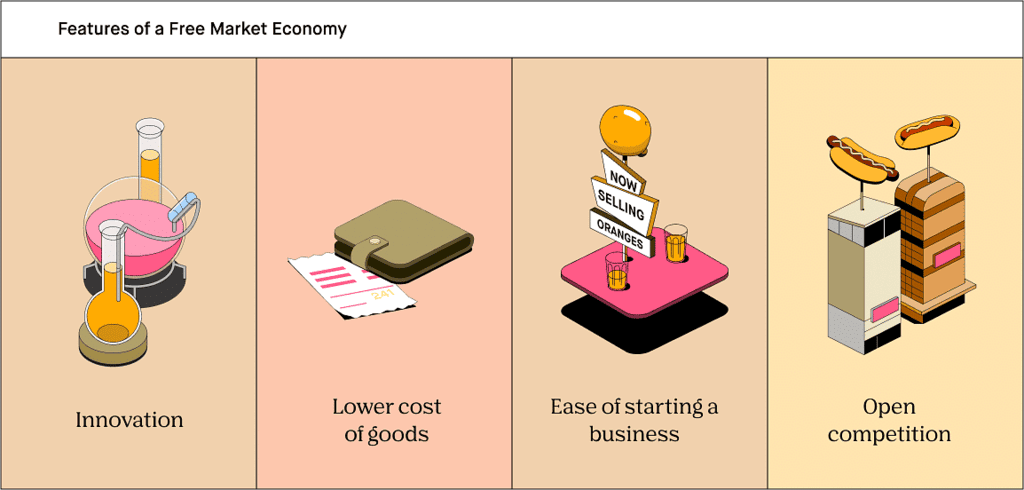

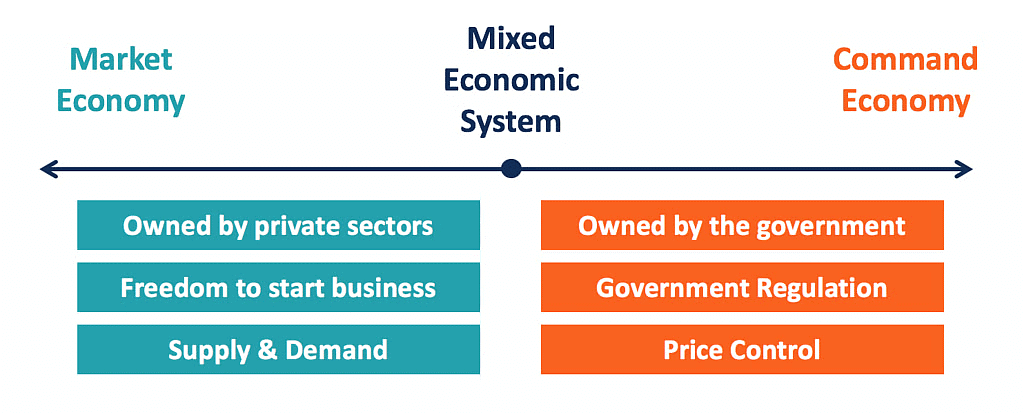

Market Economy

- Self-Interest: People and businesses naturally do things that benefit themselves. This unintentionally helps everyone, a bit like a hidden force.

- Division of Labour: Doing different parts of a job can make things faster and better.

- Market Forces: The prices of things should be decided by what people want to buy (demand) and what's available (supply).

- Competition and Hands-off Government: Businesses should compete with each other, and the government should mostly stay out of business matters. This helps the economy work better.

Resulting Economic Systems - Capitalism and Free Market Economy:

- Capitalism: This system focuses on creating wealth. Some businesses might become very powerful, limiting competition.

- Free Market Economy: This system is all about letting the market decide. There's little government control, promoting free competition.

How It Worked and Challenges:

- These economic concepts gained popularity in the United States after the late 18th century, particularly following Adam Smith's influential work in 1776. They spread to various countries, contributing to economic prosperity.

- Over time, however, wealth became concentrated in the hands of a few, leading to widespread poverty and significant inequalities.

- The system was characterized by low taxes and limited government support for those in need.

- The approach faced major challenges during the Great Depression in 1929, when many people experienced severe hardships. This crisis highlighted the need for reforms and changes in the economic system.

Cons of this System

Old System - Capitalism and Challenges:

- Features: The system supported personal success, innovation, and business, working alongside democratic rights and freedoms.

- Problems: However, it faced issues like not having effective ways to help the poor, limited government welfare, and growing inequality despite attempts to tax the rich more.

- Changes with the Great Depression: The system encountered a major problem during the Great Depression in the 1920s, leading to the emergence of a new kind of economics known as macroeconomics, suggested by economist John Maynard Keynes.

- Keynesian Approach - A Mix of Systems: Keynes proposed borrowing some ideas from a different system to address the crisis, and after implementing these suggestions, economies showed signs of improvement, resulting in a mix of old and new economic approaches.

