Basis of Charge | Commerce & Accountancy Optional Notes for UPSC PDF Download

Importance of Residential Status

According to Section 4 of the Income Tax Act, 1961, tax is to be charged, on the income of the previous year of a person at the rate fixed for the assessment year, immediately following the previous year, by the Annual Finance Act passed by Parliament in February every year. The tax liability of a person is determined based on his residence in India in the previous year. The residential status of an assessee may not necessarily be the same in each year; he may be a resident in one year and a non-resident in the next. As such, clear identification of residential status, is necessary. It is important to note, however, that the status of an assessee will be the same for all sources of income. The rules for determining the residential status are not the same for different types of assessee viz., individual, Hindu Undivided Family (HUF), firm and a company etc.

Categories of Residential Status

Section 5 of the Income tax Act deals with the scope of total income. It states that the scope of total income of a person is determined by reference to his residence in India in the previous year. Based on residence, the individuals and HUF entities are divided into three categories, viz.

- Persons who are ordinarily residents in India

- Persons who are not ordinarily residents in India

- Persons who are non-residents in India

For the purpose of determining the rules applicable in this regard, the assessees are divided into 4 groups, viz.

For the purpose of determining the rules applicable in this regard, the assessees are divided into 4 groups, viz.

- Individuals

- Non-company plural entities (H.U.F., firms or other association of persons)

- Companies

- Every other person

Rules For Determining The Residential Status

As stated earlier, there are separate rules for determining the residential status of different types of assessee. The tests for residence of an individual are contained in Section 6(1), those for Hindu Undivided Families, firms or other associations of persons are laid down in Section 6(2), those for companies in Section 6(3) and for every other person in Section 6(4).

Individual

An Individual may have any of the following residential status depending upon applicability of rules of Income Tax Act:

- Resident and Ordinarily Resident

- Not Ordinarily Resident

- Non-Resident

A) Resident and Ordinarily Resident

Section 6(1) and Section 6(6)(a) of the Income Tax Act determines the Residential status of an Individual. Section 6(1) prescribes two conditions which may be treated as basic conditions and similarly, Section 6(6)(a) also prescribes two conditions which may be treated as additional conditions. An Individual shall be considered as Resident in India if he shall fulfil at least one basic condition and both the additional conditions.

Conditions of Part I or Basic Conditions:

- He must be physically present in India for a period of 182 days or more during the relevant previous year, or

- He must be in India for a period of 60 days (182 days in some special circumstance) or more during the relevant previous year and 365 days or more for 4 years immediately preceding the relevant previous year.

Exception to the ‘Basic Conditions’

- In the case of an individual being ‘Citizen of India’, if he leaves India during the previous year as a member of the crew of an Indian ship or for the purpose of employment outside India, he shall fulfil the basic condition No (ii) only where he is in India for at least 182 days instead of 60 days.

- In the case of an individual who is a ‘Citizen of India’ or a person of ‘Indian Origin’, if he is already outside India and comes on a visit to India during the previous year, he shall fulfil the basic condition No (ii) only when he is in India for at least 182 days instead of 60 days.

Conditions of Part II or Additional Conditions [Section 6(6)(a)]

- If he has been resident in India for at least 2 out of the 10 years preceding the previous year, and

- He has been in India for a period or periods amounting in all to 730 days or more during 7 previous years preceding the previous year.

Stay in India

His stay in India for at least 182 days during the previous year need not necessarily be a continuous one and at the same place. It is the total duration of his stay in India that will be considered for the purpose. It is immaterial whether he stayed in a rented house, or his own house, in a hotel or with some friends. What is important is that he must have stayed in India for a period of 182 days or more in the previous year.

Regarding his stay for at least 365 days, the stay may be regular or irregular or only once in four years preceding the previous year. But he must have stayed in India for 365 days in all during the four years. The period of 4 years preceding the previous year means the period of 12 calendar months each immediately preceding the commencement of the relevant previous year.

Again, with regard to the second condition of Part I i.e. his stay for 365 days or more, the stay need not be regular, it could be only once in four years preceding the previous year. It is the total stay which is significant which must be 365 days or more in the 4 years preceding the previous year.

