Income from House Property | Commerce & Accountancy Optional Notes for UPSC PDF Download

Income From House Property

Under Section 22 of the Income Tax Act, 1961, an individual is liable to pay tax on the annual value of a property if it meets the following criteria:

- It comprises any buildings or lands connected to them;

- It is owned by the individual; and

- It is not utilized for the individual's business or profession.

Buildings or Lands Connected to Them

- The term "house property" refers to buildings or land connected to them, and the income from such house property is taxed under the category of "income from house property." The term "building" is not explicitly defined in the Income Tax Act, 1961. However, it has been defined in various court cases. Generally, it refers to a structure enclosed by walls, even if they are made of mud. The presence of a roof is not essential for something to be considered a building. For instance, a stadium, open-air swimming pool, or dance hall is considered a building. However, a residential house without a roof and doors cannot be considered a building.

- Land attached to a building includes various areas, such as the way to the house, courtyard, gallery, kitchen garden, playground, garage, and an area for keeping animals. Temporary huts on vacant land are not considered buildings, and any income from such huts is taxed under "income from other sources." Land not attached to any building is not considered house property for tax purposes. Thus, rental income from vacant land not attached to a building is not taxed under "income from house property." Additionally, the location of the building is irrelevant. It can be located in India or abroad. Tax on foreign buildings is only applicable to residents, meaning income from such buildings is not taxed for non-ordinary residents and non-residents.

However, there are exceptions.

- Buildings or staff quarters rented out to employees and others: If the assessee rents out a building or staff quarters to employees of a business where their residence is necessary for the efficient conduct of business, the rental income from these employees is not taxable as income from house property. Instead, it is taxable under profit and gains from the business or profession.

- Building rented out for banks, post offices, police stations, etc.: If a building is rented out to authorities for locating banks, post offices, police stations, central excise offices, etc., and the primary purpose of renting out the building is to enable the assessee to conduct their business more efficiently and smoothly, the income from such renting is considered income from business.

- Composite rental of building with other assets: When the assessee rents out machinery, plant, or furniture along with buildings for a composite rent, and the rent of the buildings is inseparable from the rent of the machinery, plant, or furniture, the income from such renting is chargeable to income tax under the head "Income from Other Sources" or under the head "Business or Profession" if it is a part of their business.

- Paying-guest accommodation: This type of accommodation is considered business income (Mannohar Singh Vs. CIT (1965) 58 ITR 592).

Assessee to Pay Tax on Annual Value

Another important point about income from house property is that the tax is based on the annual value, not the rental value. The annual value is calculated by deducting certain expenses from the rental value, reasonable rent, or municipal rent.

Assessee Should be the Owner of the House Property

Only the owner of the house property is liable to pay tax under the head "Income from house property." Ownership refers to legal ownership, not beneficial ownership. It is not necessary for the owner of a house to also be the owner of the land on which the house is built. In case of a dispute about property ownership, the person receiving rent or the person in possession of the property will be considered the owner of the house. Any income derived from subletting the property is taxable under the head "Income from other sources" and not "Income from house property." It should be noted that even if the owner is in the business of renting out house property, the income will be taxed under Section 22 as income from house property and not under Section 28 as business income.

Deemed Owner: According to Section 27 of the Income Tax Act, 1961, the following persons are treated as deemed owners of the house property:

- An individual who transfers any house property to their spouse, without adequate consideration or not as part of an agreement to live apart, or to a minor child who is not a married daughter, is considered the owner of the house property transferred [Section 27(i)].

- The holder of an impartible estate is considered the owner of the house property for all properties of the estate [Section 27(ii)].

- A member of a cooperative society, to whom a building or part of a building is allotted or leased under the society's house building scheme, is considered the deemed owner of that property [Section 27(iii)].

- A person who is allowed to take or retain possession of a building or part of a building in part performance of a contract referred to in the Transfer of Property Act is considered the owner of that building or part [Section 27(iii)(a)].