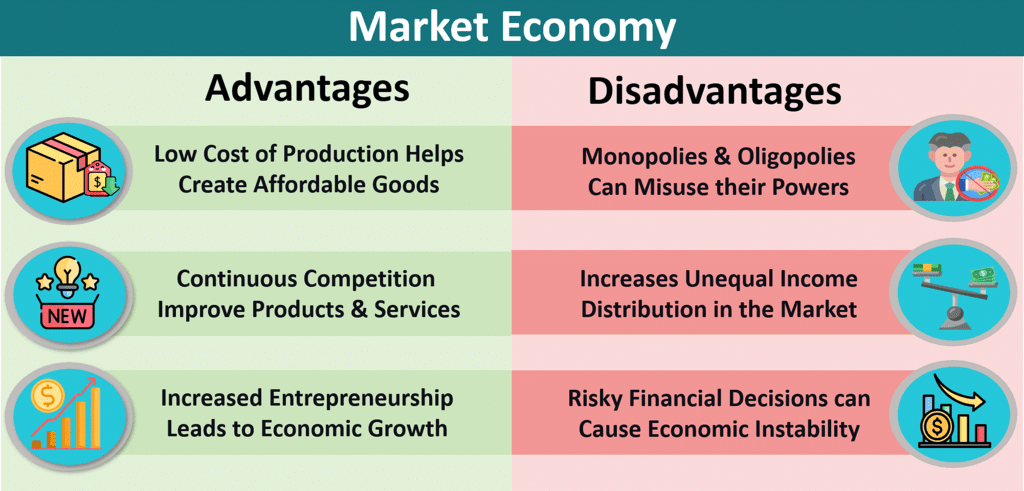

Advantages and Disadvantages of Market Economy

Advantages and Disadvantages of Market Economy

In simple terms, The old system faced challenges, especially during the Great Depression. Economist Keynes suggested combining some ideas from a different system to fix things, leading to a mix that helped economies recover.

Non-market Economy

New Economic System - Socialism and Communism: Inspired by Karl Marx: This system, influenced by Karl Marx, had two types - socialist and communist. In socialism (like ex-USSR), the state-controlled natural resources. In communism (like China), the state also controlled labor.

Non Market Economy

Non Market Economy

Main Ideas:

- Country's resources should benefit everyone.

- Society should own and control resources (socialism/communism).

- No private property to prevent exploitation and economic inequality.

- No buying and selling (no demand and supply).

- No competition (complete state control).

- People work for the government, and the government provides for their needs.

How it Worked:

- Decisions on what to make, how much, and what to share were made by the government.

- First tried in the USSR, it spread to Eastern Europe and later to communist China, creating the socialist and communist models of a non-market economy.

Cons of this System

Downsides of Socialism and Communism:

Lack of Capital Creation: The systems lacked a focus on creating wealth or capital, resulting in a shortage of funds for future investments.

Resource Misallocation: State-controlled prioritization of resources led to misallocation and wastage, ignoring market-driven optimal resource uses.

Absence of Innovation: The absence of property rights and monetary rewards discouraged hard work, leading to a lack of innovation, research, and development.

Non-Democratic Systems: Lack of political freedom and liberties in non-democratic systems, with the state becoming the sole exploiter, termed as 'state capitalism.'

Internal Decay: From the 1970s, internal decay plagued these economies, with the state facing inherent challenges.

Transition to Market Economy: By the mid-1980s, both the ex-USSR and China shifted toward mixed economies, combining socialist and market traits. Reforms like Perestroika and Glasnost in the ex-USSR and China's Open Door Policy marked a move towards a more market-oriented approach.

Mixed Economy

Mixed Economy

Mixed Economy

Evolution to Mixed Economy: By the late 1930s, market economies had already integrated aspects from non-market economies to recover from the Depression. France formally embraced the mixed system in 1944-45, emphasizing national planning. The transition gained momentum as non-market economies initiated reforms by the mid-1980s.

Insights from the World Bank: The World Bank recognized the necessity of state intervention in the market economy, deviating from its strong support for the free market. It acknowledged that both market and non-market systems have shortcomings, suggesting an optimal economic system is a fusion of both.

Key Attributes of Mixed Economy:

Mixed Economic System

Mixed Economic System

- Dual Responsibilities: Both the state and the private sector have economic roles.

- Private Sector Driven: The private sector handles roles driven by profit, like producing and supplying private goods.

- State Involvement: The state addresses roles where profit motivation is lacking, particularly in providing public goods consumed by everyone.

- Adaptability: Economic roles of both sectors can change based on evolving needs.

- Regulation: The state oversees the regulation of the economic system, including rules, competition, and taxation.

A mixed economy is flexible, capable of adjusting to socio-economic needs, marking a departure from rigid models of market and non-market systems. This resolves the longstanding debate about the role of the state in the economy.

Distribution Systems

There are three ways we handle getting stuff to people. Imagine it like this:

Types of Economic System

Types of Economic System

- Capitalist Economy: In this system, goods and services are exchanged in a competitive marketplace where prices are determined by supply and demand. Consumers buy what they need at prices set by the market.

- State Economy: Here, the government controls economic resources and distributes goods and services directly to people without any payment. The government takes charge of the entire distribution process.

- Mixed Economy: This system combines elements of both the capitalist and state economies. Some goods and services are available in the market, while the government provides others, either at subsidized rates or for free. The government plays a significant role in ensuring social welfare by providing essential services.

People seem to like the mixed way, using both market and government. But over time, different ideas influenced it. Some of these ideas had a big impact on the world's economies.

Washington Consensus

The Washington Consensus is like a list of suggestions made by big organizations (IMF, World Bank, US Treasury) to help countries that are facing economic problems. These suggestions were given by experts in Washington, so that's why it's called the "Washington Consensus."

Here are the 10 things they suggested:

- Be careful with spending (Fiscal discipline).

- Focus on important things like health, education, and infrastructure when spending money.

- Change taxes to be fairer and encourage economic growth (Tax reform).

- Let the market decide interest rates (Interest rate liberalization).

- Let the market decide the value of your country's money (Competitive exchange rate).

- Allow more open trade with other countries (Trade liberalization).

- Let more foreign businesses invest in your country (Liberalization of FDI inflows).

- Let private companies run things that were once done by the government (Privatization).

- Remove unnecessary rules for businesses (Deregulation).

- Make sure people's belongings are protected (Secure property rights).

