Financing Decisions | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Features of Capital Structure |

|

| Determinants of Capital Structure |

|

| Optimal Capital Structure |

|

| Theories on Capital structure |

|

| Conclusion |

|

Introduction

- A company requires funds to meet both its short-term and long-term financial needs. These funds are obtained from various sources, including short-term and long-term sources, in different forms. Long-term funding options typically include equity shares, preference shares, retained earnings, debentures, and bonds. The combination of these long-term funding sources utilized by a company is termed its capital structure. In this module, we will explore the concept of capital structure, the factors influencing it, and the theories that elucidate its relationship with the cost of capital and, consequently, the firm's value.

- As per Gerestenberg, "Capital structure denotes the composition or configuration of a company's capitalization, encompassing all its long-term funding sources such as loans, bonds, shares, and reserves." Thus, the capital structure encompasses both debt and equity securities and represents the permanent financing arrangement of a company.

Financial Structure

While some authors may use "capital structure" and "financial structure" interchangeably, these are distinct concepts. Financial structure pertains to how a firm's total assets are funded, encompassing the entire liabilities side of the balance sheet. On the other hand, capital structure specifically refers to long-term sources of funds and excludes short-term liabilities. Therefore, financial structure is a broader concept, while capital structure is a subset of it.

Features of Capital Structure

It is the responsibility of the financial manager to devise a capital structure that best serves the company's interests. The capital structure must be meticulously planned, taking into account the interests of equity shareholders, who are the ultimate owners of the company. Designing an optimal capital structure is a challenging task but should ideally exhibit the following characteristics:

- Profitability: The capital structure should maximize earnings per share while minimizing financing costs, ensuring maximum advantage to shareholders.

- Solvency: Excessive reliance on debt can jeopardize the solvency of the company. Therefore, debt capital should be utilized within manageable limits to mitigate financial risk.

- Flexibility: The capital structure should be adaptable to changing business conditions, enabling the company to procure funds when necessary for financing profitable ventures.

- Conservatism: The capital structure should be conservative, ensuring that the debt component does not exceed the firm's capacity to meet interest obligations and repay principal amounts.

- Control: The capital structure should minimize the loss of control by existing shareholders, allowing them to retain significant influence over the company's affairs.

These features collectively define an optimal capital structure, with their relative importance varying among companies based on their specific circumstances and priorities. While one company may prioritize flexibility over conservatism, another may prioritize solvency over profitability. Nonetheless, an adaptable capital structure is crucial for a company's success.

Determinants of Capital Structure

The capital structure of a firm is influenced by various factors, with the significance of individual factors evolving over time. The following factors should be taken into consideration when determining a firm's capital structure:

Trading on Equity and EBIT-EPS Analysis:

- Trading on equity, also known as financial leverage, involves utilizing long-term debt and preference share capital alongside equity share capital. This strategy can boost earnings per share (EPS) if the return on investment (ROI) exceeds the cost of debt. Debt is particularly effective in leveraging due to its lower cost compared to other capital sources and the tax-deductible nature of interest payments.

- Financial leverage plays a crucial role in capital structure planning, especially for companies with high Earnings Before Interest and Taxes (EBIT). EBIT-EPS analysis helps financial managers understand the impact of different financing plans on EPS under varying EBIT scenarios. While financial leverage can enhance EPS under favorable conditions, it also increases financial risk. Therefore, companies should carefully balance debt usage to avoid jeopardizing shareholder value.

Stability and Growth of Sales:

- The stability and growth of sales significantly influence a firm's capital structure. Steady sales ensure predictable earnings, enabling firms to comfortably meet fixed obligations such as interest payments and debt repayment, allowing for higher debt utilization.

- Similarly, the rate of sales growth impacts capital structure decisions. Higher sales growth often permits greater debt financing, whereas firms experiencing volatile or declining sales should exercise caution in employing debt capital.

Cost of Capital:

- The cost of capital is a critical consideration in capital structure design. Equity capital is the most expensive source due to higher risk borne by equity shareholders. In contrast, debt capital is relatively cheaper, benefitting from tax-deductible interest payments.

- Preference share capital falls between equity and debt in terms of cost. Since the overall cost of capital encompasses all specific costs, capital structure optimization aims to minimize the aggregate cost of capital.

Cash Flow Ability

- A firm's capacity to generate stable and substantial cash inflows determines its ability to utilize debt capital. Reliable cash flow is essential for meeting fixed obligations, such as interest and principal payments.

- Before raising additional funds, firms must assess future cash inflows to ensure coverage of fixed charges. Therefore, analyzing fixed charge coverage and interest coverage ratios is crucial for prudent debt management.

