Set Off and Carry Forward of Losses | Taxation for CA Intermediate PDF Download

Introduction

Profit and losses represent opposite outcomes, akin to two sides of a coin. While losses can be challenging to accept, the Income-tax law in India does offer taxpayers certain advantages when they incur losses. This includes provisions for offsetting and carrying forward losses, which will be elaborated on in this article.

Set off of losses

Set off of losses involves adjusting losses against the income or profit of the same year. If losses cannot be offset in the current year, they can be carried forward to future years for adjustment against income in those years. This adjustment can happen within the same income source or across different income sources.

Intra-head Set Off

An intra-head set off allows losses from one source of income to be offset against income from another source under the same income category.

For instance, a loss from Business A can be set off against profits from Business B, given that both fall under the same income category of "Business."

Exceptions to an intra-head set off:

- Losses from a Speculative business can only be set off against profits from the same speculative business and cannot be adjusted against income from any other business or profession.

- Losses from owning and maintaining race-horses can only be offset against profits from the same activity and not against other sources of income.

- Long-term capital losses can be adjusted only against long-term capital gains. On the other hand, short-term capital losses can be set off against both long-term and short-term capital gains.

- Losses from a specified business can be set off only against profits from that specified business. However, losses from other businesses or professions can be adjusted against profits from specified businesses.

Inter-head Set Off

After adjusting within the same head, taxpayers can utilize remaining losses against income from different sources. For instance, losses from house property can offset salary income. Let's explore various scenarios of inter-head set off:

- Loss from House property can be set off against income under any head.

- Business loss, excluding speculative business, can offset any income except for salary.

It's crucial to remember that certain losses cannot be offset against other income sources:

- Speculative business loss.

- Specified business loss.

- Capital losses.

- Losses incurred from owning and maintaining racehorses.

- Losses from lotteries, crosswords, puzzles, card games, and other forms of gambling.

- Losses from exempted sources of income are not adjustable against taxable income.

Carry forward of losses

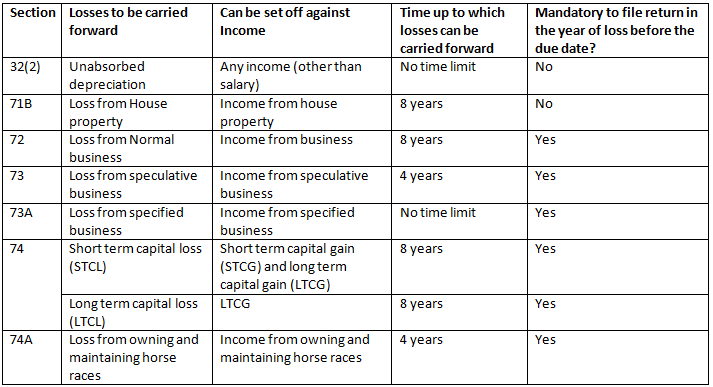

After adjusting for intra-head and inter-head considerations, there might still be losses that remain unadjusted. These losses can be carried forward to future years to offset against the income of those years. The rules for carrying forward losses vary slightly depending on the type of income. Let's explore these rules in detail:

Losses from House Property

- Losses from house property can be carried forward for up to the next 8 assessment years from the year in which the loss occurred.

- These losses can only be adjusted against income from house property.

- They can be carried forward even if the income tax return for the loss year is filed late.

- If individuals, HUF, AOP, BOI choose to pay taxes under the old tax regime, the loss from house property is first set off against income from any other head up to Rs 2,00,000 during the same year. Any remaining unabsorbed loss will be carried forward to the following assessment year to be set off against income from house property in future years.

- If individuals, HUF, AOP, BOI opt to pay taxes under the old tax regime, the loss from house property is first set off against income from any other head up to Rs 2,00,000 during the same year. Any remaining unabsorbed loss will be carried forward to the following assessment year to be set off against income from house property in future years.

- Under the new tax regime, losses from house property cannot be set off against income from any other head. Additionally, losses from previous years cannot be carried forward to future years.

- Under the new tax regime, losses from house property cannot be set off against income from any other head. Additionally, losses from previous years cannot be carried forward to future years.

Let's illustrate this with the following example:

Mr Rama aged 45 years submits the following income pertaining to the FY 2023-24

- Income from salary Rs 4,20,000

- Loss from let out property Rs -2,30,000

- Business Loss Rs -1,20,000

- Bank Interest received Rs 85,000

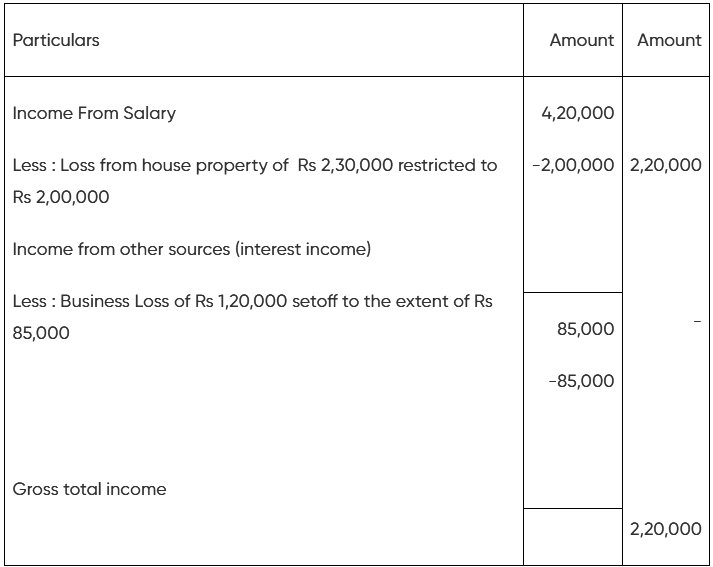

Computation of income under old tax regime

Note:

(a) The remaining loss of Rs 30,000 from the house property will be carried forward to the next assessment year for offsetting against the income from house property for that year.

