Basic Concepts – CA Inter Tax Question Bank | Taxation for CA Intermediate PDF Download

Q1: Answer the following with regard to the provisions of the Income-tax Act, 1961:

Explain the concept of “Marginal Relief” underthe Income-tax Act, 1961.

Ans:

Situation 1:

In case of Individual /HUF/AOP/BOI/AJP income other than 111 A, 112A, and115AD:

Marginal relief shall be computed as follows in case of

Individual/HUF/AOP/BOI/AJP having total income exceeding 50 lakhs but upto 1 crore.

- Step 1: Tax on total income plus surcharge @ 10% as total income

- Step 2: [(Tax on total income of ₹ 50 Lacs) + (Total Income – ₹ 50 Lacs)]

- Step 3: Step 1 (-) Step 2 = Marginal Relief if positive

It means the aggregate of income tax and surcharge payable after marginal relief shall be step 2 only.

Situation 2:

In case of Individual /HUF/AOP/BOI/AJP income other than 111 A, 112A, and 115AD:

Marginal relief shall be computed as follows in case of

Individual/HUF/AOP/AJP having total income exceeding 100 Lakhs or 1 crore but upto 2 crore

- Step 1: Tax on total income plus surcharge @ 15% as total income

- Step 2: [(Tax on total income of ₹ 1 crore inc. surcharge 10%) + (Total Income – ₹ 1 crores)]

- Step 3: Step 1 (-) Step 2 = Marginal Relief if positive

It means the aggregate of income tax and surcharge payable after marginal relief shall be step 2 only.

Situation 3:

In case of Individual /HUF/AOP/BOI/AJP income other than 111 A, 112A, and 115AD:

Marginal relief shall be computed as follows in case of

Individual/HUF/AOP/BOI/A JP having total income exceeding 2 crore but upto 5 crore.

- Step 1: Tax on total income plus surcharge @ 25% as total income

- Step 2: [(Tax on total income of ₹ 2 crore inc. surcharge 15%) + (Total Income – ₹ 2 crores)]

- Step 3: Step 1 (-) Step 2 = Marginal Relief if positive

It means the aggregate of income tax and surcharge payable after marginal relief shall be step 2 only.

Situation 4:

In case of Individual /HUF/AOP/BOI/AJP income other than 111 A, 112A, and115AD:

Marginal relief shall be computed as follows in case of Individual/HUF/AOP/BOI/AJP having total income exceeding 5 crore.

- Step 1: Tax on total income plus surcharge @ 37% as total income

- Step 2: [(Tax on total income of ₹ 5 crore inc. surcharge 25%) + (Total Income – ₹ 5 crores)] (****)

- Step 3: Step 1 (-) Step 2 = Marginal Relief if positive ****

It means the aggregate of income tax and surcharge payable after marginal relief shall be step 2 only.

Note: In Individual/HUF/AJP having income either STCG 111 A, LTCG 112A and in case of AOP/BOI having income either STCG 111 A, LTCG 112A and 115AD(1)(b) the rate of surcharge above 1 crore will be 15%. The Finance (No. 2) Act, 2019 has been amended to withdraw the enhanced surcharge, i.e., 25% or 37%, as the case may be, from income chargeable to tax under section 111 A, 112A and 115AD.

Hence the steps of marginal relief applicable in such cases will be only situation 1 and situation 2 only.

Situation 5:

In case of Firm /LLP/Cooperative Society/Local Authority:

Marginal relief shall be computed as ‘follows in case of ‘Firm/LLP/Cooperative Society/Local Authority having total income exceeding 1 crore

- Step 1: Tax on total income plus surcharge @ 12% as total income

- Step 2: [(Tax on total income of ₹ 1 crore) + (Total Income – ₹ 1 crores)]

- Step 3: Step 1 (-) Step 2 = Marginal Relief if positive

It means the aggregate of income tax and surcharge payable after marginal relief shall be step 2 only.

Situation 6:

In case of Companies:

Marginal relief shall be applicable in case of Companies (Domestic Co. and Foreign Co.) having total income exceeding 1 crore.

Case 1 and Case 2 Domestic Company

Case 1: The calculation of Marginal relief in case of Domestic Company having total income exceeding ₹ 1 crores but upto ₹ 10 crores is as follows:

- Step 1: Tax on total income plus surcharge @ 7% as total income is upto ₹ 10 crores.

- Step 2: [(Tax on total income of ₹ 1 crores) + (Total Income – ₹ 1 crores)]

Step – 3 Step 1 (-) Step 2 = Marginal Relief if positive

It means the aggregate of income tax and surcharge payable after marginal relief shall be step 2 only.

Case 2: The calculation of Marginal relief in case of Domestic Company having total income exceeding ₹ 10 crores is as follows:

- Step 1: Tax on total income plus surcharge @ 12% as total income exceeds ₹ 10 crores

- Step 2: [(Tax on total income of ₹ 10 crores including surcharge @ 7%) + (Total Income – ₹ 10 crores)]

- Step 3: 1 (-) 2 = Marginal Relief if positive

It means the aggregate of income tax and sarcharge payable after marginal relief shall be step 2 only.