- A person who acquires any rights (excluding a lease from month to month or for a period not exceeding one year under Section 269 UA(f)) in or with respect to any building or part of a building is considered the owner of that building or part [Section 27(iii)(b)].

- A person who takes land on lease and constructs a house on it.

The House Property Should Not Be Used for Assessee's Business or Profession

If a property or part of the property is used by the assessee for their business or profession, and the income from such business or profession is taxable, the annual value of the property or part of the property will not be taxed under Section 22 (Income from house property).

Exempted Incomes From House Property

- A building situated in the immediate vicinity of agricultural land and occupied by the cultivator as a dwelling house or a storehouse is treated as agricultural income and is fully exempt from tax.

- The annual value of any one palace in the occupation of an Ex-Indian Ruler.

- House properties belonging to a local authority, scientific research association, University, other recognized educational institutions, hospitals, Games or Sports Associations, and Registered Trade Unions.

- Property belonging to an authority constituted under any law for the purpose of marketing commodities and used for letting of godowns or warehouses for the storage of commodities.

- House property held by a trust established wholly for charitable purposes.

- House property held by a political party.

- House property owned by an assessee and used for his own business or professional purposes.

- Self-occupied houses - The Finance Act, 1986, W.e.f. 1.4.1987, provides that where the property consists of one house or part of a house in the occupation of the owner for his own residence and is not actually let out during any part of the previous year, the annual value of such a house shall be taken to be nil.

Some Important Points

- Income from house property situated abroad: Income from any house property situated abroad is taxable only in the case of residents. Not ordinary residents and non-residents pay tax on such property only when it is received in India. A resident will pay tax on foreign property as if such property is situated in India.

- Disputed Ownership: If the title of ownership is disputed in a court of law, the decision as to who is the owner rests with the income tax department. Generally, the recipient of rental income or the person who is in possession of the property is treated as the owner.

- Composite Rent: If a building is let out to a person along with other facilities (e.g., Electricity, Gas, Air conditioning, water, Lift, Watch and Ward, etc.) for a composite rent and if the rent of the building can be separated from the rent of such facilities, rent belonging to the building only will be taxed under the head ‘House Property’ and that which belongs to other facilities will be taxed under the head ‘Income from Other Sources’. If the composite rent cannot be split up, it will not be taxed under the head ‘House Property’, but under the head ‘Other Sources.’

- Property owned by Co-owners (Section 26): Where a property is owned by two or more persons jointly and their respective shares are definite and ascertainable, income from such property shall not be assessed on such persons as an association of persons, but the share of each person will be calculated and added to their respective total income.

- Income from sub-letting: This is chargeable under the head “other sources” as the person sub-letting is not the owner of the property.

Annual Value

As previously mentioned, the owner of the property is required to pay tax on the annual value of the house. Therefore, it is crucial to calculate the annual value of the property accurately. According to Section 23(1)(a) of the Income Tax Act, 1961, the annual value of a house property shall be:

- The amount for which the property could reasonably be expected to be let out from year to year; or

- In cases where the property is let out and the actual rent received or receivable by the owner exceeds the reasonable rent, the actual amount of rent received or receivable.

It should be noted that any taxes imposed by local authorities and borne by the owner should be deducted when calculating the annual value of the property. The definition above clarifies that the annual value of any house property is its reasonable rent. However, if the actual rent is higher than the reasonable rent, then the actual rent received or receivable will be considered the annual value. It is important to understand that the annual value is not solely determined by the actual or reasonable rent. If the rent of a house property is fixed by a rent controller under the Rent Control Act, the annual value in such a case cannot exceed the rent fixed by the rent controller. If the actual rent exceeds the rent fixed by the rent controller, then the actual rent would be considered the annual value.

From the discussion above, it is evident that the annual value is determined by taking into account various factors, including:

- Municipal valuation, which is fixed by local authorities based on the income-earning capacity of the property. This valuation is used to calculate the house tax to be paid by the owners.

- Actual rent received or receivable from the tenant.

- Reasonable rent/Fair rent, which is the rent of similar properties in the same locality.

