Class 10 Exam > Class 10 Notes > Accounting for GCSE/IGCSE > Introduction to Books of Prime Entry

Introduction to Books of Prime Entry | Accounting for GCSE/IGCSE - Class 10 PDF Download

| Table of contents |

|

| Purpose of Books of Prime Entry |

|

| Sales Journal |

|

| Sales Returns Journal |

|

| Purchases Journal |

|

| Purchases Returns Journal |

|

Purpose of Books of Prime Entry

What are books of prime entry?

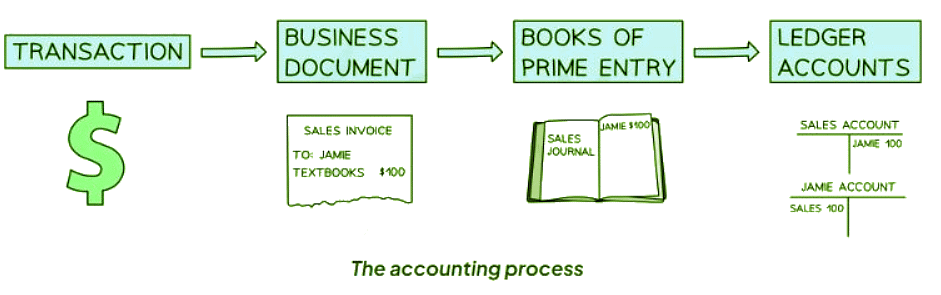

- Books of prime entry are essential for recording transaction details, serving as the initial point of entry. In the past, they were known by various names like Subsidiary books, Books of original entry, and Daybooks.

- Information extracted from business documents is meticulously transcribed into these books before being eventually posted to the ledger accounts.

- The primary purpose of these books is to streamline and organize the recording of various transactions promptly and accurately.

- There are seven main types of books of prime entry, each catering to specific transaction types, such as Sales journal, Purchases journal, Sales returns journal, Purchases returns journal, Cash book, Petty cash book, and General journal.

Advantages of using books of prime entry

- Organized record-keeping: By using books of prime entry, businesses maintain a systematic record of all transactions, making it easier to track financial activities.

- Efficiency in data entry: The use of books of prime entry streamlines the process of recording transactions, reducing the chances of errors and ensuring accuracy.

- Facilitates quick reference: Having distinct books for specific types of transactions allows for quick retrieval of information when needed.

- Enhances financial analysis: With well-maintained books of prime entry, businesses can analyze their financial performance effectively and make informed decisions.

Sales Journal

- The sales journal functions as a log for credit sales exclusively, excluding cash transactions which are directly logged in the cash book.

- Information Contained:

- Dates of sales

- Names of credit customers

- Sale amounts, adjusted post trade discounts

- Process:

- Book-keepers input data from sales invoices into the sales journal.

- Totals are periodically transferred to ledger accounts.

- Debit individual trade receivables and credit the sales account as "Sales journal".

Sales Returns Journal

- The sales returns journal is a log of all product returns from credit customers.

- It includes:

- Dates when returns were made.

- Names of the credit customers.

- Amounts associated with each return.

- The bookkeeper utilizes the credit notes provided to record information in the sales returns journal.

- Totals are periodically moved to ledger accounts.

- Debit the sales returns account with the total amount.

- Credit the individual trade receivables accounts.

Purchases Journal

The purchases journal is a specialized record used in accounting to track credit purchases. Unlike cash purchases, which are documented directly in the cash book, credit purchases are detailed in this journal. It includes essential information such as:

- The dates when purchases were made

- The names of the suppliers involved in the transactions

- The specific amounts corresponding to each purchase

To populate the purchases journal, the bookkeeper relies on purchases invoices. Regularly, the totals from this journal are moved to the appropriate ledger accounts. This transfer involves:

- Debiting the purchases account with the total amount (referred to as "Purchases journal")

- Crediting the individual trade payables accounts accordingly

Purchases Returns Journal

- The purchases returns journal serves as a log for documenting all items returned to credit suppliers.

- Key details included in the journal are:

- The dates when returns were made.

- The names of the credit suppliers.

- The respective amounts for each return.

- The bookkeeper utilizes the credit notes received to input data into the purchases returns journal.

- Periodically, the totals from the journal are moved to the ledger accounts.

- To record transactions in the purchases returns journal:

- Credit the purchases returns account under the entry "Purchases returns journal".

- Debit the individual trade payables accounts accordingly.

Question for Introduction to Books of Prime EntryTry yourself: What is the purpose of using books of prime entry in accounting?View Solution

The document Introduction to Books of Prime Entry | Accounting for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Accounting for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

21 videos|26 docs|12 tests

|

FAQs on Introduction to Books of Prime Entry - Accounting for GCSE/IGCSE - Class 10

| 1. What is the purpose of Books of Prime Entry? |  |

Ans. Books of Prime Entry are used to record specific types of transactions in a systematic and organized manner, making it easier to track and analyze financial information.

| 2. What are the main types of Books of Prime Entry? |  |

Ans. The main types of Books of Prime Entry include the Sales Journal, Sales Returns Journal, Purchases Journal, and Purchases Returns Journal, each used for recording different types of transactions.

| 3. How does using Books of Prime Entry help in financial record-keeping? |  |

Ans. By using Books of Prime Entry, businesses can streamline their accounting processes, improve accuracy in recording transactions, and provide a clear audit trail for financial statements.

| 4. Why is it important to have separate journals for sales and purchases transactions? |  |

Ans. Separate journals for sales and purchases transactions help in categorizing and organizing financial data more efficiently, allowing businesses to track their revenue and expenses separately.

| 5. How can businesses benefit from using Books of Prime Entry in their accounting practices? |  |

Ans. Businesses can benefit from using Books of Prime Entry by improving their overall financial management, enhancing reporting accuracy, and facilitating easier analysis of financial data for decision-making purposes.

Related Searches