Cost Accounting: Reconciliation and Integration between Financial and Cost Accounts | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Need for Reconciliation |

|

| Causes of Differences |

|

| Preparation of Reconciliation Statement or Memorandum Reconciliation Account |

|

| Memorandum Reconciliation Account |

|

| Solved Examples |

|

Need for Reconciliation

The coexistence of financial and cost accounting systems within the same organization involves the handling of common transactions such as purchases, material consumption, wages, and other expenses. However, due to distinct purposes, these systems differ in their approaches to collecting, analyzing, and presenting data. Financial accounts focus on determining overall profit or loss for the entire organization over a more extended period, typically a year, with less emphasis on cost computation. In contrast, cost accounts aim to ascertain the profit or loss of manufacturing or product divisions/products for cost comparison and the preparation of various cost statements.

The divergence in purpose and approach often leads to differences in profit between cost accounts and financial accounts, necessitating reconciliation.

The need for reconciliation arises for several reasons:

- Identifying the reasons for disparities in profit or loss between cost and financial accounts.

- Ensuring the mathematical accuracy and reliability of cost accounts to facilitate cost ascertainment, control, and validation against financial accounts.

- Contributing to the standardization of policies related to stock valuation, depreciation, and overheads.

- Enhancing coordination and cooperation between the financial and cost sections of the accounting department.

- Providing management with insights into the reasons for profit variations, thereby supporting more effective internal control measures.

Causes of Differences

The vital differences between the two branches of accounting are manifested in the variation of the profit figure of one from the other through the cumulative impact of the following factors:

I. Items Shown Only in Financial Accounts

Certain items are included in financial accounts but have no representation in cost accounts. These items can be categorized as follows:

(a) Purely Financial Charges:

- Loss incurred from the sale of fixed assets.

- Loss on investments.

- Discounts associated with share issuances.

- Interest payments on bank loans, mortgages, debentures, etc.

- Expenses related to the company's share transfer office.

- Damages payable.

- Penalties and fines.

- Losses resulting from the scrapping of machinery.

- Remuneration exceeding a fair reward for services rendered, paid to the proprietor.

(b) Purely Financial Income:

- Rent received (unless derived from subletting part of business premises, in which case it may be included in cost accounts).

- Interest earned on bank deposits.

- Profits gained from the sale of investments, fixed assets, etc.

- Fees received for transfers.

- Interest, dividends, etc., received on investments.

- Brokerage received.

- Discounts, commissions, etc., received.

(c) Appropriation of Profits:

- Donations and charitable contributions.

- Taxes on income and profits.

- Dividends paid.

- Transfers to reserves and sinking funds.

- Additional provisions for depreciation of buildings, plants, etc., and for bad debts.

- Write-offs, including goodwill, preliminary expenses, underwriting commissions, discount on debentures issued, organizational expenses, etc.

- Capital expenditures specifically charged to revenue.

II. Items included in cost accounts only

Certain items are excluded from financial accounts but find representation in cost accounts:

- Interest on capital employed in production, even if no actual interest is paid. This inclusion in cost books aims to indicate the nominal (notional) cost of employing capital rather than investing it outside the business.

- Charge in lieu of rent for owned premises.

- Depreciation on assets, even when the book value of the asset is reduced to a negligible figure.

- Salary of the proprietor when working without charging a salary.

III. Over or under absorption of overheads

- Cost accounts determine the recovery of overheads based on estimates or predetermined ratios (e.g., percentage on prime cost, percentage on sales), which may differ from the actual expenses recorded in financial accounting. If the overheads are not fully absorbed, resulting in an amount in cost accounts less than the actual amount, it is termed under-absorption.

- Conversely, if overhead expenses in cost accounts exceed the actual expenses, it is labeled over-absorption. This disparity in under or over absorption of overheads creates a difference between the two accounts. Under or over recovery may be carried forward to the next period, charged through a supplementary rate (positive or negative), or transferred to the costing profit and loss account. When under or over recovery is carried forward to the next period, the profit shown in cost accounts differs from that in financial books, necessitating adjustments. In some cases, selling and distribution expenses are omitted in cost accounts, resulting in a higher costing profit, requiring reconciliation.

