Costing and Budgetary Control Methods: Process Costing | Management Optional Notes for UPSC PDF Download

Meaning and Application

- Process costing is a method used to determine the cost of a product at each stage or process of manufacturing, particularly when a product undergoes distinct and well-defined consecutive processes of production. While many products go through various manufacturing operations before reaching their final form, the costs incurred in most operations are relatively small and insignificant in the overall cost. Consequently, it is often deemed impractical to compute the cost of each operation separately, making process costing less useful in such cases.

- Process costing is most appropriate when the final product results from a series of processes, with the output of one process serving as the raw material for the next. This scenario is common in industries where the output of each process may also be marketable as a finished product. For instance, in a cotton textile mill, the production of cloth involves distinct sequential processes: spinning, weaving, and finishing. The output of one process, such as yarn from the spinning process, becomes the raw material for the next process, weaving. This process is repeated until the final product, finished cloth, is obtained. In such cases, it is beneficial to calculate the costs of each process separately to ascertain the costs of individual products like yarn, coarse cloth, and finished cloth. This approach facilitates cost comparison with market prices.

- Industries suitable for process costing typically exhibit the following features:

- Continuous production involving multiple consecutive operations or processes.

- Output from one process becomes the input for the next process until the final product is obtained.

- Standardized and homogeneous products.

- The output of each process may be marketable.

- The processing of raw materials may result in the production of joint and/or by-products.

- Therefore, process costing is commonly employed by industries such as chemical works, distilleries, textile mills, sugar works, soapmaking, paper mills, food processing, paint manufacturing, breweries, oil refineries, canning factories, and milk dairies.

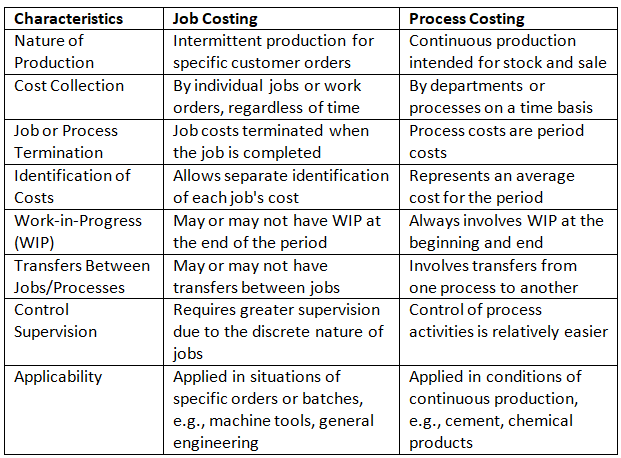

Difference between Job Costing and Process Costing

The distinction between job costing and process costing primarily arises from the unique characteristics of the manufacturing systems they are suited for.

The key differences can be summarized as follows:

Key Characteristics of Process Costing

- Process costing is applicable in industries characterized by continuous production, involving a sequence of distinct and well-defined processes.

- All costs, including material, labor, and overheads, are gathered and categorized according to the respective processes.

- Each process has a dedicated account to which both direct and indirect costs are allocated or apportioned.

- Quantities of production, measured in physical units, are recorded in the respective process accounts.

- The average cost per unit is computed for each process.

- As the output of each but the last process serves as the input for the subsequent process, and the output of the last process is transferred to the Finished Stock Account, the total cost of the finished product comprises the cumulative costs of all processes.

- The average cost per unit forms the basis for transferring costs to the subsequent process.

Costing Procedure

In the process costing method, a distinct account is created for each process to determine the costs associated with it. It is important to observe that each Process account includes an additional column on both the debit and credit sides to record the physical quantities. Refer to Figure 13.1 for an illustration of the process account template.

The key steps in the costing procedure are outlined below:

- Debit the first process account with the cost of the primary raw material, indicating both the quantity and amount involved.

- Record the costs of other materials, direct labor, and direct expenses specific to each process in their respective process accounts.

- Debit each process account with production overheads, either as provided or based on a fair allocation.

- If applicable, credit the process account with the realizable value of scrap and containers for materials returned or sold. Alternatively, deduct their amounts from the cost of raw materials.

- Determine the total cost of the process and calculate the average cost per unit of output.

- If the entire output of a process is transferred to the next process, represent the total cost on the credit side as a transfer to the next process. This transfer is mirrored on the debit side of the subsequent process account.

- If a portion of the output is designated for sale or has been sold, display its cost as a transfer to the store, with the remainder transferred to the next process. Note that when a section of the output is sold, the process account should only be credited with its cost, not the sale value.

- Debit the last process account with the cost of containers used for packaging the finished goods.

- Transfer the overall cost of the last process to the Finished Stock Account.

- Similar to a Trading Account, credit sales to the Finished Stock Account and ascertain the gross profit.

Examples

Example 1: In the course of manufacture, a product passes through three distinct processes, A, B and C. During a four week period, 1,OOQ-units are produced and the following information is made available : Indirect production costs were Rs. 4,500 and these are to be apportioned to the processes on the basis of direct wage cost. Prepare the necessary process accounts.