Control:

- Capital structure decisions are often influenced by management's desire to retain control over the firm. To avoid diluting existing shareholders' control, firms may prefer raising funds through debt or preference share capital, as these securities do not carry voting rights.

- While debt financing preserves control, excessive reliance on debt can lead to financial distress and potential liquidation.

Flexibility:

- Flexibility in capital structure allows firms to adapt to changing conditions and optimize fund utilization. Instruments like preference shares and debentures offer high flexibility as they can be redeemed at the firm's discretion.

- A flexible capital structure enables firms to raise additional funds promptly and cost-effectively as needed.

Size of the Firm:

- The size of the firm influences its ability to access long-term debt. Small firms may struggle to secure favorable debt terms, leading to reliance on equity and retained earnings for funding.

- Consequently, small firms may experience growth limitations if unable to access debt financing.

Marketability and Timing:

- Market conditions play a vital role in determining the optimal capital structure. Firms must assess market conditions to decide between equity and debt financing.

- During market downturns, debt issuance may be preferred, whereas buoyant market conditions may favor equity issuance. Additionally, a firm's leverage levels can impact marketability, with highly leveraged firms facing challenges in raising additional debt.

Floatation Costs:

- Floatation costs, incurred during external fundraising, are another factor influencing capital structure decisions. Although relatively minor, these costs vary between debt and equity issuance, with debt typically incurring lower floatation costs.

- Larger issues can result in proportionally lower floatation costs, prompting firms to consider the size of the offering when determining the most cost-effective financing option.

Purpose of Funds:

- The intended use of funds also guides capital structure decisions. Productive investments may warrant debt financing, as interest payments can be covered by investment returns.

- In contrast, unproductive uses of funds may favor equity financing to avoid the burden of fixed interest payments.

Legal Restrictions:

- Government regulations regarding share and debenture issuance must be adhered to when structuring capital.

- Legal constraints provide a framework for capital structure decisions, ensuring compliance with regulatory requirements.

Optimal Capital Structure

Given the myriad factors influencing capital structure planning, financial managers strive to achieve an optimum capital structure. This structure maximizes firm value or minimizes the cost of capital. Ezra Solomon defines the optimum capital structure as the level of financial leverage at which the firm's market value is maximized or the cost of capital is minimized.

Theories on Capital structure

The concept of an optimal capital structure is a matter of debate among financial experts, with contrasting views regarding its existence. One school of thought argues that capital structure significantly impacts firm value and cost of capital, suggesting the presence of an optimal structure. Conversely, another school contends that capital structure is irrelevant and does not influence firm value or cost of capital. These differing perspectives have led to the development of various theories on capital structure within the field of business finance, with notable contributions from scholars such as David Durand, Ezra Solomon, and Modigliani and Miller. The following theories are key in understanding the relationship between capital structure and firm value or cost of capital:

- Net Income Approach

- Net Operating Income Approach

- Traditional View

- Modigliani and Miller Hypothesis

To elucidate these theories and their implications for capital structure, several assumptions are made:

- Firms utilize only debt and equity capital.

- Total assets of the firm are fixed.

- Total financing remains constant, allowing for changes in leverage through debt issuance or share repurchases.

- The firm maintains a 100% payout ratio, distributing all earnings as dividends.

- Operating earnings (EBIT) do not grow over time.

- Business risk remains constant regardless of capital structure.

- Investors share the same probability distribution of expected future earnings.

- Corporate and personal taxes are absent initially, with later relaxation of this assumption.

The following definitions are essential for understanding the theories:

- S = Market value of equity shares

- D = Market value of debt

- V = S + D = Market value of the firm

- NOI = X - Expected net operating income (EBIT), i.e., earnings before interest and taxes

- NI = NOI - Interest = Net Income or shareholders' earnings

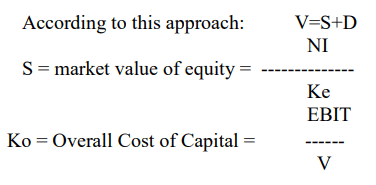

Net Income Approach:

The net income approach, pioneered by David Durand, asserts that capital structure is relevant, and a firm can enhance its value and reduce its cost of capital by incorporating debt into its structure. According to this theory, increasing debt capital leads to lower overall cost of capital and higher firm value.

This theory operates under the following assumptions:

- Cost of debt is lower than cost of equity.

- Investors' risk perceptions remain unchanged by debt usage, resulting in constant equity and debt capitalization rates (ke and kd) regardless of leverage.

- Absence of corporate taxes.

