Management of cash, receivables, inventory, and current liabilities | Management Optional Notes for UPSC PDF Download

Cash Management

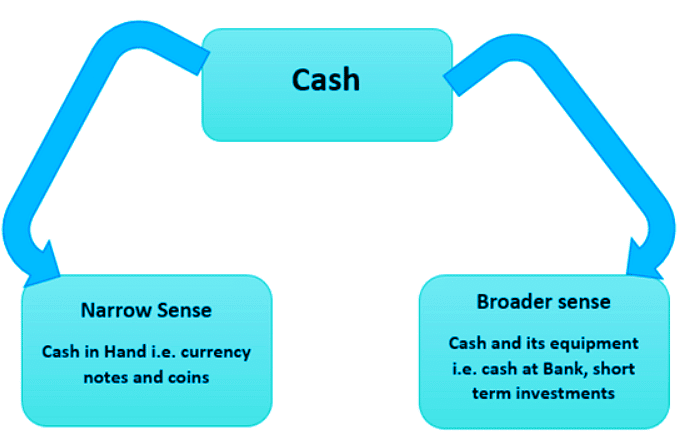

- Cash management involves the effective utilization and stewardship of an organization's cash resources. It plays a crucial role in ensuring the smooth functioning and financial robustness of the company. An adept cash management program devised by companies can facilitate growth and bolster financial resilience. Cash stands as a pivotal asset essential for procuring resources, equipment, and other assets necessary for producing goods and services. Marketable securities, classified as near cash, serve as a reserve pool of liquidity, providing quick access to cash when required.

- The concept of cash management is not novel, yet its significance has amplified in the contemporary business landscape due to evolving business practices and the escalating challenges and costs associated with borrowing (Howard, 1953). As the most liquid current asset, cash serves as the foundation upon which all current assets can be measured, as receivables and inventory eventually convert into cash (Khan, 1983), underscoring the criticality of cash management. Cash management is defined as the management's ability to anticipate and address cash-related issues proactively, ensuring timely solutions are available and effectively implemented.

- Cash management aims to strike a balance between maximum efficiency and liquidity, aligning with the firm's overarching objectives. It entails maintaining an optimal level of cash that adequately meets business obligations while minimizing excess cash balances that may hamper profitability. Cash management involves overseeing cash flows within and outside the organization, as well as managing cash balances at any given point in time.

- In financial literature, cash management encompasses a broad spectrum of finance, encompassing the collection, handling, and utilization of cash. It encompasses evaluating market liquidity, cash flow dynamics, and investment opportunities. With the evolving business environment and the escalating costs of borrowing, cash management has become increasingly vital in modern business operations.

Objectives of Cash Management

- Timely Payment Execution: Ensuring timely payments for routine expenses such as wages, salaries, and taxes.

- Optimization of Cash Balances: Striving to maintain an optimal cash balance to facilitate prompt payments while avoiding excessive idle cash, which could impact profitability.

An effective cash management system is imperative for the following reasons:

- Ensuring the availability of sufficient cash during peak periods for purchases and other operational needs.

- Facilitating the timely settlement of obligatory cash outflows.

- Facilitating strategic planning for capital expenditure projects.

- Enabling the procurement of external financing under favorable terms and conditions, if needed.

- Capitalizing on discounts, special purchases, and business opportunities.

- Investing surplus cash for short or long-term periods to maximize returns and ensure full utilization of idle funds.

Principles of Cash Management

Harry Gross has proposed several fundamental principles of cash management:

- Predictable Cash Needs: It is essential to reserve a reasonable amount of funds in cash to address anticipated periods of cash shortage. These shortages may be short-term or prolonged. Routine cash outflows lead to gradual reductions in cash balances at regular intervals. To mitigate these reductions, distributing payments to various workers on different days of the week can help balance cash levels. Another strategy involves scheduling cash disbursements to creditors during periods when accounts receivables are substantial, without jeopardizing liquidity.

- Contingency Cash Requirements: Unforeseen circumstances beyond management forecasts may arise, necessitating special cash reserves not accounted for in the cash budget. Such contingencies, such as wholesale product denials, significant bad debts, strikes, and lockouts, require specific cash allocations. Drawing from prior experiences and studying similar companies' practices can provide valuable insights. A prudent approach involves protecting the business from potential calamities, such as bad-debt losses or fires, through insurance coverage.

- External Cash Availability: The availability of funds from external sources plays a crucial role in cash management by providing credit facilities to the firm, thus reducing the need to maintain significant cash reserves. If a firm successfully secures sufficient funds from external sources such as banks, private financiers, shareholders, or government agencies, the necessity for maintaining cash reserves diminishes.