Case 3 and Case 4 Foreign Co.

Case 3: The calculation of Marginal relief in case of foreign company having total income exceeding ₹ 1 crores but upto ₹ 10 crores is as follows:

- Step 1: Tax on total income plus surcharge @ 2% as total income is upto ₹ 10 crores

- Step 2: [(Tax on total income of ₹ 1 crores) + (Total Income – ₹ 1 crores)]

- Step 3: 1 (-) 2 = Marginal Relief if positive

It means the aggregate of income tax and surcharge payable after marginal relief shall be step 2 only.

Case 4: The calculation of Marginal relief in case of foreign company having total income exceeding ₹ 10 crores is as follows:

- Step 1: Tax on total income plus surcharge @ 5% as total income exceeds ₹ 10 crores

- Step 2: [(Tax on total income of 10 crores including surcharge @2%) + (Total Income – ₹ 10 crores)]

- Step 3: 1 (-) 2 = Marginal Relief if positive

It means the aggregate of income tax and surcharge payable after marginal relief shall be step 2 only.

Q2: Answer the following with regard to the provisions of the Income-tax Act, 1961:

Explain “Previous year” for undisclosed sources of Income.

Ans: Provisions for Cash Credits, Unexplained Investments, Expenditure, and Loans under the Income Tax Act:

- Cash Credit (Sec. 68): If any amount is found credited in the books of the assessee and the assessee fails to provide an explanation for its nature and source, or if the explanation provided is deemed unsatisfactory by the Assessing Officer, the credited amount may be treated as the income of the assessee for that specific previous year and charged to income tax.

- Unexplained Investments (Sec. 69): If, during the financial year preceding the assessment year, the assessee has made investments not recorded in their books, and the assessee either offers no explanation or provides an unsatisfactory explanation regarding the source and nature of the investment, the value of such investments will be treated as income for that particular financial year and taxed accordingly.

- Unexplained Money, Bullion, Jewellery, or Other Valuable Articles (Sec. 69A): If the assessee is found to own money, bullion, jewellery, or other valuable articles that are not recorded in their books of account, and if the assessee fails to provide an explanation for the source of acquisition or if the explanation is deemed unsatisfactory, the value of these assets will be considered income for that financial year. The key factor here is ownership—mere possession of such assets does not suffice for taxation.

- Excess Investments, Bullion, or Valuable Articles (Sec. 69B): If, in any financial year, the assessee makes investments or owns bullion, jewellery, or other valuable articles, and the Assessing Officer finds that the recorded value of these items is less than the actual amount spent or the market value, and the assessee cannot explain the difference or provides an unsatisfactory explanation, the excess amount will be treated as income for that year.

- Unexplained Expenditure (Sec. 69C): If the assessee incurs any expenditure and cannot explain the source of funds used for such expenditure, or provides an unsatisfactory explanation, the expenditure may be treated as income for that financial year. Furthermore, any such unexplained expenditure, once treated as income, will not be allowed as a deduction under any income head.

- Amount Borrowed or Repaid on Hundi (Sec. 69D): If any amount is borrowed on a hundi (a type of informal promissory note) or repaid without the use of an account-payee cheque, the amount borrowed or repaid will be considered as income of the person in the year it was borrowed or repaid. However, once such amounts are treated as income, they will not be assessed again when repaid, including any interest paid on the amount borrowed.

These provisions ensure that any financial transactions that are inadequately documented or unexplained are identified and taxed as income, promoting greater transparency and accountability in financial dealings.

Q3: Answer the following with regard to the provisions of the Income-tax Act, 1961:

Define the meaning of “Infrastructure Capital Fund” as per Section 2(26B) of the Income-tax. Act, 1961.

Ans: Infrastructure Capital Fund [Sec. 2(26B)]

The term "infrastructure capital fund" refers to a fund operating under a trust deed (which is registered under the Registration Act) and established with the goal of raising funds through trustees. These funds are then invested by acquiring shares or providing long-term finance to certain enterprises or undertakings.

The types of businesses or projects eligible for such investment are:

- An undertaking fully engaged in the business specified under Section 80-IA (4).

- An undertaking fully engaged in the business mentioned in Section 80-IAB(1).

- An undertaking fully engaged in the development and construction of housing projects under Section 80-IB(10).

- An undertaking engaged in the construction of a hotel of not less than three-star category as classified by the Central Government.

- An undertaking engaged in the construction of a hospital with a capacity of at least one hundred beds for patients.

Q4: Define the term “assessee” as per the Income-tax Act, 1961.

Ans: As per Section 2(7), the term "Assessee" refers to a person who is liable to pay any tax or other sum of money under this Act. Additionally, it includes:

Every person for whom any proceeding has been initiated under this Act for:

- The assessment of their income.

- The assessment of fringe benefits.

- The income of another person for which they are responsible.

- The loss incurred by themselves or such other person.

- The amount of refund due to them or such other person.

Every person who is considered an assessee under any provision of this Act.

Every person who is deemed to be an assessee in default under any provision of this Act. This includes individuals who fail to comply with requirements such as TDS (Tax Deducted at Source) or fail to pay advance tax.