Example: 1

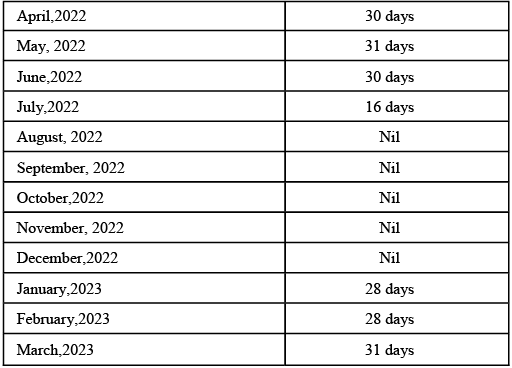

Mr. Anil citizen of Spain has been staying in India since 1985. He leaves India on 16.7.2022 on a visit to U.S.A. and returns on 4.1.2023. Determine his residential status for the previous year 2022-23.

Sol:

If Mr. Anil satisfies first condition (stay in India for at least 182 days) his stay in India during the previous year 1.4.2022 to 31.3.2023 is as under:

Thus, his total stay in India during the previous year is 194 days. As, he is in India for more than 182 days during the relevant previous year, he satisfies the first condition and is, therefore, a resident.

Thus, his total stay in India during the previous year is 194 days. As, he is in India for more than 182 days during the relevant previous year, he satisfies the first condition and is, therefore, a resident.

B) Not Ordinarily Resident

If an individual satisfies anyone of the two conditions of Part I, or basic condition but does not satisfy both the conditions or fulfils only one of the two additional conditions of Part II, he is said to be resident but not ordinarily resident or simply stated, he will be a “not ordinarily resident”.

Example: 2

Mr. Mayank came to India for the first time in July 2022 and stayed in Delhi up to 31st March 2023. Determine his residential status for the assessment year 2023-24.

Sol:

For the assessment year 2023-24, Mr. Mayank is resident but not ordinarily resident. During the previous year 2022-23, Mr. Mayank was in India for a period of more than 182 days, and he thereby fulfils one of the basic conditions or condition (1) of Part I. But he does not satisfy both the additional conditions of Part II. Therefore, he is resident but not ordinarily resident for the assessment year 2023-24.

C) Non-Resident

If an individual does not satisfy anyone of the basic conditions or conditions of Part I, he is said to be non-resident in that previous year whether he satisfies one or both conditions of Part II or additional conditions.

Exceptions (section 6(1A)) applicable from AY 2021-22

In the following cases, an individual is deemed to be resident but not ordinarily resident even if he does not satisfy the two basic conditions:

- An individual is deemed to be resident but not ordinarily resident if he satisfies the following 3 conditions:

- He is an Indian citizen and not a foreign citizen (even though he may be a person of Indian origin)

- His total taxable income during the previous year (excluding income from foreign sources) is more than Rs. 15,00,000

- He is not liable to be taxed in any other country

- An individual is deemed to be resident but not ordinarily resident if he satisfies the following 4 conditions

- He is an Indian citizen or a person of Indian origin

- His total taxable income during the previous year (excluding income from foreign sources) is more than Rs. 15,00,000

- He comes to India on a visit during the relevant previous year

- He is in India for more than equal to 120 days (but less than 182 days) during the relevant previous year and more than equal to 365 days for 4 years immediately preceding the previous year

Non-Company Plural Entities

Under this section, we will examine the rules regarding residential status of plural entities such as Hindu Undivided Family (HUF), firms and association of persons.

Hindu Undivided Family [Section 6(2)]

The residential status of an HUF depends on two factors, the location of control and management of its affairs and the residential status of its Karta.

A) Ordinarily Resident [Section 6(2)]

HUF is said to be ordinarily resident in India in any previous year:

- If the control and management of its affairs is wholly or-partly situated in India during the previous year.

- The expression ‘Control and Management’ signifies controlling and directive power. In other words, it means the ‘head and brain’. Moreover, the control and management should be de facto (in effect) and not merely the right or power to control and manage.

- If its manager (Karta) satisfies the following conditions of Section 6(6)(a):

- Its manager has been resident in India in 2 out of 10 previous years preceding that year; and

- Its manager has, during the 7 years preceding that year, been in India for a period amounting in all to 730 days or more.

- For the purposes of calculating the period of the manager’s stay in India, we shall add up the stay in India of all the successive managers of the family, in case of the death of the first manager.

B) Not Ordinarily Resident

A Hindu Undivided family is said to be “not ordinarily resident in India, if control and management of its affairs is situated wholly or partly in India during the previous year, but its manager does not satisfy the additional condition conditions of Section 6(6)(a).

C) Non-resident

A Hindu Undivided Family is said be a non-resident in such cases only where its control and management are situated wholly outside India during the previous year. If, however, the control and management is situated partly in India and the Karta satisfies the conditions of Part II Section 6(6), it becomes a resident in India.

