Year 11 Exam > Year 11 Notes > Accounting for GCSE/IGCSE > Business Documents for Cash Transactions

Business Documents for Cash Transactions | Accounting for GCSE/IGCSE - Year 11 PDF Download

| Table of contents |

|

| What is a receipt? |

|

| Cheques & Cheque Counterfoils |

|

| What is a paying-in slip? |

|

| What is a bank statement? |

|

| A Summary of Business Documents for Transactions |

|

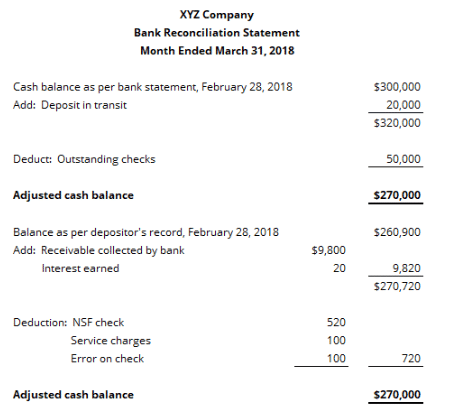

What is a receipt?

- A receipt serves as a documented proof of a cash payment made.

- When a customer pays for goods with physical cash, a supplier issues a receipt to them. Sometimes, a receipt is also provided when payment is made using funds from the customer's bank account.

- Apart from receipts, other business documents can also be utilized to record these types of transactions. Other business documents may also be utilized to record these transactions

Example of a cash receipt

Cheques & Cheque Counterfoils

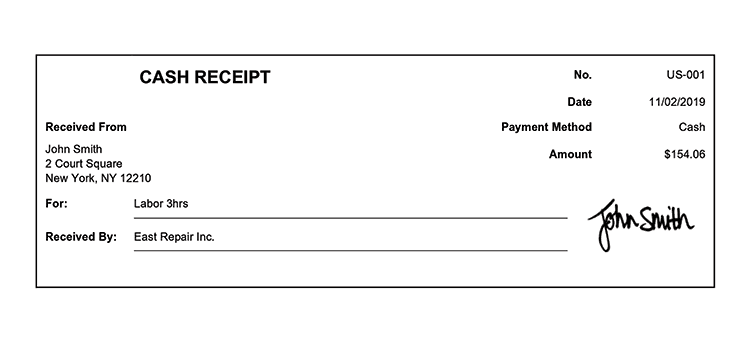

What is a cheque?

- A cheque serves as a payment method.

- It is drafted by the customer and provided to the supplier.

- The supplier subsequently takes the received cheques to the bank for deposit into the business bank account.

- Essential components of a cheque include details of the customer's bank account, the supplier's name, the payment amount, the cheque writing date, and the customer's signature.

- The supplier utilizes the cheque as the official payment documentation.

- This occurs when the customer opts to pay using a cheque.

What is a Cheque Counterfoil?

- Cheques are attached to counterfoils in a chequebook

- When a customer writes a cheque, they also fill in some basic details on the counterfoil such as the name of the payee, the amount to be paid, and the date of the cheque

- The customer tears off the cheque and hands it to a supplier as payment

- The customer retains the cheque counterfoil as a record of the payment

Example of a cheque with a counterfoil

Question for Business Documents for Cash TransactionsTry yourself: What is the purpose of a receipt?View Solution

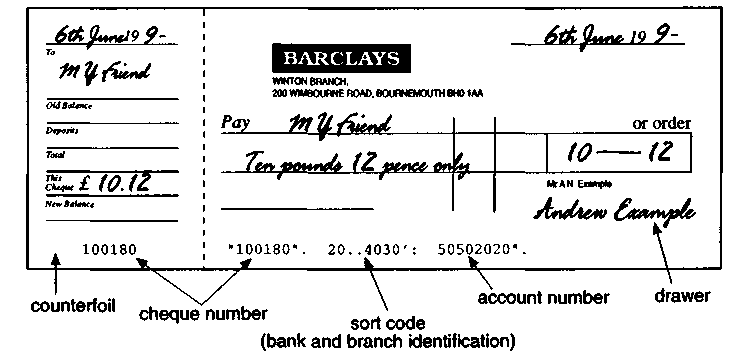

What is a paying-in slip?

- A paying-in slip is a document used for depositing cash and/or cheques into a bank account. It serves as a record of the deposit transaction.

