Cost Concepts | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Different Basis for Classification of Cost |

|

| Other Types of Costs |

|

| Cost Unit |

|

Introduction

Costs can be classified based on various factors such as their nature, function, direct or indirect nature, variability, controllability, normality, capital or revenue, time planning and control, and managerial decisions. The classification of costs is determined by considering these factors. The term "cost center" refers to the smallest segment or area of responsibility where costs are accumulated. A "cost unit" is essentially a unit of output, and costs are incurred in its production. Costing techniques can be categorized into historical costing, absorption costing, marginal costing, direct costing, standard costing, and uniform costing.

Different Basis for Classification of Cost

Cost classification is the process of grouping costs according to their common characteristics. A suitable classification of costs is very helpful in identifying a given cost with cost centers or cost units. Cost may be classified according to their nature i.e., material, labour and expenses and a number of other characteristics. Depending upon the purpose to be achieved and requirements of a particular concern the same cost figures may be classified into different categories.

The classification of costs can be done in the following ways:

- By Nature of Element

- By Functions

- As Direct and Indirect

- By Variability

- By Controllability

- By Normality

- By Capital and Revenue

- By Time

- According to Planning and Control

- For Managerial Decisions

- Others

By Nature or Element or Analytical Classification

The cost are divided into three categories, i.e., materials, Labor and Expenses. Further Sub– classification of each element can be done, for example, material into raw material components, and spare parts, consumable stores, packing material, etc.

By Functions

It leads to grouping of costs according to the broad divisions of functions of a business undertaking or basic managerial activities, i.e., production, administration, selling and distribution.

According to this classification cost are divided as follows:

Manufacturing and Production Cost

This category includes the total costs incurred in manufacture, construction and fabrication of units of production.

Commercial Costs

This category includes the total cost incurred in the operation of a business undertaking other than the costs of manufacturing and production. Commercial cost may further be sub-divided into (a) administrative cost and (b) selling and distribution cost.

As Direct and Indirect

- Definition:

- Direct Costs: Costs directly linked and identifiable with a specific cost center or unit.

- Indirect Costs: Costs incurred for the benefit of multiple cost centers or units, not easily identifiable with a specific one.

- Examples:

- Direct Costs: Materials and labor used in manufacturing a product or a specific production process.

- Indirect Costs: Rent, management salaries, machinery depreciation – costs benefiting various cost centers.

- Nature of Business and Cost Unit:

- Determining Factor: The business type and chosen cost unit decide whether a cost is direct or indirect.

- Example: Hire charges for a mobile crane on a construction site are direct, but if used as part of a factory's services, it becomes an indirect cost.

- Importance of Distinction:

- Direct Cost: Accurately identified with the specific product or activity.

- Indirect Cost: Requires apportionment based on assumptions about their incidence.

By Variability

The basis for this classification is the behaviour of costs in relation to changes in the level of activity or volume of production. On this basis, costs are classified into three groups, viz., fixed variable and semivariable

- Fixed costs are expenses that stay constant in total regardless of changes in the production volume or activity level within a specific timeframe or output range. The fixed cost per unit inversely fluctuates with production volume, decreasing as production increases and increasing as production decreases. Examples of fixed costs include rent, insurance for factory buildings, and the factory manager's salary. While these costs remain constant in total, their per-unit value varies with changes in production, earning them the label of period costs, as they are more time-dependent than output-dependent. Additionally, they are referred to as capacity costs.

- Variable costs, on the other hand, are expenses that vary in total directly in proportion to the volume of output. The per-unit value of variable costs tends to remain constant despite changes in production activity. Examples of variable costs include direct material costs, direct labor costs, power, and supplies. These costs, known as product costs, are contingent on the quantity of output rather than time.

- Semi-variable costs combine elements of both fixed and variable costs. For instance, telephone expenses consist of a fixed monthly charge and a variable charge based on the number of calls made. Other examples of semi-variable costs include depreciation, building and plant repairs, and maintenance.

By Controllability

On this basis costs are classified into two categories;

- Controllable costs refer to expenses that can be influenced or managed by a specific member of an organization. These costs are, at least partially, under the control of management. Responsibility centers within an organization, such as cost centers, allow managers to influence the controllable costs incurred in a specific area. In general, direct costs like direct material, direct labor, and some overhead expenses are typically controllable by lower levels of management.

- On the other hand, uncontrollable costs are those influenced by specific individuals within an organization but are not within the control of management. Fixed costs, such as building rent and managerial salaries, are often considered uncontrollable. Additionally, overhead costs incurred by one department and apportioned to another receiving the service are also uncontrollable by the latter.