Firms and other Association of Persons [Section 6(2)]

Firms and other association of persons can fall under two categories only. They may either be residents or non-residents. The category of non-ordinarily residents does not apply to such assessee.

A) Resident

According to section 6(2), a firm or other association of persons is said to be resident in India in any previous year where during that year the control and management of its affairs is partially or wholly situated in India. The residential status of its partners in India is immaterial.

B) Non-Resident

A firm or an association of persons is said to be non-resident in such cases only where the control and management of its affairs is situated wholly outside India during the previous year.

Residential status of a company [Section 6(3)]

A company is said to be resident in India, in a previous year, if:

- It is an Indian company, or

- The company is foreign company, its place of effective management (POEM), in that year, is in India

A company is said to be non–resident in any previous year, if:

- It is not an Indian company, and.

- Its place of effective management, in that year, is not in India.

‘Place of effective management’ means a place where key management and commercial decisions that are necessary for the conduct of the business of an entity are in substance made.

Example:

The Indian chemical limited is a registered Indian company carrying business in India and in Gulf countries. The control and management of its affair was partially situated in Riyadh (Saudi Arabia) during the year ending March 31, 2023. What will be the residential status of the company for the assessment year 2023-24?

Sol:

The Indian chemical limited is an Indian company, therefore, it should be treated as resident in India and the facts regarding control and management outside the country are immaterial.

Any other Person [Section 6(4)]

- Resident: Every other person (local authority, artificial juridical person e.g.: Statutory Corporations) is said to be resident in India in any previous year, if the control and management of its affairs is partly or wholly situated in India.

- Non-Resident: Every other person is said to be non-resident if control and management of its affairs is situated wholly outside India. Note: Firm and other Association of persons, companies and every other person can never be a ‘Not Ordinarily Resident.’

Scope of Total Income on The Basis of Residence

We have examined the rules determining the residential status of assessee as given in section 5 of Income Tax Act. As stated earlier, the scope of total income of an assessee depends on his residential status in the previous year. In the following sections, we will explain the scope of total income for the different categories of assessee viz.

- Residents and ordinarily resident [Section 5(1)]

- Not-ordinarily residents [Section 5(1)]

- Non-residents [Section 5 (2)]

Resident an d Ordinarily Resident

The total income of any person, who is resident in the relevant previous year, includes all income from whatever sources derived which:

- Is received, or deemed to be received in India in such year by him or on his behalf during the previous year; or

- Accrues or arises or is deemed to accrue or arise to him in India during the previous year; or

- Accrues or arises to him outside India during such year.

Not Ordinarily Resident

If the assessee is ‘not-ordinarily resident’, the total income of the relevant previous year includes all incomes from whatever sources derived which:

- Is received or is deemed to be received in India in such year by or on behalf of such person during the previous year; or

- Accrues or arises or is deemed to accrue or arise to him in India during the previous year; or

- Accrues or arises to him outside India during such year but derived from business controlled (wholly or partly) in India or a profession set up in India.

Thus, it will be seen that the basic difference between the scope of total income of an ordinarily resident and not ordinarily resident relates to the income which accrues or arises to him outside India. In case of a resident, it is included in his total income irrespective of the source of such income. But, in case of a not ordinarily resident, it will be included in his total income only if it is derived from a business which is controlled (wholly or partly) in or a profession set up in India.

Non-Resident

If the assessee is a non-resident in India, the total income of the relevant previous year includes all income from whichever sources derived which:

- Is received or is deemed to be received in India in such year by or on behalf of such person during the previous year, or

- Accrues or arises or is deemed to accrue or arise to him in India during such year.

Thus, non-residents are not liable in respect of income accruing or arising outside India even if it is remitted to India.

Kinds of Income

It appears from the scope of total income that four types of incomes form part of the tax liability. They are:

- Income received in India. (Section 7)

- Income deemed to be received in India. (Section 7)

- Income accruing or arising in India. (Section 9)

- Income deemed to accrue or arise in India. (Section 9)

Let us now discuss them in detail:

Income R eceived in India

- Any income received in India, during the previous year by an assessee is taxable, irrespective of the residential status of the assessee and the place of accrual of such income. The receipt of income refers to the income received by the assessee for the first time under his control. But, once amount is received as income, any remittance of the amount to another place does not result in receipt. It is not necessary that income should be received in cash, it may be received in kind also, for example, rent free accommodation and certain other facilities provided to an employee are taxable as ‘salary’ in the hands of the employee though the income is not received in cash. Though income may be received in kind, it should be equivalent of cash or should be in money’s worth.

