Capital Gains - 1 | Commerce & Accountancy Optional Notes for UPSC PDF Download

Introduction

Capital Gains is a distinct category of income, where any profit or gain resulting from the sale or transfer of a capital asset is subject to tax. In this segment, we will delve into the meaning of capital gains, the constituents of capital gains, exemptions from tax, and deductions permitted from capital gains. We will also examine how the taxable income from capital gains is determined.

Meaning of Capital Gains

Any earnings or gains arising from the transfer of a capital asset in the preceding year are subject to income tax under the label 'Capital Gains' and are treated as the income of the previous year in which the capital asset transfer took place. This definition can be divided into three components:

- Capital Asset

- Transfer of Capital Asset

- Earnings or Gains

Now, let's explore each of these elements in depth:

Concept of Capital Asset:

As per Section 2 (14), a Capital Asset denotes:

- Any form of property owned by an assessee, whether or not linked to their business or profession.

- Securities held by a foreign institutional investor who has invested in such securities in compliance with the rules under the Securities and Exchange Board of India Act, 1992.

The asset may be movable, immovable, tangible, or intangible. However, the term 'capital asset' does not encompass:

- Stock-in-trade (excluding the securities mentioned in sub-clause (b) above), consumable stores, or raw materials held for business or professional use.

- Personal effects, which include movable property (like attire and furniture but not including jewelry, archaeological collections, drawings, paintings, sculptures, or any artwork) held for personal use by the assessee or any dependent family member.

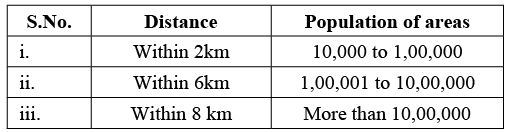

- Agricultural land in India (located in rural areas) that is not situated within the boundaries of any municipality or cantonment board having a population of 10,000 or more or located within a radius of 2 km (if the population is over 10,000 but up to 100,000), 6 km (if the population is over 100,000 but up to 1,000,000), and 8 km (if the population exceeds 1,000,000) from the local limits of such municipalities or cantonment boards. In this context, the distance should be measured aerially, and the population should be determined based on the last available census published before the first day of the preceding year.

Table: Distance and Population of Area for considering Agricultural Land as Capital Asset

Gold Deposit Bonds, 1999 issued under the Gold Deposit Scheme, 1999 or Deposit Certificates issued under Gold Monetization Scheme, 2015 notified by the central government are not considered capital assets. Note: Capital assets encompass leasehold rights, a partner's profit-sharing rights in a firm, and manufacturing licenses notified by the central government, as well as land, buildings, plants, machinery, goodwill, investment shares, permits, and jewelry. Jewelry includes ornaments made of gold, silver, platinum, or other precious metals, whether or not they are worked or sewn into any clothing, and precious or semi-precious stones, whether or not they are set in any furniture, utensil, or other article or worked or sewn into any clothing.

Gold Deposit Bonds, 1999 issued under the Gold Deposit Scheme, 1999 or Deposit Certificates issued under Gold Monetization Scheme, 2015 notified by the central government are not considered capital assets. Note: Capital assets encompass leasehold rights, a partner's profit-sharing rights in a firm, and manufacturing licenses notified by the central government, as well as land, buildings, plants, machinery, goodwill, investment shares, permits, and jewelry. Jewelry includes ornaments made of gold, silver, platinum, or other precious metals, whether or not they are worked or sewn into any clothing, and precious or semi-precious stones, whether or not they are set in any furniture, utensil, or other article or worked or sewn into any clothing. - Securities held by Foreign Institutional Investors (FII) are always treated as capital assets and cannot be treated as stock-in-trade. Securities include shares, scrips, stocks, bonds, debentures, debenture stock, or other marketable securities of any incorporated company or other body corporate, derivatives, units or any other instrument issued by any collective investment scheme to the investors in such schemes, security receipts as defined in clause (zg) of Section 2 of the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, units or any other instrument issued to the investors under any mutual fund scheme, any certificate or instrument (by whatever name called) issued to an investor by any issuer being a special purpose distinct entity which possesses any debt or receivable, including mortgage debt, assigned to such entity, and acknowledgment of the beneficial interest of such investor in such debt or receivable, including mortgage debt, as the case may be, government securities, such other instruments as may be declared by the central government to be securities, and rights or interest in securities. Self-generated assets such as goodwill, tenancy rights, route permits, and loom hours were not subject to capital gains tax until the assessment year 1987-88 due to the non-determination of the cost of acquisition of these assets.