- The controllability of costs varies based on the management level (top, middle, or lower) and the time period (long-term or short-term).

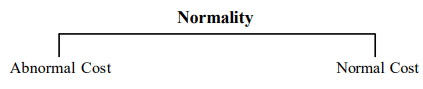

By Normality

On this basis, the costs are classified into two categories

- Normal cost refers to the expenses typically incurred at a specific production level under normal operating conditions. It is not considered a component of the production cost.

- Abnormal cost, on the other hand, is the expense that deviates from what is usually incurred at a given production level under normal conditions. This type of cost is not part of the production cost and is accounted for in the Costing Profit and Loss Account.

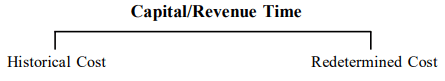

By Capital and Revenue or Financial Accounting Classification

- Capital cost refers to the expenditure incurred in acquiring assets with the aim of generating income or enhancing the business's earning potential. For instance, the cost of a rolling machine in a steel plant is considered a capital cost. The benefits derived from this cost, incurred at a specific point in time, are distributed over multiple accounting years.

- In contrast, revenue expenditure encompasses expenses undertaken to sustain the earning capacity of the business, such as maintaining assets or conducting regular business operations. Examples of revenue expenditure include the cost of materials used in production, labor charges for converting materials into products, salaries, depreciation, repair and maintenance expenses, as well as selling and distribution costs. When calculating costs, revenue items are taken into account, while capital items are entirely disregarded.

By Time

Costs can be classified as (i) Historical costs and (ii) Predetermined costs

- Historical costs are expenses determined after they have been incurred, typically available only once the production of a specific item or activity has been completed. These costs solely hold historical significance and do not serve any purpose for cost control.

- Predetermined costs, on the other hand, are anticipated or estimated costs calculated before the actual production, taking into account past periods' expenses and factors influencing those costs. When determined based on scientific principles, they become standard costs. Comparing these predetermined costs with actual costs reveals variances and their reasons, assisting management in assigning responsibility and implementing corrective measures to prevent recurrence in the future.

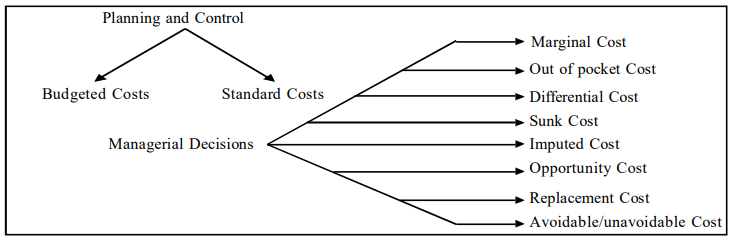

According to planning and control

Cost Accounting furnishes information to the management which is helpful in discharging the two important functions of management, i.e., planning and control. For the purpose of planning and control, costs are classified as budgeted costs and standard costs.

- Budgeted costs serve as estimates of anticipated expenditures for various business segments over a future time period, encompassing areas like manufacturing, administration, sales, research, and development. These estimates transform into written managerial objectives, with budgets created for different business phases such as sales, raw material costs, labor costs, production costs, manufacturing overheads, and office/administration overheads. Continuous comparisons between actual performance (actual costs) and budgeted costs are made to identify variations, allowing management to take corrective measures.

- Standard costs, as defined by the Institute of Cost and Management Accountants, London, are predetermined costs based on technical estimates for materials, labor, and overheads within a specified time frame and under defined working conditions. Standard costs are established before production, outlining the expected costs under specific conditions.

- While budgeted costs and standard costs share similarities as both are estimates for future periods, they differ in several aspects:

- Standard costs are scientifically determined for all aspects of business activities, whereas budgeted costs are estimates based on past financial data adjusted for future trends. Budgeted costs project financial accounts, while standard costs project cost accounts.

- The primary focus of budgeted costs is on the planning function of management, while standard costs emphasize control.

- Budgeted costs are extensive, representing a macro approach to business operations by estimating departmental operations. Conversely, standard costs are intensive, focusing on each element of business operations within a department.

- Budgeted costs are calculated for various business functions (e.g., production, sales, purchase), while standard costs are compiled for different cost elements (e.g., materials, labor, overhead).

For Managerial Decisions

On this basis, costs may be classified into the following categories:

- Marginal cost represents the additional expense incurred when producing one more unit. Essentially, it encompasses variable costs, which include prime cost and variable overheads, highlighting the distinction between fixed and variable costs.

- Out-of-pocket costs refer to the expenditure that involves cash payment, unlike non-cash expenses such as depreciation. These costs are pertinent for determining prices during a recession or making decisions between making or buying.

