Basic Concepts | Taxation for CA Intermediate PDF Download

| Table of contents |

|

| What is the meaning of tax? |

|

| Charge of Income Tax |

|

| Important Definitions |

|

| Previous Year and Assessment Year |

|

What is the meaning of tax?

- Let us begin by understanding the meaning of tax. Article 366(28) of the Constitution of India defines the term “Taxation” as follows – “Taxation includes the imposition of any tax or impost, whether general or local or special, and tax shall be construed accordingly."

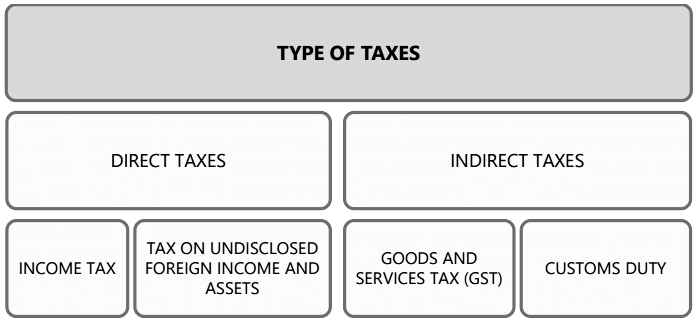

- Taxes are considered to be the “cost of living in a society”. Taxes are levied by the Governments to meet the common welfare expenditure of the society. There are two types of taxes - direct taxes and indirect taxes.

- Direct Taxes: If tax is levied directly on the income or wealth of a person, then, it is a direct tax. The person who pays the tax to the Government cannot recover it from somebody else i.e. the burden of a direct tax cannot be shifted. E.g., Incometax. Indirect Taxes: If tax is levied on the price of a good or service, then, it is an indirect tax e.g. Goods and Services Tax (GST) or Custom Duty. In the case of indirect taxes, the person paying the tax passes on the incidence to another person.

Why are taxes levied?

- The reason for levy of taxes is that they constitute the basic source of revenue to the Government. Revenue so raised is utilized for meeting the expenses of Government like defence, provision of education, health-care, infrastructure facilities like roads, dams etc.

- Power to levy taxes

- The Constitution of India, in Article 265 lays down that “No tax shall be levied or collected except by authority of law.” Accordingly for levy of any tax, a law needs to be framed by the government.

- Constitution of India gives the power to levy and collect taxes, whether direct or indirect, to the Central and the State Government. The Parliament and State Legislatures are empowered to make laws on the matters enumerated in the Seventh Schedule by virtue of Article 246 of the Constitution of India.

- Seventh Schedule to Article 246 contains three lists which enumerate the matters under which the Parliament and the State Legislatures have the authority to make laws for the purpose of levy of taxes.

The following are the lists:

- Union List: Parliament has the exclusive power to make laws on the matters contained in Union List.

- State List: The Legislatures of any State has the exclusive power to make laws on the matters contained in the State List.

- Concurrent List: Both Parliament and State Legislatures have the power to make laws on the matters contained in the Concurrent list.

Overview of Income-tax law in India

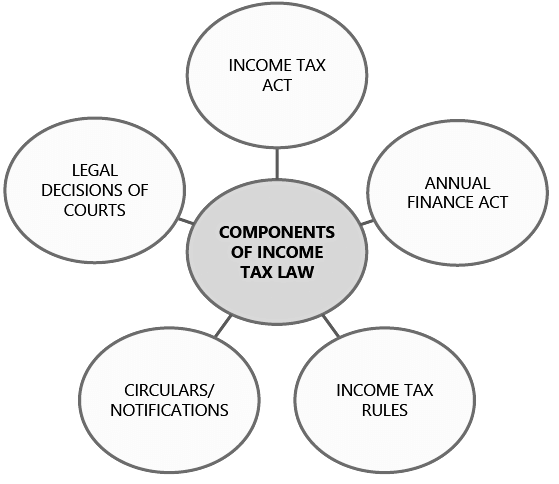

In this material, we would be introducing the students to the Income-tax law in India. The income-tax law in India consists of the following components –

The various instruments of law containing the law relating to income-tax are explained below.

Income-tax Act, 1961

The levy of income-tax in India is governed by the Income-tax Act, 1961. In this book, we shall briefly refer to this as the Act.

- It extends to the whole of India.

- It came into force on 1st April, 1962.

- It contains sections 1 to 298 and schedules I to XIV.

- A section may have sub-sections or clauses and sub-clauses. When each part of the section is independent of each other and one is not related with other, such parts are called a “Clause”. “Sub section”, on the other hand refers to such parts of a section where each part is related with other and all sub sections taken together completes the concept propounded in that section.

Example

- The clauses of section 2 define the meaning of terms used in the Income-tax Act, 1961. Clause (1A) defines “agricultural income”, clause (1B) defines “amalgamation” and so on. Each one of them is independent of other clause of the same section.

- Likewise, the clauses of section 10 contain the exemptions in respect of certain income, like clause (1) provides for exemption of agricultural income and clause (2) provides for exemption of share income of a member of a Hindu Undivided Family and so on.

- Section 5 defining the scope of total income has two subsections (1) and (2). Sub-section (1) defines the scope of total income of a resident and sub-section (2) defines the scope of total income of a non-resident. Each sub section is related with the other in the sense that only when one reads them all, one gets the complete idea related with scope of total income.

A section may also have Provisos and Explanations.

- The Proviso(s) to a section/sub-section/clause spells out the exception(s)/ condition(s) to the provision contained in the respective section/ sub-section/ clause, i.e., the proviso spells out the cases where the provision contained in the respective section/ sub-section/ clause would not apply or where the provision would apply with certain modification.

- The Explanation to a section/ sub-section/ clause gives a clarification relating to the provision contained in the respective section/ sub-section/ clause.

Example

- Sections 80GGB and 80GGC provides for deduction from gross total income in respect of contributions made by companies and other persons, respectively, to political parties or an electoral trust.

- The proviso to sections 80GGB and 80GGC provide that no deduction shall be allowed under those sections in respect of any sum contributed by cash to political parties or an electoral trust. Thus, the provisos to these sections spell out the circumstance when deduction would not be available thereunder in respect of contributions made.

- The Explanation below section 80GGC provides that for the purposes of sections 80GGB and 80GGC, "political party" means a political party registered under section 29A of the Representation of the People Act, 1951. Thus, the Explanation clarifies that the political party has to be a registered political party.

The Income-tax Act, 1961 undergoes change every year with additions and substitutions brought in by the Annual Finance Act passed by Parliament. Sometimes, the Income-tax Act, 1961 is also amended through other legislations like Taxation Laws (Amendment) Act.

The Finance Act

Every year, the Finance Minister of the Government of India introduces the Finance Bill in the Parliament's Budget Session. When the Finance Bill is passed by both the houses of the Parliament and gets the assent of the President, it becomes the Finance Act. Amendments are made every year to the Income-tax Act, 1961 and other tax laws by the Finance Act.

The First Schedule to the Finance Act contains four parts which specify the rates of tax -

- Part I of the First Schedule to the Finance Act specifies the rates of tax applicable for the current Assessment Year. Accordingly, Part I of the First Schedule to the Finance Act, 2023 specifies the rates of tax for A.Y. 2023-24.

- Part II specifies the rates at which tax is deductible at source for the current Financial Year. Accordingly, Part II of the First Schedule to the Finance Act, 2023 specifies the rates at which tax is deductible at source for F.Y. 2023-24

- Part III gives the rates for calculating income-tax for deducting tax from income chargeable under the head "Salaries" and computation of advance tax for F.Y. 2023-24 where the assessee exercises the option to shift out of the default tax regime provided under section 115BAC(1A).

- Part IV gives the rules for computing net agricultural income.

Income-tax Rules, 1962

- The administration of direct taxes is looked after by the Central Board of Direct Taxes (CBDT).

- The CBDT is empowered to make rules for carrying out the purposes of the Act.

- For the proper administration of the Income-tax Act, 1961, the CBDT frames rules from time to time. These rules are collectively called Income-tax Rules, 1962.