IV. Adoption of different basis of valuation of stock

- Raw Material: Financial accounts value raw material stock at the lower of cost or market price, while cost accounts may use methods like FIFO or LIFO, leading to different stock values.

- Work-in-progress: Valuation methods for work-in-progress may vary, with cost accounts favoring factory cost, while financial accounts may consider administrative expenses in addition to arrive at a value.

- Finished Goods: Financial accounts value finished goods at the lower of cost or market price, whereas cost accounts typically use the total cost of production. These different stock valuation methods contribute to varying results in both sets of books.

V. Different methods of charging depreciation

Divergent methods of charging depreciation may be employed in both cost and financial books. Financial accounting adheres to methods governed by regulations like the Companies Act or tax provisions, often using diminishing balance or fixed instalment methods. Conversely, cost accounts might opt for machine hour rate, production hour, or unit methods.

VI. Abnormal Gains and Losses

Treatment of abnormal gains or losses may differ in cost and financial accounts. They may be excluded entirely from cost accounts or transferred to the costing profit and loss account. Exclusion can result in discrepancies between costing and financial profit/loss, necessitating adjustments. If transferred to the costing profit and loss account, the profit or loss in cost accounts aligns with financial accounts, eliminating the need for adjustments. Examples of abnormal gains and losses include abnormal material wastage (e.g., theft, fire), costs of abnormal idle time and facilities, exceptional bad debts, and abnormal gains in manufacturing processes.

Preparation of Reconciliation Statement or Memorandum Reconciliation Account

A Reconciliation Statement or a Memorandum Reconciliation Account is essential for reconciling the profits presented in two sets of books. The approach involves taking the results from one set of books as the starting point and making necessary adjustments to align with the results from the other set of books.

The process for preparing a Reconciliation Statement or Memorandum Reconciliation Account includes the following steps:

I. Identify the various reasons causing discrepancies between the profits disclosed by cost accounts and financial accounts.

II. If the profit from cost accounts (or the loss from financial accounts) is considered the base, perform the following:

ADD:

- Items of income included in financial accounts but not in cost accounts.

- Items of expenditure like interest on capital, rent on owned premises, etc., included in cost accounts but not in financial accounts.

- Amounts by which items of expenditure are overstated in cost accounts compared to financial accounts.

- Amounts by which items of income are understated in financial accounts compared to cost accounts.

- Over absorption of overheads in cost accounts.

- The undervaluation of closing stock in cost accounts.

- The overvaluation of opening stock in cost accounts.

DEDUCT:

- Items of income included in cost accounts but not in financial accounts.

- Items of expenditure included in financial accounts but not in cost accounts.

- Amounts by which items of income are overstated in cost accounts compared to financial accounts.

- Amounts by which items of expenditure are understated in financial accounts compared to cost accounts.

- Under absorption of overheads in cost accounts.

- The overvaluation of closing stock in cost accounts.

- The undervaluation of opening stock in cost accounts.

III. After completing the additions and deductions, the resulting figure will represent the profit as per financial accounts.

Note: If the profit from financial accounts (or the loss from cost accounts) is considered the base, the above procedure is reversed, deducting the added items and adding the deducted items.

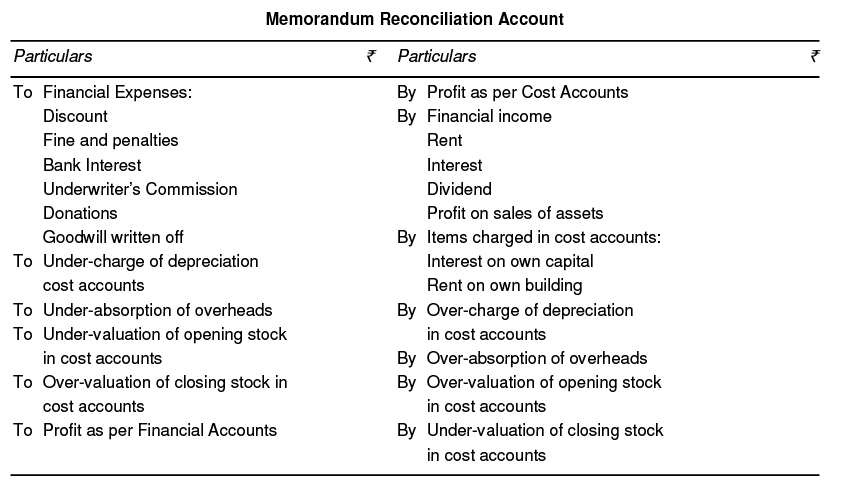

Memorandum Reconciliation Account

Reconciliation can also be done by preparing a Memorandum Reconciliation Account. This account is a memorandum account only and does not form part of the double entry.