- Differential costs arise when there is a change in costs due to alterations in activity levels, production methods, or patterns. If the change results in increased costs, it is termed incremental cost, while a decrease is labeled decremental cost.

- Sunk costs, synonymous with historical costs, are expenses already incurred and irrelevant to decision-making. Examples include depreciation on fixed assets. Despite allocating depreciation to future periods, the original cost is unavoidable, making sunk costs unaffected by changes in volume.

- Imputed (or notional) costs are present in cost accounts only, such as notional rent on business premises owned by the proprietor or interest on unpaid capital. When evaluating alternative capital investment projects, imputed interest on capital is considered to determine the most profitable project.

- Opportunity cost is the maximum potential alternative earnings foregone when productive capacity or services are used for an alternative purpose. For instance, if a building is used for a project, the likely rent becomes the opportunity cost, impacting the project's profitability assessment.

- Replacement cost is the expense at which an identical asset or material can be purchased, reflecting the current market price when replacing or revaluing.

- Avoidable costs can be eliminated if a specific product or department is discontinued, like the salary of clerks in a department. Unavoidable costs, on the other hand, persist even if a product or department is discontinued, such as the salary of a factory manager or factory rent.

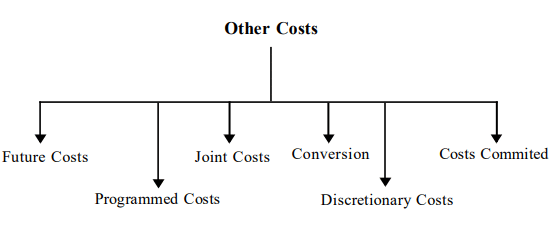

Other Types of Costs

- Future costs are expenses anticipated to be incurred at a later date.

- Programmed costs are associated with decisions reflecting the policies of top management, resulting in periodic appropriations. An example is the expenditure incurred by a company under a program like the Jawahar Rojgar Yojana initiated by the prime minister, representing a programmed cost aligning with top management's policies.

- Joint costs encompass the expenses of manufacturing joint products up to or before the split-off point. Costs incurred after the split-off point are termed separable costs. Joint costs are common to the processing of joint products and by-products until the split-off point and cannot be attributed to a specific product before this point.

- Conversion costs represent the expenses incurred in converting raw materials into finished products, calculated by subtracting the direct material costs from the overall production cost.

- Discretionary costs are those not clearly linked to capacity levels or output activity and are determined as part of the periodic planning process. Management decides on the allocation of funds for discretionary items such as advertising, research and development, and employee training during each planning period. These costs can be altered by management decisions.

- Committed costs are fixed costs resulting from management decisions made in the prior period and are beyond management control on a short-term basis in the present. They arise from the possession of production facilities, equipment, and organizational setups. Examples of committed costs include plant and equipment depreciation, taxes, insurance premiums, and rent charges.

Cost Unit

- Managers are often interested in knowing the cost of something. The ‘something’ for which the cost has to be ascertained is known as cost objective or cost object or cost unit. Examples of cost units include products, activities, department, number of patients treated, sales regions, etc.

- For example, if a factory produces motor cars then the cost unit would be motor car because the costs are all incurred in producting motor cars.

- Let us take up a more complex situation. Consider a bus operator providing bus services to the public between most of the major cities of the country. Suppose the bus operator wants to fix a cost unit, what is it?

- Note that here there is no production, what is provided is a service.

- Each trip between two cities may be taken as a cost unit. Alternatively cost per kilometre of travel may be taken as a cost unit. However, neither of the above cost units relates to the passenger who buys the service.

- If the operator wants to fix a price to be charged to each passenger, the above cost units would have to be adjusted further.

- Assume that a bus cover a distance of 700 km per day carrying 30 passengers on an average, the output is 700 × 30 = 21,000 passenger kilometres per day. On an average the passenger kilometres covered by each bus per week is 1,00,000. The total cost of operation per bus per week is ₹ 80,000, the cost per passenger kilometre is = ₹ 0.80

The implication is that the bus operator must charge, on an average, over ₹ 0.80 per kilometre to each passenger in order to make a profit.

|

196 videos|219 docs

|

FAQs on Cost Concepts - Commerce & Accountancy Optional Notes for UPSC

| 1. What are the different bases for the classification of costs? |  |

| 2. What are some other types of costs besides classification based on behavior? |  |

| 3. What is a cost unit and how is it important in cost accounting? |  |

| 4. What are some key cost concepts that are important to understand in cost accounting? |  |

| 5. How does understanding different types of costs help in effective cost management for businesses? |  |