Indirect production costs were Rs. 4,500 and these are to be apportioned to the processes on the basis of direct wage cost. Prepare the necessary process accounts.

Ans:

Example 2: The following details are extracted from the costing records of an oil mill for the year ended 1 31st March, 1989 : 300 tonnes of crude oil were produced. 250 tonnes of oil were produced by the refining process. 248 tonnes of refined oil were finished for delivery. Copra sacks were sold for Rs. 400. 175 tonnes of copra residue were sold for Rs. 11,000. Loss in weight in crushing 25 tonnes, 45 tonnes of by-products obtained from refining process valued at Rs. 6,750.

300 tonnes of crude oil were produced. 250 tonnes of oil were produced by the refining process. 248 tonnes of refined oil were finished for delivery. Copra sacks were sold for Rs. 400. 175 tonnes of copra residue were sold for Rs. 11,000. Loss in weight in crushing 25 tonnes, 45 tonnes of by-products obtained from refining process valued at Rs. 6,750.

You are required to show the accounts in respect of each of the following stages of manufacture for the purpose of arriving at the cost per tonne of each process and the total cost per tonne of the finished oil. (a) Copra Crushing Process (b) Refining Process (c) Finishing Process including casking.

Ans:

Process Losses

- In many manufacturing sectors, a certain amount of material loss or waste is inevitable as the materials progress through various production stages. Consequently, the output from a process is typically lower than the input, and this variance is referred to as process loss.

- Process losses can be categorized into two types: (1) normal process loss and (2) abnormal process loss. Let's delve into the characteristics of each type of loss and explore how they are handled in process costing.

Normal Process Loss

Some losses are inherent to the production process and cannot be avoided due to the nature of materials or the production process itself. These losses may include evaporation, chemical reactions, scrap, or unavoidable spoilage. The reduction in output resulting from these factors is termed as 'normal process loss' or 'normal wastage.' Since such losses are anticipated under regular circumstances, they can be predicted in advance based on past experiences.

Accounting treatment: It is a fundamental accounting principle that the cost of any normal loss should be absorbed by the cost of production of good units. Hence, for ascertaining the cost per unit of output, the total cost should be divided by the number of good units (normal output). However, if the wastage has some realisable value, the same should be credited to'the process account and duly adjusted in the cost of output. For example, 500 tonnes of raw material costing Rs. 5,000 have been placed in a process I, The other process costs are : labour-Rs. 2,500 and overheads-Rs.1,100. If 10% of material is normally losr in the process and the wastage realises Re, 1 per unit, the cost per unit of output wiil be ascertained as follows :

The same thing you had observed in example 2 where 500 tonnes of copra was put in crushing process and only 300 tonnes of crude oil was produced. The cost per tonne of oil was worked out by dividing the total cost (after adjusting the sale value of copra residue) by 300. Obviously, it had been assumed that 40% loss of weight was normal at crushing stage in case of coconut oil production.

Abnormal Process Loss

Any material loss exceeding the normal loss is termed as 'abnormal process loss' or 'abnormal wastage.' For instance, if the normal loss in a crushing process is 40%, and the expected output for an input of 500 tonnes is 300 tonnes, an actual output of 280 tonnes results in an abnormal loss of 20 tonnes. Such losses may occur due to unexpected conditions like accidents, carelessness, inefficiency, or the use of substandard materials. It is crucial to thoroughly investigate such losses, and remedial measures should be implemented to prevent recurrence.

Accounting Treatment: Abnormal loss is not considered part of the cost of good units, as including it would artificially inflate the cost of production. Therefore, the cost of abnormal loss is excluded from process costs by transferring it to the Costing Profit and Loss Account. To ascertain the cost of abnormal process loss, the guiding principle is to treat it as a loss of good units of output. This means that the cost of abnormal loss units is calculated in the same manner and on the same basis as the cost of good units of production. The total process cost is spread proportionately over both good units and abnormal loss units.

Procedure:

- Determine the normal loss quantity and display it on the credit side of the respective process account with its realizable value.

- Calculate the cost per unit of output assuming there is no abnormal loss:

- Ascertain the cost of abnormal loss units based on the calculated cost per unit.

- Debit Abnormal Loss Account and credit the respective process account with the quantity and amount of abnormal wastage.

- The remaining balance in the Process Account represents the cost of the actual output, which is then transferred to the next process account.

- Create an Abnormal Loss Account, debiting it with the cost of abnormal loss units and crediting the scrap value. The balance in the Abnormal Loss Account is transferred to the Costing Profit and Loss Account.

Look at Example 3 and study how abnormal loss is treated in process costing.

Example

Example 3: 1200 Units were introduced into a process at a cost of Rs. 12,000. The additional expenditure incurred for the process was Rs. 3,000. From past experience and technical estimates, a norma1 loss equal to one-sixth of the input is expected which has scrap value of Re. 1 per unit. The actual output for the period was 900 units. Complete the Process Accoullt and show how abnormal loss will be treated in accounts.