- Presently, the cost of acquisition of self-generated assets is considered to be Nil, and the entire amount of the sale proceeds is treated as capital gains, effective from the assessment year 2003-04. Self-generated assets became taxable on the following dates: the sale of goodwill of a business is taxable with effect from the assessment year 1988-89, tenancy rights, route permits, and loom hours are taxable with effect from the assessment year 1995-96, and the right to manufacture, produce, or process any article is taxable with effect from the assessment year 1998-99. Capital assets are divided into two categories: short-term capital assets and long-term capital assets. Short-term capital assets are assets held for 36 months or less from the date of acquisition (12 months or less in the case of shares, securities, units of UTI, mutual funds, and zero-coupon bonds). Long-term capital assets are assets held for more than 36 months from the date of transfer (more than 12 months in the case of shares, securities, units of UTI, mutual funds, and zero-coupon bonds). Capital gains arising from the transfer of short-term capital assets are called short-term capital gains (STCG), while capital gains arising from the transfer of long-term capital assets are called long-term capital gains (LTCG).

Transfer of Capital Assets [(Section 2 (47)]

Transfer in relation to capital assets includes:

- Sale, exchange, or relinquishment of the assets, or

- The extinguishment of any rights therein, or

- The compulsory acquisition by the Government under any law, or

- Where the asset is converted by the owner thereof into stock-in-trade of a business carried on by him, such conversion. Further, where a business is converted into a limited company, there is a transfer of capital assets, or

- The maturity or redemption of zero coupon bonds or

- Any transaction involving the allowing of the possession of any immovable property to be taken or retained in part performance of a contract of the nature referred to in the Transfer of Property Act, 1882, or

- Any transaction which has the effect of transferring or enabling the enjoyment of any immovable property.

Examples of transfer

- Redemption of preference shares by a company is a transfer in the hands of shareholders and they will be liable to capital gain for the same. [Anarkali Sarabai v CIT (1997) 90 Taxman 509 (SC)].

- Conversion of preference share into ordinary shares amounts to transfer in the hands of the shareholder. [CIT v Motors and General Stores P. Ltd. (1967) 66 ITR 692 (SC)].

- Distribution of capital assets in case of liquidation of a company is not transfer in the hands of the company but transfer in the hands of the shareholders.

- Proprietary business taken over by a firm. [CIT v Ramakrishnan (1969) 73 ITR 356 (Ker)(FB)].

- Slump sale of an undertaking of a business (Section 50 B).

- Grant of mining lease at a premium [A.R. Krishnamurthy and Another v CIT(1989) 176 ITR 416 (SC)].

- Salami or premium received for lease of plots for 99 years [R.K. Palshikar HUF v CIT (1988) 172 ITR 310 (SC)].

Transactions not regarded as transfer [Sections 46 and 47]:

The meaning of transfer is given in Section 2(47), whereas transactions not regarded as transfer are covered u/s 46 and 47. In many transactions although there is a transfer, but these are not considered to be transfer for purposes of capital gains. Some of the relevant transactions which are not regarded as transfer are:

- where the assets of a company are distributed to its shareholders on liquidation of a company, such distribution shall not be regarded as transfer in the hands of company [Section 46 (1)],

- any distribution of capital assets on the total or partial partition of Hindu Undivided Family [Section 47 (i)];

- any transfer of a capital asset under a gift or will or an irrevocable trust [Section 47 (iii)];

- any transfer of a capital asset by a company to its 100% subsidiary company provided the subsidiary company is an Indian company [Section 47 (iv)]; Note: The transfer of the asset shall not be in form of stock-in-trade.

