Cost of Capital | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Computing Cost of Capital for Individual Components |

|

| Weighted Cost of Capital |

|

| Conclusion |

|

Introduction

The cost of capital stands as a pivotal financial concept, bridging the gap between a company's long-term decisions and the wealth of its shareholders as reflected in the market. Whenever a business organization seeks to raise funds, it must meticulously consider its associated costs. Therefore, computing the cost of capital holds significant importance, requiring finance managers to closely monitor it. In this unit, we will delve into the concept, classification, and importance of the cost of capital, along with the process of computing the cost of capital for individual components, weighted cost of capital, its significance, and dispelling a few misconceptions.

Meaning and Importance:

The term "cost of capital" pertains to the minimum rate of return necessary for a firm to maintain or enhance the market value of its equity shares. According to John Hampton, it is defined as "the rate of return required by the firm from its investments to augment its value in the marketplace." The essential characteristics of the cost of capital are as follows:

- The cost of capital represents a rate of return rather than an actual cost.

- This return is computed based on the actual costs associated with different capital components.

- It signifies the minimum rate of return required by a firm to sustain or increase the value of its equity shares.

- It is linked to long-term capital funds.

The cost of capital comprises three components:

- Return at Zero Risk Level (ro)

- Premium for Business Risk (b)

- Premium for Financial Risk (f)

The formula for calculating the cost of capital is:

- K = ro + b + f

Where:

- K = Cost of Capital

- ro = Return at Zero Risk Level

- b = Premium for Business Risk

- f = Premium for Financial Risk

A firm's cost of capital primarily entails three types of risks:

- Return at Zero Risk Level: This denotes the anticipated rate of return when a project entails no risk, whether business or financial.

- Premium for Business Risk: Business risk pertains to the possibility of a firm being unable to operate successfully in the market. The higher the business risk, the greater the cost of capital.

- Premium for Financial Risk: This refers to the risk associated with the capital structure pattern. Essentially, a firm with a higher debt proportion in its capital structure is deemed riskier compared to one with a lower debt proportion.

Importance:

Determining the firm's cost of capital holds significance due to the following reasons:

- It serves as the foundation for evaluating new capital expenditure proposals, providing the criterion for accepting or rejecting such projects.

- Finance managers need to procure capital from various sources in a manner that optimizes risk and cost factors. Assessing the cost of capital aids in determining the most favorable capital structure.

- It forms the basis for assessing the financial performance of top management.

- It assists in crafting an appropriate dividend policy.

- Moreover, it aids the organization in devising an effective working capital policy.

Classification of Cost of Capital:

The classification of cost of capital varies based on the specific needs, processes, and objectives. It can be categorized as follows:

- Explicit Cost and Implicit Cost: Explicit cost pertains to the discount rate that aligns the present value of received funds (net of underwriting costs) with the present value of expected cash outflows. Conversely, implicit cost refers to the rate of return associated with the best foregone investment opportunity for the firm and its shareholders.

- Average Cost and Marginal Cost: Average cost represents the weighted average of the costs of each capital component, while marginal cost of capital denotes the weighted average cost of new funds raised by the firm.

- Future Cost and Historical Cost: In financial decision-making, future costs are relevant, and they are estimated using historical costs.

- Specific Cost and Combined Cost: Specific costs pertain to the costs of individual capital components, while combined cost represents the average cost of capital, encompassing costs from all sources. In capital budgeting decisions, the combined cost of capital is utilized for project acceptance or rejection.

Computing Cost of Capital for Individual Components

Business firms typically rely on four primary sources for long-term funds: (i) Long-term Debt and Debentures, (ii) Preference Share Capital, (iii) Equity Share Capital, and (iv) Retained Earnings. While not all sources may be utilized by every firm, each firm typically incorporates some of these sources into its capital structure. The specific cost associated with each source of funds is the after-tax cost of financing. It may also be calculated on a before-tax basis, provided the basis is consistent across all sources of finance considered for determining the cost of capital. The procedure for determining the costs of debt, preferences, equity capital, and retained earnings is outlined in the following subsections.

