Costing and Budgetary Control Methods: Budget and Budgetary Control | Management Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Objectives |

|

| Definition |

|

| Type of Budget |

|

| Fixed Budget V/S Flexible Budget |

|

| Budgetary Control |

|

| Solved Examples |

|

Introduction

Budgets play a crucial role in profit planning, serving as a vital tool. The primary objective of budgetary control is to provide an overall perspective on budgeting as a planning mechanism and the creation of diverse budget types. In this, we will explore how the Budgetary Control technique is utilized for cost management.

Objectives

- The initial step in the planning and control system involves establishing objectives, which are broadly defined as the desired future state or position over the long term. Objectives serve as motivational or directional factors and are articulated in qualitative terms. Fundamental objectives encompass aspects such as determining the line of business, ensuring customer satisfaction, prioritizing employee welfare, and more, forming the foundational policies.

- Following this, the second stage in the planning process entails delineating goals. In the context of planning, the term "goal" refers to quantifiable targets set to be achieved within a specified time frame.

Definition

CIMA has provided a definition for budgets, stating that they are financial and/or quantitative statements crafted and endorsed before a specified period. These statements outline the policies to be followed during that timeframe with the aim of achieving a specific objective. Budgets may encompass aspects such as income, expenditure, and the utilization of capital.

Type of Budget

In the context of planning and control, a comprehensive and coordinated set of budgets is commonly referred to as a master budget.

The master budget typically includes three main types of budgets:

- Operating budgets

- Financial budgets

- Special decision budgets

Furthermore, the master budget can be classified into two categories:

- Fixed/static budget

- Flexible/variable/sliding budget

(i) Operating Budgets: Operating budgets are associated with the physical activities and operations of a firm, encompassing areas such as sales, production, purchasing, debtors collection, and creditors payment schedules.

Specifically, an operating budget consists of various components, including:

- Sales Budget

- Production Budget

- Purchase Budget

- Direct Labour Budget

- Manufacturing Expense Budget

- Administrative and Selling Expenses Budget, and so on.

(ii) Financial Budgets: Financial budgets focus on expected costs, receipts, disbursements, financial position, and operational results.

This category includes the following components:

- Budgeted Income Statement

- Budgeted Statement of Retained Earnings

- Cash Budget

- Budgeted Balance Sheet

Operational Budgets

1. Sales Budget: Within the operational budgets, the Sales Budget holds particular significance. It serves as a pivotal forecast for the quantities and values of sales expected in a budget period. Accuracy in its figures is crucial as it forms the foundation upon which all other budgets are developed. Factors considered during the preparation of a Sales Budget include past sales figures, trends, relative product profitability, pricing policies, production capacity, and market research studies. The Sales Manager typically assumes direct responsibility for creating and executing this budget.

2. Production budget: The production budget is an anticipation of the overall output of the entire organization, providing estimates for each product type, along with a detailed schedule of operations by weeks and months. It also forecasts the anticipated closing finished stock. The budget may be presented in quantitative terms, such as weights or units, financial rupees, or a combination of both. Preparation of this budget involves considering the estimated opening stock, projected sales, and the targeted closing finished stock for each product.

3. Purchase Budget: When creating the production budget, it's essential to identify the various inputs required for carrying out production activities. The purchase budget outlines the quantity of direct or indirect material units and services to be procured during the budget period. It also includes the monetary value of the materials needed for producing goods and services as per the production budget. Several factors need consideration during the preparation of the purchase budget, including:

- Sales and production budgets

- Anticipated fluctuations in raw material prices

- Storage capabilities

- Inventory levels and economic ordering quantity

- Nature of raw material availability.

4. Direct Labour Budget: The Direct Labour Budget outlines the count of employees and/or labor hours—categorized as skilled, semi-skilled, or unskilled—needed for the production necessary to meet the budgeted output or sales. When preparing the direct labor budget, certain factors should be taken into account, including:

- Output and sales

- Capital expenditure programs

- Research and Development activities

This budget also presents the financial value of labor, incorporating the applicable wage rates.

5. Manufacturing Expenses Budget: The Manufacturing Expenses Budget provides an estimate of the overhead expenses associated with production for a given budget period. It encompasses costs related to indirect labor, indirect material, and other indirect work expenses. This budget can be categorized into fixed, variable, and semi-variable costs. When preparing this budget, fixed overheads can be projected based on historical data, while variable expenses are estimated considering the budgeted output.