- any transfer of a capital asset by a 100% subsidiary company to its holding company, if the holding company is an Indian Company [Section 47 (v)].

- any transfer in a scheme of amalgamation of a capital asset by the amalgamating company to the amalgamated company, if the amalgamated company is an Indian company [Section 47 (vi)];

- any transfer in a scheme of amalgamation of shares held in an Indian company by the amalgamating foreign company to the amalgamated foreign company, if certain conditions are satisfied.

- any transfer, in a demerger, of a capital asset by the demerged company to the resulting company, if the resulting company is an Indian company [Section 47 (vib)];

- any transfer in a demerger, of a capital asset, being a share or shares held in an Indian company, by the demerged foreign company to the resulting foreign company, if certain conditions are satisfied.

- any transfer or issue of shares by the resulting company, in a scheme of demerger to the shareholders of the demerged company if the transfer or issue is made in consideration of demerger of the undertaking [Section 47 (vid)];

- any transfer by a shareholder, in a scheme of amalgamation, of shares held by him in the amalgamating company if certain conditions are satisfied.

- any transfer of Sovereign Gold Bond issued by the Reserve Bank of India under the Sovereign Gold Bond Scheme, 2015, by way of redemption, by an assessee being an individual.

- any transfer of a capital asset, being -

- bond or Global Depository Receipt referred to in Section 115 AC (1); or

- rupee denominated bond of an Indian company; or

- derivative, made by a non-resident on a recognized stock exchange located in any International Financial Services Centre and where the consideration for such transaction is paid or payable in foreign currency [Section 47 (viiab)]; [Inserted by the Finance Act, 2018, W.e.f. A.Y. 2019-20].

- any transfer of a capital asset, being any work of art, archaeological, scientific art collection, book, manuscript, drawing, painting, photograph or print, to the Government or a University or the National Museum, National Art Gallery, National Archives or any such other public museum or institution, as may be notified by the Central Government in the Official Gazette to be of national importance, or to be of renown throughout any State or States [Section 47(ix)];

- any transfer by way of conversion of bonds or debentures, debenturestock or deposit certificates in any form, of a company into shares or debentures of that company [Section 47 (x)];

- any transfer by way of conversion of preference shares of a company into equity shares of that company [Section 47(xb) inserted by the Finance Act, 2017, W.e.f. A.Y. 2018-19];

- any transfer of a capital asset or intangible asset by a firm to a company as a result of succession of the firm by a company in the business carried on by the firm provided the following conditions are satisfied:

- all the assets and liabilities of the firm, relating to the business immediately before the succession become the assets and liabilities of the company;

- all the partners of the firm immediately before the succession become the shareholders of the company in the same proportion in which their capital accounts stood in the books of the firm on the date of the succession;

- the partners of the firm do not receive any consideration or benefit, directly or indirectly, in any form or manner, other than byway of allotment of shares in the company;

- the aggregate of the shareholding in the company of the partners of the firm is not less than 50% of the total voting power in the company and their shareholding continues to be as such for a period of 5 years from the date of the succession [Section 47 (xiii)]; and

- any transfer of a capital asset or intangible asset by a private company or unlisted public company (hereafter in this clause referred to as the company) to a limited liability partnership or any transfer of a share or shares held in the company by a shareholder as a result of conversion of the company into a Limited Liability Partnership in accordance with the provisions of Section 56 or Section 57 of the Limited Liability Partnership Act, 2008 provided following conditions are satisfied:

- all the assets and liabilities of the company immediately before the conversion become the assets and liabilities of the limited liability partnership;

