CA Intermediate Exam > CA Intermediate Notes > Advanced Accounting for CA Intermediate > AS 3 – Cash Flow Statements

AS 3 – Cash Flow Statements | Advanced Accounting for CA Intermediate PDF Download

| Table of contents |

|

| Applicability of AS 3 Cash Flow Statements |

|

| Cash and Cash Equivalents |

|

| Presentation of Cash Flow |

|

| Major differences between AS 3 and Ind AS 7 |

|

Applicability of AS 3 Cash Flow Statements

- The Companies Act, 2013 defines the applicability of the Cash Flow Statement, which is a part of the financial statement along with the Balance Sheet, Profit and Loss Account, Statement of Changes in Equity, and Explanatory Notes.

- All companies are required to prepare Cash Flow Statements, except for specific categories like One Person Company (OPC), Small Company, and Dormant Company.

- OPC refers to a company with a single person as its member.

- Small Company is a private company with limited capital and turnover.

- Dormant Company is an inactive company formed for future projects or asset holding with minimal transactions.

Cash and Cash Equivalents

- Cash equivalents are short-term assets held by a company for meeting immediate cash needs rather than for investment purposes.

- To qualify as cash equivalents, an investment must be easily convertible into cash with low risk and a maturity of three months or less.

Presentation of Cash Flow

- A cash flow statement should categorize cash flows into Operating, Investing, and Financing activities to reflect a company's financial position.

Operating Activities:

- Cash flows from operating activities mainly come from a company's core revenue-generating operations.

- Examples include cash received from sales, fees, and cash paid to suppliers.

Investing Activities:

- Investing activities involve cash flows related to acquiring assets for generating income in the future.

- Examples include cash paid for acquiring fixed assets or shares of other companies.

Financing Activities:

- Financing activities include transactions that affect a company's capital and borrowings.

- Examples include cash received from issuing shares or loans and cash repayment on borrowings.

Cash Flow from Operating Activities

- Companies report cash flows from operating activities using either the Direct or Indirect method, adjusting for non-cash transactions.

Cash Flow from Investing and Financing Activities

- Companies must separately record major cash receipts and payments from these activities, except for those reported on a net basis.

Foreign Currency Cash Flows

- Cash flows in foreign currencies should be converted to the reporting currency using appropriate exchange rates.

- The impact of exchange rate changes on cash and cash equivalents must be disclosed separately.

Extraordinary Items, Dividends & Interests

- Cash flows related to extraordinary items, dividends, and interests must be categorized and disclosed appropriately.

Taxes on Income

- Cash flows from income taxes should be reported separately as operating, investing, or financing activities.

Acquisitions and Disposal of Business Units including Subsidiaries

- Cash flows from acquiring or disposing of business units should be classified as investing activities.

- Details regarding these transactions should be clearly presented in the financial statements.

Non-Cash Transactions and Disclosure

- Transactions not involving cash must be excluded from the cash flow statement and disclosed separately.

- Enterprises must disclose substantial cash and cash equivalents not available for use and other relevant commitments.

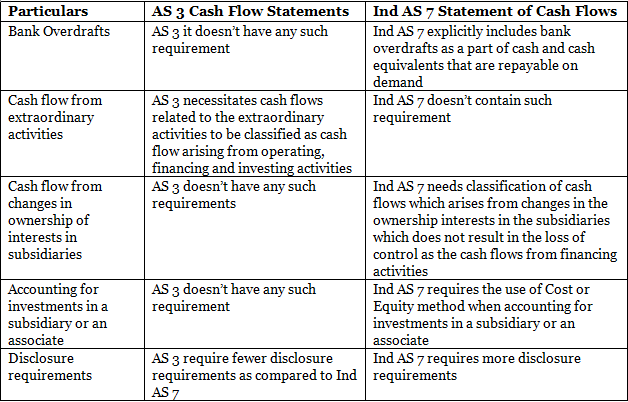

Major differences between AS 3 and Ind AS 7

The document AS 3 – Cash Flow Statements | Advanced Accounting for CA Intermediate is a part of the CA Intermediate Course Advanced Accounting for CA Intermediate.

All you need of CA Intermediate at this link: CA Intermediate

|

53 videos|123 docs|6 tests

|

FAQs on AS 3 – Cash Flow Statements - Advanced Accounting for CA Intermediate

| 1. What is the applicability of AS 3 Cash Flow Statements? |  |

Ans. AS 3 Cash Flow Statements is applicable to all enterprises that prepare and present financial statements in accordance with the accounting standards notified under the Companies Act, 2013.

| 2. How does AS 3 define Cash and Cash Equivalents? |  |

Ans. Cash and Cash Equivalents are defined by AS 3 as cash on hand, demand deposits with banks, and other short-term, highly liquid investments that are readily convertible into known amounts of cash and subject to insignificant risk of changes in value.

| 3. What are the major differences between AS 3 and Ind AS 7? |  |

Ans. Some major differences between AS 3 and Ind AS 7 include the treatment of interest and dividends received, treatment of interest paid, and the classification of cash flows from operating activities.

| 4. How should Cash Flow be presented according to AS 3? |  |

Ans. Cash flows should be classified into operating activities, investing activities, and financing activities in the cash flow statement as per AS 3 Cash Flow Statements.

| 5. What are the key components of the presentation of Cash Flow as per AS 3? |  |

Ans. The key components of the presentation of Cash Flow as per AS 3 include the opening and closing balances of cash and cash equivalents, cash flows from operating activities, investing activities, and financing activities, and the net increase or decrease in cash and cash equivalents for the period.

Related Searches