A specimen form of Memorandum Reconciliation Account is given below:

Solved Examples

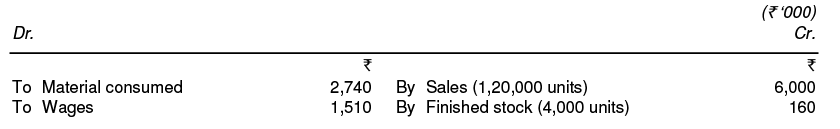

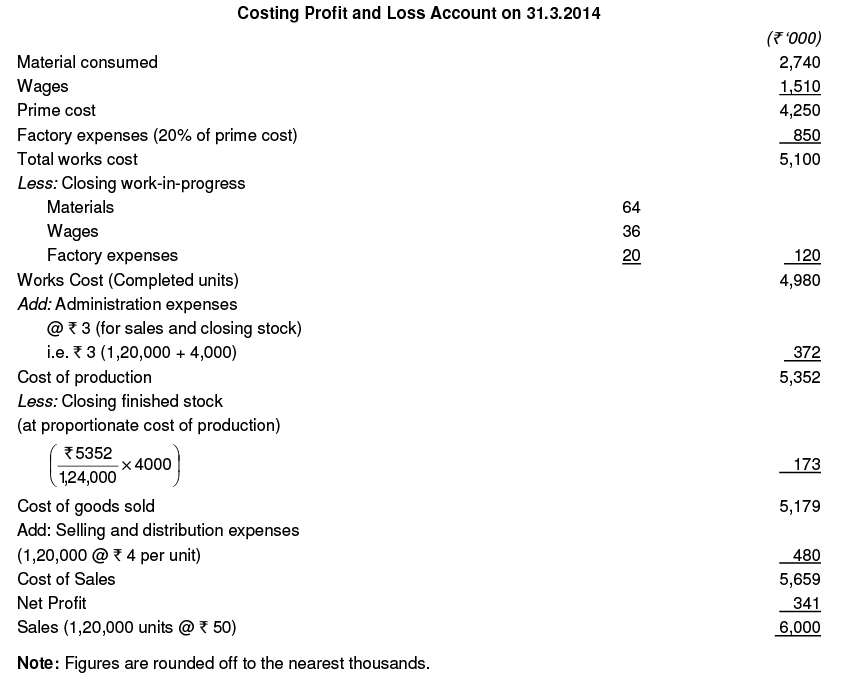

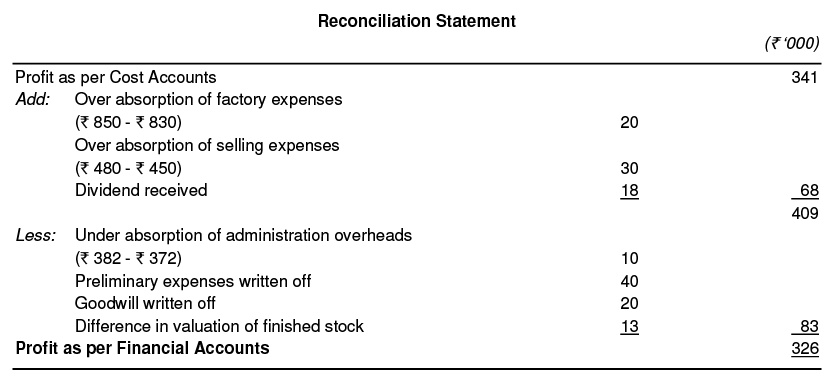

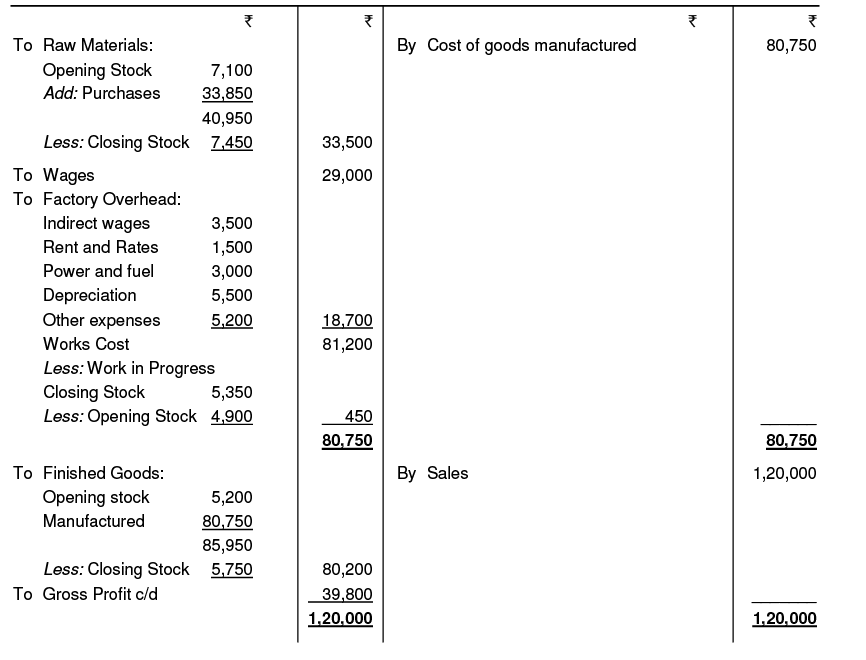

Example 1: The following is a summary of the trading and profit and loss account of a manufacturing company for the year ended 31st March, 2014:

In the cost accounts, the following allocations have been made:

(i) Factory expenses at 20% on prime cost.

(ii) Administration expenses at ₹ 3 per unit of production.

(iii) Selling and distribution expenses at ₹ 4 per unit of sales.

You are required to prepare a costing profit and loss account of the company and to reconcile the profit disclosed with that shown in the financial account.

Ans:

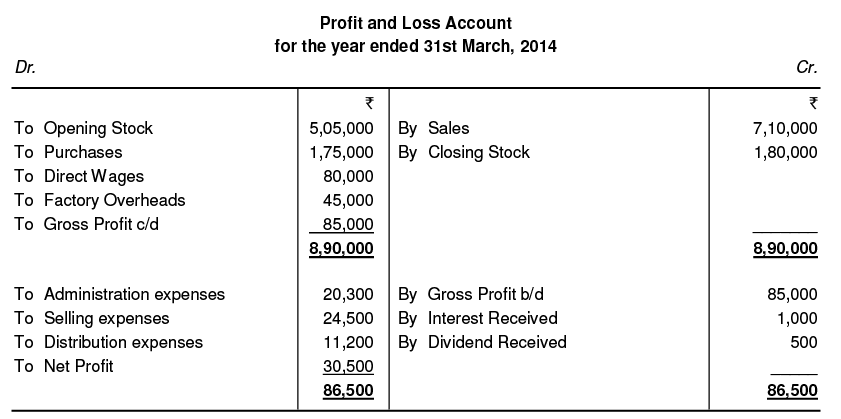

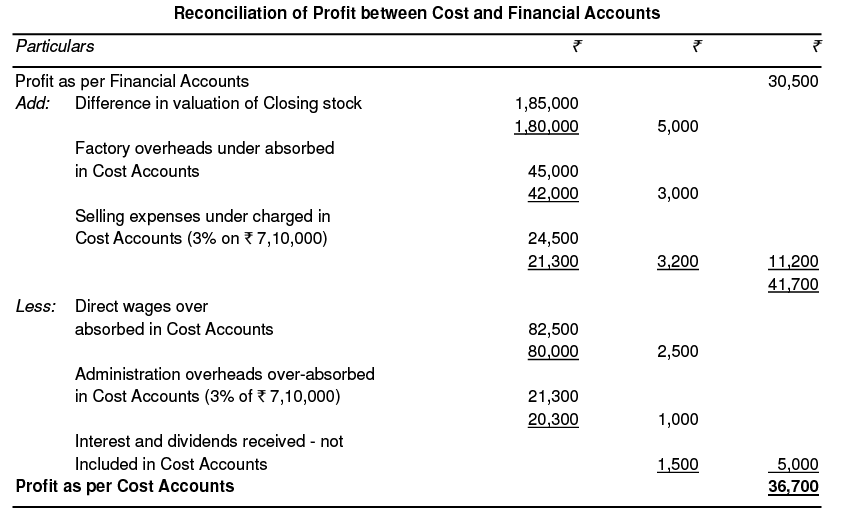

Example 2: The audited final accounts showed a profit of ₹ 30,500 whereas costing records showed a profit of ₹ 36,700. From the following additional information, reconcile the two accounts. The Cost accounts showed the following:

The Cost accounts showed the following:

1. Stock balance of ₹ 1,85,000

2. Direct wages absorbed ₹ 82,500

3. Factory overheads absorbed ₹ 42,000

4. Administration expenses charged @ 3% of sale value

5. Selling expenses charged @ 3% of sales value.

Ans:

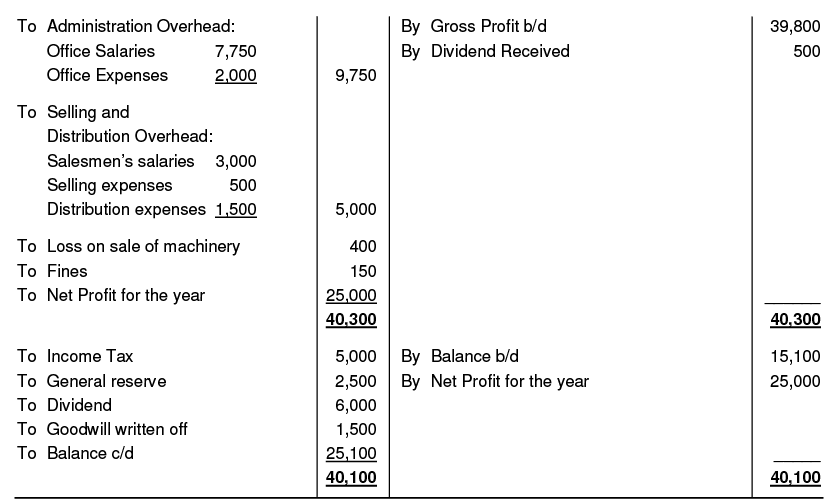