6. Administrative and Selling Expenses Budget: The Administrative Budget forecasts the expenses related to central offices and management salaries. It relies on past experience and expected changes, with expenses often being fixed and associated with various executives. The Selling Expenses Budget, closely linked to the sales budget, anticipates the selling and distribution expenses for the company's products during the budget period. These expenses are proportionate to sales.

Financial Budget

1. Cash Budget: The Cash Budget offers an estimate for the expected cash receipts and payments during the budget period. Prepared by the Chief Accountant under management guidance, it serves as a crucial tool whenever financial assistance is required for meeting production and sales programs. The cash budget comprises two parts - Receipts and Payments.

- Receipts encompass cash sales, debtors' collections, received dividends, and other income.

- Payments include creditor payments, cash purchases, income tax disbursements, asset purchases, and other miscellaneous expenses.

- Special Decision on Budget - Master Budget: The Master Budget can be categorized into a fixed budget and a flexible budget. The Master Budget serves as a consolidated summary of various functional budgets and is described as "a summary of the budget schedules in capsule form made for the purpose of presenting, on one report, the highlighting of the budget forecast." The budget committee, based on coordinated functional budgets, prepares this budget, and upon approval, it becomes the company's target for the budget period.

(i) Fixed Budget: A Fixed Budget is prepared for a specific level of activity and does not account for changes in expenditure resulting from variations in the level of activity.

(ii) Flexible Budget: A Flexible Budget is designed to adjust according to the level of activity achieved. Consequently, it provides different budgeted costs for various levels of activity. The preparation of a flexible budget involves intelligent classification of all expenses into fixed, semi-variable, and variable categories. The effectiveness of such a budget relies on the accuracy of expense classification.

Fixed Budget V/S Flexible Budget

Budgetary Control

Budgetary Control is described as the creation of budgets aligning the duties of executives with policy requirements. It involves the ongoing comparison of actual outcomes with budgeted figures, aiming to either achieve the objectives of the policy through individual actions or provide a foundation for policy revision.

Advantages of Budgetary Control

There are several advantages of Budgetary Control, including the following:

- Formalizing responsibilities through budget control compels managers to think ahead, anticipate changing conditions, and plan accordingly.

- It facilitates coordination among various departments and functions within the business.

- Enhanced production efficiency is achieved through effective communication with employees and management, motivating them to maximize production and profits.

- Ensures the availability of working capital for the smooth operation of the business.

- Provides clear guidance for capital expenditure, ensuring it is directed in the most profitable manner.

- Acts as a motivational tool for employees to achieve set goals.

- Facilitates obtaining bank credit as needed.

- Creates cost consciousness and fosters an attitude that encourages efficiency and minimizes waste.

Limitations of Budgetary Control

- Budgets rely on estimations, and the effectiveness of the budgetary control system depends significantly on the accuracy of these estimates. It is essential to remember that budgets are formulated based on estimates rather than actual figures.

- The budget program needs to be dynamic and adaptable to changing business conditions. It cannot remain fixed over time, as alterations in business circumstances lead to corresponding changes in results.

- Budgetary control is merely a management tool. Merely introducing a budget program is not sufficient for ensuring success; the entire organization must actively participate in the program to achieve budgetary goals.

- The preparation of a budget demands a substantial amount of time and effort. While budgeting might not be a major expense for large or medium-sized organizations, smaller companies may find it challenging to justify the associated costs.

Solved Examples

Example 1: From the following information prepare a cash Budget for Six months ended 31st December, 2014 of India Co. Ltd. Cash balance on 1st July was ₹5000. A new machine is to be installed at ₹15,000 on credit, to be repaid in two equal installments in September 2014 & October 2014. Sales commission at 5% on total sales is to be paid within the month following actual sales. ₹500 being the amount of second call may be received in September 2014. Share premium amounting to ₹1000 is also obtainable with second call. Period of credit allowed by supplier is 1 month. Period of credit allowed to customers is 1 month. Delay in payment of overheads is 1 month. Delay in payment of wages is ½ month. Assume cash sales to be 50% of total sales.

Cash balance on 1st July was ₹5000. A new machine is to be installed at ₹15,000 on credit, to be repaid in two equal installments in September 2014 & October 2014. Sales commission at 5% on total sales is to be paid within the month following actual sales. ₹500 being the amount of second call may be received in September 2014. Share premium amounting to ₹1000 is also obtainable with second call. Period of credit allowed by supplier is 1 month. Period of credit allowed to customers is 1 month. Delay in payment of overheads is 1 month. Delay in payment of wages is ½ month. Assume cash sales to be 50% of total sales.