Cost of Long-Term Debt

Debt instruments may be issued at par value, at a premium, or at a discount, and they may be either perpetual or redeemable. The method for calculating the cost varies based on these factors:

(a) When calculating the Cost of Long-Term Debt at par, the formula is as follows:

Kd = (1 − T) × R

Where:

Kd = Cost of long-term debt

T = Marginal Tax Rate

R = Debenture Interest

Rate For example, if a company issues 10% debentures and the tax rate is 50%, the cost of debt will be:

(1 − 0.5 ) × 10 = 5 %

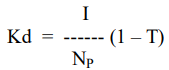

(b) If debentures are issued at a premium or discount, the cost of debt should be calculated based on the net proceeds realized. The formula is as follows:

where

- Kd = Cost of debt after tax

- I = Annual Interest Payment

- NP = Net Proceeds of Loans

- T = Tax Rate

Illustration No. 1: A company issue 10% irredeemable debentures of Rs. 10,000. The company is in 50% tax bracket. Calculate cost of debt capital at par, at 10% discount and at 10% premium

Solution:

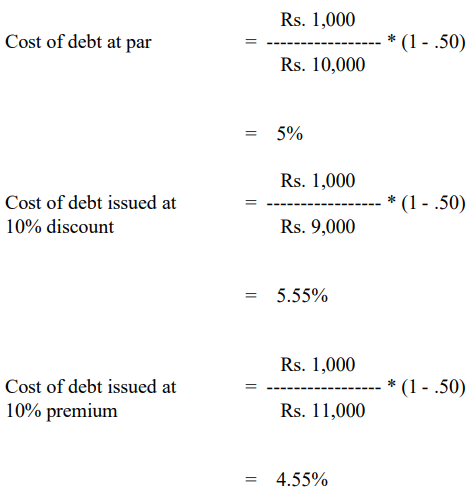

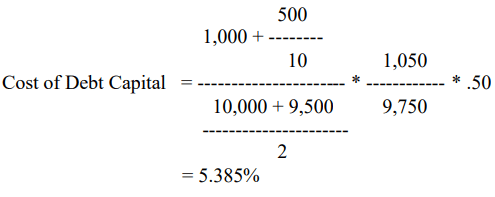

(c) For computing cost of redeemble debts, the period of redemption is considered. The cost of long term debt is the investor’s yield to maturity adjusted by the firm’s tax rate plus distribution cost. The question of yield to maturity arises only when the loan is taken either at discount or at premium. The formula for cost of debt will be

where

- mp = maturity period

- p = nominal or par value

- np = net proceeds i.e. (Par value – Discount + Premium)

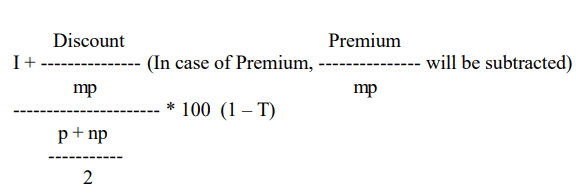

Illustration No. 2: A firm issued 100 10% debentures, each of Rs. 100 at 5% discount. The debentures are to be redeemed at the end of 10th year. The tax rate is 50%. Calculate cost of debt capital.

Solution:

(d) In case of underwriting and other issuing costs, they are adjusted in the same way as discount is being adjusted in net proceeds and other calculations.

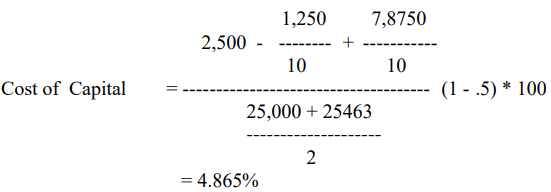

Illustration No. 3: A company raised loan by selling 250 debentures with 10% rate of interest at premium of Rs. 5 per debentures (Par value = Rs. 100), redeemable at the end of 10th year. Underwriting and other issuance costs amounted to 3% of the proceeds. The tax rate is 50%. Calculate cost of debt capital.

Solution:

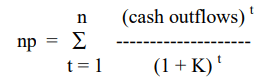

(e) Yield to maturity method of computing cost of debt capital is an approximation method. A better method is that which converts yield to maturity into a discount rate. James C. Van Horne says “the discount rate that equates the present value of the funds received by the firm, net of underwriting and other costs with the present value of expected outflows. These outflows may be interest payments, repayment of principal or dividends”. It may symbolically written as :

where

- np = net amount available for use

(cash outflows) t = amount of interest after tax + amount of repayment of principal in different periods

- K = discount rate

(f) Effective cost of debt is lower than the interest paid to the creditors because the firm can deduct interest amount from its taxable income. The higher the tax rate, the lower will be the effective interest rate and the cost of debt.