- Rules also have sub-rules, provisos and Explanations. The proviso to a Rule/ Sub-rule spells out the exception to the limits, conditions, guidelines, basis of valuation, as the case may be, spelt out in the Rule/ Sub-rule. The Explanation gives clarification for the purposes of the Rule.

- It is important to keep in mind that along with the Income-tax Act, 1961, these rules should also be studied.

Circulars and Notifications

Circulars

- Circulars are issued by the CBDT from time to time to deal with certain specific problems and to clarify doubts regarding the scope and meaning of certain provisions of the Act.

- Circulars are issued for the guidance of the officers and/or assessees.

- The department is bound by the circulars. While such circulars are not binding on the assessees, they can take advantage of beneficial circulars.

Notifications

Notifications are issued by the Central Government to give effect to the provisions of the Act. The CBDT is also empowered to make and amend rules for the purposes of the Act by issue of notifications which are binding on both department and assessees.

Legal decisions of Courts

- Case Laws refer to decision given by courts. The study of case laws is an important and unavoidable part of the study of Income-tax law. It is not possible for Parliament to conceive and provide for all possible issues that may arise in the implementation of any Act. Hence the judiciary will hear the disputes between the assessees and the department and give decisions on various issues.

- The Supreme Court is the Apex Court of the Country and the law laid down by the Supreme Court is the law of the land. The decisions given by various High Courts will apply in the respective states in which such High Courts have jurisdiction.

Note – Case laws are dealt with at the Final level.

Charge of Income Tax

Section 4 of the Income-tax Act, 1961 is the charging section which provides that:

- Tax shall be charged at the rates prescribed for the year by the Annual Finance Act or the Income-tax Act, 1961 or both.

- The charge is on every person specified under section 2(31);

- Tax is chargeable on the total income earned during the previous year and not the assessment year. (There are certain exceptions provided by sections 172, 174, 174A, 175 and 176);

- Tax shall be levied in accordance with and subject to the various provisions contained in the Act.

This section is the back bone of the law of income-tax in so far as it serves as the most operative provision of the Act. The tax liability of a person springs from this section. A person includes an individual, Hindu Undivided Family (HUF), Association of Persons (AOP), Body of Individuals (BOI), a firm, a company etc.

- Total Income and Tax Payable Income-tax is levied on an assessee’s total income. Such total income has to be computed as per the provisions contained in the Income-tax Act, 1961.

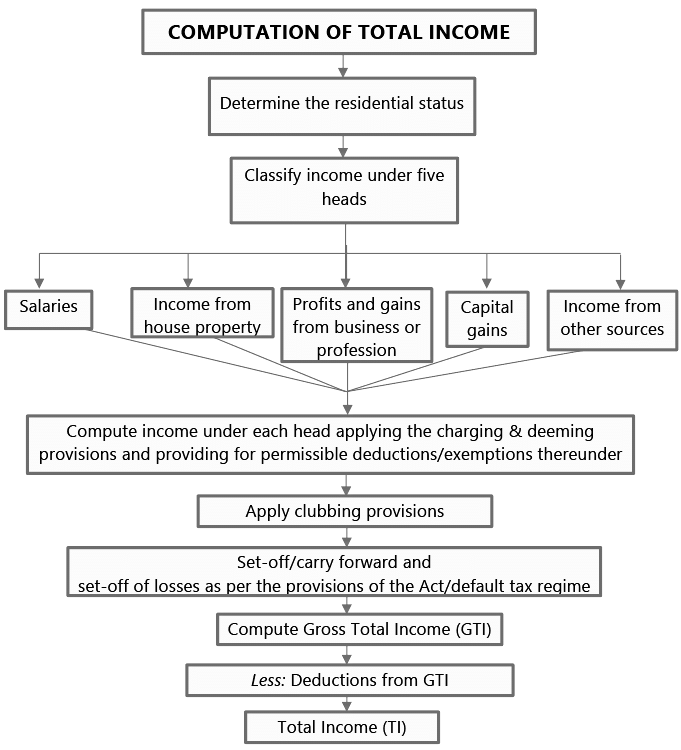

Let us go step by step to understand the procedure for computation of total income of an individual for the purpose of levy of income-tax –

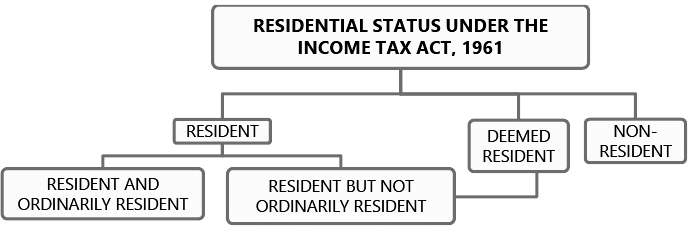

Step 1 – Determination of residential status The residential status of a person has to be determined to ascertain which income is to be included in computing the total income. The residential status as per the Income-tax Act, 1961 can be classified as under –

- In the case of an individual, the duration for which he is present in India in the relevant previous year or relevant previous year and the earlier previous years determines his residential status. Based on the days spent by him in India, he may be (a) resident and ordinarily resident, (b) resident but not ordinarily resident, or (c) non-resident. The residential status of a person determines the taxability of the income. For e.g., income earned and received outside India will not be taxable in the hands of a nonresident but will be taxable in case of a resident and ordinarily resident.

- There is also a concept of deemed resident for which presence of individual in India is not required. A deemed resident is always a resident but not ordinarily resident in India.

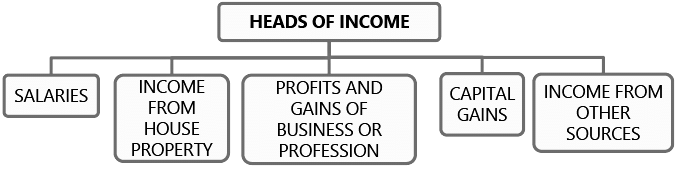

Step 2 – Classification of income under different heads

- A person may earn income from different sources. For example, a salaried person earns income by way of salary. He also gets interest from bank savings account/ fixed deposit. Apart from this, if he has invested in shares, he would be getting dividend and when he sells these shares, he may earn profit on such sale. If he owns a residential property which he has let out, he would earn rental income.

Under the Income-tax Act, 1961, for computation of total income, all income of a tax payer are classified into five different heads of income. These are shown below –

There is a charging section under each head of income which defines the scope of income chargeable under that head. These heads of income exhaust all possible types of income that can accrue to or be received by the tax payer. Accordingly, income earned is classified as follows:

- Salary, pension etc. earned is taxable under the head "Salaries".

- Rental income is taxable under the head "Income from house property".

- Income derived from carrying on any business or profession is taxable under the head "Profits and gains of business or profession".

- Profit from sale of a capital asset (like land, building and shares) is taxable under the head "Capital Gains".

- The fifth head of income is the residuary head. Income which is chargeable to tax under the Income-tax Act, 1961 but not taxable under the first four heads will be taxed under the head "Income from other sources".

- The tax payer has to classify the income earned under the relevant head of income.

Step 3 - Computation of income under each head

- Income is to be computed in accordance with the provisions governing a particular head of income.

Exemptions: There are certain incomes which are wholly exempt from income-tax e.g., agricultural income. These incomes have to be excluded and will not form part of total income.

- Also, some incomes are partially exempt from income-tax e.g., Commuted pension. These incomes are excluded only to the extent of the limits specified in the Act. The balance income over and above the prescribed exemption limits would enter computation of total income and have to be classified under the relevant head of income.

Deductions: There are deductions and allowances prescribed under each head of income. For example, while calculating income from house property for let out property, municipal taxes and interest on loan are allowed as deduction. Similarly, deductions and allowances are prescribed under other heads of income. These deductions etc. have to be considered before arriving at the net income chargeable under each head.

These exemptions and deductions would be available to the individual depending upon the regime in which he pays tax. Tax regime under section 115BAC is the default tax regime which provides for concessional rates of tax to individuals/HUFs/AoPs/BoIs/Artificial juridical persons. However, certain exemptions and deductions are not allowed under the default tax regime. Such assessees have an option to opt out of the said regime and pay tax under normal provisions of the Act.

