Costing and Budgetary Control Methods: Job Costing | Management Optional Notes for UPSC PDF Download

Introduction

- When a company is involved in the production of a uniform product, it employs the unit costing method. However, for businesses handling various small projects with differing material, labor, and overhead costs, such as automobile repair shops, interior decorators, or furniture makers, the unit costing method is impractical. Instead, these businesses utilize the 'job costing' method, treating each job as a distinct cost unit. Under this approach, costs are accumulated and analyzed on a per-job basis.

- On the other hand, when a company takes on significant projects like constructing buildings, roads, or bridges, involving substantial sums and extended durations, it adopts the contract costing method to determine costs and profits. Notably, these large projects may not be completed by the end of the accounting year, adding complexity to profit or loss determination.

- This unit delves into both methods, providing a detailed understanding of how costs and profits for small jobs are determined. Specifically, it covers the preparation of a Job Cost Sheet.

Job Costing

- Job costing is a cost determination approach used when a product is manufactured or a service is provided based on a specific order, distinct from continuous production for stock and general sale. In this method, costs are gathered and recorded for each job or a batch of similar jobs, assigned a unique production order number.

- Each job possesses unique characteristics and requires individualized treatment. For instance, consider a machine tool manufacturer or an automobile repair shop. Each machine order or repair job entails varying amounts of materials, labor, and overheads. Consequently, it becomes essential to accumulate costs for each order or job to determine its total cost and facilitate the proper matching of costs with revenues.

Definition and Characteristics

The ICMA Terminology offers a precise definition of job costing, characterizing it as a specific order costing method applied when work is tailored to customers' unique specifications, and each order has a relatively brief duration. Typically conducted within a factory or workshop, the work progresses through processes and operations as a consistently identifiable unit.

The distinctive features related to production and cost determination in industries suitable for job costing include:

- Each job is distinct, specific, and dissimilar.

- Each job is executed to meet the special requirements of the customer, not for stock.

- Each job is relatively short in duration.

- Each job can be identified at all stages of production.

- Each job order is individually labeled with a job order number.

- There is no uniformity in the production flow from one department to another.

- Direct costs of labor, materials, and expenses are directly allocated to the job order.

- Overheads are applied based on predetermined rates.

Applicability

Considering the aforementioned characteristics, job costing can be effectively applied in the following types of organizations:

- Printing Press: Each printing task, whether it involves producing a handout, a book, or an advertising flyer, is treated as a distinct job.

- Garage: In a garage setting, each car requiring repair or tuning up is considered a separate job.

- Furniture Manufacturer: For a furniture manufacturer, every order for furniture is regarded as an individual job. For instance, several units of one style of chairs may be produced in one batch as part of a specific job.

- Service Organizations (e.g., Chartered Accountants): In service organizations, such as a firm of Chartered Accountants, each work order assigned by the client is treated as a separate job, and fees are charged accordingly.

- Construction Companies: For construction companies, each building is viewed as a distinct job due to variations in covered area and design for each structure.

Procedure

Implementing job costing involves extensive recording and analysis, relying on accurate production control records. These records should depict material allocation to different jobs, labor hours dedicated to various tasks, and the proper distribution of overheads as each job progresses through production cost centers.

Organizations utilizing job costing typically follow the outlined procedure for costing purposes:

- Job Cost Estimation: Estimating job costs is a crucial step in the job costing process, essential for tender submissions and price quotations. The Costing Department is responsible for preparing estimates of the total cost for each job before its commencement, serving as the foundation for quoting prices to customers.

- Job Order Number Assignment: Upon receiving and accepting an order, it is crucial to assign a distinct job order number. This number facilitates easy reference for both production and costing purposes.

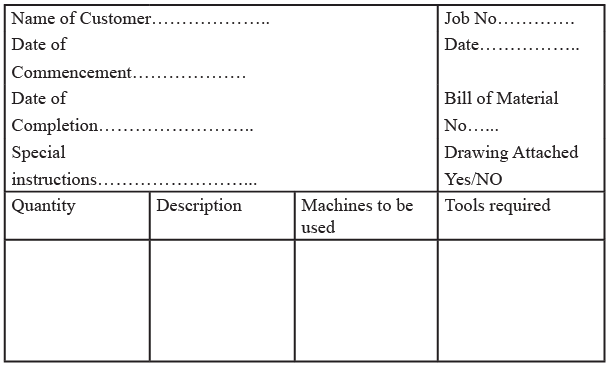

- Production Order Preparation: If the job is accepted, the Planning Department generates a production order in a specified format. A production order serves as written authorization for the factory to proceed with the job, outlining all essential details. It acts as the official document authorizing the allocation of costs to a particular job.