- all the shareholders of the company immediately before the conversion become the partners of the limited liability partnership and their capital contribution and profit sharing ratio in the limited liability partnership are in the same proportion as their shareholding in the company on the date of conversion;

- the shareholders of the company do not receive any consideration or benefit, directly or indirectly, in any form or manner, other than by way of share in profit and capital contribution in the limited liability partnership;

- the aggregate of the profit sharing ratio of the shareholders of the company in the limited liability partnership shall not be less than fifty per cent at any time during the period of five years from the date of conversion;

- the total sales, turnover or gross receipts in business of the company in any of the three previous years preceding the previous year in which the conversion takes place does not exceed sixty lakh rupees; and

- the total value of the assets as appearing in the books of account of the company i n any of the three previous years preceding the previous year in which the conversion takes place does not exceed 5 crore; and

- no amount is paid, either directly or indirectly, to any partner out of balance of accumulated profit standing in the accounts of the company on the date of conversion for a period of three years from the date of conversion. [Section 47 (xiiib)];

Note: For the purpose of this clause, the expressions “Private Company” and “Unlisted Public Company” shall have the meanings respectively assigned to them in the Limited Liability Partnership Act, 2008 [Explanation to Section 47 (xiiib)]

where a sole proprietary concern is succeeded by a company in the business carried on by it as a result of which the sole proprietary concern sells or otherwise transfers any capital asset or intangible asset to the company provided the following conditions are satisfied:

- all the assets and liabilities of the sole proprietary concern relating to the business immediately before the succession become the assets and liabilities of the company;

- the shareholding of the sole proprietor in the company is not less than 50%, of the total voting power in the company and his shareholding continues to remain as such for a period of 5 years from the date of the succession; and

- the sole proprietor does not receive any consideration or benefit, directly or indirectly, in any form or manner, other than by way of allotment of shares in the company [Section 47 (xiv)].

any transfer of a capital asset in a transaction of reverse mortgage under a scheme made and notified by the Central Government [Section 47(xvi)];

- any transfer by a unit holder of a capital asset, being a unit or units, held by him in the consolidating scheme of a mutual fund, made in consideration of the allotment to him of a capital asset, being a unit or units, in the consolidated scheme of the mutual fund shall not be regarded as transfer. Provided that the consolidation is of two or more schemes of equity-oriented fund or of two or more schemes of a fund other than an equity-oriented fund [Section 47 (xviii)];

- any transfer by a unit holder of a capital asset, being a unit or units, held by him in the consolidating plan of a mutual fund scheme, made in consideration of the allotment to him of a capital asset, being a unit or units, in the consolidated plan of that scheme of the mutual fund. [Section 47(xix)].

- It may be observed that the above transactions are not treated as transfer for purposes of capital gains.

Capital gain should arise in the previous year in which transfer took place Normally, capital gain arises in the previous year in which the transfer of the asset takes place even if the consideration for the transfer is received or realized in a later year. There are, however, 4 exceptional cases where capital gain is taxable not in the year of transfer of the asset, but in some other year.

These exceptions are:

- Damage or destruction of any capital asset by fire or other calamities.

- Conversion of capital asset into stock-in-trade.

- Compulsory acquisition of an asset.

- Transfer of capital asset, being land or building or both by an individual HUF under a specified agreement with the developer [Section 45(5A)].

Computation of Capital Gains

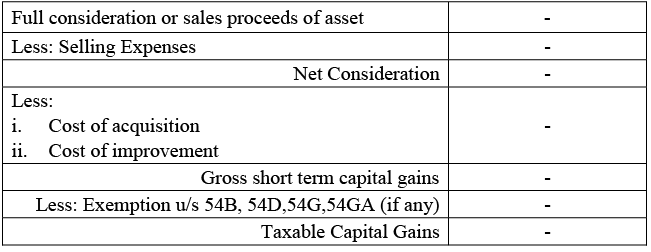

A) Short term capital gain It shall be computed by deducting from the full value of the consideration received or accruing as a result of the transfer of the capital asset the following amounts: a) Expenditure incurred wholly and exclusively in connection with such transfer, and b) The cost of acquisition of the capital asset and cost of any improvement thereof.