Step 4 – Clubbing of income of spouse, minor child etc.

In case of individuals, income-tax is levied on a slab system on the total income. The tax system is progressive i.e., as the income increases, the applicable rate of

tax increases. Some taxpayers in the higher income bracket have a tendency to divert some portion of their income to their spouse, minor child etc. to minimize their tax burden.

In order to prevent such tax avoidance, clubbing provisions have been incorporated in the Act, under which income arising to certain persons (like spouse, minor child etc.) have to be included in the income of the person who has diverted his income for the purpose of computing tax liability.

Step 5 - Set-off or carry forward and set-off of losses

- An assessee may have different sources of income under the same head of income. He may have profit from one source and loss from the other. For instance, an assessee may have profit from his textile business and loss from his printing business. This loss can be set-off against the profits of textile business to arrive at the net income chargeable under the head "Profits and gains of business or profession".

- Similarly, an assessee can have loss under one head of income, say, profits and gains of business or profession and profits under another heads of income, say, income from house property. There are provisions in the Income-tax Act, 1961 for allowing inter-head adjustment in certain cases.

- However, there are also restrictions in certain cases, like business loss is not allowed to be set-off against salary income. Default tax regime under section 115BAC puts further more restrictions like loss from house property cannot be set off from income under any other head. Further, losses which cannot be set-off in the current year due to inadequacy of eligible profits can be carried forward for set-off in the subsequent years as per the provisions contained in the Act. Generally, brought forward losses under a particular head cannot be set-off against income under another head i.e., brought forward business loss cannot be set-off against income from house property of the current year.

Step 6 - Computation of Gross Total Income

The final figures of income or loss under each head of income, after allowing the eligible deductions, allowances and other adjustments, are then aggregated, after giving effect to the provisions for clubbing of income and set-off and carry forward of losses, to arrive at the gross total income.

Step 7 – Deductions from Gross Total Income

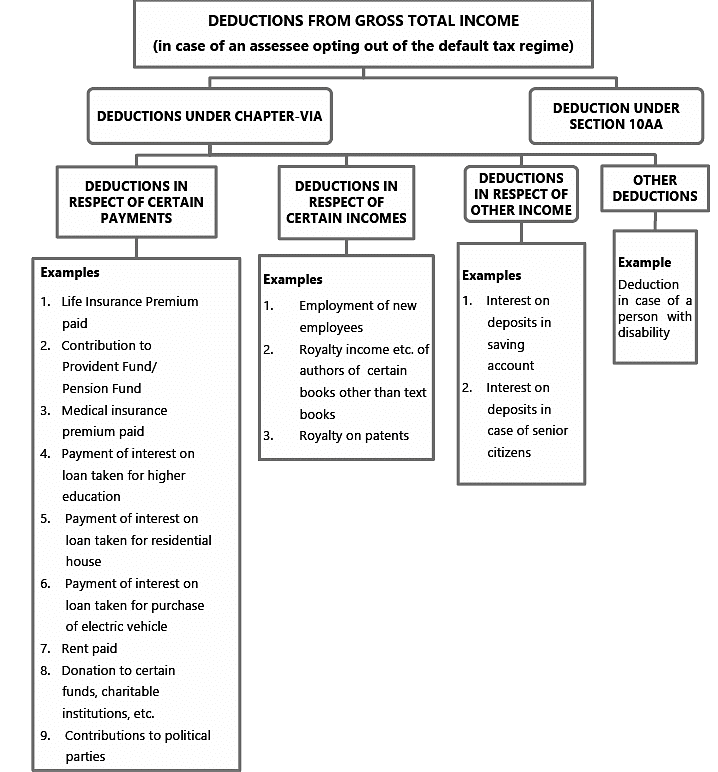

There are deductions prescribed from Gross Total Income. Two types of deductions are allowable from Gross Total Income - Deductions under Chapter VIA and deduction under section 10AA. These deductions would be allowable to the assessee who opts out of the default tax regime and pays tax under the optional tax regime as per normal provisions of the Act, subject to fulfillment of requisite conditions stipulated thereunder.

However, under the default tax regime under section 115BAC, only select deductions are permissible.

Step 8 – Computation of Total income

The income arrived at, after claiming the above deductions from the Gross Total Income is known as the Total Income. It should be rounded off to the nearest multiple of ` 10 as per section 288A. The process of computation of total income is shown hereunder –

Step 9 – Application of the rates of tax on the total income

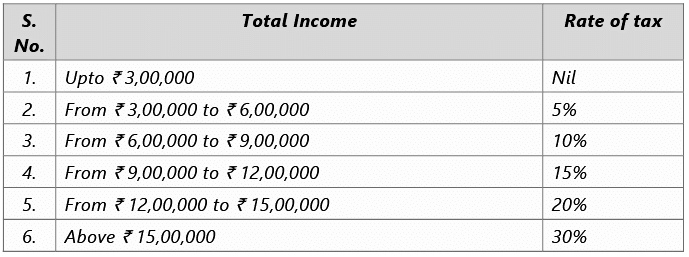

Rates prescribed under section 115BAC of the Income-tax Act for default tax regime

Section 115BAC of the Income-tax Act, 1961 provides for concessional rates of tax to individuals/HUF/AoPs/BoIs and artificial juridical persons. Under this regime certain exemptions/deductions are, however, not available like Leave Travel Concession, interest on housing loan on self-occupied property, deductions under Chapter VI-A [other than section 80CCD(2), 80CCH(2) or section 80JJAA] etc. The rates given under section 115BAC are the default tax rates unless the assessee exercises an option to shift out of the said regime. The basic exemption limit under section 115BAC is ` 3,00,000. This means that no tax is payable by an assessee with total income of upto ` 3,00,000. The tax rates under section 115BAC is as follows -

Rates prescribed by the Annual Finance Act under the optional tax regime

- Individuals/HUF/AoPs/BoIs and artificial juridical persons, who exercise the option to opt out of the default tax regime under section 115BAC, have to pay tax as per normal provisions of the Act. Under the normal provisions of the Act, the rates of tax are prescribed by the Annual Finance Act of the year.

- For individuals, HUF etc., the basic exemption limit is ` 2,50,000. This means that, as per the normal provisions of the Act, no tax is payable by individuals with total income of upto ` 2,50,000. Those individuals whose total income is more than ` 2,50,000 but less than ` 5,00,000 have to pay tax on their total income in excess of ` 2,50,000@5%. Total income between ` 5,00,000 and ` 10,00,000 attracts tax @20%. The highest rate is 30%, which is attracted in respect of income in excess of ` 10,00,000. The tax rates have to be applied on the total income to arrive at the income-tax liability. However, resident individuals enjoy rebate under section 87A in both the tax regimes which are discussed later on in this chapter.

- For certain income (like Long Term Capital Gains, Lottery Income, Specified Short Term Capital Gains etc.), slab rates are not applicable under both the tax regimes. These incomes are taxable at special rates of taxation under both the tax regimes. These special rates are contained in the Income-tax Act, 1961 itself.

Step 10 - Surcharge / Rebate under section 87A

- Surcharge: Surcharge is an additional tax payable over and above the income-tax. Surcharge is levied as a percentage of income-tax, where total income exceeds ` 50 lakhs.

- Rebate under section 87A: In order to provide tax relief to the individual tax payers, section 87A provides a rebate from the tax payable by an assessee, being an individual resident in India, whose total income does not exceed ` 7,00,000 under the default tax regime under section 115BAC or ` 5,00,000 under the normal provisions of the Act if he opts out of the default tax regime. Under the default tax regime, an individual whose total income exceeds ` 7 lakhs marginally is also entitled to a rebate of the difference between tax on total income and the amount by which the total income exceeds ` 7 lakhs, when the former is greater than the latter.

Step 11 – Health and education cess on income-tax

- The income-tax, as increased by the surcharge or as reduced by the rebate under section 87A, if applicable, is to be further increased by an additional surcharge called health and education cess on income-tax @4% of income-tax plus surcharge, if applicable.