- Maximizing Cash Receipts: Financial managers strive to optimize cash receipts, which, when managed effectively, minimize cash requirements. Continuous evaluation of the comparative costs of offering cash discounts to customers versus incurring interest expenses on borrowing is essential to determine the most effective approach for maximizing cash receipts. Several techniques have proven beneficial in this regard:

- Concentration Banking: Establishing banking centers in different areas enables efficient cash collection. Customers are directed to send payments to these centers, which promptly deposit the collected funds into local banks. The collected funds are then transferred to the company's central bank accounts operated by the head office.

- Local Box System: Renting local post office boxes in various cities allows customers to forward their remittances. Approved lock banks collect these remittances from the boxes and transfer them to the company's central bank accounts.

- Credit Procedures Review: Evaluating credit procedures helps assess the impact of slow payers and bad debtors on cash flow. Assessing slow-paying customers' accounts reveals the extent of tied-up cash, while reviewing the credit policy identifies necessary modifications to strike a balance between strictness and leniency.

- Minimizing Cash Disbursements: Minimizing cash payments is the corollary of maximizing cash receipts. Implementing practices such as discontinuing fraudulent activities, issuing time drafts to large-sum creditors, staggering payments, and staggering payroll disbursements helps control cash outflows.

- Maximizing Cash Utilization: Maximizing cash utilization ensures efficient cash receipts and payments. When a company finds itself with excess funds, investing in interest-bearing securities can optimize returns. Fundamental procedures recommended by Gitman include:

- Delaying accounts payable payments without damaging the firm's credit rating while taking advantage of cash discounts.

- Expedite inventory turnover to avoid stockouts that could halt production or result in lost sales.

- Accelerate accounts receivable collections without jeopardizing future sales, possibly by offering cash discounts where economically feasible.

In conclusion, these principles serve as guiding tenets for effective cash management, ensuring liquidity while maximizing financial efficiency.

Cash Management Function

Cash management, as widely acknowledged in financial literature and various studies, revolves around minimizing idle cash balances, strategically investing temporary surpluses, and ensuring effective arrangements to meet both planned and unforeseen cash demands on the firm (Hunt, 1966). The primary objective of cash management is to reduce the necessary cash level while mitigating the risk of being unable to fulfill company obligations as they arise. This involves five key functions:

- Cash Planning: The prudent planning of funds is essential for achieving significant success, as emphasized by experts. Planning serves as the cornerstone of any management decision-making process. Cash planning involves forecasting future cash needs, assessing available resources, and identifying various uses for cash over a specified period. It entails formulating cash policies and procedures to ensure consistent business operations, aiming to provide cash not only for regular but also for irregular and exceptional requirements.

- Cash Flow Management: Another vital function of cash management is to effectively manage cash flows, which encompasses optimizing cash inflows and minimizing outflows. Achieving this entails accelerating collections, reducing excessive inventories, and enhancing control over payments. By enhancing cash flow management, a business can safeguard its cash reserves and consequently require a lower cash balance for its operations.

- Cash Flow Control: While cash planning is based on predictions, which may vary from actual results, control becomes indispensable in cash management. Cash control enhances the availability of usable cash within the enterprise. Faster cash flow cycles allow firms to convert goods and services into cash more frequently, reducing the cash requirement to finance business operations. Additionally, uncovering hidden cash reserves significantly decreases the enterprise's cash requirement.

- Optimizing Cash Levels: Financial managers must strive to maintain a sound liquidity position, or cash level, by focusing on planning, managing, and controlling cash effectively. Optimization involves striking a balance between risk and expected profit, ensuring the firm maintains an optimal cash level to meet all obligations timely.

- Investing Idle Cash: Surplus cash, or idle cash, refers to excess cash inflows not currently allocated to specific operations or purposes. Firms are required to hold cash for working capital needs, contingencies, and maintaining goodwill with bankers. Efficiently investing idle cash involves exploring financial instruments such as money market funds, treasury bills, and certificates of deposit.

In the banking sector, cash management encompasses various services offered to large business clients, including cash concentration, zero balance accounting, and automated clearinghouse facilities. These services aim to streamline cash flow management for businesses of a certain size. Additionally, private banking customers may also benefit from tailored cash management services.

Benefits of Cash Management System

In the era of technological advancement, the Cash Management System offers the following benefits to its customers:

- Timely Funds Availability: Corporate entities can access funds as needed on various days, enabling them to plan their cash flows effectively.

- Faster Collection of Instruments: The system facilitates the swift collection of financial instruments, leading to savings in bank interest.

- Competitive Rates: The Cash Management System provides affordable and competitive rates, ensuring cost-effectiveness for customers.

- Single Point of Contact: Customers benefit from a single point of contact for all their queries, simplifying the communication process.

- Pooling of Funds: The system allows for the pooling of funds at desired locations, enhancing liquidity management and optimizing resource utilization.