Example 3: A manufacturing, trading, profit and loss, and profit and loss appropriation accounts of Tata Limited for the year ending 31st March, 2014 are as follows:

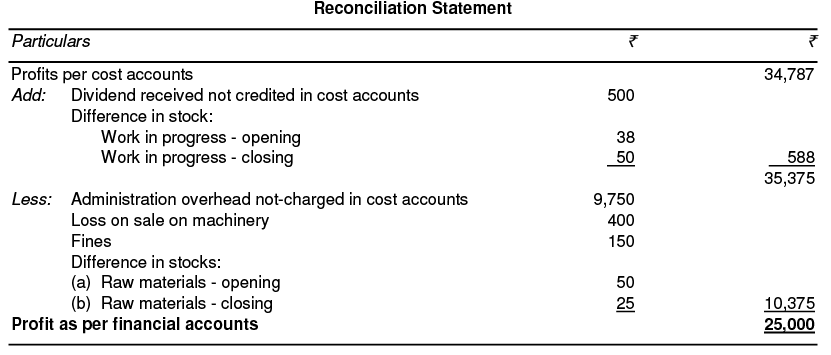

The cost accounts revealed a profit of ₹ 34,787. In preparing this figure stocks have been valued in cost accounts as follows:

The cost accounts revealed a profit of ₹ 34,787. In preparing this figure stocks have been valued in cost accounts as follows: Administration Overhead has been ignored in cost accounts. Prepare a reconciliation statement.

Administration Overhead has been ignored in cost accounts. Prepare a reconciliation statement.

Ans: