Inventory Valuation and Depreciation | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Significance of Inventories |

|

| Valuation of Inventories |

|

| Inventory Valuation Methods |

|

| Techniques of Inventory Evaluation |

|

| Depreciation |

|

| Method of Calculating Depreciation |

|

Introduction

- Inventory is a crucial component of financial statements in both business and manufacturing concerns, representing a significant portion of a company's assets (Rajasekaran V., 2011). The process of inventory valuation is essential as it assigns a monetary value to the items constituting the inventory. This includes products available for resale to customers. Inventories often stand out as the largest existing asset for a business, underscoring the importance of accurately measuring and valuing them to ensure precise financial reporting. A correct inventory valuation is vital for matching expenses and revenues accurately, enabling informed business decision-making.

- The inventory valuation encompasses all costs associated with bringing the inventory items into place and preparing them for sale. Proper inventory valuation is critical for income measurement, and effective inventory management is essential for overall financial management. In the realm of management accounting, inventories are described as assets held for sale in the ordinary course of business, in the process of production or manufacture, and in the form of materials and supplies consumed in such processes. Inventories, therefore, encompass finished goods inventory, work in process inventory, raw materials, stores, and supplies.

- The closing stock at the end of an accounting period becomes the opening stock for the next period, underscoring the ongoing significance of inventory valuation. However, achieving accurate inventory valuation can be challenging due to variations in management policies and accounting principles adopted by different firms (Rajasekaran V., 2011).

Significance of Inventories

- Inventory holds a prominent position among the assets of business enterprises, and assessing the liquidity position of an enterprise can be simplified through the computation of accounting ratios. Inventory valuation plays a crucial role in this assessment. Moreover, accurate inventory valuation is essential for determining the true income of a business. The gross profit, calculated as sales minus the cost of goods sold, relies heavily on proper inventory valuation (Rajasekaran V., 2011).

Gross profit = sales - cost of sold goods. - The importance of inventory valuation extends beyond mere financial reporting. It is instrumental in estimating correct gross profit, facilitating comparisons, determining accurate financial positions, aiding effective decision-making by management, and providing insights for estimating future purchases (Sripal Jain, 2015). Therefore, inventory valuation is a pivotal aspect that influences various facets of financial analysis and decision-making within a business.

Valuation of Inventories

- As per the generally accepted accounting principles, inventories are required to be valued at cost, which comprises the cost of acquisition and the cost of conversion. For raw materials, stores, spare parts, and consumables, the cost of acquisition includes purchase costs, duties, taxes, freight, and other directly related expenses. Any discounts or rebates on such purchases should be deducted.

- In the case of finished goods for manufacturing concerns, the cost is calculated as the sum of the cost of raw materials and the cost of converting raw materials into finished goods. This includes direct expenses such as labor costs and indirect manufacturing costs like power, water, fuel, factory rent, and factory insurance directly linked to production/manufacturing. Indirect expenses like salaries and office expenses are excluded since they are considered period costs.

- Work in process (WIP) is valued at cost based on the stage of completion of labor and overheads, as determined by the production department.

Inventory Valuation Methods

While inventories are required to be valued at cost, it's important to note that the cost continually changes throughout the year. Connecting the cost of purchase directly with the closing stock of goods on hand might not always be feasible. Various inventory valuation methods are employed to calculate the cost of goods sold and the cost of ending inventory.

Here are three common inventory valuation methods:

- First-In, First-Out Method (FIFO):

- This method implies that items from the inventory are sold in the order in which they are acquired or produced.

- The cost of older inventory is charged to the cost of goods sold first, and the ending inventory consists of goods purchased or produced later.

- This method closely aligns with the actual physical flow of goods, as companies typically sell goods in the order in which they are acquired or produced.

- Last-In, First-Out Method (LIFO):

- In contrast to FIFO, LIFO assumes that newer inventory is sold first, and older items remain in inventory.

- When prices of goods increase, the cost of goods sold in the LIFO method is relatively higher, and the ending inventory balance is lower.

- This is because the cost of goods sold mostly comprises newer, higher-priced goods, and the ending inventory cost consists of older, lower-priced items.

- Average Cost Method (AVCO):

- Also known as AVCO, this method involves calculating the weighted average cost per unit for the entire inventory on hand.

- The weighted average cost per unit is computed by dividing the total cost of goods in inventory by the total units in inventory.

- This average cost per unit is then multiplied by the number of units sold to determine the cost of goods sold and by the number of units in ending inventory to calculate the cost of ending inventory.

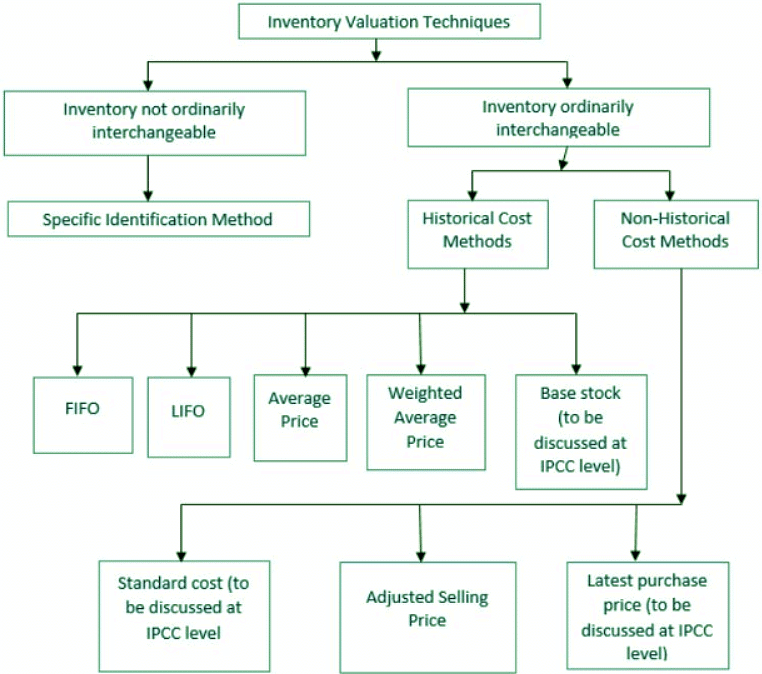

Techniques of Inventory Evaluation

It is well-established that inventory stands as the most significant component of current assets held by manufacturing enterprises. The valuation of inventory is crucial in determining the true income earned by a business during a particular period.

Depreciation

- Depreciation is the systematic allocation of the cost of an asset over its useful life. In accounting, it represents the way in which the cost of assets is spread across the periods during which the assets are expected to contribute to revenue generation. This allocation follows the matching principle, aligning expenses with the revenues they help generate. Depreciation impacts the financial statements of businesses by reducing the book value of assets on the balance sheet. Additionally, it affects net income and is recorded as an expense for financial reporting and tax purposes.

- The concept of depreciation acknowledges the natural wear and tear, technological obsolescence, and other factors that lead to a decrease in the value of an asset over time. As per accounting principles, depreciation is applied to allocate the historical cost or an equivalent value of an asset over its expected useful life, typically reflecting its normal wear and tear. This principle is particularly relevant for assets with a fixed and relatively short service life, such as machinery, buildings, vehicles, and equipment.

- Accounting Standard 6 defines depreciation as the measure of the reduction in value due to wear and tear, consumption, or obsolescence arising from the use of a depreciable asset. It is considered a permanent and continuous decrease in the quantity, quality, or value of an asset. Depreciation is applicable to depreciable assets held for use in the production or supply of goods and services, with examples including machinery, plants, furniture, buildings, computers, trucks, and equipment.

- Depreciation is calculated on the depreciable amount, which is the historical cost or a substituted value less the estimated salvage value. The process of systematically allocating the cost of an asset over its useful life is essential for assessing and presenting the financial position and operating results of an enterprise. Depreciation accounting involves charging depreciation in each accounting period based on the depreciable amount, providing a logical and consistent approach to recognizing the decrease in the value of assets over time.