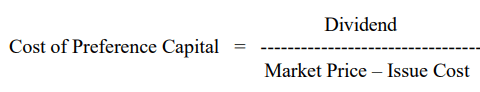

Cost of Preference Capital

- Preference shares signify a unique form of ownership stake in the company. Unlike equity shareholders, preference shareholders are entitled to receive their predetermined dividends before any earnings are distributed to equity shareholders. In essence, preference shares resemble bonds or debentures with fixed interest payments. The cost of preference shares can be approximated by dividing the preference dividend per share by the current share price, as the dividend can be viewed as a consistent level of payment over time.

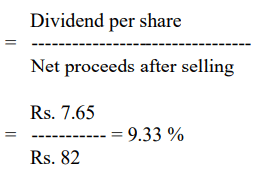

- For instance, suppose a company intends to issue 9% preference shares projected to be sold at Rs. 85 per share. It is estimated that the costs associated with issuing and selling the shares will amount to Rs. 3 per share.

- To calculate the cost of preference capital, the initial step involves determining the total amount of preference dividends, which are specified as 9% of the share value of Rs. 85 per share. Consequently, 9% of Rs. 85 equals Rs. 7.65. After accounting for the flotation costs, the net proceeds amount to Rs. 82 per share.

Hence, the cost of preference capital:

Currently, companies are limited to issuing redeemable preference shares. The cost of capital associated with these shares is determined by the discount rate that aligns the funds obtained from issuing preference shares with the present value of all dividends and the eventual repayment of preference share capital. This method of calculating the cost of preference share capital relies on present value, akin to the approach used for calculating the cost of debt capital, with the distinction being the utilization of stated dividends on preference shares instead of interest.

Equity Capital Cost

"Equity capital cost entails the expense associated with the anticipated flow of net capital investments sought from equity sources," according to E.W. Walker. James C. Van Horne describes the cost of equity capital as the discount rate that balances the present value of all anticipated future dividends per share, as perceived by investors.

Determining the cost of equity capital is notably challenging due to several factors:

- Equity cost isn't the direct expenditure of utilizing equity capital.

- It's based on the anticipated stream of future dividends as envisioned by shareholders, which is challenging to predict.

- The correlation between market price and earnings is understood, but dividends also influence market value, creating ambiguity.

Approaches to calculating the cost of equity capital include:

- Earnings-Price (E/P) Ratio Method: This method gauges equity capital cost through the earnings price ratio, represented symbolically as (Eo/Po) * 100. However, limitations of this method include the fluctuating nature of earnings per share and uncertainty about which earnings to consider—current or average.

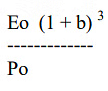

- E/P Ratio + Growth Rate Method: This method incorporates earnings growth over a three-year period. Typically, a growth rate is factored in, accounting for changes in earnings.

The expression (1 + b)3 represents the growth factor, where 'b' denotes the growth rate expressed as a percentage and estimated over a three-year period.

- For instance, consider a company with an EPS (Earnings Per Share) of Rs. 5 and a 10% earnings growth rate over three years. The current market price of the equity share stands at Rs. 50.

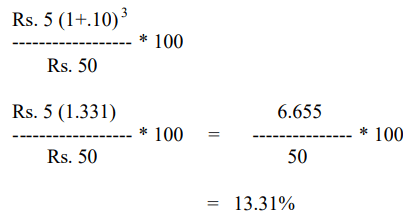

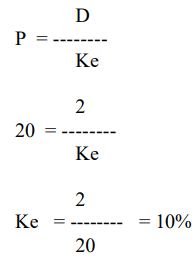

(c) D / P Ratio Method : Cost of equity capital is measured by dividends price ratio. Symbolically

The method operates under the following assumptions:

- The level of risk remains constant.

- Investors prioritize dividends.

- Investors acquire shares at their par value.

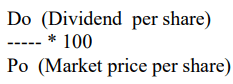

In this approach, the anticipated future dividend payments of a company, as perceived by investors, are projected. The current share price is utilized to calculate the anticipated rate of return for shareholders. Hence, if Ke represents the risk-adjusted expected rate of return by investors, the present value of future dividends discounted by Ke would equal the share price.

Where:

- P = price of the share

- D1 ……. Dn = dividends in periods 1,2,3,….n,

- Ke = the risk-adjusted rate of return expected by equity investors.

