UPSC Exam > UPSC Notes > Commerce & Accountancy Optional Notes for UPSC > Tax Audit

Tax Audit | Commerce & Accountancy Optional Notes for UPSC PDF Download

Introduction

- The primary objective of the tax audit is to calculate the taxable income in accordance with the law and to ensure transparency in the financial statements submitted by taxpayers to the Income-tax department.

- The tax audit under section 44AB of the Income-tax Act 1961 is an important area of practice for Chartered Accountants. Since the inception of the tax audit, we have been entrusted with the responsibility to fulfill the duties as tax auditors to ensure proper compliance with tax laws by taxpayers.

The Institute of Chartered Accountants of India has defined auditing as follows:

- "A systematic and independent examination of data, statements, records, operations, and performances (financial or otherwise) of an enterprise for a stated purpose. In any auditing situation, the auditor perceives and recognizes the propositions before him for examination, collects evidence, evaluates the same, and on this basis formulates his judgment which is communicated through his audit report."

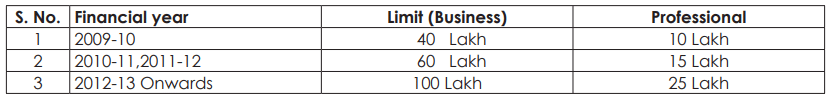

- Under the current provisions of section 44AB, every person engaged in business is required to have their accounts audited if the total sales, turnover, or gross receipts in the previous year exceed sixty lakh rupees. Similarly, a person engaged in a profession is required to have their accounts audited if the total sales, turnover, or gross receipts in the previous year exceed fifteen lakh rupees.

In order to reduce the compliance burden on small businesses and professionals, it is proposed to increase the threshold limit for:

- Total sales, turnover, or gross receipts specified under section 44AB for getting accounts audited, from sixty lakh rupees to one crore rupees for persons engaged in business, and

- from fifteen lakh rupees to twenty-five lakh rupees for persons engaged in a profession.

- It is also proposed that for the purposes of presumptive taxation under section 44AD, the threshold limit of total turnover or gross receipts would be increased from sixty lakh rupees to one crore rupees.

- The year-wise limit for section 44AB tax audit from the financial year 2009-10 onwards is provided below. Two years ago, the limit was extended by 50%.

These amendments will take effect from 1st April, 2013 and will, accordingly, apply to the assessment year 2013-14 and subsequent assessment years.

Question for Tax AuditTry yourself: What is the primary objective of a tax audit?View Solution

The document Tax Audit | Commerce & Accountancy Optional Notes for UPSC is a part of the UPSC Course Commerce & Accountancy Optional Notes for UPSC.

All you need of UPSC at this link: UPSC

|

196 videos|219 docs

|

FAQs on Tax Audit - Commerce & Accountancy Optional Notes for UPSC

| 1. What is a tax audit and why is it conducted? |  |

Ans. A tax audit is an examination of a taxpayer's financial information to ensure that their tax returns are accurate. It is conducted by the tax authorities to verify the taxpayer's compliance with tax laws and to detect any discrepancies or errors in their tax filings.

| 2. Who can be subjected to a tax audit by the UPSC? |  |

Ans. Any individual or entity that is required to file taxes can be subjected to a tax audit by the UPSC. This includes individuals, businesses, and organizations that are liable to pay taxes as per the Income Tax Act.

| 3. What are the different types of tax audits conducted by the UPSC? |  |

Ans. The UPSC conducts three main types of tax audits: (1) Regular audit under section 44AB of the Income Tax Act, (2) Transfer pricing audit under section 92E, and (3) Special audit under section 142(2A) of the Income Tax Act.

| 4. How can a taxpayer prepare for a tax audit conducted by the UPSC? |  |

Ans. To prepare for a tax audit conducted by the UPSC, a taxpayer should maintain accurate financial records, ensure timely filing of tax returns, keep all supporting documents handy, and seek professional help if needed to ensure compliance with tax laws.

| 5. What are the consequences of failing to comply with a tax audit conducted by the UPSC? |  |

Ans. Failing to comply with a tax audit conducted by the UPSC can result in penalties, fines, and even legal action. It is important for taxpayers to cooperate with the tax authorities during the audit process to avoid any adverse consequences.

Related Searches