Features of Depreciation

Depreciation encompasses several key features and considerations, as outlined by Singhvi (2006):

- Reduction in Book Value: Depreciation leads to a reduction in the book value of fixed assets, though it does not impact their market value.

- Loss of Value Factors: It includes factors such as loss of value due to the passage of time, usage, and obsolescence.

- Continuing Process: Depreciation is a continuous process that persists until the end of the useful life of the assets.

- Expired Cost: Depreciation is considered an expired cost, and as such, it must be deducted before calculating taxable profits.

- Non-Cash Expense: Depreciation is a non-cash expense, meaning it does not involve actual cash outflows.

- Writing-off Capital Expenditure: It is a process of writing off the capital expenditure already incurred in acquiring the assets.

- Measure of Loss of Value: Depreciation serves as a measure of the loss of value of an asset over time.

- Tangible Fixed Assets: The term "depreciation" is specifically used for tangible fixed assets.

The causes of depreciation are attributed to various factors:

- Wear and Tear: Significant depreciation occurs due to wear and tear, primarily resulting from the regular use of assets.

- Obsolescence: Technological advancements may lead to the obsolescence of assets. The introduction of superior machinery in the market can render older equipment less valuable, even if it is still functional.

- Accidents: Accidental damage can contribute to depreciation. While accidental loss may be permanent, it might not always be gradual and continuous.

Understanding these features and causes is crucial for businesses in managing and accounting for the depreciation of their assets.

Purpose of Charging Depreciation

The following are the purpose of charging depreciation of fixed assets:

- To determine in the true profit of the business.

- To demonstrate the true presentation of financial position.

- To offer fund for replacement of assets.

- To demonstrate the assets at its practical value in the balance sheet.

Factors Affecting the Amount of Depreciation

Numerous factors must be taken into account when charging the amount of depreciation:

- The original cost of the asset.

- The useful life of the asset.

- Estimated scrap or residual value of the asset at the end of its life.

- Selecting an appropriate method of depreciation.

Method of Calculating Depreciation

Various methods are employed to calculate the allocation of depreciation costs. One commonly used method is:

- Straight Line Method (Constant Charge Method): Also known as the Constant Charge Method, this approach involves charging a consistent amount of depreciation each year over the estimated life of the asset. The calculation of depreciation under this method is done by subtracting the scrap value from the original cost of the asset, and then dividing the balance by the number of years expected as the asset's life. The formula for depreciation charge in a given year is typically represented as follows (Kolitz, 2009):

The Straight Line Method, also known as the Constant Charge Method, offers several advantages, including its simplicity and ease of calculation. It facilitates the reduction of the original cost of the asset down to its scrap value at the end of the estimated life. Moreover, the estimated useful life of the asset can be reasonably determined using this method. Despite these advantages, there are limitations associated with this approach. It does not account for the intensity of asset use, neglects any additions or opportunity costs in depreciation calculations, overlooks the effective utilization of fixed assets, makes it challenging to determine the correct depreciation rate, and, under the assumption of constant maintenance charges, may result in an inability to accurately calculate true depreciation.

The Straight Line Method, also known as the Constant Charge Method, offers several advantages, including its simplicity and ease of calculation. It facilitates the reduction of the original cost of the asset down to its scrap value at the end of the estimated life. Moreover, the estimated useful life of the asset can be reasonably determined using this method. Despite these advantages, there are limitations associated with this approach. It does not account for the intensity of asset use, neglects any additions or opportunity costs in depreciation calculations, overlooks the effective utilization of fixed assets, makes it challenging to determine the correct depreciation rate, and, under the assumption of constant maintenance charges, may result in an inability to accurately calculate true depreciation. - The Written Down Value Method, also known as the Fixed Percentage on Declining Base Method or Reducing Instalment Method, involves charging depreciation at a fixed rate on the diminishing balance, i.e., the cost less depreciation every year. This approach results in a gradual reduction in the depreciation amount each year. The method has several advantages, including acceptance by income tax authorities, minimized impact of obsolescence, and no need for fresh calculations when additions are made. However, there are disadvantages to this method. It makes it challenging to accurately estimate the residual value of the asset, overlooks the interest on investment or opportunity cost, which complicates the determination of the depreciation rate. The method also poses difficulties in ascertaining true profits since the revenue contribution of the asset is not constant, and the original cost of the asset cannot be brought down to zero.