Form of Production Order

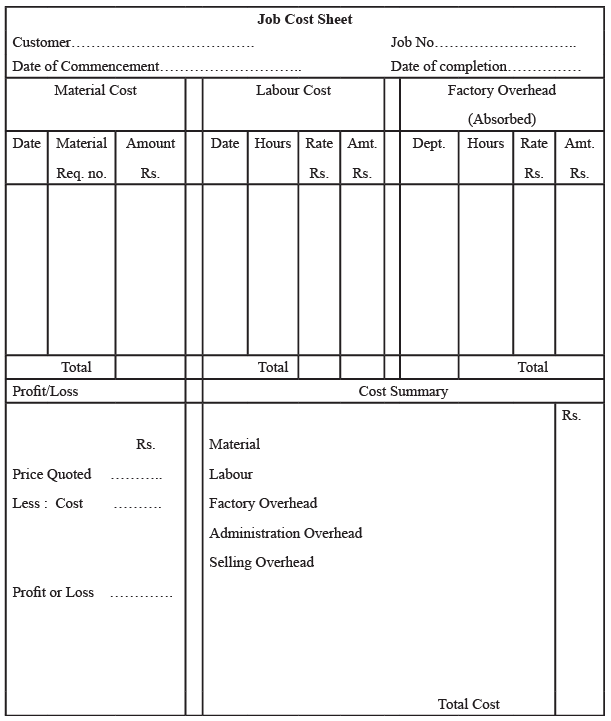

- Gathering and documenting costs: Costs are meticulously collected and recorded individually. A job cost sheet, illustrated in Figure, serves the purpose of documenting and consolidating the costs related to materials, labor, and overheads for each job. Commonly termed as the fundamental document of job costing, the job cost sheet is employed in updating the Work-in-Progress Control Account upon job completion, and it is also utilized in determining the profit or loss associated with each job.

Form of Job Cost Sheet Collecting job costs involves obtaining information from various sources:

Collecting job costs involves obtaining information from various sources:

a) Materials: Information is gathered through Material Requisition Slips, Materials Abstract, or Materials Issue Analysis Sheets.

b) Wages: Job Cards or Labor Abstracts (Wages Analysis Sheets) are utilized to record labor costs.

c) Direct Expenses: Vouchers related to direct expenses are used for collecting information.

d) Overheads: Overheads are applied based on predetermined rates determined by the chosen absorption method. After the job is completed, a completion report is sent from the Production Shop to the Costing Department. The Costing Department then creates the job cost sheet, determining the actual cost and profit associated with the job. A comparison with the initial estimates is conducted to identify any variances, enabling the suggestion of future courses of action.

Evaluation

- The primary aim of job costing is to ascertain the profit or loss associated with each job, acting as a validation of the accuracy of the initial estimates used for quoting prices. By comparing actual costs with estimated costs or with the costs of comparable completed jobs from the past, any inefficiencies during production can be identified.

- Job costing effectively distinguishes profitable jobs from unprofitable ones, serves as a validation for past estimates, and provides a foundation for estimating costs for similar work in the future. This method is particularly applicable when contracts are accepted on a 'cost plus' basis, incorporating actual costs along with an agreed percentage of profit. However, the main drawback of job costing is the resource-intensive paperwork required for estimating costs and planning production schedules. As such, it should only be employed when absolutely necessary.

Examples

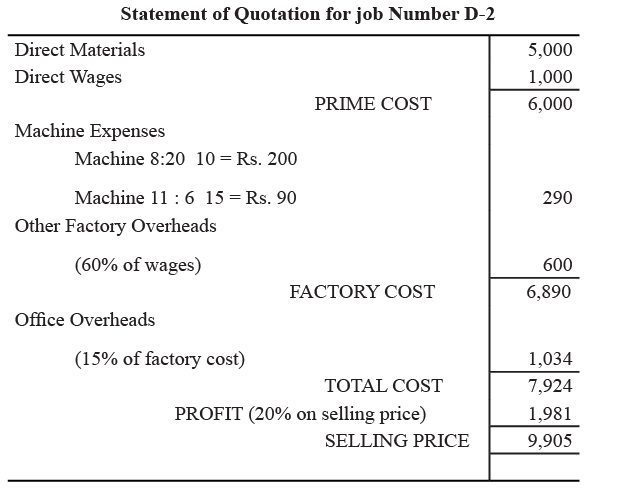

Example 1: The estimated material cost of job D-2 is Rs. 5,000 and direct labour cost is likely to be Rs. 1,000. In the machine shop it will require machining by Machine No. 8 for 20 hours and by Machine No. 11 for 6 hours. Machine hour rates for Machine No. 8 and Machine No. 11 are Rs. 10 and Rs. 15 respectively. Last year, the direct wages amounted to Rs. 80,000 and factory overheads (excluding those related to Machine No. 8 and 11) amounted to Rs. 48,000. Similarly, the factory cost of all jobs last year amounted to Rs. 2,50,000 and office expenses Rs. 37,500. Prepare a statement of quotation which provides for 20% profit used on selling price.