The Washington Consensus, initially a set of suggestions to help countries facing economic problems, later became linked to ideas like extreme free-market beliefs. Some people see it as a rigid commitment to the belief that markets can handle everything.

- But, in reality, the policies suggested by the IMF and World Bank during the 1980s and early 1990s, known as the Washington Consensus, were meant to address issues in Latin America. However, these ideas were later criticized, even by their original supporters. The term has become somewhat negative, with some thinking it represents an imposition of strict rules by the United States on developing countries.

- John Williamson, who coined the term, says people often misunderstand it. He believes it was called a consensus because it was meant to be universally applicable, not a strict set of rules imposed by the U.S. Many supporters see it as a moderate way to bring stability to a country.

- However, these policies led to processes like liberalization, privatization, and globalization, reducing the role of the state in the economy. This was especially true for nations receiving funding from the World Bank or going to the IMF during financial crises, like India did in 1991.

- Some experts think that the economic troubles, like the 2008 U.S. subprime crisis and the subsequent global recession, were influenced by the ideas promoted by the Washington Consensus. After the recession, there's been a shift in trust from the market to a preference for more government involvement in the economy, known as 'state intervention.'

Beijing Consensus

China has become economically strong since the mid-1980s, and people have debated whether it followed a specific plan for this. In 2004, Joshua Cooper Remo introduced the idea of the "Beijing Consensus," also known as the Chinese way of economic development. This was seen as an alternative to the ideas of the "Washington Consensus," which were suggested by big international organizations.

The Chinese model, according to experts, is based on three main things:

- Constant experimentation and innovation: Always trying new things and being creative.

- Peaceful distributive growth with gradual reforms: Growing the economy in a way that benefits everyone, with changes happening slowly.

- Self-determination and inclusion of selective foreign ideas: China deciding things for itself and taking in useful ideas from other countries.

Global Attention

- This model got a lot of attention, especially during the global recession when China was still doing well.

- Some experts saw it as an alternative to the free-market approach suggested by the Washington Consensus.

- But whether other countries should copy China's way is a debated topic. Some think what worked for China might not work everywhere.

Interest from Developing Countries

- As of 2010, many developing countries were interested in the Chinese model.

- However, when China's economic growth slowed down in recent times, experts have suggested being careful about blindly following this model.

- Some also believe that the rise of protectionism in various countries is linked to an interest in the Chinese way of doing things.

Santiago Consensus

The Santiago Consensus, introduced by the then World Bank Group President James D. Wolfensohn, serves as an alternative to the Washington Consensus.

Its primary focus is on inclusion, emphasizing not only economic but also social development.

This model is designed to adapt its features to suit the specific needs of local situations, sharing similarities with the concept found in the Beijing Consensus.

The World Bank's approach involves leveraging the power of technology and global cooperation to share the best practices of development worldwide. As part of this strategy, there is a proposal to establish a "knowledge bank."

This approach from the World Bank has inspired governments globally to prioritize aspects of inclusive socio-economic growth.

In the case of India, the launch of the third generation of economic reforms in 2002 aimed to make the benefits of reforms more inclusive.

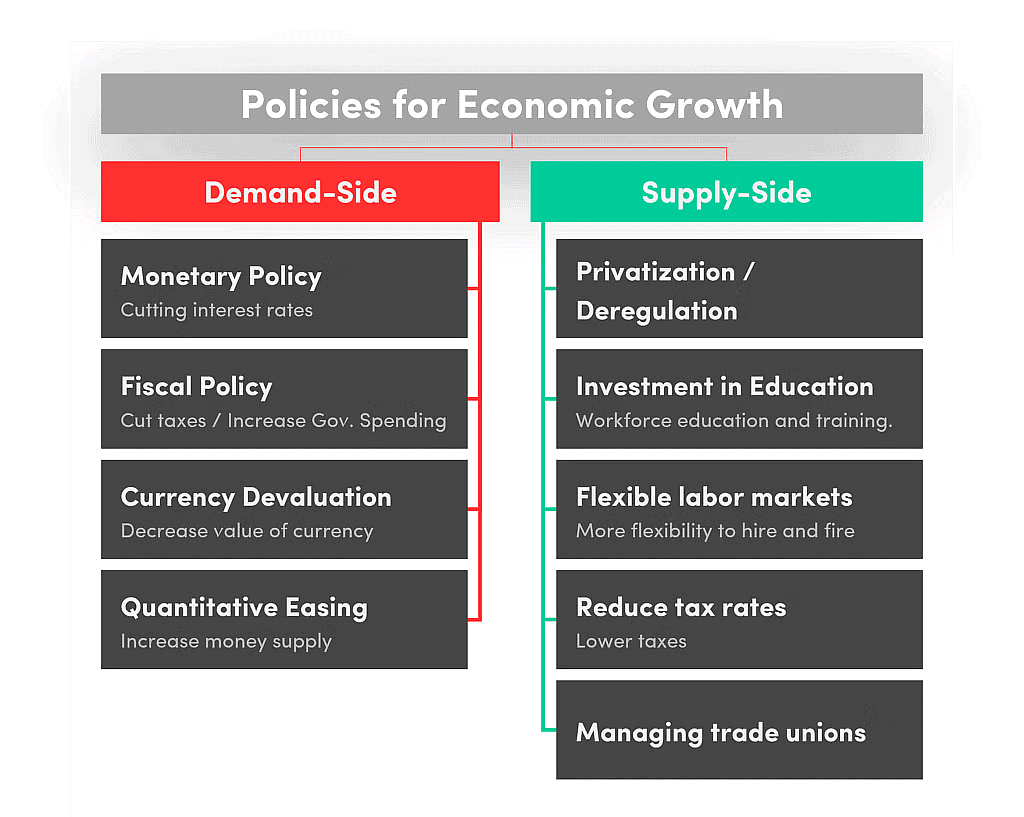

Capitalism as a Tool of Growth Promotion

- A long time ago, capitalism had problems during the Great Depression. They made some changes, creating a mix of different economic ideas.