Step 12 – Alternate Minimum Tax (AMT)

- The Income-tax Act, 1961 contains certain profit-linked and investment linked deductions under normal provisions of the Act to promote investment in various sectors. These tax benefits help to reduce the tax liability of the taxpayers who exercise the option to opt out of the default tax regime under section 115BAC and become eligible to claim such deductions. In order to preserve the tax base vis-avis profit linked and investment linked deductions, the Income-tax Act, 1961 provides for levy of alternate minimum tax. Section 115JC provides for minimum tax to be paid by the taxpayers on their total income without providing profit linke and investment linked deductions. However, the taxpayer can claim the tax credit of the excess tax paid over the regular income-tax payable. Individuals/HUF/AoPs/BoIs and artificial juridical persons paying tax under default tax regime under section 115BAC, are not liable to alternate minimum tax under section 115JC.

Step 13 – Examine whether to pay tax under the default tax regime under section 115BAC or pay tax under the optional tax regime as per the regular provisions of the Act

- Total income and tax liability of individuals/HUF/AoPs/BoIs and artificial juridical persons may be computed in accordance with both the default tax regime under section 115BAC and as per the regular provisions of the Act including provisions relating to AMT, if applicable. Then, such persons can determine which is more beneficial and accordingly decide whether or not to opt out of the default tax regime under section 115BAC.

Individuals/HUF/AoPs/BoIs not having income from business or profession can choose whether or not to exercise the option of shifting out of the default tax regime in each previous year. They may choose to pay tax under default tax regime under section 115BAC in one year and exercise the option to shift out of default tax regime in another year.

Step 14 – Advance tax and tax deducted/ collected at source

Although the tax liability of an assessee is determined only at the end of the year, tax is required to be paid in advance in four installments on the basis of estimated income i.e., on or before 15th June, 15th September, 15th December and 15th March. However, residents declaring profits under presumptive taxation scheme (where business income is computed as a percentage of gross receipts/turnover) can pay advance tax in one installment on or before 15th March instead of four installments. In certain cases, tax is required to be deducted at source from the income by the payer at the rates prescribed in the Income-tax Act, 1961 or the Annual Finance Act. Such deduction should be made either at the time of accrual or at the time of payment, as prescribed by the Act.

Example: In the case of salary income, the obligation of the employer to deduct tax at source arises only at the time of payment of salary to the employees.

However, in respect of other payments like, fees for professional services, fees for technical services, interest payable to residents, the person responsible for paying is liable to deduct tax at source at the time of credit of such income to the account of the payee or at the time of payment, whichever is earlier. Such tax deducted at source has to be remitted to the credit of the Central Government through any branch of the RBI, SBI or any authorized bank within the statutory due dates.

Step 15: Tax Payable/Tax Refundable

- After adjusting the advance tax and tax deducted/ collected at source, the assessee would arrive at the amount of net tax payable or refundable. Such amount should be rounded off to the nearest multiple of ` 10 as per section 288B.

- The assessee has to pay the amount of tax payable (called self-assessment tax) on or before the due date of filing of the return. Similarly, if any refund is due, assessee will get the same after filing the return of income.

Return of Income

- The Income-tax Act, 1961 contains provisions for filing of return of income. Return of income is the format in which the assessee furnishes information as to his total income and tax payable. The format for filing of returns by different assessees is notified by the CBDT. The particulars of income earned under different heads, gross total income, deductions from gross total income, total income and tax payable by the assessee are required to be furnished in the return of income. In short, a return of income is the declaration of income by the assessee in the prescribed format.

- The Act has prescribed due dates for filing return of income in case of different assessees. Companies and firms have to mandatorily file their return of income before the due date. Other assessees are required to file a return of income subject to fulfilling of certain conditions.

Important Definitions

In order to understand the provisions of the Act, one must have a thorough knowledge of the meanings of certain key terms like ‘person’, ‘assessee’, ‘income’, etc. To understand the meanings of these terms we have to first check whether they are defined in the Act.

Terms defined in the Act: Section 2 gives definitions of the various terms and expressions used therein. If a particular definition is given in the Act itself, we have to be guided by that definition. For e.g. the term ‘perquisite’ has been defined under section 17(2) for the purpose of taxation of salaries.

Terms not defined under the Act: If a particular definition is not given in the Act, reference can be made to the General Clauses Act or dictionaries. Students should note this point carefully because certain terms like “dividend”, “transfer”, etc. have been given a wider meaning in the Income-tax Act, 1961 than they are commonly understood. Some of the important terms defined under section 2 are given below:

Assessee [Section 2(7)]

“Assessee” means a person by whom any tax or any other sum of money is payable under this Act. In addition, it includes –

- Every person in respect of whom any proceeding under this Act has been taken for the assessment of

- his income; or

- the income of any other person in respect of which he is assessable; or

- the loss sustained by him or by such other person; or

- the amount of refund due to him or to such other person.

- Every person who is deemed to be an assessee under any provision of this Act;

- Every person who is deemed to be an assessee-in-default under any provision of this Act.

- Every assessee is a ‘person’, but every ‘person’ need not be an assessee.

Assessment [Section 2(8)] This is the procedure by which the income of an assessee is determined. It may be by way of a normal assessment or by way of reassessment of an income previously assessed. Assessment Procedure will be dealt with in detail at the Final level.

Assessment [Section 2(8)]

This is the procedure by which the income of an assessee is determined. It may be by way of a normal assessment or by way of reassessment of an income previously assessed.

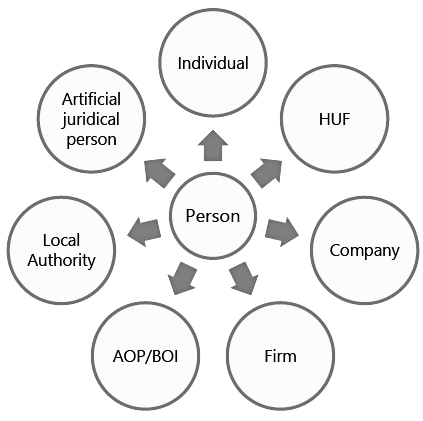

Person [Section 2(31)]

The definition of ‘assessee’ leads us to the definition of ‘person’ as the former is closely connected with the latter. The term ‘person’ is important from another point of view also viz., the charge of income-tax is on every ‘person’.

We may briefly consider some of the above seven categories of persons each of which constitute a separate unit of assessment or a separate tax entity.

(i) Individual: The term ‘individual’ means only a natural person, i.e., a human being.

- It includes both males and females.

- It also includes a minor or a person of unsound mind. But the assessment in such a case may be made 1 on the guardian or manager of the minor or lunatic who is entitled to receive his income. In the case of deceased person, assessment would be made on the legal representative.

(ii) HUF

- Under the Income-tax Act, 1961, a Hindu undivided family (HUF) is treated as a separate entity for the purpose of assessment. It is included in the definition of the term "person" under section 2(31). The levy of income-tax is on "every person". Therefore, income-tax is payable by a HUF.

- "Hindu undivided family" has not been defined under the Income-tax Act. The expression is, however, defined under the Hindu Law as a family, which consists of all males lineally descended from a common ancestor and includes their wives and daughters.

- Some members of the HUF are called co-parceners. They are related to each other and to the head of the family. HUF may contain many members, but members within four degrees including the head of the family (Karta) are called co-parceners. A Hindu Coparcenary includes those persons who acquire an interest in joint family property by birth. Earlier, only male descendants were considered as coparceners. With effect from 6th September, 2005, daughters have also been accorded coparcenary status. It may be noted that only the coparceners have a right to partition.

- A daughter of coparcener by birth shall become a coparcener in her own right in the same manner as the son. Being a coparcener, she can claim partition of assets of the family. The rights of a daughter in coparcenary property are equal to that of a son. However, other female members of the family, for example, wife or daughter-in-law of a coparcener are not eligible for such coparcenary rights.

- The relation of a HUF does not arise from a contract but arises from status. There need not be more than one male member or one female coparcener w.e.f. 6th September, 2005 to form a HUF. The Income-tax Act, 1961 also does not indicate that a HUF as an assessable entity must consist of at least two male members or two coparceners.