Ans:

Note: All other expenses, i.e. payment to creditors, production and selling overheads, credit period is given 1 month, i.e. to be paid in the next month, it means June paid in July, July paid to August and so on.

Note: All other expenses, i.e. payment to creditors, production and selling overheads, credit period is given 1 month, i.e. to be paid in the next month, it means June paid in July, July paid to August and so on.

Example 2: Jay Company making for a stock in the first quarter of the year is assisted by its bankers with overdraft accommodation. The following are the relevant budget figures. Budgeted cash at Bank, 1st January, 2004 is ₹17,200. Credit terms of sales on payment by the end of the month following the month of supply. On an average, one half of sales are paid on the due date while the other half are paid during the next month. Creditors are paid during the month following the month of supply. You are required to prepare a Cash Budget for the quarter, 1st January - 31st March, 2004, showing the budgeted amount of bank facilities required at each month.

Budgeted cash at Bank, 1st January, 2004 is ₹17,200. Credit terms of sales on payment by the end of the month following the month of supply. On an average, one half of sales are paid on the due date while the other half are paid during the next month. Creditors are paid during the month following the month of supply. You are required to prepare a Cash Budget for the quarter, 1st January - 31st March, 2004, showing the budgeted amount of bank facilities required at each month.

Ans: Cash Budget for quarter ending 31.3.2004.

No Information is given so it is assumed that the wages are paid in the same month.

No Information is given so it is assumed that the wages are paid in the same month.

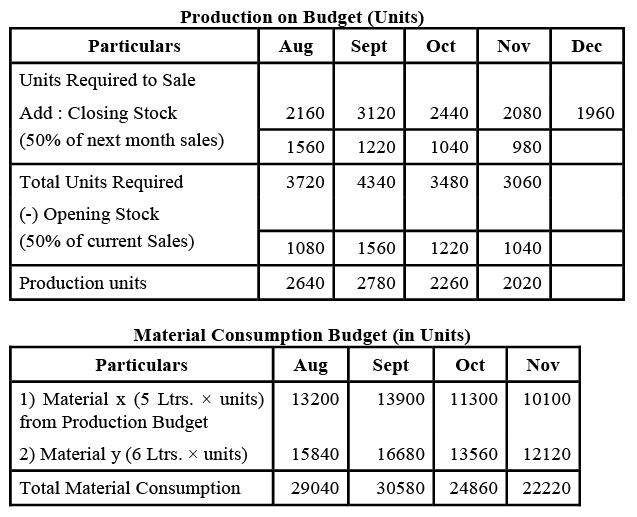

Example 3: A company estimate sales of Product ‘A’ during the last five months of 2008 as under.

Inventory of product ‘A’ at the end of every month is to be equal to 50% of sales estimate for the next month. Closing inventory of July was maintained on the above basis. There was no work in progress at the end of any month. Every unit of product requires two types of material in the following quantities.

Material x - 5 Ltr.

Material y - 6 Ltr.

Material equal to 25% of the requirement for the next month consumption are kept as closing stock. The stock position on 31st July was as under.

Material x - 3200 Ltr.

Material y - 2800 Ltr.

The purchase price of materials x ₹3 per ltr. And material y ₹2 per ltr. There was no closing stock of material x & y on 30th November 2008. From the above prepare the following budget for the period August to November.

1) Production budget

2) Material Consumption budget

3) Purchase Budget showing quantity and value.

Ans:

Note: It is assumed that sales unit for December 1960.

Note: It is assumed that sales unit for December 1960.

∴ Closing Stock (25% of next consumption) in taken as. For material Production units 1960

∴ 1960 × 50% = 980 units

∴ Material Consumption

Material x = 980 × 5 = 4900

Material y = 980 × 6 = 5880

∴ Closing Stock x = 4900 × 25% = 1225

y = 5880 × 25% = 1470

FAQs on Costing and Budgetary Control Methods: Budget and Budgetary Control - Management Optional Notes for UPSC

| 1. What is the purpose of budgetary control? |  |

| 2. What is a fixed budget? |  |

| 3. How does a flexible budget differ from a fixed budget? |  |

| 4. What is budgetary control? |  |

| 5. Can you provide an example of budgetary control? |  |

|

Explore Courses for UPSC exam

|

|