- The Annuity Method is particularly suitable for enterprises that invest capital in long-term properties. In this method, the calculation of depreciation involves charging a fixed amount for each year of the estimated useful life of the asset. The fixed amount is determined based on the interest that would have been earned if the capital had been invested in an alternative form of capital investment. Essentially, depreciation under the annuity method represents the loss of interest or reduction in the original cost of the fixed assets. This method accounts for the loss of interest caused by the investment made in the form of an asset when calculating depreciation.

- Sinking Fund Method involves charging depreciation with the assistance of a Sinking Fund Table. In this approach, an amount equivalent to the depreciation written off is invested in external securities. This investment aims to accumulate funds for replacing the asset at the end of its estimated useful life. The depreciation amount is debited to the depreciation account, and an equal amount is credited to the Sinking Fund Account. As the asset reaches the end of its estimated useful life, the annual depreciation amount is invested in easily realizable securities, ensuring readily available funds for the replacement of the asset.

- Revaluation or Appraisal Method is designed for assets such as livestock, loose tools, and patents. This method, also known as the Appraisal Method, calculates depreciation by comparing the year-end valuation of the asset (considering the opening value and any additional value) with the difference treated as depreciation.

- Insurance Policy Method involves calculating depreciation by taking out an insurance policy on the asset to be replaced. A fixed premium, equivalent to the annual depreciation amount, is paid. Upon the maturity of the policy, which corresponds to the agreed sum, the accumulated amount is utilized for replacing the existing asset.

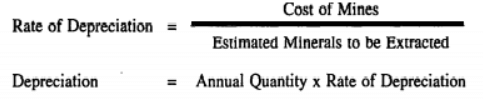

- Depletion Method is particularly applicable to natural resources like mines, quarries, oil, and gas, where a specific quantity of resources can be obtained based on the availability of minerals. The method considers the quantity of output extracted to determine the stage of depletion. The rate of depreciation is established by assessing the quantity obtained each year. The formula is as under:

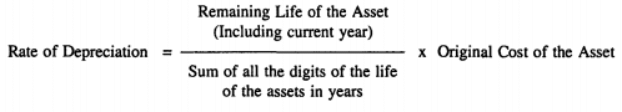

- Sum of the Digits Method, also known as SYD Method, is a depreciation calculation method derived from the Written-Down Value Method. This approach involves a gradual reduction in the amount of depreciation charged to the Profit and Loss Account each year over the entire life of the asset. The formula for calculating the amount of depreciation is as follows:

- The Machine Hour Rate Method is similar to the Depletion Method, but instead of estimating available quantities in advance, the working life of the machine is projected in terms of hours. The hourly rate of depreciation is calculated by dividing the cost of the machine (minus scrap value) by the estimated total number of hours utilized each year.

In accounting literature, it is established that depreciation is a systematic allocation of the cost of a fixed asset over its useful life. Depreciation represents a portion of the original purchase price of the fixed asset that is consumed during its period of use by the firm. As the revenue generated from the use of the fixed asset decreases each year, depreciation is treated as an expense, reducing net profit. This method ensures a proper matching of the cost of a fixed asset with the revenue it generates over its useful life. Without depreciation accounting, the entire cost of a fixed asset would be recorded in the year of purchase, providing a misleading view of the entity's profitability.

FAQs on Inventory Valuation and Depreciation - Management Optional Notes for UPSC

| 1. What is the significance of inventories? |  |

| 2. What are the different inventory valuation methods? |  |

| 3. What are the techniques of inventory evaluation? |  |

| 4. How is depreciation calculated? |  |

| 5. How are inventory valuation and depreciation related? |  |