- But then, capitalism came back in two waves - first with something called the Washington Consensus in the 1980s and later with globalization through the World Trade Organization (WTO) after 1995.

- The big economic crash in 2007, caused by issues in the United States, showed that extreme capitalist policies (ways of doing things) in rich countries can be really bad for everyone.

- Now, people agree that while capitalism by itself isn't perfect, some of its ideas can help make things better.

- Many countries, like India, are using a mix of ideas. They use some capitalist policies to help businesses, but they also have other plans to make sure everyone is taken care of.

- In 2015-16, people in India complained that the budget was helping rich people too much. The person in charge of money, the finance minister, said they were trying to help both rich and poor.

- So, experts now see capitalism not just as a type of economy but as a practical way to make things grow and ensure everyone gets enough money.

National Income

National income is the total value of all the goods and services manufactured by the residents of the country, in a year., within its domestic boundaries or outside. It is the net amount of income of the citizens by production in a year. There are four main concepts involved: GDP, NDP, GNP, and NNP. Let's take a straightforward look at each.

(i) Gross Domestic Product(GDP)

Gross Domestic Product (GDP) is the total value of all goods and services produced in a country within a year. For India, this year runs from April 1 to March 31.

To calculate GDP, we add up spending on national consumption, investment, government spending, and the trade balance (exports minus imports). This helps us account for goods and services produced within the country and those exported.

Gross Domestic Product (GDP)

Gross Domestic Product (GDP)

Understanding the terms used in GDP:

- "Gross" means total.

- "Domestic" refers to economic activities within the country.

- "Product" includes both goods and services.

- "Final" means the end product with no further value addition.

Uses of GDP:

- It shows the growth rate of an economy. For example, if a country's GDP is 10% higher than the previous year, it has a growth rate of 10%.

- It quantitatively indicates the internal strength of the economy but doesn't provide information about the quality of goods and services.

- GDP is commonly used to compare the sizes of world economies. The International Monetary Fund (IMF) ranks economies based on their GDP. As of the latest data in 2022, India is the fifth-largest economy at the exchange rate and the third-largest at purchasing power parity (PPP), with China and the USA being the largest and second-largest economies, respectively.

(ii) Net Domestic Product (NDP)

Net Domestic Product (NDP) is like the GDP, but we adjust it by considering the wear and tear, or "depreciation," that happens to assets during production. All things, except humans, experience this wear and tear over time.

Governments set rates for how assets depreciate, like houses or machinery. For example, a residential house might have a 1% depreciation rate per year. This is done to account for the loss in value over time.

NDP is calculated by subtracting the depreciation from GDP: NDP = GDP – Depreciation.

There are two main uses of NDP:

- For domestic use: It helps understand the historical loss due to depreciation in the economy and analyze sectoral situations in different periods.

- It shows the achievements of an economy in research and development, aiming to reduce depreciation levels over time.

However, NDP is not used for comparing economies globally because different countries have different rates of depreciation. Rates can be logical, based on asset durability, or sometimes influenced by government policies to boost certain sectors. So, depreciation is not a universal measure for comparing economies worldwide.

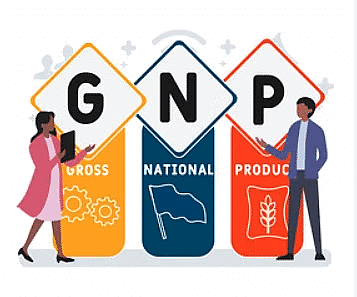

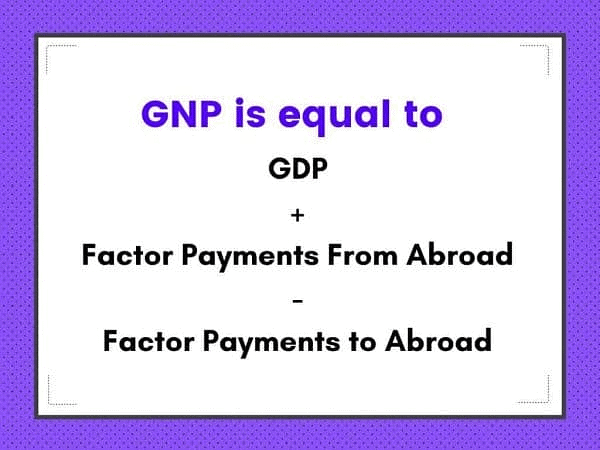

(iii) Gross National Product(GNP)

Gross National Product (GNP) is like GDP, but it includes the country's income from abroad. This means it accounts for economic activities that cross borders.

Gross National Product(GNP)

Gross National Product(GNP)

Income from Abroad has three components: Private Remittances, Interest on External Loans, and External Grants. The balance of these components determines if a country is a net gainer or loser. In India's case, it's been negative due to trade deficits and interest payments on foreign loans.

