Profits and Gains from Business or Profession - 1 | Commerce & Accountancy Optional Notes for UPSC PDF Download

| Table of contents |

|

| Introduction |

|

| Basis of Charge |

|

| General Principles For Calculating Business And Profession Income |

|

| Computation Of Income From Business Or Profession |

|

| Specific Deductions-i |

|

Introduction

- Section 2 (13) of the Income Tax Act defines business to encompass any trade, commerce, manufacture, or any venture or endeavor that resembles trade, commerce, or manufacture. This definition is broad and covers a wide range of activities, including rendering services to others, in addition to activities related to trade, commerce, or manufacture, or activities in the exercise of a profession or vocation. It's important to note that one cannot engage in business transactions with oneself.

- A profession is an occupation that requires a specific intellectual or manual skill based on specialized learning or qualifications. On the other hand, vocation refers to any activity undertaken to earn a livelihood, such as agency work, writing stories or plays, brokerage, magic performances, music, dance, etc.

- Income under the head profits and gains of business or profession includes income from business, profession, and vocation. Therefore, the distinction between these terms is not material for tax purposes.

Basis of Charge

Under Section 28, the following incomes shall be subject to income tax under this head, and income will be computed in accordance with the provisions laid down in Sections 29 to 44DB:

- Profits or gains from any business or profession

- Any compensation or other payments due to or received by any person specified in Section 28 (ii)

- Income derived by a trade, professional, or similar association from specific services performed for its members

- The value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession

- Any profit on the transfer of the Duty Entitlement Pass Book Scheme.

- Any profit on the transfer of the Duty Free Replenishment Certificate.

- Export incentives for exporters

- Any interest, salary, bonus, commission, or remuneration received by a partner from a firm

- Any sum received under a Keyman Insurance Policy, including Bonus

- Any sum received for not carrying out any activity related to any business or profession or not sharing any know-how, patent, copyright, trademark, etc.

- Any sum received or receivable, in cash or kind, on account of any capital asset (other than land or goodwill or financial instrument) being demolished, destroyed, discarded, or transferred, if the whole of the expenditure on such capital asset has been allowed as a deduction under section 35AD.

- Income from speculative transactions.

General Principles For Calculating Business And Profession Income

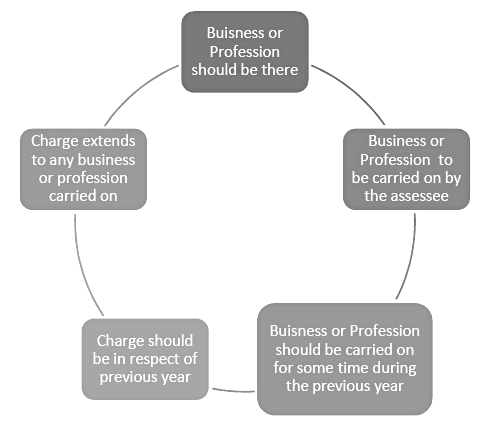

Necessary conditions for income to be chargeable under head ‘Profits and Gains of Business and Profession’:

The operation of a business must be ongoing during the previous year for it to be considered as such. It is not essential for the business to be conducted throughout the entire previous year or until the end of the previous year. If an assessee does not conduct any business at all, Section 28 of the Income Tax Act does not apply, and the income cannot be assessed as business income. However, there are exceptions to this rule, and income from a business, even if it was not conducted by the assessee in the year of receipt, may still be taxable as income from business.

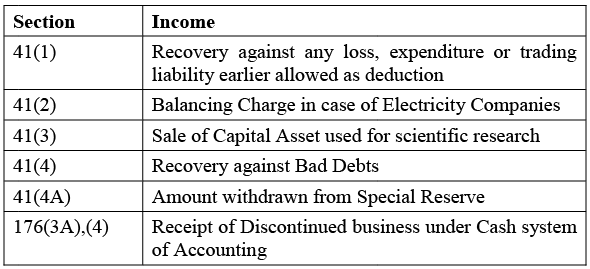

Table: Receipts taxable as income from business even when Business is not carried out by the assessee