Ans:

Abnormal Effectiveness

In instances where the actual output of a process exceeds the expected (normal) output, it signifies an 'abnormal gain.' This can occur when the actual loss is less than the normal loss due to increased efficiency or overestimation of normal loss. Despite the presence of abnormal effectiveness, the cost per unit of output remains unaffected, calculated in the same manner as in the case of abnormal loss.

Accounting Treatment

The value of abnormal gain units is determined using the cost per unit of output. It is recorded on the debit side of the respective process account and on the credit side of a newly established Abnormal Gain Account. This Abnormal Gain Account is eventually closed by transferring its balance to the Costing Profit and Loss Account.

It is crucial to note that whether there is abnormal loss or abnormal gain, the normal loss is presented in the process account based on a predetermined rate, not the actual loss. Consequently, in the case of abnormal effectiveness, the realizable value of normal loss units, as displayed in the process account, will surpass the actual amount realized from the sale of scrap. To rectify this, the unrealized amount of scrap is adjusted by reflecting it on the credit side of the Normal Loss Account and the debit side of the Abnormal Gain Account before the balance is transferred to the Costing Profit and Loss Account.

Look at Example 4 and study how abnormal effectiveness is treated in process costing.

Example

Example 4: Based on data given in Example 3 and assuming the actual output was 1,050 units, prepare the Process Account and show how abnormal loss effectiveness will be treated in accounts.

Ans:

Comprehensive Examples

Example 1: In a factory the product passes through two processes A and B. A loss of 5% is allowed in Process A and 2% in Process B, nothing being realised by disposal of the wastage.

During April 1990, 10,000 units of material costing Rs. 6 per unit were introduced in Process A. The other costs were as follows : The output was 9,300 units from Process A. 9,200 units were produced iq Process B which were transferred to the warehouse, 8,000 units of the finished product were sold at Rs. 151- per unit, the selling and distribution expenses were Rs. 2 per unit. Prepare (1) Process Accounts, and (ii) a statement of Profit and Loss of the firm for April, 1990, assuming there were no opening stocks of any type.

The output was 9,300 units from Process A. 9,200 units were produced iq Process B which were transferred to the warehouse, 8,000 units of the finished product were sold at Rs. 151- per unit, the selling and distribution expenses were Rs. 2 per unit. Prepare (1) Process Accounts, and (ii) a statement of Profit and Loss of the firm for April, 1990, assuming there were no opening stocks of any type.

Ans:

Example 2: Product '2' is obtained after it passes through three distinct processes. The following information is obtained from the accounts for the month-ending December, 31, 1989 :

1,000 Units at Rs. 3 each were introduced in process I. There was no stock of materials or work-in-progress at the beginning or at the end of the period. The output of each process passes direct to the next process and finally to finished stock. Production overheads are recovered at 100 per cent of direct wages. The following additional data are obtained :

1,000 Units at Rs. 3 each were introduced in process I. There was no stock of materials or work-in-progress at the beginning or at the end of the period. The output of each process passes direct to the next process and finally to finished stock. Production overheads are recovered at 100 per cent of direct wages. The following additional data are obtained : Prepare process accounts; and normal loss, abnormal gain and abnormal loss accounts.

Prepare process accounts; and normal loss, abnormal gain and abnormal loss accounts.

Ans:

Conclusion

- Process costing is a methodology used to determine the product cost at each stage or process of manufacturing. This approach is suitable in scenarios where:

- Production is continuous, involving multiple processes.

- The output of one process serves as the material for the subsequent process.

- The products are standardized and uniform.

- Industries such as textile, oil refining, paper, and breweries find process costing applicable. Under process costing, a distinct account is established for each manufacturing process, with all relevant costs debited to these accounts.

- If the entire output of a process is transferred to the next stage, the total cost is reflected as a credit entry denoted as a "transfer to the next process." If a portion of the output is retained for market sale, the corresponding cost is noted as a "transfer to store." For the final process, its total cost is transferred to the Finished Stock Account.

- Normal losses, inherent in any process, are unavoidable and absorbed within the overall production.

- Abnormal losses, caused by factors like sub-standard materials, inefficiency, or accidents, are costed per unit and transferred to the Costing Profit and Loss Account via the Abnormal Loss Account.

- When actual output exceeds normal output, the surplus is termed abnormal effectiveness or gain.

- The cost of this gain is calculated based on the cost per unit of output and transferred to the Costing Profit and Loss Account.

- In summary, process costing systematically allocates costs across various production stages, addressing normal losses, abnormal losses, and abnormal gains to determine the comprehensive cost of the final product.

FAQs on Costing and Budgetary Control Methods: Process Costing - Management Optional Notes for UPSC

| 1. What is the difference between job costing and process costing? |  |

| 2. What are the key characteristics of process costing? |  |

| 3. What is the costing procedure in process costing? |  |

| 4. What are process losses in process costing? |  |

| 5. What is abnormal effectiveness in process costing? |  |