- In case of non-resident, their foreign income is not assessable unless it is received in India. At the time the money is received in India, it is received as income from an outside source; such receipt will not be an income receipt. If a non – resident had already received money outside India as income or exempt income and he has transferred the money into India, in any year, such transfer will not count as income.

Income Deemed to be Received in India

The given below incomes shall be deemed to be received in India in the previous year:

- The contribution made by the central Government in the previous year to the account of an employee under a pension scheme u/s 80CCD.

- Contribution made by the employer to the recognized provident fund in excess of 12% of the salary of the employee is the income deemed to be received.

- Interest credited to the recognized provident fund of the employee which is in execs of 9.5% p.a is the income deemed to be received.

- When an employee, who is member of an unrecognized provident fund, becomes member of a recognized provident fund, the accumulated amount transferred to a recognized provident fund from the unrecognized provident fund, is termed as ‘transferred balance’. Employer’s contribution and interest, thereon, induced in the transferred balance, is the income deemed to be received.

Incomes Accruing or Arising in India

- Income is said to be received, when it reaches the assessee, but where the right to receive the income becomes vested in the assessee, it is said to accrue or arise. Accrual of income means a stage, where the assessee has acquired a right to receive such income, when the same income is received in the accounting year, it is said to arise. Income accrues when the right to receive it comes into existence; but it arises when the method of accounting shows it in the shape of profits or gains.

- The income must accrue or arise in India. If it accrues or arises outside India; it cannot be taxed in the hands of person who is non-resident in India.

Income Deemed to Accrue or Arise in India

The given below incomes shall be deemed to accrue or arise in India:

- Income from a business connection in India: Any income which arises, directly or indirectly, from any acting or a business connection in India, is deemed to be earned in India. Business connections may be in several forms: formation of a subsidiary company in India to carry business of the non – resident parent company, branch office in India or an agent of an organization of non – resident in India.

- Income from any property, asset or source of income situated in India: Any income which arises from any property, movable or immovable, tangible, or intangible which is situated in India is deemed to accrue or arise in India.

- Income from interest, royalty or technical fee is deemed to accrue or arise in India, if it is payable by:

- Government, or

- A person who is a resident in India and use for the purpose of business or profession in India.

- A person who is a non–resident in India provided, the interest is payable in respect of money borrowed and used for business or profession carried on in India.

- Salary payable by the Government to a citizen of India for the services rendered outside India.

- Any salary payable for services rendered in India will be regarded as income earned in India.

- Income from the transfer of any capital asset situated in India regardless of the residential status of the transferor or transferee would be deemed to be income accruing or arising in India and would be taxable.

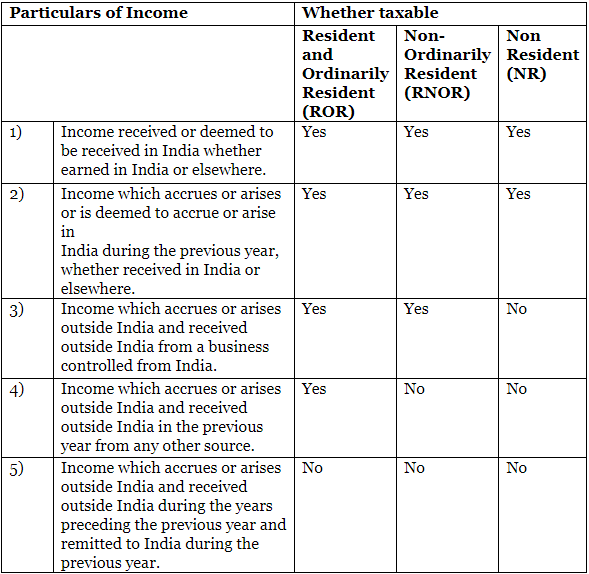

Incidence of Tax

The below table summarizes the provisions regarding incidence of tax.

Provisions regarding incidence of tax

|

196 videos|219 docs

|

FAQs on Basis of Charge - Commerce & Accountancy Optional Notes for UPSC

| 1. What are the categories of residential status for taxation purposes? |  |

| 2. What are the rules for determining the residential status of an individual? |  |

| 3. How does the residential status affect the scope of total income for taxation? |  |

| 4. What are the different kinds of income considered for taxation based on residence status? |  |

| 5. How is the basis of charge for taxation determined based on an individual's residential status? |  |