- Standard rent, which is the rent fixed by the Rent Controller under the Rent Control Act. When the standard rent is applicable, reasonable rent and municipal value will not be taken into consideration, even if they are higher than the standard rent.

Computation of Annual Value

When an individual owns a house, they may use it for their own residence or lease it out for rent. The annual value of a house property can vary depending on whether it is rented out or used by the owner for residential purposes. For computation purposes, house properties are divided into two main categories:

- House Property Let Out

- House Property Occupied by the Owner for Residential Purposes

Let's discuss each of these categories in detail:

House Property Let Out

A house that is rented out is further categorized as follows:

- Not Covered by Rent Control Act

- Covered by Rent Control Act

- Let-Out House Vacant for Whole or Part of Previous Year

- Let-Out House with Unrealized Rent

- Let-Out House Vacant for Part of Previous Year with Unrealized Rent

Calculation of Annual Value Not Covered by Rent Control Act

- The Gross Annual Value is determined by the actual rental income, the expected rental income, or the municipal valuation, whichever is the highest.

- Any municipal taxes paid by the owner are deducted from the Gross Annual Value to arrive at the Net Annual Value.

- Municipal taxes are deducted in the year they are paid, regardless of the financial year to which they belong.

Please refer to Illustration 1 for an example of how the annual value of a let-out house not covered by the Rent Control Act is calculated.

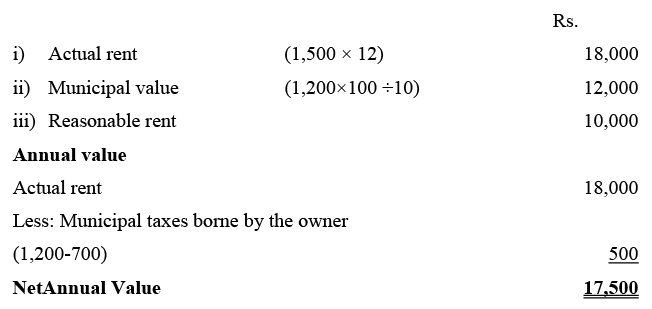

Illustration 1: Mr. Ashok is the owner of a house (not covered under Rent Control Act) which is let out at Rs. 1,500 per month. Municipal taxes of the house are Rs. 1,200 (being 10% of the municipal value) out of which Rs. 700 are paid by the tenant. The reasonable rent is Rs. 10,000 per annum. What will be annual value of the house?

Solution: Annual value is the highest of the following three taxes borne by the owner:

b) Which is covered by the Rental Control Act

In this case, standard rent is fixed by the Rent Controller. The annual value will be the actual rent received or standard rent, whichever is higher. It will be gross annual value. From the gross annual value, any municipal taxes or tax levied by any local authority paid by the owner will be deducted and the balance left will be the net annual value. Look at Illustration 2 for calculation of annual value of a let-out house covered under Rent Control Act.

Note: Even if the Municipal value or reasonable rent is higher than standard rent or actual rent, they will not be considered in this case.