This may be explained in the form of equation as under:

Short term Capital Gain = Full value of consideration - (Cost of acquisition + Cost of improvement + Selling Expenses)

Table: Computation of Short-Term Capital Gains

Long Term capital gain

Long Term capital gain

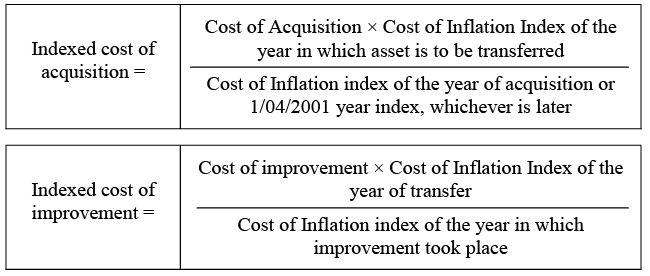

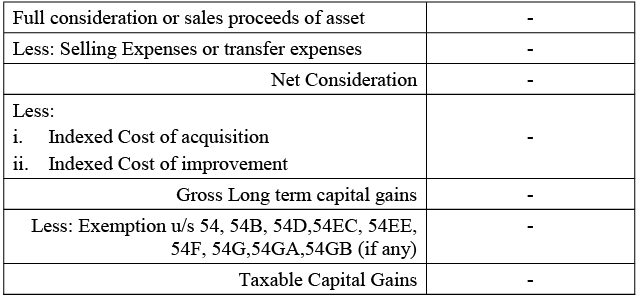

It shall be computed by deducting from the full value of the consideration received the following amounts:

- Expenditure incurred exclusively in connection with such transfer

- The indexed cost of acquisition of the capital asset and indexed cost of improvement.

Table: Computation of Long-Term Capital Gains

Table: Computation of Long-Term Capital Gains

Note:

- If improvements are made before April 1, 2001, the cost of improvement will be disregarded.

- The full value of consideration refers to what the transferor received or was entitled to receive as consideration for the capital asset transferred. The market value of the asset on the date of transfer does not necessarily need to be the full value of consideration.

- Transfer of a capital asset includes not only sale but also other methods of transfer such as exchange, relinquishment of the asset, and extinguishment of rights in the capital asset.

- The expression "full value" means the whole price without any deduction and is not concerned with the adequacy or inadequacy of the price bargain. Similarly, market value is also not concerned with the full value.

- Where the consideration is to be received in installments, the entire value of the consideration is to be considered while computing capital gains which become chargeable in the year of transfer.

- In the case of an exchange, the market value of the property shall be the full value of consideration.

- In some cases, instead of actual consideration, the full value of consideration shall be the deemed value. Such cases are explained under sections 45(IA), 45(2), 45(3), 45(4), 45(5A), 46(2), 50(C), and 50(D).

- Both direct and indirect expenses incurred shall be considered as expenses on transfer. Expenses of transfer for the purpose of transferring capital assets include expenses such as advertisement expenses, brokerage, stamp duty, registration fees, and legal expenses.

- The cost of acquisition and cost of improvement are discussed in the ensuing pages of this unit.

- Similarly, the indexed cost of acquisition and indexed cost of improvement are also discussed in the ensuing pages of this unit.

- From the capital gains, available exemptions are deducted to arrive at taxable capital gains.

|

196 videos|219 docs

|

FAQs on Capital Gains - 1 - Commerce & Accountancy Optional Notes for UPSC

| 1. What is the cost of acquisition in the computation of capital gains? |  |

| 2. How is the cost of improvement taken into account in the calculation of capital gains? |  |

| 3. What is the indexed cost of acquisition and improvement in the context of capital gains? |  |

| 4. Are there any capital gains that are exempt from tax? |  |

| 5. How can one calculate capital gains on assets for tax purposes? |  |