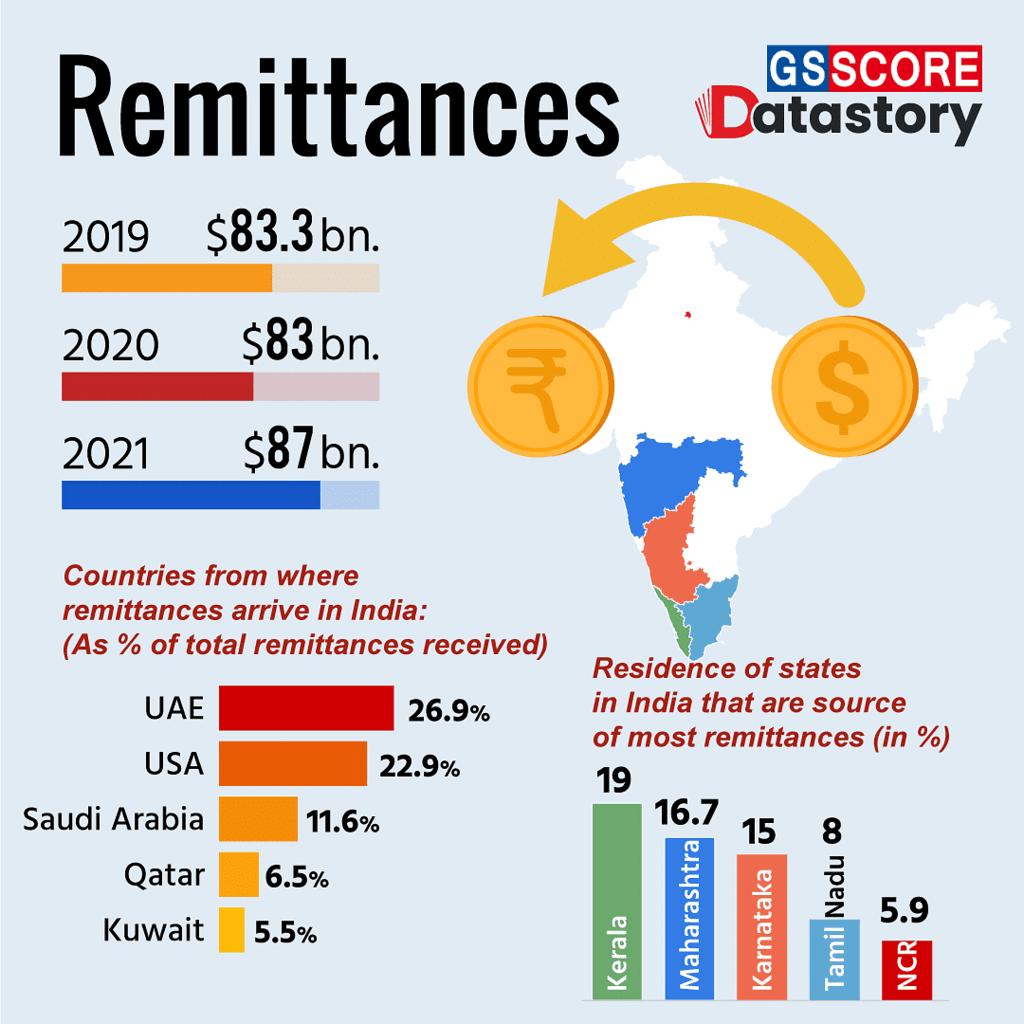

(i) Private Remittances

- It includes funds sent by Indian nationals working abroad back to India and by foreign nationals working in India to their home countries.

- India has historically gained from private remittances, particularly from the Gulf region until the early 1990s.

- The Gulf region remittances decreased due to the Gulf War, and the source shifted to remittances from the United States and other European nations.

- In 2022, India became the top recipient of remittances globally, receiving a significant amount of US$100 billion.

- This money plays a crucial role in supporting families and contributes to the overall economy.

(ii) Interest on External Loans

Interest on External Loans involves the net outcome of interest payments related to money borrowed and lent internationally.- It reflects the balance of inflow (interest earned on money lent) and outflow (interest paid on money borrowed) concerning external financial dealings.

- In the context of India, this outcome has consistently been negative, indicating that the country is a 'net borrower' from the global economy.

- A negative outcome means that India pays more in interest on the money it borrows internationally than it earns from money it lends out.

(iii) External Grants

- The outcome indicates whether India is a net recipient or donor of external grants.

- In recent times, India has been more of a giver than a receiver of such grants, contributing more to other nations.

- This shift aligns with India's increased participation in international economic diplomacy and its commitment to providing developmental and humanitarian assistance.

To calculate GNP (Gross National Product), Income from Abroad is subtracted from GDP (Gross Domestic Product): GNP = GDP - Income from Abroad.

In India, GNP is consistently lower than GDP due to the negative balance in Income from Abroad.

GNP is a more comprehensive measure of national income than GDP, reflecting both internal and external economic strength.

- It provides insights into how much a country depends on its products in the global market and vice versa, indicated by the size and direction of the balance of trade.

- Private Remittances showcase the standard of human resources, and the flow of interests indicates the country's financial interactions with the world.

(iv) Net National Product(NNP)

Net National Product (NNP) is a measure of a nation's economic performance that accounts for depreciation, providing a more accurate representation of its actual income. The calculation of NNP involves subtracting the depreciation (wear and tear) of assets from the Gross National Product (GNP). This adjustment is crucial because it reflects the real economic output available for consumption or investment after accounting for the loss in value of existing capital.

Net National Product(NNP)

Net National Product(NNP)

The formula to derive NNP can be expressed in two ways:

NNP = GNP - Depreciation: This version emphasizes the subtraction of depreciation directly from GNP.

NNP = GDP + Income from Abroad - Depreciation: An alternative formula that incorporates the balance of income from abroad along with depreciation.

Key points about NNP:

Accuracy of National Income: NNP is considered the purest form of national income, capturing the net value of economic output available to the nation.

Comparison with Other Measures: While GDP, NDP, and GNP are all considered national incomes, NNP is unique in its approach.