Under these assumptions, the cost of debt is cheaper than equity, and both remain constant irrespective of leverage levels. Consequently, increasing debt capital, due to its relative cost advantage, lowers overall cost of capital and increases firm value.

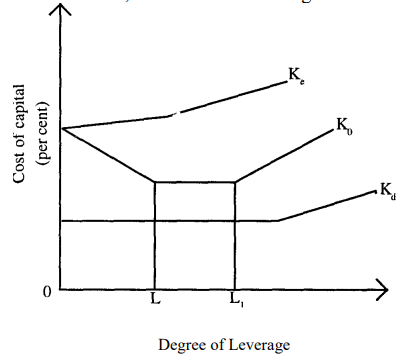

Figure: NI Approach

It is apparent from Figure that when the degree of leverage is zero (i.e., no debt capital is employed), the overall cost of capital equals the cost of equity (ko = ke). As debt capital is gradually introduced, which is relatively cheaper compared to equity, the overall cost of capital decreases, eventually equating to the cost of debt (kd) when leverage reaches one (i.e., the firm is fully debt-financed). Therefore, according to this perspective, the firm achieves its optimal capital structure when leverage is at one.

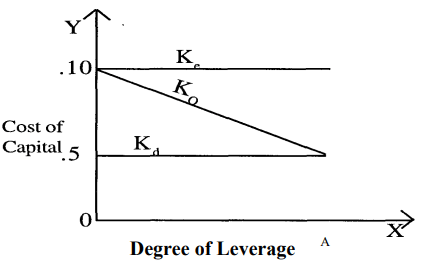

Net Operating Income Approach:

The net operating income (NOI) approach, also proposed by David Durand, represents another extreme view on the relationship between capital structure and firm value. According to this approach, the firm's capital structure has no impact on its cost of capital or value.

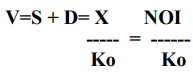

The firm's value (V) is determined as follows:

Ko represents the comprehensive cost of capital and is contingent upon the business risk of the firm, which remains unaffected by the capital structure.

The following are the pivotal assumptions of this theory:

- The market values the firm holistically, disregarding the division between debt and equity.

- Business risk remains constant regardless of the debt-equity mix.

- Corporate taxes are absent.

- The debt capitalization rate (Kd) remains steady.

According to this perspective, the utilization of less expensive debt amplifies the risk to equity shareholders, prompting an increase in the equity capitalization rate (Ke). Consequently, the cost advantage of debt is entirely counterbalanced by the elevation in the equity capitalization rate. Consequently, the overall capitalization rate (Ko) remains unchanged, and correspondingly, the firm's value remains constant.

The figure illustrates that Ko and Kd remain constant, while Ke steadily increases with leverage. The escalating cost of equity (Ke) precisely counterbalances the benefit of low-cost debt, resulting in a consistent overall cost of capital (Ko) at every level of leverage. This suggests that every capital structure is optimal, and there is no singular optimum capital structure.

Traditional View

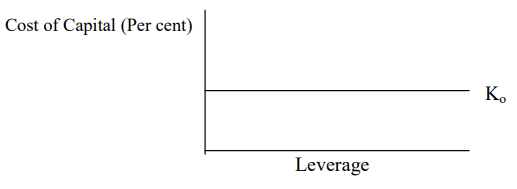

The Traditional approach, also termed the intermediate approach, advocated by Ezra Solomon, strikes a balance between the extremes of the net income approach and net operating income approach. According to this perspective, the cost of capital can be minimized, or the firm's value can be enhanced, through a balanced blend of debt and equity. This theory posits that the cost of capital decreases with a moderate increase in debt capital, but beyond a certain threshold, further increments in debt capital lead to an increase in the cost of capital. Hence, the traditional theory delineates three stages in the relationship between capital structure and firm value, elucidated as follows:

First Stage: Increasing Value

In this initial stage, the cost of equity (Ke) and the cost of debt (Kd) remain constant, with the cost of debt being lower than the cost of equity. Utilizing debt capital up to a reasonable extent results in a decline in the overall cost of capital due to the cost advantage of debt. Consequently, Ko diminishes with increasing leverage, thereby augmenting the total value of the firm, V.

Second Stage: Optimal Value

Once the firm attains a certain level of leverage, further increases in debt do not impact the firm's value or the cost of capital. This is because the heightened debt capital escalates the risk for equity shareholders, leading to a corresponding rise in Ke. This increase in Ke precisely offsets the advantage of low-cost debt capital, maintaining a constant overall cost of capital (Ko), thereby maximizing the firm's value.