In summary, Cash Management encompasses the concentration, collection, and disbursement of cash, with a primary focus on maintaining cash flow. It involves a series of activities aimed at efficiently managing cash inflows and outflows, ensuring cash is directed where it is needed most. Cash management is ultimately about optimizing cash flows, balances, and short-term investments to support the financial health and stability of an organization.

Management of Accounts Receivable

- Accounts receivable, often comprising over 25 percent of a firm's assets, represent debts owed to the firm by customers arising from the sale of goods or services. These receivables result from credit sales, where payments are not immediately received but expected in the near future. Receivables management encompasses decisions regarding overall credit and collection policies, as well as evaluating individual credit applicants, also known as trade credit management.

- Robert N. Anthony defines accounts receivable as amounts owed to the business enterprise, typically by customers. Receivables are investments for businesses engaged in credit sales, tying up substantial funds in trade debtors. Credit sales enable businesses to shield sales from competitors and attract potential customers with favorable terms, typically conducted on open accounts without formal reactions of debt obligations from buyers, streamlining transactions and reducing paperwork.

- Accounts receivable management involves decisions regarding investment in current assets to maximize return on investment in receivables. It includes maintaining optimal levels of receivables, determining the extent of credit sales, and managing debtor collections.

- Receivables benefit customers by increasing their purchasing power, particularly those averse to borrowing from other sources. Additionally, receivables play a crucial role in expediting distributions, enabling intermediaries to mobilize goods swiftly and allowing customers to make purchases even without immediate cash payment, facilitating the movement of goods from production to distribution channels.

Maintenance of Accounts Receivable

Objectives of Accounts Receivable Management: The aim of managing accounts receivable is to foster sales and profits until reaching a point where the return on further investment in funding receivables is outweighed by the cost of financing that additional credit, i.e., the cost of capital. Managing accounts receivable incurs significant costs, including:

Advantages of Accounts Receivable Management:

Accounts receivable management offers numerous benefits, such as:

- Increased Sales: Offering goods or services on credit boosts sales by retaining existing customers and attracting potential ones.

- Expanded Market Share: Retaining existing customers and attracting new ones naturally leads to a larger market share through increased sales.

- Profit Growth: Increased sales result in higher profits since producing more products with a given fixed cost and selling products with an established sales network reduces the cost per unit, leading to improved profits.

Inventory Management

Inventory management pertains to controlling assets produced for sale in the firm's regular operations. In supply chain management, effective inventory management is crucial. The significance of inventory management for a company depends on its inventory investment level.

The objectives of inventory management are twofold:

- Operational Objective: Maintain sufficient inventory to meet product demand by efficiently coordinating production and sales operations.

- Financial Objective: Minimize idle inventory and reduce inventory carrying costs.

- Effective inventory management involves striking a balance between stock availability and the cost of holding inventory.

Components of Inventory Management:

Inventories in a manufacturing company come in various forms:

- Raw Materials: Inputs transformed into finished goods during the manufacturing process, essential for uninterrupted production.

- Work-in-Process: Semi-finished products between raw materials and finished goods, requiring further processing.

- Finished Products: Fully manufactured products ready for immediate sale to customers, serving as a buffer between production and the market.

- Stores and Spares: Office and plant maintenance materials like cleaning supplies, fuel, and light bulbs stored for machinery upkeep.

Inventory Control

- Inventory control involves managing existing inventory in warehouses or stores to track available products, quantities, and locations accurately. It requires maintaining precise, comprehensive, and timely inventory transaction records to avoid discrepancies between accounting and actual inventory levels. ABC analysis and cycle counting are common tools used to ensure inventory accuracy and control.

- Inventory management involves determining how and how much to order products and identifying the most efficient supply source for each item in every stocking location. It encompasses planning, forecasting, and replenishment activities aimed at minimizing discrepancies between customer demand and item availability, caused by fluctuations in demand, supplier delivery times, and inventory control accuracy.

Types of Inventory

The purpose of maintaining inventories is to compartmentalize a firm's operations, ensuring that each function operates independently of the others. This independence prevents delays or shutdowns in one area from affecting the production and sale of the final product. Given that production stoppages increase costs and delivery delays can result in lost customers, managing and controlling inventory becomes crucial for financial managers. Inventory comes in various types, with common categories including raw materials inventory, work-in-process inventory, and finished goods inventory.

- Raw Materials Inventory: This type consists of basic materials purchased from external sources for use in the firm's production operations. Examples include steel, lumber, petroleum, or manufactured items like wire, ball bearings, or tires not produced in-house. Regardless of the specific items, all manufacturing firms maintain raw materials inventory to separate the production and purchasing functions, ensuring that delays in raw material delivery do not disrupt production. In case of delays, the firm can rely on its inventory to meet raw material needs.