Given the current price (P) and values for future dividends (Dt), one can calculate Ke using the Internal Rate of Return (IRR) procedure. If the firm has consistently maintained a regular pattern of dividends in the past, it is reasonable to anticipate that the same pattern will persist. For instance, if a firm is disbursing a dividend of 20% on a share with a par value of Rs. 10 as a perpetual level dividend, and its market price is Rs. 20, then

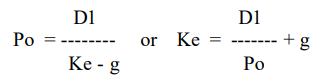

(d) D / P + Growth Rate Method: The method is comparatively more realistic as i) it considers future growth in dividends, ii) it considers the capital appreciation. Thus

where,

- Po = the current price of the equity share

- D1 = the per share dividend expected at the end of year 1.

- Ke = the risk adjusted rate of return expected an equity shares.

- G = the constant annual rate growth in dividends and earnings.

The equation indicate that the cost of equity share can be found by dividing the dividend expected at the end of the year 1 by the current price of the share and adding the expected growth rate.

(e) Realized Yield Method: Estimating the expected return rate is challenging when using D/P Ratios and E/P Ratios to determine Ke. Therefore, this method relies on the actual rate of return earned by shareholders. Typically, the most recent five to ten years are considered, and the return rate is calculated for investors who purchased shares at the study's outset, held them until the present, and sold them at current prices. This yield represents the realized return by the investor and is assumed to indicate the cost of equity shares, under the premise that the investor earns what they anticipate. However, this method's utility is constrained by several factors. Firstly, it assumes that investors' expectations remain constant throughout the study period, there are no significant changes in dividend rates, and investors' risk attitudes remain unchanged. Since these conditions are seldom met, the yield method is significantly limited. Additionally, the yield may vary depending on the chosen time frame.

(f) Beta Method for Security: Investors are primarily concerned with the risk associated with their entire portfolio, and a particular security's relevant risk is its impact on the overall portfolio. A security's Beta indicates how closely its returns correlate with those of a diversified portfolio. A Beta of 1.0 suggests that the security's price moves in line with the market, while a Beta of 2.0 implies that its price changes twice as much as the market, and a negative Beta means the security moves inversely to the market. The Beta of a portfolio is the weighted average of the individual securities' Betas, reflecting their proportional investments. Adding high-Beta securities to a diversified portfolio increases its risk, while low-Beta securities decrease it.

- Determining Beta: Beta coefficients are derived by analyzing a security's historical returns relative to the market. Since examining all securities is impractical, a sample is used. The Capital Asset Pricing Model (CAPM) utilizes these Beta coefficients to estimate the required rate of return on securities. This model posits that the expected return on a share depends on its Beta, expressed as: Ke = riskless rate + risk premium x Beta. The riskless rate can be the current government securities rate, and the difference between the long-run average returns of shares and government securities represents the risk premium. Published data or independent estimates provide Beta coefficients.

Example Calculation: Suppose Pan Am's stock had a Beta of 0.95 in 1984, and long-term government bond rates were 12 percent. The required rate of return on Pan Am's stock would be: Required Rate = 12% + 6% * 0.95 = 17.7%. - Advantages of Beta Method: Using Beta to assess the cost of equity capital is advantageous as it incorporates risk analysis, unlike other methods. However, its practical application is limited, possibly due to the complexity of calculating Beta values.

Cost of Retained Earnings

Some scholars argue against the necessity of separately calculating the cost of retained earnings, contending that it is already encompassed within the cost of equity share capital. They posit that the existing share price, used to ascertain the cost of equity capital, inherently reflects the impact of both dividends and retained earnings. However, there are also proponents who advocate for determining the cost of retained earnings independently. Two alternative approaches exist:

- One approach is to consider the cost of equity capital as synonymous with the cost of retained earnings.

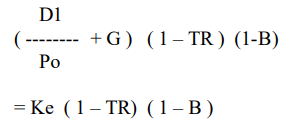

- Another approach involves the concept of external yields, as proposed by Ezra Soloman, which entails reinvesting retained earnings in another firm. Symbolically, the Cost of Retained Earnings = [remainder of the text is missing].

where

- Ke = Cost of equity capital based on dividends growth method

- TR = Shareholder’s Tax Rate

- B = Percentage Brokerage Cost

For example, A firm’s cost of equity capital is 12% and tax rate of majority of shareholders is 30%. Brokerage is 3%

= 12% ( 1 – 30% ) ( 1 – 3% )

= 12 * .70 * .97 = 8.15%

Weighted Cost of Capital

The weighted cost of capital, also known as composite cost of capital, overall cost of capital, weighted marginal cost of capital, or combined cost of debt and equity, encompasses the costs associated with different components of financing. These components are weighted based on their relative proportions in the total capital structure.

