Overhead Costing | Management Optional Notes for UPSC PDF Download

The third important element of costs of any product or service is overheads. Overheads may be manufacturing or non-manufacturing. Later we briefly discuss the classification of overheads. Before that let us see what are overheads? Defining overheads particularly focuses on the concept of direct and indirect expenses which in turn depends on the traceability of the expenses with the product or service. In other words, expenses that cannot be directly traceable to any product or service are known as overheads. Simply, overheads are sum of all indirect expenses i.e

Overheads = Indirect materials+ Indirect labour + Indirect expenses

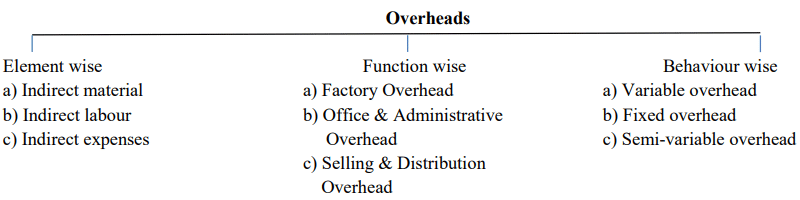

Classification of overheads: In general, overheads may be classified as

The syllabus covers two main classifications of overhead costs: functional and behavioral.

Functional classification divides overheads into three categories: Factory, Office and Administrative, and Selling and Distribution. Factory overheads pertain directly to manufacturing processes, while the other two categories are non-manufacturing. Examples of factory overheads include rent and taxes for manufacturing facilities, and indirect wages. Office and administrative overheads include expenses like salaries for office staff, while selling and distribution overheads encompass costs such as sales commissions.

- Behavioural classification categorizes overheads based on their behavior into three types: variable, fixed, and semi-variable.

- Variable overheads fluctuate directly with the level of activity, such as indirect wages and sales commissions.

- Fixed overheads remain constant regardless of activity levels, like factory rent.

- Semi-variable overheads vary with activity levels but not proportionately, for instance, repair and maintenance costs and electricity charges.

When it comes to segregating semi-variable costs into fixed and variable components, several methods are used, including:

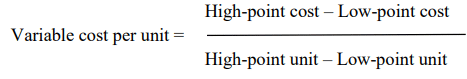

- High-point and Low-point method

- Simultaneous equation method

- Methods of Least Square

- Scatter Diagram method

The syllabus focuses on the first two methods (i and ii) for solving problems at the preliminary level. To illustrate, consider the following example with units produced and total semi-variable costs.

Sol: (i) Under High-point and Low- point method-

Sol: (i) Under High-point and Low- point method-

So, variable cost per unit =( Rs 8000- Rs 5000)/ (4000- 1000) = Rs 3000/3000 = Re 1 per unit

Fixed cost = Total cost- variable cost per unit at any level can be applied

= Rs 8000 – 4000 x 1 = 8000- 4000 = Rs 4000.

(ii) Under simultaneous equation method – Here we have to form two equations to find fixed and variable portion of semi-variable cost.

Let, a = variable cost per unit and b = fixed cost, applying we get

1000a +b = 5000 ……………..(i)

4000a +b = 8000 …………….(ii) ,

Solving we get, a= 1 and b= 4000.

Factory overhead costing involves several steps:

- Collection of factory overhead costs: This step involves gathering all the overhead costs incurred in the manufacturing process.

- Allocation of overhead costs: In this step, overhead costs are allocated to specific cost centers within the manufacturing process.

- Apportionment or distribution of overhead costs: Apportionment is the process of distributing overhead costs to various cost centers when direct identification is not feasible. This distribution is based on logical criteria, such as machine hours or labor hours.

- Re-distribution of service department costs to production departments: Sometimes, certain costs incurred by service departments (like maintenance or administrative departments) need to be redistributed to production departments based on their usage of these services.

- Absorption of overheads: Finally, overhead costs are absorbed into the cost of production. This step involves incorporating overhead costs into the unit cost of the goods produced.