- Work-in-Process Inventory: Work-in-process inventory comprises partially finished goods requiring further processing before becoming finished products. The complexity and duration of the production process determine the investment in work-in-process inventory. The main objective is to isolate various production process operations so that machine failures or work stoppages in one operation do not affect others.

- Finished Goods Inventory: This type includes goods on which production is complete but are not yet sold. Finished goods inventory serves to separate the production and sales functions, allowing sales to occur directly from inventory without needing to produce goods upon sale.

Motives of Inventory Management:

Managing inventory involves addressing funds shortage and inventory holding costs. Despite the expense, there are three general motives for retaining inventory:

- The transaction motive: Inventory is held to facilitate smooth and continuous production and sales operations. Delays in obtaining raw materials or producing goods after customer demand necessitates holding raw material and finished goods inventory. Work-in-progress inventory may be needed due to the production cycle.

- The precautionary motive: Firms hold inventory to guard against unpredictable changes in demand or supply, such as delays in raw material supply due to strikes or transportation disruptions.

- The speculative motive: Inventory may be purchased and stocked in quantities exceeding production and sales needs to leverage quantity discounts from bulk purchases or anticipated price increases.

Merits of Inventory Management

There are several advantages to proper inventory management:

- Ensures adequate material and store supply to minimize stockouts and shortages, preventing costly interruptions in operations.

- Reduces investment in inventories, inventory carrying costs, and losses due to obsolescence.

- Facilitates purchasing economies by accurately measuring requirements based on past experience.

- Reduces duplication in stock ordering by centralizing purchase requisitions.

- Facilitates inter-department transfers, enabling better utilization of available stock.

- Provides a safeguard against material loss due to negligence or theft.

- Perpetual inventory values offer a stable and reliable basis for financial statement preparation and utilization.

Demerits of Holding Inventory

Despite its benefits, holding inventory also has drawbacks:

- Price decline: Inventory holding exposes firms to price declines due to excess supply or decreased demand. Controlling inventory is crucial to counteract these risks, as prices are often beyond the firm's short-term control.

- Product deterioration: Prolonged inventory holding, especially under unfavorable conditions of light, heat, or humidity, can lead to product deterioration.

- Product obsolescence: Holding inventory for an extended period increases the risk of product obsolescence due to factors like improved products or changes in customer preferences, leading to significant revenue losses.

In conclusion, inventory management is a critical aspect of business management, involving the optimization of available resources for maintaining stocks of various materials. Shortages in inventory lead to production stoppages, while excessive inventory results in increased costs. Therefore, efficient inventory management is essential for business success.

Managing Current Liabilities

- A current liability refers to an obligation that must be settled within one year. The management of current liabilities is crucial as businesses need to ensure they have sufficient liquidity to meet these obligations when they become due. In accounting, current liabilities encompass all obligations that a business is expected to settle in cash within the financial year or its operating cycle, whichever period is longer.

- In cases where a business's operating cycle exceeds one year, a current liability is considered payable within the term of that operating cycle. The operating cycle represents the time required for a business to acquire inventory, sell it, and convert the sales into cash. Generally, the one-year rule applies in most cases.

- Current liabilities are typically settled by utilizing current assets, highlighting the importance of maintaining a balance between the two on a company's balance sheet. Alternatively, current liabilities may be settled by replacing them with other liabilities, such as short-term debt.

- The total amount of current liabilities is a significant component in various measures of a business's short-term liquidity, including the current ratio, quick ratio, and cash ratio.

Some common examples of current liabilities include:

- Accounts payable: Trade payables owed to suppliers, typically evidenced by supplier invoices.

- Sales taxes payable: Obligations to remit sales taxes charged to customers on behalf of the government.

- Payroll taxes payable: Taxes withheld from employee pay or additional taxes related to employee compensation.

- Income taxes payable: Taxes owed to the government but not yet paid.

- Interest payable: Interest owed to lenders but not yet paid.

- Bank account overdrafts: Short-term advances made by the bank to offset account overdrafts.

- Accrued expenses: Expenses already incurred but not yet payable to a third party, such as wages payable.

- Customer deposits: Payments made by customers in advance of completing their orders for goods or services.

- Dividends declared: Dividends approved by the board of directors but not yet paid to shareholders.

- Short-term loans: Loans due on demand or within the next 12 months.

- Current maturities of long-term debt: Portions of long-term debt due within the next 12 months.

FAQs on Management of cash, receivables, inventory, and current liabilities - Management Optional Notes for UPSC

| 1. What are the objectives of cash management? |  |

| 2. What are the principles of cash management? |  |

| 3. What is the cash management function? |  |

| 4. What are the benefits of a cash management system? |  |

| 5. How can current liabilities be effectively managed? |  |