- Under the Income-tax Act, 1961, Jain undivided families and Sikh undivided families would also be assessed as a HUF.

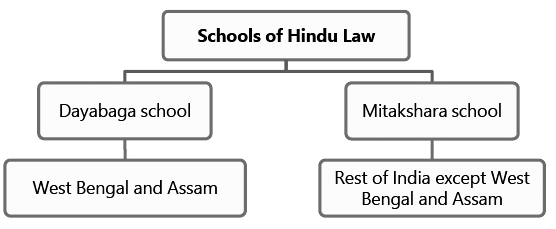

The basic difference between the two schools of Hindu law with regard to succession is as follows:

(iii) Company [Section 2(17)]

For all purposes of the Act, the term ‘Company’, has a much wider connotation than that under the Companies Act. Under the Act, the expression ‘Company’ means:

- any Indian company as defined in section 2(26); or

- any body corporate incorporated by or under the laws of a country outside India, i.e., any foreign company; or

- any institution, association or body which is assessable or was assessed as a company for any assessment year under the Indian Income-tax Act, 1922 or for any assessment year commencing on or before 1.4.1970 under the present Act; or

- any institution, association or body, whether incorporated or not and whether Indian or non-Indian, which is declared by a general or special order of the CBDT to be a company for such assessment years as may be specified in the CBDT’s order.

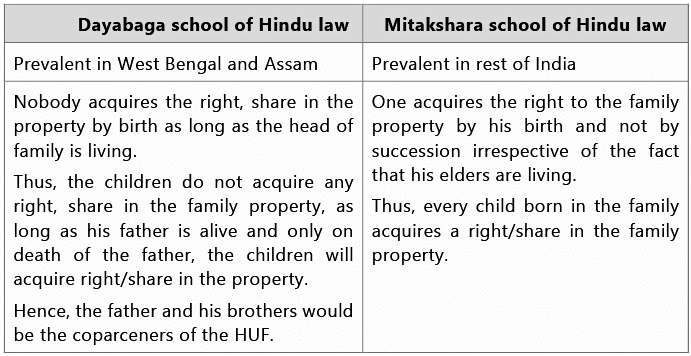

Classes of Companies

- Domestic company [Section 2(22A)] - It means an Indian company or any other company which, in respect of its income liable to income-tax, has made the prescribed arrangements for the declaration and payment of dividends (including dividends on preference shares) within India, payable out of such income.

- Indian company [Section 2(26)] - Two conditions should be satisfied so that a company can be regarded as an Indian company -

- the company should have been formed and registered under the Companies Act, 1956 2 and

- the registered office or the principal office of the company should be in India.

- The expression ‘Indian Company’ also includes the following provided their registered or principal office is in India:

- a corporation established by or under a Central, State or Provincial Act (like Financial Corporation or a State Road Transport Corporation);

- an institution or association or body which is declared by the Board to be a company under section 2(17)(iv);

- a company formed and registered under any law relating to companies which was or is in force in any part of India [other than Jammu and Kashmir and Union territories mentioned in sub-clause (v) below];

- in the case of Jammu and Kashmir, a company formed and registered under any law for the time being in force in Jammu and Kashmir;

- in the case of any of the Union territories of Dadra and Nagar Haveli, Daman and Diu, and Pondicherry or State of Goa, a company formed and registered under any law for the time being in force in that Union territory or State, respectively.

- Foreign company [Section 2(23A)] - Foreign company means a company which is not a domestic company

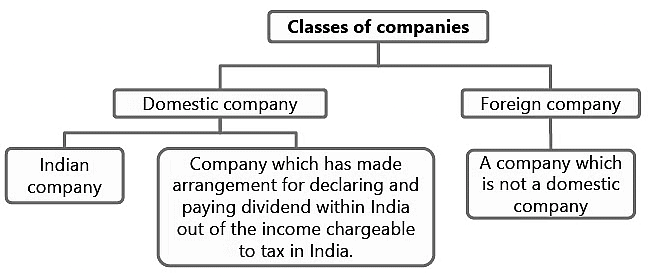

(iv) Firm [Section 2(23)]

- The terms ‘firm’, ‘partner’ and ‘partnership’ have the same meanings as assigned to them in the Indian Partnership Act, 1932. In addition, the definitions also include the terms limited liability partnership and a partner of limited liability partnership as they have been defined in the Limited Liability Partnership Act, 2008. In an LLP, since liability of the partners is limited to their agreed contribution therein, it contains elements of both a corporate structure as well as a partnership firm structure.

- However, for income-tax purposes a minor admitted to the benefits of an existing partnership would also be treated as partner.

(v) Association of Persons

(AOP) When persons combine together for promotion of joint enterprise they are assessable as an AOP, if they do not in law constitute a partnership. In order to constitute an association, persons must join for a common purpose or action and their object must be to produce income; it is not enough that the persons receive the income jointly. Co-heirs, co-legatees or co-donees joining together for a common purpose or action would be chargeable as an AOP. For e.g., Mr. Yash, AB & Co. (Firm) and X (P) Ltd. join together to carry on construction activity otherwise than as a partnership firm, such an association will be recognized as an association of persons.

(vi) Body of Individuals (BOI)

- It denotes the status of persons like executors or trustees who merely receive the income jointly and who may be assessable in like manner and to the same extent as the beneficiaries individually. Thus, co-executors or co-trustees are assessable as a BOI as their title and interest are indivisible. Income-tax shall not be payable by an assessee in respect of the receipt of share of income by him from BOI and on which the tax has already been paid by such BOI. For e.g., mutual trade associations, members club, etc.

- Section 2(31) further explains that an association of persons or a body of individuals shall be treated as a person, whether or not it was formed with the object of deriving income, profits or gains. Accordingly, even if such entities have been formed not for earning any income/ profit still they are "person" for the purpose of the Act and are covered by the provisions of the Act.

Difference between AOP and BOI:

- In case of a BOI, only individuals can be the members, whereas in case of AOP, any person can be its member i.e. entities like company, firm etc. can be the member of AOP but not of BOI.

- In case of an AOP, members voluntarily come together with a common will for a common intention or purpose, whereas in case of BOI, such common will may or may not be present.

Local Authority

- The term "Local Authority" means a municipal committee, district board, body of port commissioners or other authority legally entitled to or entrusted by the Government with the control or management of a municipal or local fund.

- Note: A local authority is taxable in respect of that part of its income which arises from any business carried on by it in so far as that income does not arise from the supply of a commodity or service within its own jurisdictional area. However, income arising from the supply of water and electricity even outside the local authority's own jurisdictional area is exempt from tax.

(viii) Artificial Juridical Persons

Artificial Juridical Persons are the entities which are not natural persons but are separate entities in the eyes of law. This is a residual category could cover all artificial persons with a juristic personality not falling under any other category of persons. Deities, Bar Council, Universities are some important examples of Artificial Juridical Persons.

Income [Section 2(24)]

Definition of Income

The definition of income as per the Income-tax Act, 1961 begins with the words "Income includes". Therefore, it is an inclusive definition and not an exhaustive one. Such a definition does not confine the scope of income but leaves room for more inclusions within the ambit of the term.

Section 2(24) of the Act gives a statutory definition of income. The following items of receipts are specifically included in the said definition:

- Profits and gains;

- Dividends;

- Voluntary contributions received by a trust/institution created wholly or partly for charitable or religious purposes or by certain research association or universities and other educational institutions or hospitals and other medical institutions or an electoral trust;

- The value of any perquisite or profit in lieu of salary taxable under section 17(2)/(3);

- Any special allowance or benefit, other than the perquisite included above, specifically granted to the assessee to meet expenses wholly, necessarily and exclusively for the performance of the duties of an office or employment of profit;

- Any allowance granted to the assessee to meet his personal expenses at the place where the duties of his office or employment of profit are ordinarily performed by him or at a place where he ordinarily resides or to compensate him for the increased cost of living;

- The value of any benefit or perquisite whether convertible into money or not, obtained from a company either by a director or by a person who has a substantial interest in the company or by a relative of the director or such person and any sum paid by any such company in respect of any obligation which, but for such payment, would have been payable by the director or other person aforesaid;

- The value of any benefit or perquisite, whether convertible into money or not, which is obtained by any representative assessee3 or by any beneficiary and any amount paid by the representative assessee for the benefit of the beneficiary which the beneficiary would have ordinarily been required to pay.