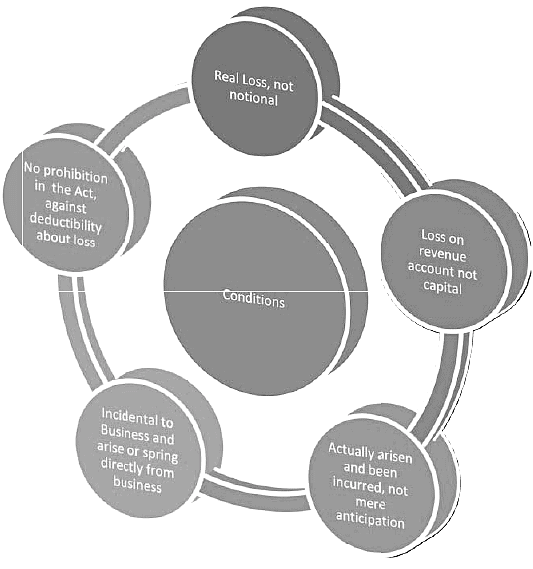

Business Loss: A trading loss is deductible in computing the profit earned by the business if following conditions are satisfied:

Losses incidental to trade are deductible from income, while business losses that are not incidental to trade or profession carried on by the assessee are not deductible from income. Here are examples of both:

Deductible Business Losses:

- Loss of stock-in-trade due to enemy action or arising under similar circumstances

- Loss of stock-in-trade because of destruction by natural disasters

- Loss on account of failure to accept delivery of goods

- Depreciation in funds kept in foreign currency for purchase of stock-in-trade

- Loss due to exchange rate fluctuations of foreign currency

- Loss arising from sale of securities held in the regular course of business

- Loss of cash and securities in a banking company due to robbery

- Loss incurred on realization of amount advanced in connection with business

- Loss of security deposit for the purpose of acquiring stock-in-trade

- Loss due to forfeiture of a deposit made for properly carrying out a contract for supply of commodities

- Loss on account of embezzlement by an employee

- Loss incurred due to theft or burglary in factory premises

- Loss of precious stones or watches of a dealer while bringing them from business premises to his house

- Loss arising from negligence or dishonesty of employees

- Loss incurred on account of insolvency of a banker with which a current account is maintained

- Loss incurred due to freezing of stock-in-trade by enemy action

Non-Deductible Business Losses:

- Loss incurred due to damage, destruction, etc., of capital asset

- Loss incurred due to sale of shares held as investment

- Loss of advances made for setting up a new business that ultimately could not be started

- Depreciation of funds kept in foreign currency for capital purposes

- Loss arising from non-recovery of tax paid by an agent on behalf of a non-resident

- Anticipated future losses

- Provision made by the assessee in respect of non-performing assets

- Loss relating to any business or profession discontinued before the commencement of the previous year

Income of previous year is taxable during the following assessment year. There are, however, certain exceptions to this rule.

- There is no distinction between legal or illegal business. Therefore, profits from illegal business are taxable in a similar manner as legal business.

- Not only the legal ownership but beneficial ownership is also to be considered for Section 28.

- Anticipated profits or potential or notional profits are not considered for calculating taxable income under this head.

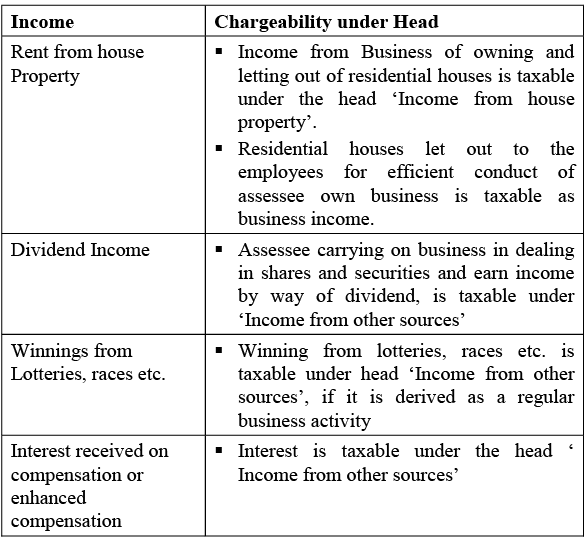

The mode or system of bookkeeping cannot override the substantial character of a transaction. Special cases where income from business is not taxable under ‘Profit and Gains of Business’:

Table: Cases where income from business is not taxable under ‘Profit and Gains of Business’

Computation Of Income From Business Or Profession

Section 29 of the Income Tax Act specifies that the profits and gains of business and profession, which are taxable under Section 28, shall be computed according to the provisions contained in Sections 30 to 43D, including Sections 44 to 44D, which consist of special provisions regarding the computation of profits and the deduction of expenditure in certain cases.