Allocation and apportionment are crucial aspects of factory overhead costing. Allocation involves assigning overhead costs directly to specific cost centers, while apportionment involves distributing overhead costs among various cost centers when direct allocation is not possible. Cost centers can include individuals, locations, equipment, or groups used for cost control purposes within the manufacturing process. These cost centers can be classified as production cost centers or service cost centers. During the apportionment or distribution of overhead costs, logical bases are utilized. These may include factors such as machine hours, labor hours, or other relevant indicators of resource usage within the manufacturing process.

Here are various types of expenses and their respective bases of apportionment:

- Rent, rates, and taxes: Apportioned based on the area occupied or floor space.

- Insurance of Stock: Apportioned based on the value of stock.

- Insurance of other fixed assets: Apportioned based on the value of fixed assets.

- Depreciation of fixed assets: Apportioned based on the value of fixed assets.

- Stores overhead: Apportioned based on the value of materials.

- Indirect wages: Apportioned based on direct wages.

- Indirect materials: Apportioned based on direct materials.

- Lighting/Electricity expenses: Apportioned based on wattage multiplied by working hours, number of light points, or space occupied.

- Power: Apportioned based on kilowatts multiplied by working hours or horsepower of machines.

- Canteen expenses: Apportioned based on the number of workers.

- Supervisor’s salary: Apportioned based on the number of workers.

- Employee welfare expenses: Apportioned based on the number of workers.

- Workers’ compensation insurance: Apportioned based on direct wages.

- General expenses: Apportioned based on working hours or direct wages.

- Repair & maintenance of assets: Apportioned based on the value of assets.

The above is illustrative and not exhaustive.

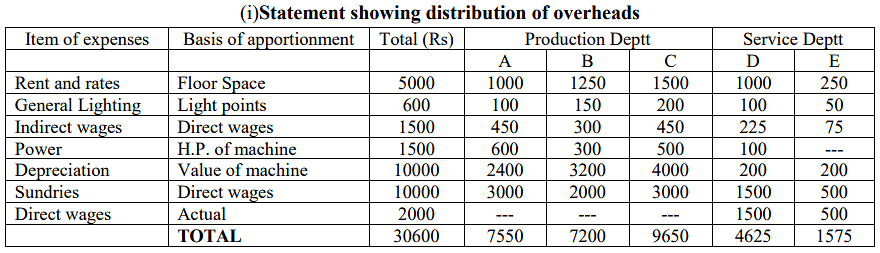

Let us discuss the distribution of overheads and re-distribution of service department cost to production department with an illustration.

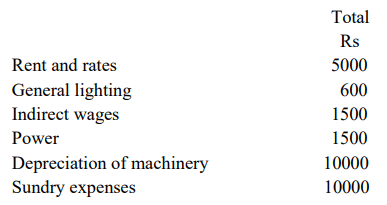

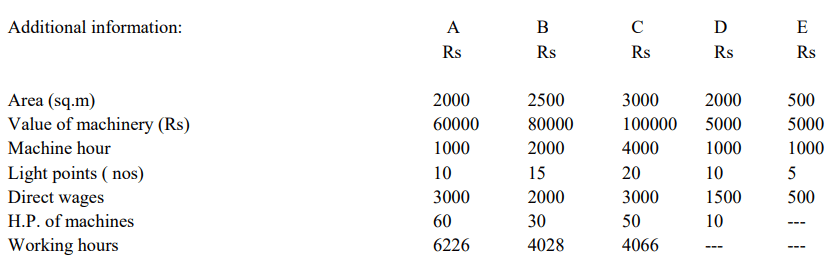

Example 1: P.Ltd is a manufacturing company having three production departments A,B and C, and two service departments X and Y. The following is the budget for December, 2019:

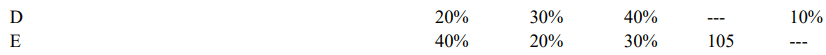

The expenses of D and E are allocated as follows:

You are required to do the following:

- A statement showing distribution of overheads

- A statement showing re-distribution of service department cost to production department

- Compute overhead recovery rate

- Ascertain total cost of an article if material cost is Rs 50, labour cost is Rs 30 and it passes through departments A,B and C for 4,5 and 3 hours respectively.