- The paying-in slip includes the following details:

- The total amount from cash

- The total amount from cheques

- The total amount being deposited

- The date of the transaction

Example of a paying-in slip

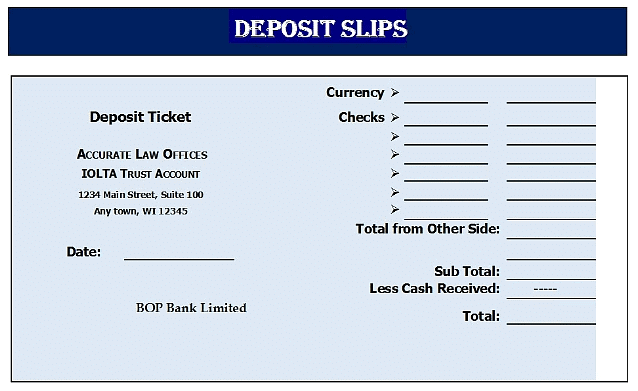

What is a bank statement?

- A bank statement is a document regularly provided by a bank to account holders.

- It contains a comprehensive record of all financial transactions during a specific period.

- This document displays the flow of money into and out of a business' bank account.

- Additionally, it outlines the starting and ending balances for the specified timeframe.

- Bank statements serve as essential tools for businesses to track and reconcile various transactions, including:

- Payments made via credit transfers

- Transactions conducted through telephone transfers

- Debits processed via direct debit arrangements

- Regular payments made through standing orders

- Details regarding bank charges and accrued interest

What is a direct debit?

- A direct debit is a method used by businesses to make regular payments to individuals or other businesses through automated bank transfers.

- The recipient of the payment sets up the direct debit, and the paying business must agree to the terms.

- Direct debits allow for flexibility in payment amounts and dates, accommodating changes as needed.

What is a Standing Order?

- A standing order is a method used by businesses to conduct regular bank transfers to individuals or other businesses.

- The standing order is initiated by the paying business.

- Payments within a standing order are consistent in value and timing.

- Dates for payments are predetermined, often occurring on the same day each month.

Example of bank statement

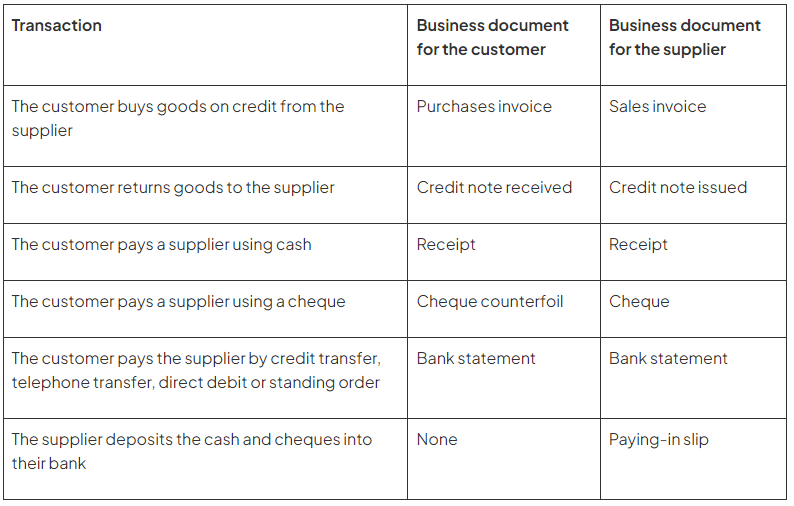

A Summary of Business Documents for Transactions

The document Business Documents for Cash Transactions | Accounting for GCSE/IGCSE - Year 11 is a part of the Year 11 Course Accounting for GCSE/IGCSE.

All you need of Year 11 at this link: Year 11

|

22 videos|29 docs|12 tests

|

FAQs on Business Documents for Cash Transactions - Accounting for GCSE/IGCSE - Year 11

| 1. What is the purpose of a receipt in terms of business transactions? |  |

Ans. A receipt is a written acknowledgment that a specified article or sum of money has been received as an exchange for goods or services provided. It serves as proof of a transaction and helps in keeping track of financial records.

| 2. How are cheques and cheque counterfoils used in business transactions? |  |

Ans. Cheques are commonly used as a form of payment in business transactions, where the issuer directs their bank to pay a specific amount to the recipient. Cheque counterfoils are used to keep a record of issued cheques for accounting purposes.

| 3. What information is typically included in a paying-in slip? |  |

Ans. A paying-in slip includes details such as the account holder's name, account number, the amount being deposited, and any additional information required by the bank to process the deposit. It is used when depositing funds into a bank account.

| 4. How can a bank statement be helpful for businesses in tracking financial transactions? |  |

Ans. A bank statement provides a detailed record of all transactions related to a business bank account, including deposits, withdrawals, and any fees incurred. It helps businesses reconcile their accounts, track income and expenses, and monitor cash flow.

| 5. Why are business documents for cash transactions important for maintaining financial records? |  |

Ans. Business documents for cash transactions, such as receipts and invoices, are crucial for maintaining accurate financial records. They provide evidence of transactions, help in tracking income and expenses, and facilitate the preparation of financial statements for accounting and tax purposes.

Related Searches