(b) The remaining business loss of Rs 35,000 will also be carried forward since it cannot be offset against salary income but can be used for offsetting against income from house property in the following year.

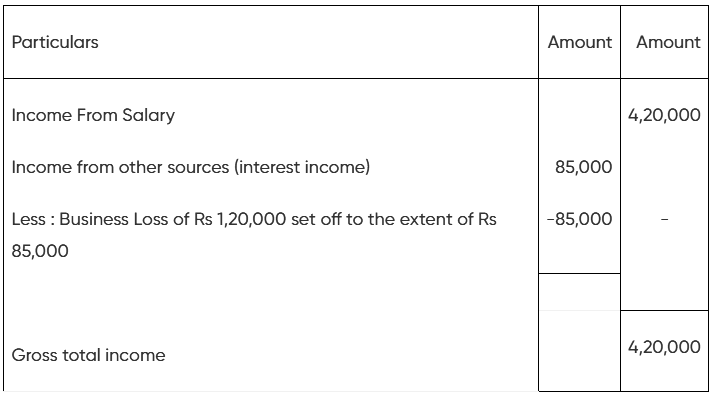

Computation of income under New tax regime

Note:

- The loss from the house property cannot be offset against income from any other source. Hence, the full loss of Rs 2,30,000 from the house property will be carried forward to the next assessment year to offset against income from the house property for that year.

- The remaining business loss of Rs 35,000 will also be carried forward since it cannot be offset against salary income.

Losses from Non-speculative Business (Regular Business)

- These losses must have been incurred in the business.

- They can be carried forward for up to the next 8 assessment years from the year in which the loss occurred.

- These losses can only be adjusted against income from business or profession.

- It is not necessary to continue the business at the time of set off in future years.

- However, they cannot be carried forward if the return is not filed within the original due date.

- The person who incurred the loss is the only one entitled to carry forward and set off the loss; it cannot be transferred to another person.

Speculative Business Loss

- These losses can be carried forward for up to the next 4 assessment years from the year in which the loss occurred.

- They can only be adjusted against income from speculative business.

- Similar to non-speculative losses, they cannot be carried forward if the return is not filed within the original due date.

- It is not mandatory to continue the business at the time of set off in future years.

Specified Business Loss under Section 35AD

- There is no time limit to carry forward losses from specified business under Section 35AD.

- It is not necessary to continue the business at the time of set off in future years.

- Like other losses, they cannot be carried forward if the return is not filed within the original due date.

- These losses can only be adjusted against income from specified business under Section 35AD.

Capital Losses

- These losses can be carried forward for up to the next 8 assessment years from the year in which the loss occurred.

- Long-term capital losses can only be adjusted against long-term capital gains.

- Short-term capital losses can be set off against both long-term and short-term capital gains.

- Just like other losses, they cannot be carried forward if the return is not filed within the original due date.

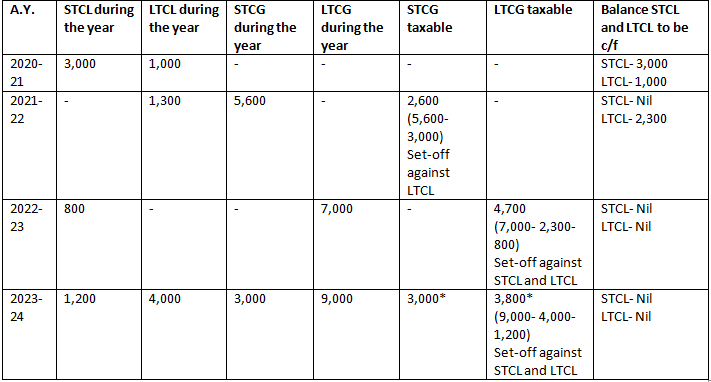

Let us understand with an example-

Mr P has invested in equity shares. Below are the details related to his capital gain/loss transactions for different years.

* Assuming there is 15% tax on STCG and 20% tax on LTCG. The order of adjusting STCL and LTCL is not prescribed in the Act. Hence, the STCL and LTCL are first adjusted with LTCG of the year to reduce the tax liability.

Losses from the ownership and upkeep of racehorses

- These losses can be carried forward for up to the next 4 assessment years from the year in which the loss occurred.

- However, they cannot be carried forward if the return is not filed within the original due date.

- They can only be offset against income derived from owning and maintaining racehorses.

Additional points to consider:

- If a taxpayer incurs a loss from a source that is tax-exempt, such as income from owning and maintaining racehorses, these losses cannot be offset against profits from any taxable income source.

- Furthermore, these losses cannot be offset against casual income, such as winnings from activities like crossword puzzles, lotteries, races, card games, or betting.

|

38 videos|118 docs|12 tests

|