- Profits and gains of business or profession chargeable to tax under section 28(ii)/(iii)/(iiia)/(iii b)/(iiic)/(v)/(va);

- Deemed profits chargeable to tax under section 41 or section 59;

- The value of any benefit or perquisite taxable under section 28(iv);

- Any capital gains chargeable under section 45;

- Any winnings from lotteries, crossword puzzles, races including horse races, card games and other games of any sort or from gambling, or betting of any form or nature whatsoever. For this purpose,

- "Lottery" includes winnings from prizes awarded to any person by draw of lots or by chance or in any other manner whatsoever, under any scheme or arrangement by whatever name called;

- "Card game and other game of any sort" includes any game show, an entertainment programme on television or electronic mode, in which people compete to win prizes or any other similar game;

- Any sum received by the assessee from his employees as contributions to any provident fund (PF) or superannuation fund or Employees State Insurance Fund (ESI) or any other fund for the welfare of such employees;

- Any sum received under a Keyman insurance policy including the sum allocated by way of bonus on such policy will constitute income;

"Keyman insurance policy" means a life insurance policy taken by a person on the life of another person where the latter is or was an employee of former or is or was connected in any manner whatsoever with the former's business. - It also includes such policy which has been assigned to a person with or without any consideration, at any time during the term of the policy.

- Fair market value of inventory as on the date of its conversion into or treatment as a capital asset under section 28(va);

- Any consideration received for issue of shares as exceeds the fair market value of the shares [Section 56(2)(viib)];

- Any sum of money received as advance, if such sum is forfeited consequent to failure of negotiation for transfer of a capital asset [Section 56(2)(ix)];

- Any sum of money or value of property received without consideration or for inadequate consideration by any person [Section 56(2)(x)];

- Any compensation or other payment, due to or received by any person, in connection with termination of his employment or the modification of the term and conditions relating thereto [Section 56(2)(xi)];

- Sum received, including the amount allocated by way of bonus, under a LIP other than under a ULIP and keyman insurance policy, which is not exempt u/s 10(10D), to the extent the same exceeds the aggregate of the premium paid during the term of the policy, and not claimed as deduction under any other provision of the Act [Section 56(2)(xiii)];

Assistance in the form of a subsidy or grant or cash incentive or duty drawback or waiver or concession or reimbursement, by whatever name called, by the Central Government or a State Government or any authority or body or agency in cash or kind to the assessee is included in the definition of income. However, subsidy or grant or reimbursement which has been taken into account for determination of the actual cost of the depreciable asset in accordance with Explanation 10 to section 43(1) shall not be included in the definition of income.

Concept of Income under the Income-tax Act, 1961

- Regular receipt vis-a-vis casual receipt: Income, in general, means a periodic monetary return which accrues or is expected to accrue regularly from definite sources. However, under the Income-tax Act, 1961, even certain casual receipts which do not arise regularly are treated as income for tax purposes e.g. Winnings from lotteries, crossword puzzles.

- Revenue receipt vis-a-vis Capital receipt: Income normally refers to revenue receipts. Capital receipts are generally not included within the scope of income in general parlance. However, the Income-tax Act, 1961 has specifically included certain capital receipts within the definition of income e.g., Capital gains i.e., gains on sale of a capital assets like land, jewellery.

- Net receipt vis-a-vis Gross receipt: Income means net receipts and not gross receipts. Net receipts are arrived at after deducting the expenditure incurred in connection with earning such receipts. The expenditure which can be deducted while computing income under each head is prescribed under the Income-tax Act, 1961. Income from certain eligible businesses/ professions is also determined on presumptive basis i.e., as a certain percentage of gross receipts.

- Due basis vis-a-vis receipt basis: Income is taxable either on due basis or receipt basis. For computing income under the heads "Profits and gains of business or profession" and "Income from other sources", the method of accounting regularly employed by the assessee should be considered, which can be either cash system or mercantile system. Some receipts are taxable only on receipt basis, like, income by way of interest received on compensation or enhanced compensation.

- Application of Income vis-a-vis Diversion of Income: Application of income means to discharge an obligation (which is gratuitous or self-imposed) after such income reaches the assessee. Where by virtue of an obligation by overriding title, income is diverted before it reaches the assessee, it is known as diversion of income. In case of the former, the income would be taxable in the hands of the person who applies it, whereas in the case of the latter, it is not taxable (i.e., even if the assessee were to collect the income he does so on behalf of the person to whom it is payable).

Concept of revenue and capital receipts

- Students should carefully study the various items of receipts included in the definition of income. Some of them like capital gains are not revenue receipts. However, since they have been included in the definition, they are chargeable as income under the Act. The concept of revenue and capital receipts is discussed hereunder

- The Act contemplates a levy of tax on income and not on capital and hence it is very essential to distinguish between capital and revenue receipts. Capital receipts cannot be taxed, unless they fall within the scope of the definition of "income" and so the distinction between capital and revenue receipts is material for tax purposes.

- Certain capital receipts which have been specifically included in the definition of income are compensation for modification or termination of services, income by way of capital gains etc.

- It is not possible to lay down any single test as infallible or any single criterion as decisive, final and universal in application to determine whether a particular receipt is capital or revenue in nature. Hence, the capital or revenue nature of the receipt must be determined with reference to the facts and circumstances of each case.

Criteria for determining whether a receipt is capital or revenue in nature

The following are some of the important criteria which may be applied to distinguish between capital and revenue receipts.

- Fixed capital or Circulating capital: A receipt referable to fixed capital would be a capital receipt whereas a receipt referable to circulating capital would be a revenue receipt. The former is not taxable while the latter is taxable. Tangible and intangible assets which the owner keeps in his possession for making profits are in the nature of fixed capital. The circulating capital is one which is turned over and yields income or loss in the process.

- Income from transfer of capital asset or trading asset: Profits arising from the sale of a capital asset are chargeable to tax as capital gains under section 45 whereas profits arising from the sale of a trading asset being of revenue nature are taxable as income from business under section 28 provided that the sale is in the regular course of assessee's business or the transaction constitutes an adventure in the nature of trade.

Capital Receipts vis-a-vis Revenue Receipts: Tests to be applied

- Transaction entered into the course of business: Profits arising from transactions which are entered into in the course of the business regularly carried on by the assessee, or are incidental to, or associated with the business of the assessee would be revenue receipts chargeable to tax.

Example: A banker’s or financier’s dealings in foreign exchange or sale of shares and securities, a shipbroker’s purchase of ship in his own name, a share broker’s purchase of shares on his own account would constitute transactions entered and yielding income in the ordinary course of their business. Whereas building and land would constitute capital assets in the hands of a trader in shares, the same would constitute stock-in-trade in the hands of a property dealer.

- Profit arising from sale of shares and securities: In the case of profit arising from the sale of shares and securities, the nature of the profit has to be ascertained from the motive, intention or purpose with which they were bought. If the shares were acquired as an investor or with a view to acquiring a controlling interest or for obtaining a managing or selling agency or a directorship, the profit or loss on their sale would be of a capital nature; but if the shares were acquired in the ordinary course of business as a dealer in shares, it would constitute his stock-in-trade. If the shares were acquired with speculative motive, the profit or loss (although of a revenue nature) would have to be dealt with separately from the profit or loss of other businesses.

- A single transaction - Can it constitute business? Even a single transaction may constitute a business or an adventure in the nature of trade even if it is outside the normal course of the assessee’s business. Repetition of such transactions is not necessary. Thus, a bulk purchase followed by a bulk sale or a series of retail sales or bulk sale followed by a series of retail purchases would constitute an adventure in the nature of trade and consequently, the income arising therefrom would be taxable. Purchase of any article with no intention to resell it, but resold under changed circumstances would be a transaction of a capital nature and capital gains would arise. However, where an asset is purchased with the intention to resell it, the question whether the profit on sale is capital or revenue in nature depends upon (i) the conduct of the assessee, (ii) the nature and quantity of the article purchased, (iii) the nature of the operations involved, (iv) whether the venture is on capital or revenue account, and (v) other related circumstances of the case.