Per Capita Income (PCI): When NNP is divided by the total population of a nation, it gives the per capita income (PCI). PCI is a crucial indicator, representing the average income per person per year. The comparison of PCI among nations is influenced by the rates of depreciation they apply to different assets.

Impact of Depreciation Rates: Different nations may have varying rates of depreciation for their assets. The rates of depreciation they choose can impact the international comparison of national incomes, especially when assessed by organizations like the International Monetary Fund (IMF), World Bank (WB), and Asian Development Bank (ADB).

Revision of National Accounts: The Central Statistics Office (CSO) revised the 'base year' and the methodology for calculating national accounts in January 2015. This revision aimed to enhance the accuracy and relevance of economic data.

Cost and Price of National Income

When we talk about the income of a country, it can be calculated in two ways: "factor cost" or "market cost." Let's simplify the difference:

Factor Cost:

- This is like the producer's input cost, covering things like capital, raw materials, labor, rent, and power.

- Also known as "factory price" or "production cost," it represents the price from the producer's perspective.

Market Cost:

- This is what you see on price tags in stores. It's derived by adding indirect taxes to the factor cost, representing the final cost when goods reach the market.

India's Approach:

- India used to calculate national income at factor cost, but since January 2015, it switched to market price.

- Market price is calculated by adding product taxes (indirect taxes from the center and states) to the factor cost.

Key Change: This shift aligns India with global practices, making it easier to calculate national income, especially after the implementation of the Goods and Services Tax (GST).

Revised Method

National Accounts Changes in 2015: A Simplified Overview

In January 2015, the Central Statistics Office (CSO) made important updates to the National Accounts, bringing about two main changes:

Base Year Revision: The base year was shifted from 2004-05 to 2011-12. This adjustment followed the advice of the National Statistical Commission (NSC), which recommended revising the base year for all economic indices every 5 years.

Methodology Alignment: The methodology used for calculating National Accounts was revised to align with the System of National Accounts (SNA), 2008—a globally recognized standard.

Major Changes in National Accounts Revision (2015): Simplified Overview

The 2015 revision of National Accounts brought several significant changes, making the system more comprehensive and aligned with international standards. Here are the key modifications:

Headline Growth Rate Measurement: The headline growth rate is now measured by Gross Domestic Product (GDP) at constant market prices. This aligns with international practices. Previously, growth was measured using the growth rate in GDP at factor cost and at constant prices.

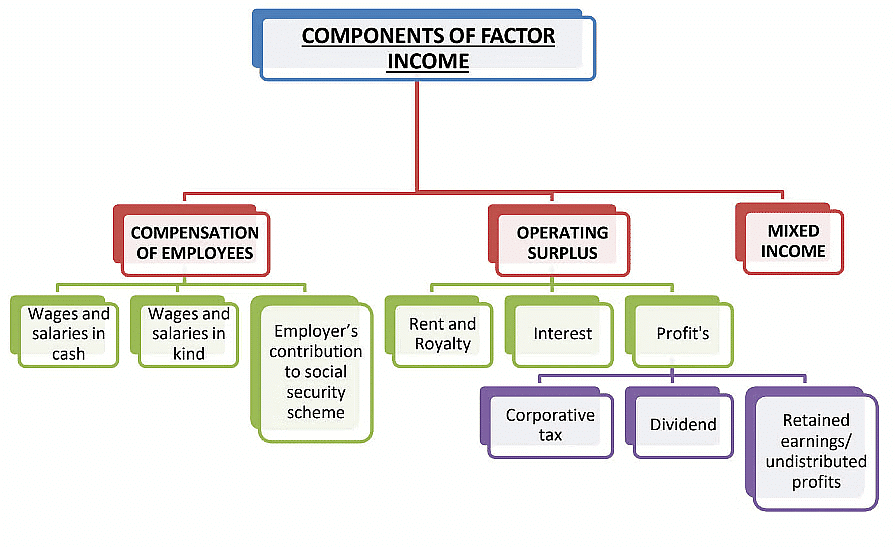

Sector-wise Estimates: (CE) refers to the compensation of employees, (OS) stands for operating surplus, (MI) is mixed-income, (CFC) represents consumption of fixed capital or depreciation,(GVA) represents Gross Value Added.

- GVA at basic prices is now calculated by considering CE, OS/ MI, and CFC, along with adjustments for production taxes and subsidies.

Components of Factor Income

Components of Factor Income - GVA at factor cost is derived from GVA at basic prices, accounting for production taxes and subsidies.

- GDP is calculated based on GVA at basic prices, incorporating product taxes and subsidies.

- Production taxes or subsidies are payments or benefits related to production and are not influenced by the actual volume of production. Examples include land revenues, stamp duties, and taxes on professions.

- On the other hand, product taxes or subsidies are associated with each product unit, such as excise tax, sales tax, and import/export duties. Product subsidies cover areas like food, petroleum, and fertilizer subsidies, as well as interest subsidies provided to farmers and households.

- These changes enhance the accuracy and completeness of economic data, offering a clearer picture of the economic landscape.

- GVA at basic prices is now calculated by considering CE, OS/ MI, and CFC, along with adjustments for production taxes and subsidies.

- Better Understanding of Companies:

- We now have a more complete view of businesses in both manufacturing and services.

- We achieve this by looking at the financial records (annual accounts) of companies. These records are filed with the Ministry of Corporate Affairs under their governance initiative called MCA21.

- By using the MCA21 database, especially for manufacturing companies, we can now account for all the activities a company is involved in, not just its manufacturing activities.

- Understanding Financial Institutions Better:

- We now have more detailed information about various financial institutions like stockbrokers, stock exchanges, asset management companies, mutual funds, and pension funds.