Third Stage: Declining Value

- When a firm exceeds an acceptable level of debt capital, it escalates the risk for both equity shareholders and debt-holders. Consequently, both the cost of equity (Ke) and the cost of debt (Kd) begin to rise in this stage, leading to an increase in the overall cost of capital (Ko).

- From the preceding discussion, it can be deduced that the cost of capital (Ko) is contingent upon leverage. As debt capital increases up to a certain threshold, the cost of capital decreases and the firm's value rises. However, beyond this threshold, the overall cost of capital (Ko) tends to increase, resulting in a decline in the firm's value, as illustrated in Figure.

The figure illustrates that the overall cost of capital experiences a decline as leverage increases up to point L, but it begins to rise beyond point L1. Therefore, the optimal capital structure is situated between points L and L1.

Critique of the Traditional View:

The traditional perspective on capital structure suggests that investors assign a higher value to leveraged firms compared to unleveraged ones, implying they are willing to pay a premium for shares of leveraged firms. However, this assumption lacks sufficient justification as it assumes investors perceive the risk of leverage differently at various levels of leverage.

Modigliani-Miller (MM) Hypothesis:

Contrary to the traditional view, the Modigliani-Miller (MM) hypothesis challenges this notion. Modigliani and Miller contended that, in the absence of taxes and transaction costs, changes in capital structure do not impact the cost of capital or the firm's value. Essentially, they argue that capital structure decisions are inconsequential, and the firm's value remains unaffected by the debt-equity mix. The MM hypothesis is best understood through their two propositions.

Assumptions of the M&M Hypothesis:

M&M's Proposition I is predicated on certain assumptions pertaining to investor behavior, capital market conditions, and tax regulations within the country. These assumptions include:

- The existence of a perfect capital market, wherein:

- Investors have unrestricted access to buying and selling securities.

- Borrowing funds is unrestricted and offered at the same terms as those available to firms.

- Investors behave rationally and make decisions based on available information.

- Investors are well-informed about market conditions and investment opportunities.

- Transaction costs are nonexistent.

- Firms can be categorized into homogeneous risk classes, meaning firms within the same risk class exhibit identical levels of financial risk.

- All investors hold the same expectations regarding a firm's net operating income (EBIT).

- The dividend payout ratio is 100%, indicating that there are no retained earnings.

- Absence of corporate taxes. This assumption is later revised.

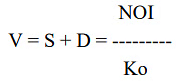

Proposition I: According to M&M, the overall cost of capital (Ko) and the firm's value are unaffected by the capital structure. The total market value of the firm is determined by capitalizing the expected net operating income at a rate appropriate for the corresponding risk class. Under M&M's Proposition I, firms within the same risk class have market values independent of their capital structures. The total market value is derived by capitalizing the net operating income at a rate suitable for that specific risk class.

Where, V = the market value of the firm

- S = the market value of equity

- D = the market value of debt

- x = the expected net operating income (EBIT)

- K = the capitalization rate appropriate to the risk class of the firm.

According to the proposition I, the average cost of capital (Ko) is not affected by the degree of leverage and is determined as:

- Ko = X/V

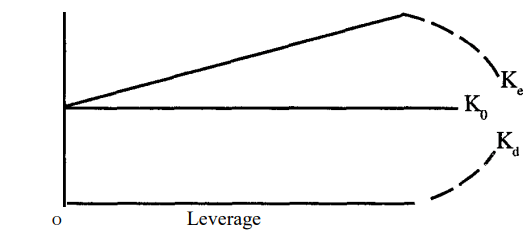

According to M-M, the average cost of capital is constant as shown in the following Figure: 7.4

Figure: Average Cost of capital

Arbitrage Mechanism:

- According to M-M theory, Proposition I is grounded in the straightforward principle that two firms identical in all respects except their capital structures cannot possess different market values or distinct costs of capital. If such discrepancies were to arise, arbitrage would swiftly rectify the imbalance, restoring equilibrium in market values. The arbitrage process involves investors shifting their investments from one firm to another when disparities in market values exist, aiming to exploit the difference by selling securities in the higher-priced market and purchasing those in the lower-priced market. This utilization of debt by investors is termed personal leverage or homemade leverage. Through this arbitrage mechanism, the market price of securities in the higher-valued market decreases, while that in the lower-valued market rises, persisting until equilibrium is attained in the market values of both firms. Thus, M-M argue that identical firms cannot have differing market values.

- This arbitrage process operates in reverse as well. Leverage offers neither advantage nor disadvantage. If an unlevered firm possesses a higher market value than a levered firm, investors will seek to reallocate their investments from the unlevered firm to the levered one, swiftly restoring equilibrium.