Sol: We shall discuss the theory while solving the problem:

Note: While direct wages of production departments are included in the prime cost, direct wages of service departments, despite being direct in nature, are treated as indirect for production departments since service departments do not directly produce goods or services. Similarly, direct materials of service departments are also treated as indirect for production departments.

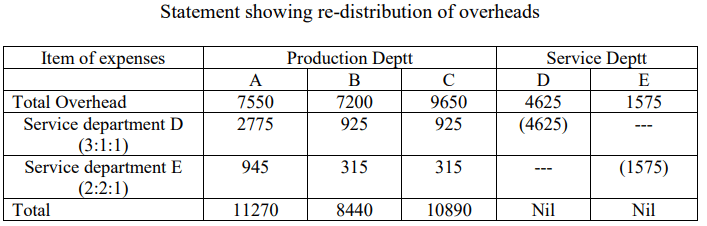

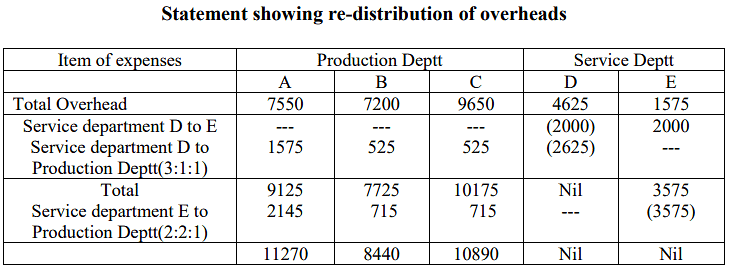

Re-distribution of service department costs to production departments involves various methods based on the services rendered by the service department:

- Direct service to production department only.

- One-way service to both production and service departments, where a service department provides service to another service department in addition to the production department.

- Reciprocal service provided by service departments, where service departments offer services to each other.

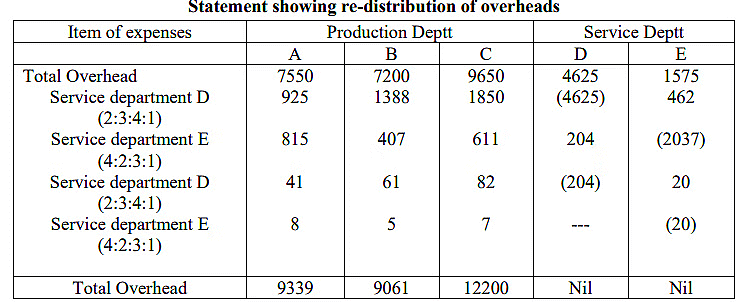

Case-I: Using the above illustration, if service departments D and E provide services in the ratio of 3:1:1 and 2:2:1 to departments A, B, and C respectively, the re-distribution statement would be as follows:

Case-II- Service department D renders service to E worth Rs 2000 and the balance to A,B and C in the ratio of 3:1:1, while service department E provides service only to A, B and C in the ratio of 2:2:1. In that case redistribution will be as under-

Case-III: Reciprocal services between service departments, as outlined in the illustration, present two feasible methods for redistribution:

- Repeated distribution method: This approach involves initiating the redistribution with the service department incurring the highest cost. The costs are then distributed to production and other service departments according to the provided ratio. This process iterates until all service department costs are allocated.

- Simultaneous equation method: Alternatively, this method involves setting up simultaneous equations based on the relationships between service departments. By solving these equations, the costs can be accurately redistributed among the production and service departments.

In the last step, share of cost of D from E will be distributed to A,B and C as it is negligible.

Simultaneous equation method- In this case we first construct two simultaneous equations to find the total cost of each service department, then the same will be distributed.

Let,

- a = Total cost of department D after receiving 10% share of E department’s cost

- b = Total cost of department E after receiving 10% share of D department’s cost

Then, a = 4625 + 0.10 b ……………………..(i)

- b = 1575 + 0.10 a ……………………..(ii) solving we get a = 4831 and b = 2058

Absorption or recovery of overheads involves charging each department's total overhead costs, including its own costs, joint costs, and service department costs, to cost units based on a reasonable basis. This process is crucial in allocating overhead costs effectively. The method chosen for overhead absorption depends on the production process adopted in each department. Several methods for absorption include:

Absorption or recovery of overheads involves charging each department's total overhead costs, including its own costs, joint costs, and service department costs, to cost units based on a reasonable basis. This process is crucial in allocating overhead costs effectively. The method chosen for overhead absorption depends on the production process adopted in each department. Several methods for absorption include:

- Production unit method: Applicable when producing similar products.