- Additionally, we also know more about the rules and regulations set by authorities such as SEBI, PFRDA, and IRDA, which oversee these financial institutions.

Better Insight into Local Governance: There's an improved understanding of the financial activities of local governments and self-governing bodies. Approximately 60% of the money they receive and spend is now accounted for, giving us a clearer view of their financial operations.

Comparing GVA and GDP

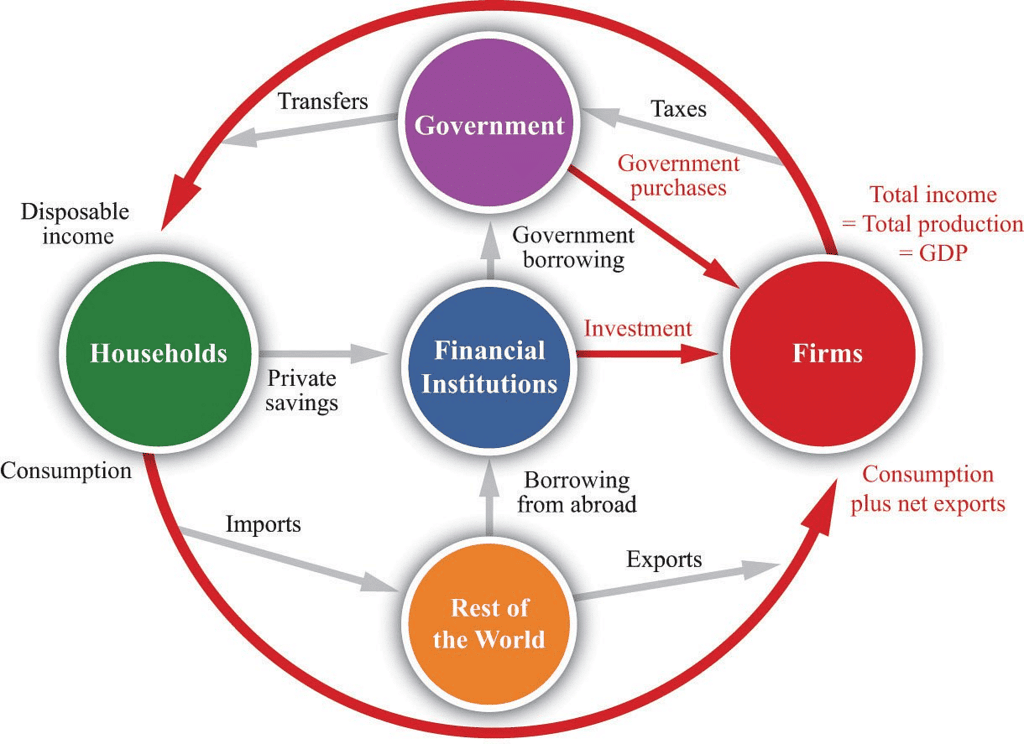

Methods of Calculating Economic Output: We estimate a country's economic output using two main approaches: demand side and supply side.

Demand Side vs Supply Side

Demand Side vs Supply Side

Supply Side:

- Supply side calculates the value added by different sectors like agriculture, industry, and services to derive the Gross Value Added (GVA).

- This method captures the income generated by all economic sectors across the country.

Demand Side:

- GDP (Gross Domestic Product) is calculated on the demand side by adding all expenditures in the economy.

- The four sources of expenditures are private consumption (individuals and households), government, business enterprises, and net exports (exports minus imports).

- GDP equals GVA plus net taxes (taxes minus subsidies), including all taxes received and subsidies provided by the government.

Comparison:

- While GDP is useful for comparing entire economies, GVA is better for comparing different sectors within an economy.

- GVA is particularly important when analyzing quarterly growth data, as quarterly GDP is derived by dividing the observed GVA data into different spender categories.

Gross Value Added (GVA) measures the value of goods and services produced in an economy, while Gross Domestic Product (GDP) accounts for the total economic output.

Fixed Base to Chain Base Method

The government is currently exploring a shift from the fixed-base method to the chain-base method for calculating GDP. In this new approach, GDP estimates are compared with the previous year instead of a fixed base year that undergoes revision every five years. The fixed-base method, currently in use, has limitations as it maintains unchanged weights assigned to economic activities, irrespective of structural changes, and does not consider relative price changes and their impact on demand.

The chain-base method offers several advantages over the existing approach.

- Firstly, it allows for a faster adaptation to structural changes by incorporating new activities and items into the calculation every year. This is particularly crucial as the current GDP estimates, based on 2011-12 data, are due for revision, and the new method ensures quicker updates.

- Secondly, the chain-base method facilitates easier and better international comparisons of India's growth data with other countries. This alignment with international best practices is essential for making informed global investment and trade decisions.

- Lastly, the shift to the chain-base method is believed to prevent ongoing controversies related to datasets, providing more accurate and up-to-date information for economic analysis.

Standing Committee on Economic Statistics(SCES)

- The Standing Committee on Economic Statistics (SCES) was formed by the government in late December 2019, under the leadership of former Chief Statistician Pronab Sen.

- This 24-member committee includes representatives from notable entities such as the UNO, RBI, Ministry of Finance, Niti Auyoy, Tata Trust, and economists/statisticians from various universities.

- The committee's broad mandate encompasses the examination of economic datasets, covering surveys like the Periodic Labour Force Survey, Annual Survey of Industries, Annual Survey of Services Sector Enterprises, Annual Survey of Unorganised Sector Enterprises, Time Use Survey, Index of Service Production, Index of Industrial Production, Economic Census, and other relevant statistics. This new panel replaces the existing Standing Committees on labor, industry, and services.