Q5: Briefly explain the purpose for which the words “PROVISO” and “EXPLANATION” are incorporated under various sections of the Income Tax Act, 1961.

Ans:

Proviso: The proviso to a section is included to define exceptions to the provision mentioned in the respective section. It indicates the situations where the provision in the section does not apply or where it applies with certain modifications.

Explanation: An explanation is added to a section to provide clarification regarding the provision in that section. Explanations are typically classificatory in nature, helping to clarify the intent or meaning of the section's provisions.

Q6: Define the meaning of “Infrastructure Capital Company” as per Section 2(26A) of the Income-tax. Act, 1961.

Ans: "Infrastructure Capital Company" refers to a company that invests by acquiring shares or providing long-term finance to:

- Any enterprise or undertaking fully engaged in the business described in Section 80-IA(4) or Section 80-IAB(1),

- An undertaking involved in developing and building a housing project as mentioned in Section 80-IB(10),

- A project for constructing a hotel classified by the Central Government as not less than a three-star category,

- A project for constructing a hospital with at least 100 beds for patients.

Q7: State any four instances where the income of the previous year is assessable in the previous year itself instead of the assessment year.

Ans: The income of an assessee for a previous year is typically taxed in the assessment year following that year. However, there are certain exceptions where the income is taxed in the same year in which it is earned, primarily to protect the interests of revenue.

These exceptions include:

- Ship owned or chartered by a non-resident: If a ship, belonging to or chartered by a non-resident, carries passengers, livestock, mail, or goods from a port in India, the ship can leave the port only after the tax is paid or satisfactory arrangements are made. 7.5% of the freight paid or payable to the owner or charterer, whether in India or abroad, for such carriage is deemed to be income and taxed in the year it is earned.

- Individual likely to leave India: If an individual is likely to leave India during the current assessment year or shortly after its expiry with no intention of returning, their total income for the period from the end of the previous year to the likely date of departure is chargeable to tax in that assessment year.

- Assessment of AOP/BOI: If an AOP (Association of Persons)/BOI (Body of Individuals) is formed for a particular purpose or event and the Assessing Officer anticipates its dissolution within the year or the next, the income up to the date of dissolution may be assessed as income for the relevant assessment year.

- Avoidance of tax liability: If an individual is likely to sell, charge, transfer, or part with any of their assets to avoid tax liability, their total income from the end of the previous year to the commencement of proceedings under this section is chargeable to tax in the same assessment year.

- Discontinuance of business or profession: If a business or profession is discontinued during the current assessment year, the income from the end of the previous year up to the date of discontinuance may, at the discretion of the Assessing Officer, be charged to tax in that assessment year.

Q8: Describe average rate of tax and maximum marginal rate under Section 2(10) and 2(29C) of the Income-tax Act, 1961.

Ans: As per Section 2(10), “Average Rate of tax” means-the rate arrived at by dividing the amount of income-tax calculated on the total income, by such total income.

Section 2(29C) defines “Maximum marginal rate” to mean the rate of income-tax (including surcharge on the income-tax, if any) applicable in relation to the highest slab of income in the case of an individual, AOP or BOI, as the case may be, as specified in Finance Act of the relevant year.

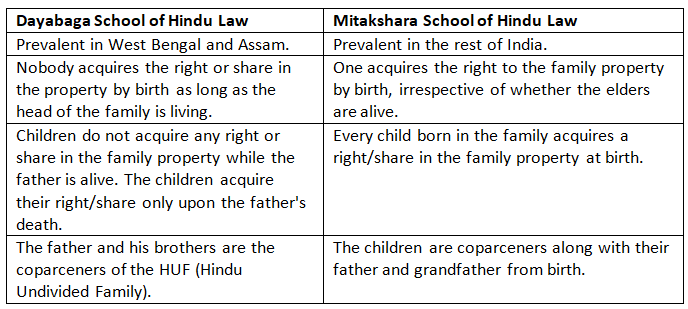

Q9: What is the difference between the two schools of Hindu law?

Ans: The basic difference between the two schools of Hindu law with regard to succession is as follows:

Q10: Define India as per Income Tax Act, 1961?

Ans: The term ‘India’ as per Section 2(25A) means:

- The territory of India as defined in Article 1 of the Constitution,

- Its territorial waters, seabed, and subsoil underlying such waters,

- The continental shelf,

- The exclusive economic zone or any other specified maritime zone (as referred to in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and Other Maritime Zones Act, 1976),

- The air space above its territory and territorial waters.

|

38 videos|118 docs|12 tests

|

FAQs on Basic Concepts – CA Inter Tax Question Bank - Taxation for CA Intermediate

| 1. What is marginal relief and how does it apply to firms and LLPs? |  |

| 2. How is marginal relief calculated for companies under the Income Tax Act? |  |

| 3. What are the key sections of the Income Tax Act related to unexplained expenditure? |  |

| 4. What defines an Infrastructure Capital Fund under the Income Tax Act? |  |

| 5. What are the tax implications for foreign companies in India? |  |