CA Intermediate Exam > CA Intermediate Notes > Advanced Accounting for CA Intermediate > Accounting Standards – Meaning and its Applicability

Accounting Standards – Meaning and its Applicability | Advanced Accounting for CA Intermediate PDF Download

| Table of contents |

|

| Accounting Standards Overview |

|

| Scope and Compliance |

|

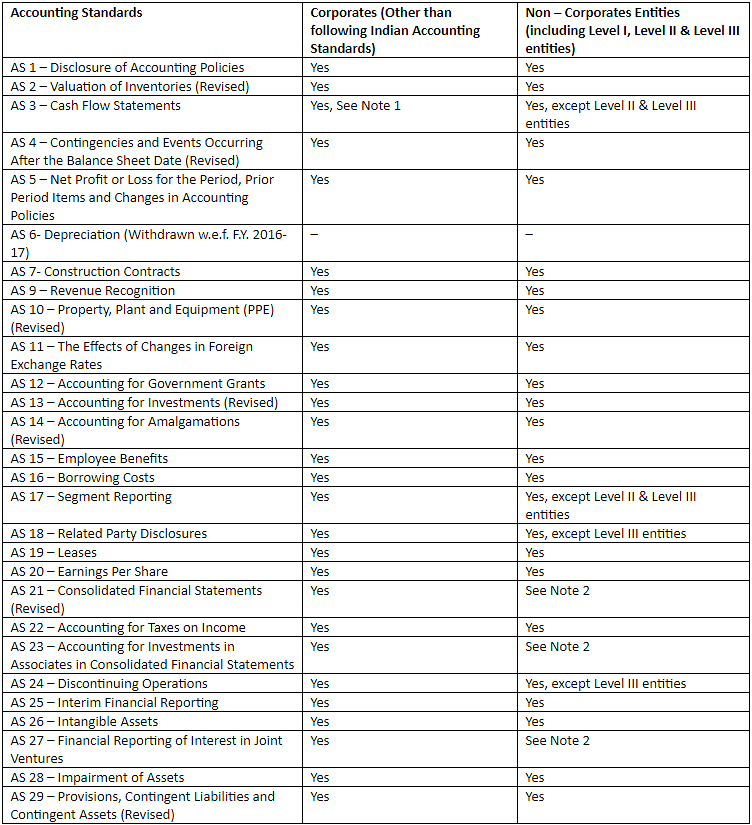

| Applicability of Accounting Standards |

|

| Classification of Enterprises |

|

Accounting Standards Overview

- Accounting Standards are formal guidelines that dictate how financial statements should be prepared and presented by businesses.

- They are established by accounting bodies, regulatory authorities, or governments to ensure consistency and transparency in financial reporting.

- These standards provide rules on how financial transactions should be measured, recognized, and disclosed in a company's books of accounts.

Scope and Compliance

- Accounting Standards issued by bodies like the ASB of ICAI do not supersede local regulations governing financial statement preparation.

- Businesses must comply with relevant accounting standards when preparing financial statements.

- Auditors are responsible for disclosing any deviations in their audit reports to inform users of financial statements.

Applicability of Accounting Standards

For the purpose of applicability of accounting standards, the enterprises are classified as Level I, Level II and Level III entities.

Classification of Enterprises

Level I Enterprises

- Non-corporate entities falling under specific categories, such as listed securities, banks, institutions with substantial turnover or borrowings.

Level II Enterprises (SMEs):

- Non-corporate entities with turnovers or borrowings falling below Level I thresholds but exceeding other defined limits.

Level III Enterprises (SMEs):

- Non-corporate entities not covered under Level I or II criteria are classified as Level III enterprises.

Notes on Exemptions:

- Certain Accounting Standards offer exemptions and relaxations for Small and Medium Companies, Level II, and Level III entities.

Note 1:

- Not applicable to Small and Medium-Sized Companies, One Person Companies, and Dormant Companies.

Note 2:

- Non-corporate entities preparing consolidated financial statements must comply with specific Accounting Standards.

Note 3:

- Exemptions from certain disclosure requirements apply to Small and Medium Companies, Level II, and Level III entities for select Accounting Standards.

AS 19 Leases

- Specific disclosure requirements under AS 19 Leases have exemptions for certain entities.

AS 20 Earnings Per Share

- Diluted Earnings per Share (DPS) disclosure requirements do not apply to Small and Medium Companies, Level II, or Level III entities.

AS 29 Provisions, Contingent Liabilities and Contingent Assets

- Disclosure requirements under AS 29 have exemptions for certain entities regarding provisions and contingent liabilities.

The document Accounting Standards – Meaning and its Applicability | Advanced Accounting for CA Intermediate is a part of the CA Intermediate Course Advanced Accounting for CA Intermediate.

All you need of CA Intermediate at this link: CA Intermediate

|

53 videos|134 docs|6 tests

|

Related Searches