General principles for allowing deduction:

- The expenditure should have been incurred during the previous year.

- The expenditure should be incurred for the purpose of business.

- Expenditure done before in respect of setting up of business is not allowed.

- No expenses in respect of discontinued business is allowed to be deducted.

- Reserves/provisions for contingencies/anticipated losses cannot be claimed as a deduction.

- No deduction is admissible in respect of diminution or exhaustion of the capital asset from which income is derived.

- No deduction is allowed in respect of non-taxable business; like agricultural income in India is exempt.

- No deduction is allowed in respect of depreciation of investment.

Method of Accounting:

- Income to be deducted either on the basis of cash or accrual system of accounting as followed or employed regularly by the assessee. [Section 145 (1)]

- Central Government is empowered to notify income computation and disclosure standards. [Section 145 (2)]

- Assessing Officer is empowered to make assessment in the manner provided in section 144 in certain special cases. [Section 145 (3)]

- Allowances under Sections 30 to 37 are cumulative and not alternative.

Scheme of allowing business expenses:

- Section 30 to 37 – Expenses expressly allowed

- Section 40 – Expenses specifically disallowed

- Section 40A – Expenses or payments not deductible in certain cases

Specific Deductions-i

The treatment of expenses depends on the accounting system followed by the assessee. If the assessee follows a cash basis, expenses are treated as paid only when they have been actually paid. On the other hand, if the assessee follows an accrual basis, expenses are treated as paid regardless of whether they have been paid or not.

Rent, Rates, Taxes, Repairs, and Insurance of Buildings [Section 30]

- Expense Treatment Rent & Repairs

- Rent & repairs of a building are deductible expenses, but only if the assessee has occupied the property as a tenant. This expense must not be of a capital nature.

- Income from House Property & Profits and Gains of Business or Profession

Municipal Taxes/Land Revenue/Other Taxes

- Taxes are deductible, but payment should be made actually during the previous year or by the due date of submission of the income tax return.

Insurance

- Insurance against the risk of damage or destruction of a building is deductible.

Repair and Insurance of Machinery, Plant & Furniture [Section 31]

Rent & Repairs

- Rent & repairs of machinery, plant, and furniture for business purposes are deductible expenses. These expenses must not be of a capital nature.

Depreciation [Section 32]

- Depreciation is the reduction in the value of an asset due to normal wear and tear and obsolescence over the useful life of the asset. Common methods for calculating depreciation in financial accounting are the Straight-Line Method (SLM) and the Written Down Value Method (WDV). However, the method of claiming depreciation as an expense is different in income tax compared to financial accounting.

General Principles for Depreciation Allowance

- Depreciation is allowed on tangible assets such as buildings, machinery, plant, and furniture, and on intangible assets such as know-how, patents, copyrights, trademarks, licenses, franchises, or any other business or commercial rights of a similar nature. The asset must be owned partially or fully by the assessee, and depreciation is allowed if the asset is used for the purpose of business or profession.

- Depreciation is computed on the written down value method of the asset as on the last day of the previous year, and the asset must have been used for the purpose of business during the relevant previous year.

- For the first year in which an asset is acquired, it should be used for at least 180 days to claim depreciation for the whole year. If the asset is put to use for less than 180 days, half-year depreciation is provided in the first year in which the asset is acquired.

Block of Assets [Section 2 (11)]

A block of assets refers to a collection of assets falling within a specific class of assets, which includes: a) Tangible assets, such as buildings, machinery, plant, or furniture b) Intangible assets, such as know-how, patents, copyrights, trademarks, licenses, franchises, or any other business or commercial rights of a similar nature, for which the same percentage of depreciation is prescribed. Classes of Asset: There are four types of classes: buildings, furniture, plant & machinery, and intangible assets. From the assessment year 2018-19, the maximum rate of depreciation has been set at 40%, thereby reducing the number of blocks from 12 to 10.

Block Formation & Calculation of Written Down Value of Asset for Charging Depreciation

Step 1: Formation of Block

Assets of the same class, having the same rate of depreciation, are grouped into a single block. The written down value of the entire block at the start of the previous year is determined, which is the written down value of the block of assets in the immediately preceding year, less the depreciation allowed for that block of assets in relation to the said preceding year.

Step 2: Additions

The actual cost of any asset falling within the block, acquired during the previous year, is added.