Special Data Dissemination Standard (SDDS)

Special Data Dissemination Standard (SDDS) - The establishment of SCES is regarded as a response to concerns about India's failure to meet the requirements of the Special Data Dissemination Standard (SDDS) of the IMF. Many experts had expressed reservations about economic datasets and their publication methods since early 2015.

Income Estimates for FY 2022-23

India's GDP for FY 2022-23 to be 7%

India's GDP for FY 2022-23 to be 7%

Real GDP (Constant Prices): Estimated at ₹157.60 lakh crore, compared to ₹147.36 lakh crore in 2021-22, with a growth rate of 7.0% (down from 8.7% in 2021-22).

Nominal GDP (Current Prices): Estimated at ₹273.08 lakh crore, down from ₹236.65 lakh crore in 2021-22, with a growth rate of 15.4% (down from 19.5% in 2021-22).

GVA at Basic Prices (Current Prices): Estimated at ₹247.26 lakh crore, a 15.8% increase from ₹213.49 lakh crore in 2021-22.

GVA at Basic Prices (Constant Prices): Estimated at ₹145.18 lakh crore, a 6.7% increase from ₹136.05 lakh crore in 2021-22.

Net Taxes (Taxes - Subsidies): Estimated at ₹25.81 lakh crore, an 11.5% increase from ₹23.15 lakh crore in 2021-22.

Per Capita Income (Constant Prices): Estimated at ₹396,522, a 5.6% increase from ₹375,481 in 2021-22.

Per Capita Income (Current Prices): Estimated at ₹1,70,620, a 13.7% increase from ₹1,50,007 in 2021-22.

Recent Developments

1. Economic Growth and Macroeconomic Indicators

- GDP Growth: India’s real GDP growth for FY25 is estimated at 6.4%, with projections for FY26 ranging from 6.3% to 6.8%. Q2 FY25 saw a slowdown to 5.4% due to election uncertainties and global trade volatility, but robust domestic demand sustains optimism.

- Inflation: Retail inflation (CPI) eased to 3.34% in March 2025 from 4.85% in March 2024, aligning with RBI’s 4% ± 2% target. Food inflation remains a concern at 8.4% due to vegetable and pulse prices.

- Fiscal Deficit: Targeted at 4.5% of GDP for FY26, down from 5.1% in FY25, reflecting fiscal prudence. Public debt stabilized at ~83% of GDP, supported by robust revenue growth.

- Forex Reserves: Peaked at $704.9 billion in September 2024, easing to $634.6 billion by January 2025, covering 90% of external debt and 10 months of imports.

2. Digital Economy and Technology

- UPI Dominance: UPI handled ~120 billion transactions in 2024, accounting for 50% of global digital payment volume, reinforcing India’s fintech leadership.

- IT-BPM Sector: Projected to contribute 10% to GDP by 2025, with 80% export-driven revenue. Initiatives like ONDC and Digital India enhance e-commerce and digital inclusion.

- AI and Innovation: India ranks 39th in the Global Innovation Index 2024, with 3rd place in scientific publications. AI adoption in banking, healthcare, and agriculture boosts productivity.

3. Climate Economics and Sustainability

- Renewable Energy: Installed capacity reached ~200 GW by 2025, with 40% of energy from non-fossil sources, aligning with the 2030 target of 500 GW.

- Climate Budget: Union Budget 2025-26 allocates ₹3 lakh crore for green energy, including PM Suryaghar Yojana for solar adoption.

- Air Pollution: Economic Survey 2025 highlights air pollution in Delhi-NCR as a health concern, advocating efficient fossil fuel use alongside renewables due to transition challenges.

4. Global Trade and Economic Policies

- Trade Challenges: Higher global tariffs (e.g., 26% reciprocal tariffs) could reduce India’s trade surplus by 12.8% in FY26. PLI schemes and FTAs (e.g., India-UAE) aim to boost exports to $1 trillion by 2030.

- FDI Trends: FDI inflows rose 17.9% to $55.6 billion in FY25 (first 8 months), but net FDI dropped to $479 million (April-November 2024) due to global uncertainties.

- Atmanirbhar Bharat: Policies like Make in India and PLI for semiconductors and EVs promote self-reliance, countering deglobalization trends.

5. Sectoral Developments

- Agriculture: Foodgrain production for FY25 estimated at 330.9 million tonnes, up 4.8% from FY24. Wheat procurement rose 34% to 22.36 MT by April 2025, ensuring food security.

- Services: Contributes 55.3% to GVA in FY25, driven by skill development and digital services. Services PMI rose to 59.1 in April 2025.

- Manufacturing: HSBC Manufacturing PMI increased to 58.4 in April 2025, reflecting robust growth despite global slowdowns.

6. Social and Financial Inclusion

- Health: Ayushman Bharat PM-JAY issued 36.36 crore cards by January 2025, saving ₹1.25 lakh crore in out-of-pocket healthcare costs.

- Financial Inclusion: RBI’s Financial Inclusion Index rose to 64.2 in March 2024, with Regional Rural Banks expanding rural banking access.

- Employment: Job market grew 41% YoY in February 2025, driven by graduate hiring, though rural unemployment and gig economy skilling remain challenges.

|

121 videos|490 docs|159 tests

|

FAQs on Ramesh Singh Summary: Introduction to Economics- 2 - Indian Economy for UPSC CSE

| 1. What is the difference between microeconomics and macroeconomics? |  |

| 2. What are the main types of economic systems? |  |

| 3. What is the Washington Consensus? |  |

| 4. How does the Beijing Consensus differ from the Washington Consensus? |  |

| 5. What is national income and why is it important? |  |