- Consequently, M-M, through Proposition I, demonstrate that a firm's value remains unaffected by the debt-equity mix in its capital structure.

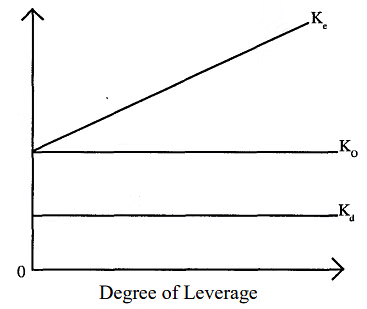

Proposition II: With Proposition II, M-M assert that the introduction of more debt into the capital structure heightens financial risk. Consequently, the cost of equity (Ke) increases proportionally to offset precisely the cost advantage of debt, thus maintaining the overall cost of capital (Ko) unchanged.

M-M's proposition II defines cost of equity as for any firm in a given risk class, it is equal to the constant average cost of capital (Ko) plus a premium for the financial risk, which is equal to debt - equity ratio times the spread between average cost and cost of debt. Thus, cost of equity is explained as:

- Ke = Ko + (Ko - Kd)D/S

- Where, Ke = cost of equity

- D/S = debt - equity ratio

M-M argue that Ko will not increase with the increase in the leverage, because the low - cost advantage of debt capital will be exactly offset by the increase in the cost of equity as caused by the increased risk to equity shareholders. The crucial part of the M-M hypotheses is that an excessive use of leverage will increase the risk to the debt holders which results in an increase in cost of debt (Kd). However, this will not lead to a rise in Ko. At this context, the M and M advocates that Ke will increase at a decreasing rate or even it may decline. This is because of the reason that at an increased leverage, the increased risk will be shared by the debt holders and hence, the Ke remains constant. This is illustrated in the Figure 7.5 given below:

Cost of capital (per cent)

Critique of M & M Hypothesis

The M & M Hypothesis relies on the arbitrage process as its fundamental behavioral and operational framework, but it encounters several limitations that hinder the attainment of equilibrium:

- Discrepancies in Interest Rates: Interest rates differ between individuals and firms. Firms typically enjoy a higher credit standing, enabling them to borrow funds at lower interest rates compared to individuals.

- Inadequate Substitution of Leverage: Home-made leverage is not a perfect substitute for corporate leverage. When a firm borrows, shareholders' risk is limited to their shareholding, whereas personal borrowing extends liability to personal assets. Therefore, the assumption that home-made leverage perfectly mirrors corporate leverage is flawed.

- Unrealistic Absence of Transaction Costs: The hypothesis assumes the absence of transaction costs, which is impractical as such costs are invariably incurred in securities transactions.

- Institutional Restrictions: Institutional investors are typically prohibited from engaging in home-made leverage, impacting the functioning of arbitrage.

- Impact of Corporate Taxes: A major limitation arises from the presence of corporate taxes, which are tax-deductible. Consequently, levered firms benefit from a lower cost of debt due to tax advantages when taxes are applicable.

Corporate Taxes in M-M Hypothesis:

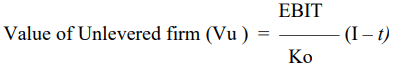

Modigliani and Miller subsequently acknowledged the significance of corporate taxes. They conceded that the value of a firm would increase or the cost of capital would decrease with the incorporation of debt capital in the capital structure, owing to the tax deductibility of interest charges. Thus, optimizing the capital structure involves augmenting the debt component. According to this perspective, the valuation of a firm can be determined as follows: Value of Levered firm (VL) = Vu + Dt

Value of Levered firm (VL) = Vu + Dt

Where, EBIT = Earnings Before Interest and Taxes

Ko = Overall cost of capital

D represents the value of debt capital, while t denotes the tax rate.

Conclusion

- The capital structure decision of a firm involves selecting the optimal mix of debt and equity to maximize firm value or minimize the overall cost of capital. Designing an effective capital structure is a complex task influenced by various factors such as EBIT-EPS analysis, sales growth and stability, cost of capital, cash flow capabilities, and flexibility.

- There is no unanimous consensus regarding the existence of an optimum capital structure, leading to the development of multiple theories. The Net Income approach and traditional view assert that capital structure impacts firm value and cost of capital, implying the existence of an optimal structure. Conversely, the Net Operating Income approach and M&M Hypothesis argue that capital structure is irrelevant to firm value and cost of capital.

- Modigliani and Miller initially supported the notion of capital structure irrelevance, using the arbitrage process to justify their argument under specific assumptions. However, they later acknowledged the significance of corporate taxes, recognizing that capital structure indeed influences the firm value and cost of capital.

|

196 videos|219 docs

|