- Percentage of value of raw material: Suitable for industries where raw material cost is a significant factor.

- Percentage of Direct labour cost: Applicable in labor-intensive production processes.

- Labour hour rate method: Appropriate for labor-intensive production processes based on labor time.

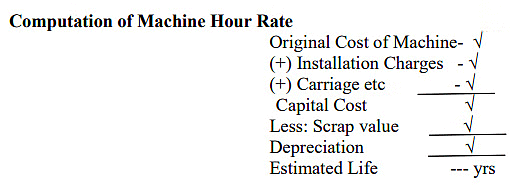

- Machine hour rate method: Used in machine-based production processes.

The selection of the overhead absorption method depends on the specific characteristics of the production process within each department. For instance, labor hour rate method might be preferred in labor-intensive environments, while machine hour rate method would be more suitable in machine-based production processes. In the provided illustration, we will calculate the overhead absorption or recovery rate based on the given working hours. The absorption rate can be calculated separately or within the redistribution statement itself.

The formula for overhead absorption rate is:

- Overhead absorption rate = (Total overheads of the cost center) / quantum of absorption base.

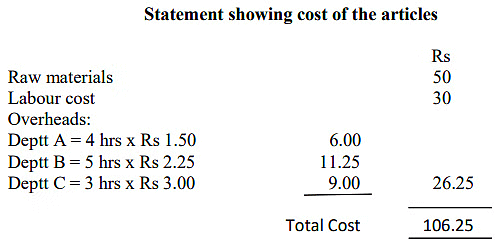

Here, Overhead absorption rate will be –

- Department A = Rs 9339/6226 hrs = Rs 1.50

- Department B = Rs 9061/4026hrs = Rs 2.25

- Department C = Rs 12200/4066hrs = Rs 3.00

After determining the overhead absorption rate the cost of product is determined as below. In the give illustration the same is computed as below:

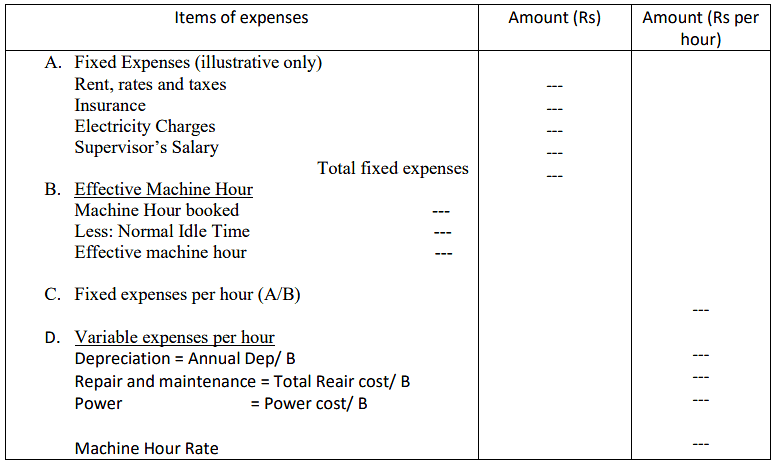

Absorption of overheads on the basis of Machine Hour Rate: Where the production in the factory is purely based on machine work, absorption rate will be adopted is machine hour rate. A standard format of which may be followed as below:

Comprehensive machine hour rate- In case of comprehensive machine hour rate, wages of operator will be added with the above determined rate. This is mainly because when the production process is entirely machine operated except operators are engaged for its running, then in that case instead of charging operator’s wages as direct wages the same is added with the overhead cost to find comprehensive rate.

Over or Under Absorption of Overheads: Let's first outline the four types of overhead absorption rates:

- Normal rate: Calculated as Actual overhead incurred divided by Actual quantum of absorption base.