Choice of Weights

- Various weights can be used, including book value, market values, historic values, or target values. Book value weights rely on accounting values to determine the proportion of each type of capital in the firm's structure. On the other hand, market value weights assess the proportion of each type of financing based on its market value. Market value weights are typically preferred as they provide a closer approximation of the current value of the various financial instruments employed by the company.

- Historical weights, whether based on book or market values from actual data, reflect the real proportions of various types of capital in the capital structure rather than the desired proportions. Conversely, target weights, also based on either book or market values, represent the desired proportions of the capital structure. If the firm's historical capital structure closely resembles the optimal or desired structure, the cost of capital will be similar in both cases. However, from a purely theoretical standpoint, the target market value weighting scheme should be favored.

- Marginal weights are determined by the financing mix for additional new capital required for investments. This new capital is considered marginal capital, and the proportions of new capital raised will serve as the marginal weights.

Calculating The Weighted Cost of Capital : A Few Examples

In this subsections, two problems are solved :

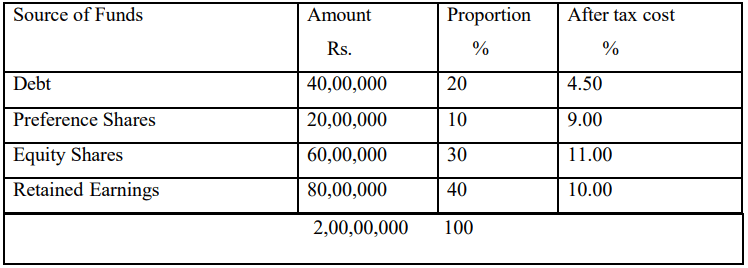

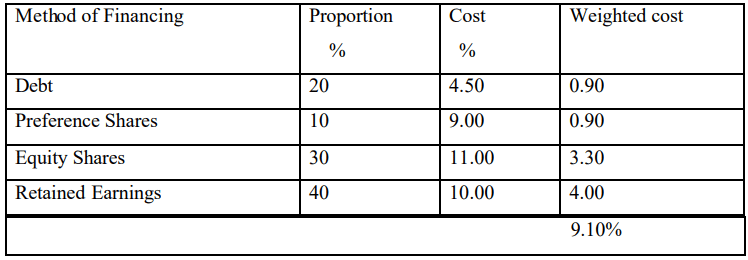

Illustration: A firm has the following capital structure and after tax costs for the different sources of funds used :

Calculate cost of weighted capital by using book value method.

Solution:

Misconceptions Regarding Cost of Capital

Misconceptions Regarding Cost of Capital

The cost of capital serves as a pivotal concept in financial management, connecting investment and financing decisions. Several misconceptions about this concept include the following:

- The notion of cost of capital is considered purely academic and impractical.

- It is believed to be equivalent to the dividend rate.

- Retained earnings are perceived as either free of cost or significantly less costly than external equity.

- Depreciation is assumed to have no associated cost.

- The cost of capital is thought to be definable in terms of an accounting-based approach.

- If a project relies heavily on debt financing, its weighted average cost of capital is presumed to be low.

Conclusion

- The cost of capital represents the minimum rate of return deemed acceptable for new investments. Key factors influencing a firm's cost of capital include its risk profile, tax obligations, and the dynamics of financing supply and demand. It signifies the threshold rate of return necessary for a firm to maintain or increase its equity share market value.

- In assessing the cost of capital, it is assumed that asset acquisitions do not alter business risk and that financial risk remains constant. Estimating the cost of capital entails determining the expected rates of return on the firm's securities, including debt and equity, and averaging these rates based on the securities' market values.

- While calculating the cost of debt and preference capital involves the contractual interest or dividend rate (adjusted for taxes), estimating the cost of equity capital is more challenging. Generally, six approaches are used to estimate the cost of equity: the E/P method, E/P + Growth method, D/P method, D/P + Growth method, Realised Yield method, and employing the share's Beta coefficient. The weighted cost of capital is computed by assigning either book or market weights.

|

196 videos|219 docs

|

FAQs on Cost of Capital - Commerce & Accountancy Optional Notes for UPSC

| 1. What is the cost of capital for individual components? |  |

| 2. How is the weighted cost of capital calculated? |  |

| 3. Why is it important to compute the cost of capital for a business? |  |

| 4. Can the cost of capital change over time? |  |

| 5. How does the cost of capital impact a company's overall financial performance? |  |