AS 14: Accounting For Amalgamations | Advanced Accounting for CA Intermediate PDF Download

| Table of contents |

|

| Introduction |

|

| Types of Amalgamation |

|

| Methods of Accounting for Amalgamation |

|

| Treatment of Goodwill Arising on Amalgamation |

|

| Treatment of Reserve Described in a Scheme of Amalgamation |

|

Introduction

The Accounting Standard for Amalgamation, known as AS-14, applies when two companies merge and the amalgamation has been finalized. This standard specifically addresses the accounting treatment in the books of the Transferee Company.

Types of Amalgamation

Amalgamation in the Nature of Merger:

- All assets and liabilities of the transferor company become those of the transferee company.

- Shareholders holding at least 90% of the face value of the equity shares of the transferor company become equity shareholders of the transferee company.

- No adjustments should be made to the book value of the transferor company's assets and liabilities when incorporating the financial statements into those of the transferee company.

- The transferee company intends to continue the business of the transferor company.

Amalgamation in the Nature of Purchase:

- This type of amalgamation is considered when any one or more of the conditions mentioned under "Amalgamation in the Nature of Merger" is not satisfied.

Methods of Accounting for Amalgamation

As outlined in AS-14, there are two methods for accounting for amalgamation:

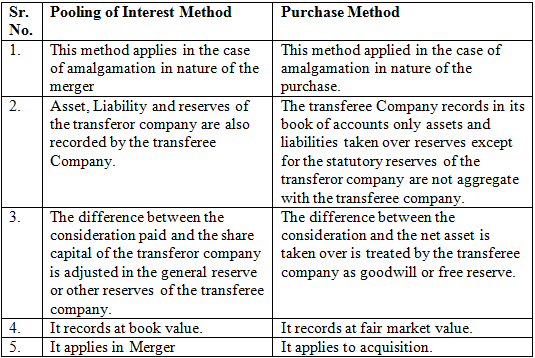

Pooling of Interest Method:

- In this method, the balance sheets of both companies are combined based on their book values during the acquisition or merger.

Purchase Method:

- This method involves accounting for a merger or acquisition where one firm has purchased the assets of the other firm.

Difference Between Pooling of Interest Method And Purchase Method

Treatment of Goodwill Arising on Amalgamation

Goodwill resulting from amalgamation represents future income and is considered an asset of the company. Estimating the useful life of goodwill is challenging due to its nature. It is recommended to amortize goodwill over a period not exceeding five years. Factors to consider when estimating the useful life of goodwill include:

- The future prospects of the business

- Changes in demand and other economic factors

- Expected or potential competition

- Legal, regulatory, or contractual provisions affecting the life of goodwill

Treatment of Reserve Described in a Scheme of Amalgamation

The scheme of amalgamation sanctioned under the law dictates the treatment of reserves in the transferor company, and this treatment should be followed as specified. If the scheme does not prescribe a treatment, different from this standard, the following disclosure is required in the first financial statement following the amalgamation:

- A detailed accounting treatment given to the reserves and the reason for the treatment given to reserves different from that as prescribed in the standard.

- Treatment of Reserves described in the scheme of amalgamation is different compared to the requirement of this standard that would be considered that no treatment has been prescribed by the scheme.

- Any financial effect arising due to such deviations.

Disclosure

As stated in AS-14, the acquirer must disclose the following in the financial statement:

- The name and general nature of the business of the amalgamating company

- The effective date of amalgamation for accounting purposes

- The specific scheme sanctioned under the law

- The method of accounting used to reflect the amalgamation

Additional Disclosure Required under the Pooling of Interest Method:

- The number of shares issued and the percentage of each company's equity shares exchanged to effect the amalgamation

- The amount of any difference between the consideration and the value of net identified assets acquired, and the treatment thereof.

Additional Disclosure Required under the Purchase Method:

- The consideration for the amalgamation, including any amount paid or contingently payable

- The amount of any difference between the consideration and the value of net identifiable assets acquired, the treatment of this difference, and the period of amortization for any resulting goodwill

Conclusion

This standard ensures uniformity in accounting for amalgamations. Companies must adhere to the prescribed treatments and disclose any deviations in the financial statements to maintain transparency for stakeholders.

|

53 videos|134 docs|6 tests

|

FAQs on AS 14: Accounting For Amalgamations - Advanced Accounting for CA Intermediate

| 1. What is the reason behind the discontinuation of QuickBooks in India? |  |

| 2. Are there any important trademarks associated with QuickBooks in India? |  |

| 3. What are the terms and conditions that users need to be aware of regarding the discontinuation of QuickBooks in India? |  |

| 4. How will the discontinuation of QuickBooks in India impact businesses and individuals using the software? |  |

| 5. Are there any alternatives to QuickBooks that users in India can consider after its discontinuation? |  |