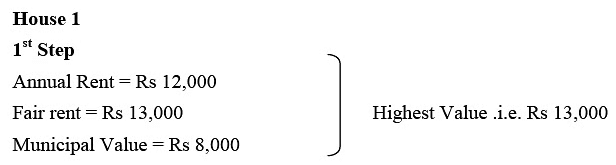

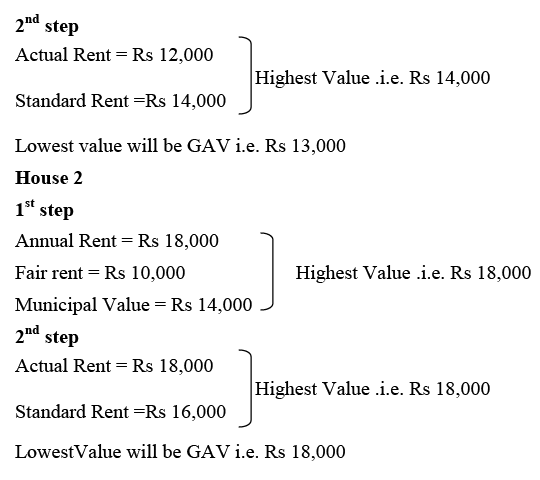

Illustration 2: Mr. X is the owner of two houses (covered under the Rent Control Act) which are let at Rs. 1,000 p.m. and Rs, 1,500 p.m. Municipal taxes on these houses are paid by the owner which amount to Rs. 800 and Rs. 1,000 respectively (being 10% of municipal valuation). The Standard Rents fixed under the Rent Control Act are Rs. 14,000 and Rs. 16,000 per annual respectively. Fair rent of these two houses is Rs. 13,000 and Rs. 14,000 respectively. What will be their Annual Value?

Solution:

Note: In order to arrive at GAV of the house, we should take the highest value of 1st step, and 2nd step which is Rs. 13,000 and Rs. 14,000 in case of 1st house and Rs. 18,000 for 1st and 2nd step for 2nd house. After arriving at highest value of 1st step and 2nd step, we must take lowest value among the two highest values calculated above. Now, this lowest value of highest values will be the GAV of house. Now, afterarriving the GAV of the house if we subtract the municipal tax paid by the land lord we shall arrive at Annual value of house. value.

Deductions From Annual Value

To calculate the income taxable under the "Income from House Property" category, the following deductions are allowed from its annual value as per Section 24:

- Standard Deduction: 30% of the annual value is allowed as a standard deduction for expenses.

- Interest on Loan: Interest on a loan taken for the purpose of purchasing, constructing, repairing, or renovating a house property can be deducted. This deduction is allowed on an accrual basis. Interest on unpaid interest is not allowed as a deduction. However, interest on a new loan taken solely to repay the original loan amount used for the mentioned purposes will be allowed as a deduction. If the landlord has paid any brokerage or commission for raising the loan, it is not allowed as a deduction.

- Interest for Pre-acquisition or Pre-construction Period: Interest payable on funds raised for acquiring or constructing a house property, which pertains to the period before the previous year in which the property was constructed or acquired, is allowed in five equal annual installments. This starts from the previous year in which the house was acquired or constructed. This deduction is in addition to the interest of the current year. The maximum limit for this deduction is Rs. 30,000 if the loan was acquired before March 31, 1999, and Rs. 2,00,000 if the loan was acquired after March 31, 1999. The acquisition or construction should be completed within five years from the end of the financial year in which the funds were raised. To claim this deduction, the assessee must provide a certificate from the person to whom any interest is payable on the raised funds. The maximum limit of Rs. 30,000/2,00,000 is applicable only for self-occupied houses.

Loss Under The Head ‘income From House Property’

When the total of deductions exceeds the adjusted annual value of a house property, the remaining amount is termed as a loss from house property. This loss can take two forms:

- Loss in the case of a self-occupied house: The annual value of a self-occupied house is always zero, and a deduction of interest on a loan up to a maximum amount of Rs. 30,000 is allowed. After deducting this amount, a loss from house property may occur. This loss can be set off against the profits of houses that are rented out.

- Loss from a house let out on rent for the full year: For houses that are rented out, deductions are provided from their net annual value. If the total of deductions (excluding unrealized rent) is greater than the net annual value, the remaining amount is considered a loss from house property. This loss can be set off against the profits of other houses that are rented out. Any unabsorbed loss from house property can be set off against any other source of income.

- If in any previous year, the amount of loss exceeds Rs. 2,00,000, then this surplus cannot be deducted from any other head of income in that previous year.

|

196 videos|219 docs

|

FAQs on Income from House Property - Commerce & Accountancy Optional Notes for UPSC

| 1. What is the concept of 'Income From House Property'? |  |

| 2. What are some examples of Exempted Incomes From House Property? |  |

| 3. How is the Annual Value of a property computed? |  |

| 4. What are some of the deductions that can be claimed from the Annual Value of a property? |  |

| 5. Can a loss be incurred under the head 'Income From House Property'? |  |