Step 3: Deductions

The money received or receivable (including scrap value) in respect of the asset of the same block, which is sold, discarded, demolished, or destroyed during the previous year, is deducted. However, the sum of Step 1 and Step 2 cannot be exceeded by Step 3.

Step 4: Final Figure

The figure arrived at will be the written down value of the block at the end of the year for the purpose of charging the current year’s depreciation.

Depreciation Allowance for Special Cases

Case 1: Depreciation in case of Power Units [Section 32 (1) (i)] – Undertakings involved in the business of power generation or generation and distribution of power have two options:

- Straight Line Method – For tangible assets, depreciation is calculated at the rates specified in Appendix IA to the Income Tax Rules, based on the actual cost of each asset.

- Written Down Value Method – Similar to other taxpayers, the option should be exercised before the due date for filing the return of income. Once chosen, it applies to all subsequent years.

Case 2: Additional Depreciation on New Machinery or Plant [Section 32 (1) (i)]

Conditions for claiming additional depreciation (in addition to normal depreciation):

- Engaged in manufacturing or production of any article or thing or generation, transmission, or distribution of power.

- New plant and machinery installed and acquired after March 31, 2005 – Few exceptions are there where assets are not eligible for additional depreciation:

Ships and aircraft

- Any machinery or plant which, before its installation by the assessee, was used either within or outside India or by any other person

- Any machinery or plant which is installed in any office premises, residential accommodation, or guest house

- Any office appliances or road transport vehicles

Any machinery or plant, which is eligible for 100% deduction in the first year

- Additional Depreciation @ 20% of the actual cost of the asset acquired and installed after March 31, 2005. If the asset is used for less than 180 days, then 10% depreciation shall be allowable, and the rest 10% shall be allowed in the immediately next year.

- In case of acquisition of any depreciable asset in respect of which a payment (or aggregate of payments made to a person in a day), otherwise than by an account payee cheque/draft or use of the electronic clearing system through a bank account, exceeds Rs. 10,000, such payment shall not be eligible for additional depreciation.

- If new plant and machinery are acquired for setting up an undertaking in a notified backward area in Andhra Pradesh, Bihar, Telangana, and West Bengal during April 1, 2015, to March 31, 2020, additional depreciation will be provided at 35% instead of 20%. The rate will be halved if the machinery is used for less than 180 days, i.e., 17.5%, and the remaining 17.5% shall be allowed in the immediately next year.

- Additional Depreciation shall be allowed to be deductible while computing WDV for the next year.

Unabsorbed Depreciation

If during any previous year, the depreciation cannot be absorbed owing to no profits or gains from business or due to insufficient profits or gains during the relevant previous year, then it will be set off in the following sequence:

- Current year’s profits or gains as far as possible

- Income from other heads (Except Income from salary)

- If still left, then it will be allowed to carry forward to the next year

In the next year, the following sequence will be followed to set off unabsorbed Depreciation of the last previous years:

- Current Year’s Depreciation

- Brought forward business loss

- Unabsorbed Depreciation of previous years

Depreciation provision shall apply whether or not the assessee has claimed this deduction in computing total income. Unabsorbed Depreciation can be carried forward for an infinite time period. Depreciation can be carried forward by the same assessee. Continuity of business is not relevant for set-off and carry-forward provisions.

Incentive for Acquisition and Installation of New Plant or Machinery in Notified Backward Areas in Certain States [Section 32 AD]

- Incentive – 15% of the actual cost of a new asset being eligible plant and machinery

- Conditions to be fulfilled –

- Any company or non-company assessee engaged in the business of manufacturing an article or thing on or after 01.04.2015 in any backward notified area by the Central Government in the states of Andhra Pradesh, Bihar, Telangana, and West Bengal.

- Acquired and installed new assets on or after 01.04.2015 and installed on or before 31.03.2020

- A company can claim both deductions under section 32 AC & 32 AD if conditions are satisfied for both

- Deduction shall be allowed in the year of installation of the new asset.

|

196 videos|219 docs

|

FAQs on Profits and Gains from Business or Profession - 1 - Commerce & Accountancy Optional Notes for UPSC

| 1. What is the basis of charge for calculating business and profession income? |  |

| 2. What are the general principles for calculating business and profession income? |  |

| 3. How is income from business or profession computed? |  |

| 4. What specific deductions are allowed for calculating profits and gains from business or profession? |  |

| 5. How can one ensure that the income from business or profession is accurately calculated for tax purposes? |  |