- Liquidated damages: Receipt of liquidated damages directly and intimately linked with the procurement of a capital asset, which lead to delay in coming into existence of the profit-making apparatus, is a capital receipt. The amount received by the assessee towards compensation for sterilization of the profit earning source is not in the ordinary course of business. Hence, it is a capital receipt in the hands of the assessee.

- Compensation on termination of agency/service contract: Where an assessee receives compensation on termination of the agency business being the only source of income, the receipt is of capital nature, but taxable under section 28(ii)(c). However, where the assessee has a number of agencies and one of them is terminated and compensation is received therefor, the receipt would be of a revenue nature since taking up an agency and exploiting the same for earning income is in the ordinary course of business. The loss of one agency would be made good by profit from another agency. Compensation received from the employer or from any person for premature termination of the service contract is a capital receipt, but is taxable as profit in lieu of salary under section 17(3) or as income from other sources under section 56(2)(xi), respectively. Compensation received or receivable in connection with the termination or the modification of the terms and conditions of any contract relating to its business shall be taxable as business income.

- Gifts: Normally, gifts constitute a capital receipt in the hands of the recipient. However, certain gifts are brought within the purview of income-tax, for example, receipt of property without consideration is brought to tax under section 56(2)(x). For example, any sum of money or value of property received without consideration or for inadequate consideration by any person, other than a relative, is chargeable under the head “Income from Other Sources”.

India [Section 2(25A)]

The term 'India' means –

- the territory of India as per Article 1 of the Constitution,

- its territorial waters, seabed and subsoil underlying such waters,

- continental shelf,

- exclusive economic zone or

- any other specified maritime zone and the air space above its territory and territorial waters.

Specified maritime zone means the maritime zone as referred to in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976.

Agricultural income [Section 2(1A)]

Agricultural income definition is very wide and covers the income of not only the cultivators but also the land holders who might have rented out the lands. Agricultural income may be received in cash or in kind.

Agricultural income may arise in any one of the following three ways

It may be rent or revenue derived from land situated in India and used for agricultural purposes.

- It may be income derived from such land by

- agriculture or

- the performance of a process ordinarily employed by a cultivator or receiver of rent in kind to render the produce fit to be taken to the market or

- the sale, by a cultivator or receiver of rent in kind, of such agricultural produce raised or received by him, in respect of which no process has been performed other than a process of the nature mentioned in point (b) above. (3) Lastly, agricultural income may be derived from any farm building required for agricultural operations.

Now let us take a critical look at the following aspects:

Rent or revenue derived from land situated in India and used for agricultural purposes: The following three conditions have to be satisfied for income to be treated as agricultural income:

- Rent or revenue should be derived from land;

- land has to be situated in India (If agricultural land is situated in a foreign country, the entire income would be taxable); and

- land should be used for agricultural purposes.

The amount received in money or in kind, by one person from another for right to use land is termed as Rent. The rent can either be received by the owner of the land or by the original tenant from the sub-tenant. It implies that ownership of land is not necessary. Thus, the rent received by the original tenant from sub-tenant would also be agricultural income subject to the other conditions mentioned above. The scope of the term “Revenue” is much broader than rent. It includes income other than rent. For example, fees received for renewal for grant of land on lease would be revenue derived from land.

Income derived from such land by

- Agriculture The term “Agriculture” has not been defined in the Act. However, cultivation of a field involving human skill and labour on the land can be broadly termed as agriculture.

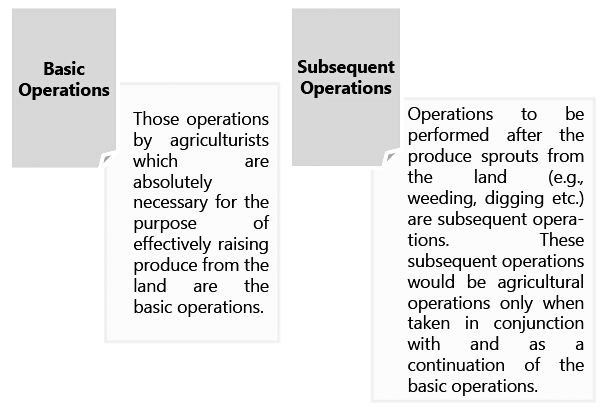

- “Agriculture” means tilling of the land, sowing of the seeds and similar operations. It involves basic operations and subsequent operations.

Process ordinarily employed to render the produce fit to be taken to the market: Sometimes, to make the agricultural produce a saleable commodity, it becomes necessary to perform some kind of process on the produce. The income from the process employed to render the produce fit to be taken to the market would be agricultural income. However, it must be a process ordinarily employed by the cultivator or receiver of rent in kind and the process must be applied to make the produce fit to be taken to the market.

- The ordinary process employed to render the produce fit to be taken to market includes thrashing, winnowing, cleaning, drying, crushing etc. For example, the process ordinarily employed by the cultivator to obtain the rice from paddy is to first remove the hay from the basic grain, and thereafter to remove the chaff from the grain. The grain has to be properly filtered to remove stones etc. and finally the rice has to be packed in gunny bags for sale in the market. After such process, the rice can be taken to the market for sale. This process of making the rice ready for the market may involve manual operations or mechanical operations. All these operations constitute the process ordinarily employed to make the product fit for the market. The produce must retain its original character in spite of the processing unless there is no market for selling it in that condition.

- However, if marketing process is performed on a produce which can be sold in its raw form, income derived therefrom is partly agricultural income and partly business income.

Sale of such agricultural produce in the market: Any income from the sale of any produce to the cultivator or receiver of rent-in kind is agricultural income provided it is from the land situated in India and used for agricultural purposes. However, if the produce is subjected to any process other than process ordinarily employed to make the produce fit for market, the income arising on sale of such produce would be partly agricultural income and partly non-agricultural income.

- Similarly, if other agricultural produce like tea, cotton, tobacco, sugarcane etc. are subjected to manufacturing process and the manufactured product is sold, the profit on such sale will consist of agricultural income as well as business income. That portion of the profit representing agricultural income will be exempted.

Apportionment of Income between business income and agricultural income

- Rules 7, 7A, 7B & 8 of Income-tax Rules, 1962 provide the basis of apportionment of income between agricultural income and business income. (i) Rule 7 - Income from growing and manufacturing of any product - Where income is partially agricultural income and partially income chargeable to income-tax as business income, the market value of any agricultural produce which has been raised by the assessee or received by him as rent in kind and which has been utilised as raw material in such business or the sale receipts of which are included in the accounts of the business shall be deducted. No further deduction shall be made in respect of any expenditure incurred by the assessee as a cultivator or receiver of rent in kind.

Determination of market value - There are two possibilities here:

The agricultural produce is capable of being sold in the market either in its raw stage or after application of any ordinary process to make it fit to be taken to the market. In such a case, the value calculated at the average price at which it has been so sold during the relevant previous year will be the market value. It is possible that the agricultural produce is not capable of being ordinarily sold in the market in its raw form or after application of any ordinary process. In such case the market value will be the total of the following:

- The expenses of cultivation;

- The land revenue or rent paid for the area in which it was grown; and

- Such amount as the Assessing Off icer finds having regard to the circumstances in each case to represent at reasonable profit.