Ans:  Working Notes:

Working Notes:

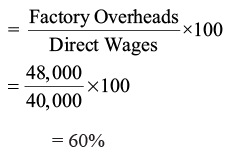

1) Factory overheads rate has been worked out as 60% of wages as under:

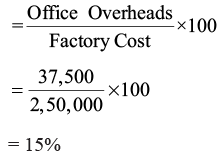

2) Office overhead rate has been worked out as 15% of factory cost as under:

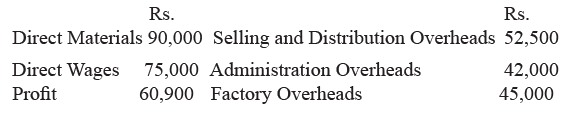

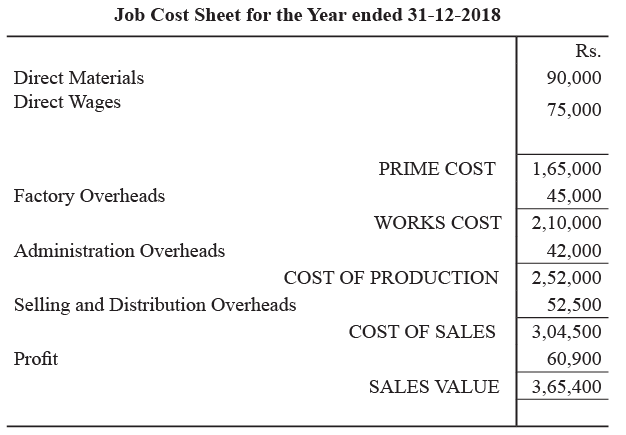

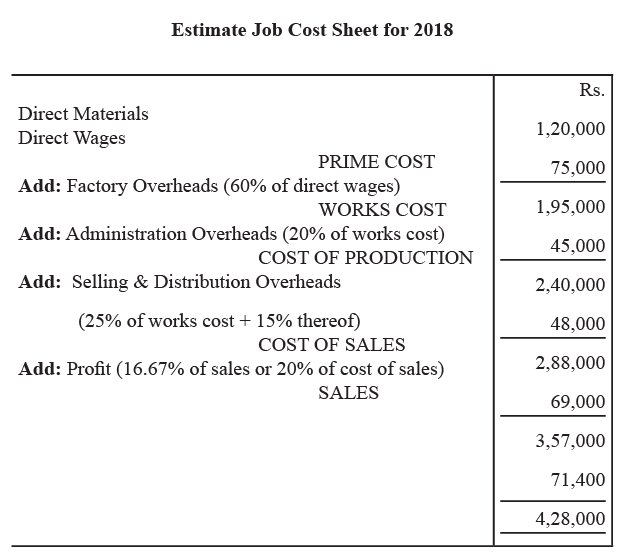

Example 2: A factory uses job costing. The following data is obtained from its books for the year ended 31st December, 2018: a) Prepare a Job Cost Sheet indicating the Prime Cost, Works Cost, Cost of Production, Cost of Sales and Sales Value.

a) Prepare a Job Cost Sheet indicating the Prime Cost, Works Cost, Cost of Production, Cost of Sales and Sales Value.

b) In 2018, the factory received an order for a number of jobs. It was estimated that direct materials required would be for Rs. 1,20,000 and direct labour would cost Rs. 75,000. What should be the price for these jobs if factory intends to earn the same rate of profit on sales as in 2018, assuming that the selling and distribution overheads had gone up by 15%? The factory recovers factory overheads as a percentage of direct wages and administration and selling and distribution overheads as a percentage of works cost.

Ans:  Overhead Recovery Rates

Overhead Recovery Rates

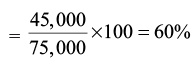

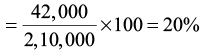

1) Percentage of Factory Overheads to Direct Wages

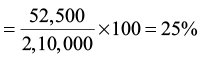

2) Percentage of Admin. Overheads to Works Cost

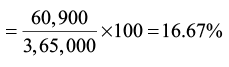

3) Percentage of Selling & Distribution Overheads to Works Cost

4) Percentage of Profit to Sales

Conclusion

Job costing is a cost determination approach employed when work is customized to meet specific customer requirements, typically involving small-scale jobs such as car repairs, painting, decorating, printing, and furniture making. In this method, every job is considered a distinct cost unit, and a Job Cost Sheet is created to analyze the cost and profit associated with each job. Additionally, the Job Cost Sheet serves the purpose of estimating the cost for prospective jobs and providing quotations accordingly.

FAQs on Costing and Budgetary Control Methods: Job Costing - Management Optional Notes for UPSC

| 1. What is job costing and how is it used in budgetary control? |  |

| 2. What are some examples of job costing? |  |

| 3. How does job costing differ from process costing? |  |

| 4. How does job costing help in determining the profitability of a job? |  |

| 5. What are the advantages of using job costing in budgetary control? |  |