- Pre-determined Rate: Computed by dividing Budgeted overhead by Budgeted quantum of absorption base.

- Blanket Overhead Rate: Derived from Total Budgeted overhead divided by Total quantum of estimated base.

- Departmental Overhead Rate: Calculated as the Total Budgeted or estimated overhead for each department divided by the Departmental absorption base.

When overhead absorption is based on historical costs, there is typically no over or under absorption. However, when absorption is based on estimated overheads, using a predetermined rate, the potential for over or under absorption arises. The blanket rate is generally utilized for single-product organizations, while the departmental overhead rate is more suitable for multiple-product organizations. Over absorption of overhead occurs when Estimated Absorbed overhead is greater than Actual Overhead incurred, whereas Under absorption arises when Estimated Overhead is less than Actual Overhead.

Over or under absorption of overheads may occur due to various factors:

- Incorrect estimation of overheads or absorption base.

- Unexpected fluctuations in production levels.

- Significant changes in material and labor costs, affecting recovery based on these costs.

- Changes in technology or production processes leading to variations in overhead costs.

Example 2: The budget of a machine shop for 2018-19 is as follows:

Normal working week - 42 hours

Number of machines - 15

Hours spent on maintenance per week (normal loss) 5 hrs per machine

Estimated annual overhead - Rs 5,55,000

Number of working weeks in 2018-19 - 50

The actuals in respect of 4-week period in 2018-19 are :

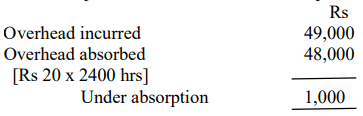

Overhead incurred Rs - 49,000

Machine hour worked - 2400

Calculate: a) Overhead rate per machine hour for 2018-19

b) The amount of over or under absorption of overhead in respect of the 4-week period.

Ans: Machine hour worked = Working weeks x working hours per week x no of machine- Normal idle time

= 50 weeks x 42 hours x 15 - 15 x 5 x 50

= 31,500 – 3750 = 27750 hrs

Machine hour rate = Total estimated annual overhead / machine hour worked

= Rs 5,55,000 / 27750 = Rs 20

Computation of Over or under-absorption of Overhead

Treatment of Over or Under Absorption of Overheads: Over or under absorbed overheads can be handled in three distinct ways, depending on the reasons for their occurrence:

- Carried forward to next year: In this approach, over or under absorption of overhead is carried forward to the next year through an overhead reserve account for charge. However, this method is not ideal as it violates the matching concept, delaying the recognition of current year's items in the appropriate period. It is typically employed when the reasons for over or under absorption are not immediately determinable.

- Charging to Costing Profit & Loss Account: When the over or under absorption of overhead is insignificant or arises due to abnormal reasons, it should be charged to the costing profit and loss account.

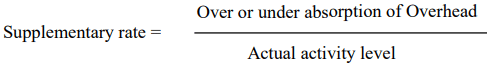

- Use of Supplementary Rate: This method is utilized when over or under absorption arises due to incorrect estimation of overheads, significant changes in production methods, or errors in estimating the recovery base.

For under absorption of overhead, the supplementary rate is applied. For example, if overhead absorbed is Rs 1,00,000 and overhead incurred is Rs 1,20,000, resulting in under absorption of Rs 20,000. As a result, costs are lower by Rs 20,000, leading to an increase in profit by the same amount. Adjustments need to be made in the current year's output, considering that it may consist of fully finished or half-finished goods, with a portion potentially remaining unsold. Thus, adjustments are made to finished goods sold, with the balance deferred for charge through Stock of Work in Progress (WIP) and Finished Goods.

FAQs on Overhead Costing - Management Optional Notes for UPSC

| 1. What is overhead costing in UPSC exams? |  |

| 2. Why is overhead costing important in UPSC exams? |  |

| 3. What are the common methods of overhead costing used in UPSC exams? |  |

| 4. How does overhead costing impact the final cost of a project in UPSC exams? |  |

| 5. What are the challenges associated with overhead costing in UPSC exams? |  |

|

Explore Courses for UPSC exam

|

|