ILLUSTRATION 1

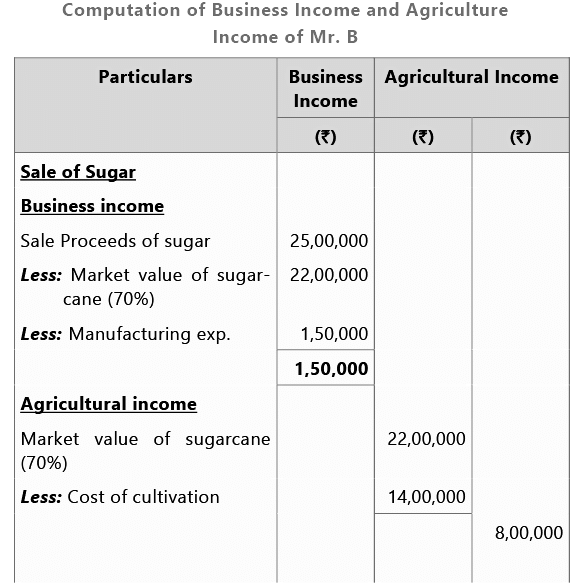

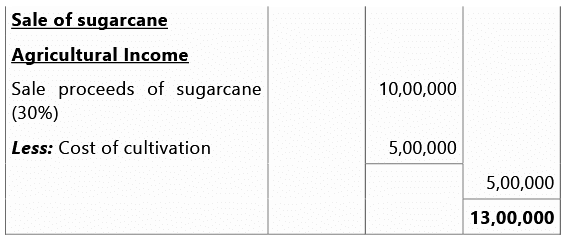

Mr. B grows sugarcane and uses the same for the purpose of manufacturing sugar in his factory. 30% of sugarcane produce is sold for ` 10 lakhs, and the cost of cultivation of such sugarcane is ` 5 lakhs. The cost of cultivation of the balance sugarcane (70%) is ` 14 lakhs and the market value of the same is ` 22 lakhs. After incurring ` 1.5 lakhs in the manufacturing process on the balance sugarcane, the sugar was sold for ` 25 lakhs. Compute B’s business income and agricultural income.

Ans: Computation of Business Income and Agriculture Income of Mr. B

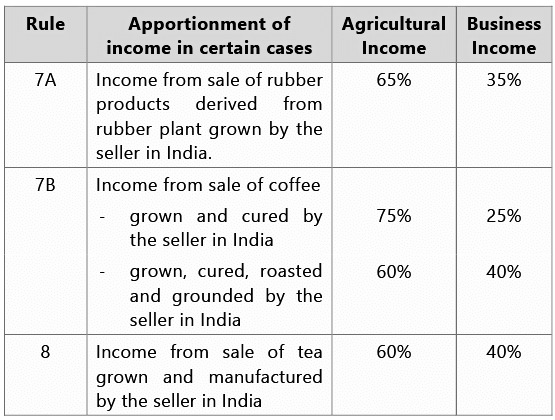

Rule 7A – Income from growing and manufacturing of rubber - This rule is applicable when income derived from the sale of centrifuged latex or cenex or latex based crepes or brown crepes or technically specified block rubbers manufactured or processed from field latex or coagulum obtained from rubber plants grown by the seller in India. In such cases, 35% profits on sale is taxable as business income under the head “Profits and gains from business or profession”, and the balance 65% is agricultural income which is exempt.

ILLUSTRATION 2

Mr. C manufactures latex from the rubber plants grown by him in India. These are then sold in the market for ` 30 lakhs. The cost of growing rubber plants is ` 10 lakhs and that of manufacturing latex is ` 8 lakhs. Compute his total income.

Ans: The total income of Mr. C comprises of agricultural income and business income. Total profits from the sale of latex= ` 30 lakhs – ` 10 lakhs – ` 8 lakhs= ` 12 lakhs.

Agricultural income = 65% of ` 12 lakhs = ` 7.8 lakhs

Business income = 35% of ` 12 lakhs = ` 4.2 lakhs

Rule 7B – Income from growing and manufacturing of coffee

- In case of income derived from the sale of coffee grown and cured by the seller in India, 25% profits on sale is taxable as business income under the head “Profits and gains from business or profession”, and the balance 75% is agricultural income and is exempt.

- In case of income derived from the sale of coffee grown, cured, roasted and grounded by the seller in India, with or without mixing chicory or other flavoring ingredients, 40% profits on sale is taxable as business income under the head “Profits and gains from business or profession”, and the balance 60% is agricultural income and is exempt.

Rule 8 - Income from growing and manufacturing of tea - This rule applies only in cases where the assessee himself grows tea leaves and manufactures tea in India. In such cases 40% profits on sale is taxable as business income under the head “Profits and gains from business or profession”, and the balance 60% is agricultural income and is exempt.

Income from farm building: Income from the farm building which is owned and occupied by the receiver of the rent or revenue of any such land or occupied by the cultivator or the receiver of rent in kind, of any land with respect to which, or the produce of which, any process discussed above is carried on, would be agricultural income. However, the income arising from the use of such farm building for any purpose (including letting for residential purpose or for the purpose of business or profession) other than agriculture referred in (1) & (2) of para 3.6 in page 1.35 would not be agricultural income. Further, the income from such farm building would be agricultural income only if the following conditions are satisfied:

- The building should be on or in the immediate vicinity of the land; and

- The receiver of the rent or revenue or the cultivator or the receiver of rent in kind should, by reason of his connection with such land require it as a dwelling house or as a store house.

In addition to the above conditions any one of the following two conditions should also be satisfied:

- The land should either be assessed to land revenue in India or be subject to a local rate assessed and collected by the officers of the Government as such or;

- Where the land is not so assessed to land revenue in India or is not subject to local rate:

- It should not be situated in any area as comprised within the jurisdiction of a municipality or a cantonment board and which has a population not less than 10,000 or

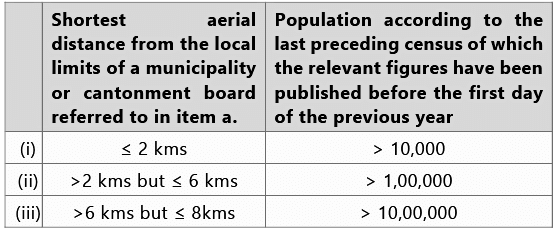

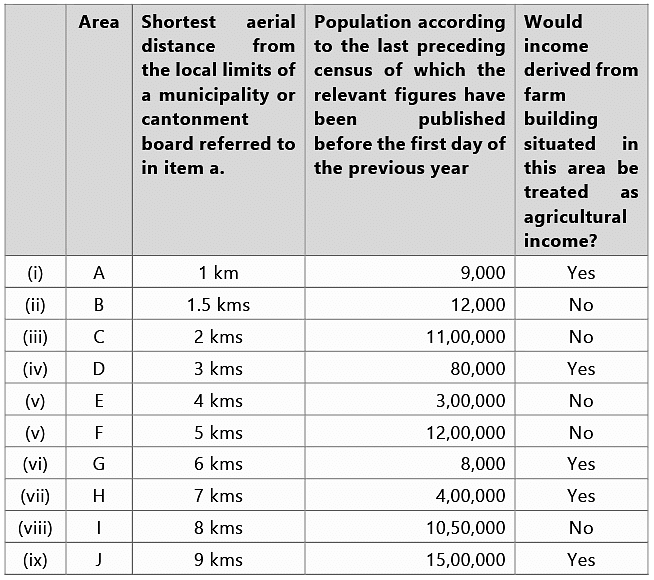

- It should not be situated in any area within such distance, measured aerially, in relation to the range of population as shown hereunder –

Example:

Example:

Would income arising from transfer of agricultural land situated in urban area be agricultural income?

No, as per Explanation 1 to section 2(1A), the capital gains arising from the transfer of urban agricultural land would not be treated as agricultural income under section 10 but will be taxable under section 45.

Previous Year and Assessment Year

Assessment year The term has been defined under section 2(9). This means a period of 12 months commencing on 1st April every year. The year in which income is earned is the previous year and such income is taxable in the immediately following year which is the assessment year. Income earned in the previous year 2023-24 is taxable in the assessment year 2024-25. Assessment year always starts from 1st April and it is always a period of 12 months.

|

38 videos|118 docs|12 tests

|

FAQs on Basic Concepts - Taxation for CA Intermediate

| 1. What is the meaning of tax? |  |

| 2. What is the purpose of income tax? |  |

| 3. How is income tax calculated? |  |

| 4. What are some examples of deductions that can lower taxable income for income tax purposes? |  |

| 5. What is the difference between tax evasion and tax avoidance? |  |