Class 10 Exam > Class 10 Notes > Accounting for GCSE/IGCSE > The Double Entry System

The Double Entry System | Accounting for GCSE/IGCSE - Class 10 PDF Download

The Double Entry System

- Assets = Liabilities + Capital

- The equation is always balanced.

- Each transaction impacts both sides of the equation: it can increase, decrease, or remain the same.

- When a transaction causes an increase

- When a transaction causes a decrease

- When a transaction causes no change

- Every transaction involves two entries: a debit entry and a credit entry.

- The debit entry represents the amount entered on the left side of the account.

- The credit entry represents the amount entered on the right side of the account.

Layout of a Ledger Account

- Each account is divided into two sections: debit (left) and credit (right).

- Debit entries are recorded on the left side (Dr), while credit entries are recorded on the right side (Cr).

- Every entry in a ledger account should include the date, transaction details, the name of the other account involved, and the transaction value.

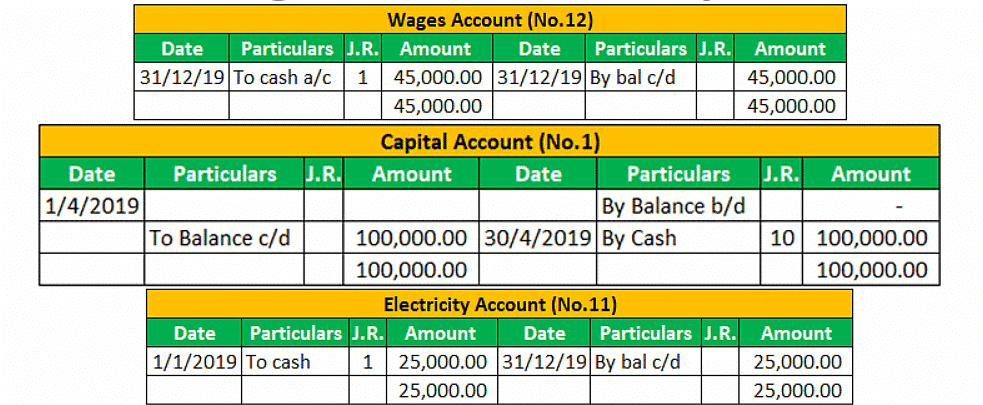

Example of a ledger account

Advantages of Double Entry Records

- It makes preparing financial statements easier: By recording each transaction twice (as a debit and a credit), it simplifies the process of creating financial reports.

- Facilitates accurate profit and loss calculations: With each transaction having a corresponding debit and credit entry, it enables a precise assessment of profits or losses.

- Reduces the risk of fraud: Because every transaction is recorded twice, discrepancies are easier to spot, deterring potential fraudulent activities.

- Enhances access to information for stakeholders: By maintaining clear and organized records, it provides easy access to financial data for banks and other interested parties.

Debits & Credits

What is a debit entry?

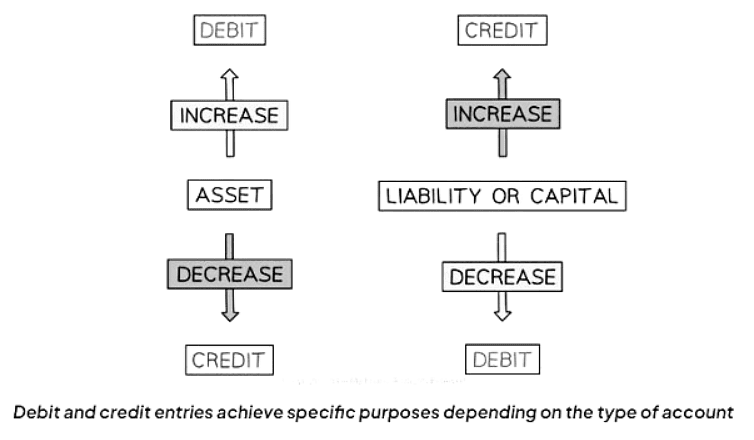

- A debit entry is used to increase the value of an asset, which affects the left-hand side of the accounting equation.

- Conversely, a debit entry is employed to decrease the value of a liability or capital, impacting the right-hand side of the accounting equation.

What is a credit entry?

- A credit entry serves the purpose of increasing the value of a liability or the capital. This action results in the right-hand side of the accounting equation experiencing an increase.

- Conversely, a credit entry can also lead to a decrease in the value of an asset, causing the left-hand side of the accounting equation to decrease.

Which accounts should I debit?

- Debit an asset account when its value is increasing

- Example: You receive cash

- Transaction: Debit the cash account

- When a customer buys goods on credit

- Transaction: Debit their trade receivables account

- Debit a liability account when its value is decreasing

- When you make a repayment on a bank loan

- Transaction: Debit the bank loan account

- When you pay an invoice to a credit supplier

- Transaction: Debit their trade payables account

- When you make a repayment on a bank loan

Which accounts should I credit?

- Credit a liability account when its value is increasing

- You take out a bank loan

- You buy goods on credit from a supplier

- Credit an asset account when its value is decreasing

- You pay rent by bank transfer

- A credit customer pays their invoice

How do I decide whether an account should be debited or credited?

- Step 1: Identify the asset, liability, or capital involved in the transaction. This typically includes cash, trade receivables, or trade payables.

- Step 2: Determine whether the value of the identified account is increasing or decreasing.

- Step 3: Debit or credit the account based on the following criteria:

- Debit the account if:

- It's an asset account and its value is increasing.

- It's a liability or capital account and its value is decreasing.

- Credit the account if:

- It's an asset account and its value is decreasing.

- It's a liability or capital account and its value is increasing.

- Debit the account if:

- Step 4: Create an equal entry on the opposite side for the second account involved in the transaction.

Do I debit or credit accounts for expenses & incomes?

- When an expense is paid, you will debit the expense account, as the cash or bank account is credited. This is because the cash balance decreases with the payment.

- Conversely, when income is received, you will credit the income account, as the cash or bank account is debited. This is because the cash balance increases with the receipt of income.

Do I debit or credit accounts for drawings & capital?

- When the owner withdraws money or goods from the business for personal use, the drawings account is debited, while the cash or bank account is credited. This is because the company's cash decreases.

- Conversely, when the owner contributes their own funds to the business, the capital account is credited, while the cash or bank account is debited. This is because the company's cash increases.

Question for The Double Entry SystemTry yourself: What is the purpose of a credit entry in the double-entry system?View Solution

The document The Double Entry System | Accounting for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Accounting for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

21 videos|26 docs|12 tests

|

FAQs on The Double Entry System - Accounting for GCSE/IGCSE - Class 10

| 1. What is the Double Entry System in accounting? |  |

Ans. The Double Entry System is a method of recording financial transactions in which every transaction affects at least two accounts, with one account debited and the other credited.

| 2. What is the Fundamental Accounting Equation and why is it important? |  |

Ans. The Fundamental Accounting Equation is Assets = Liabilities + Equity. It is important because it represents the relationship between a company's assets, liabilities, and equity, and must always be in balance.

| 3. What are debits and credits in accounting? |  |

Ans. Debits and credits are used in the Double Entry System to record transactions. Debits increase assets and expenses, while credits increase liabilities, equity, and revenue.

| 4. When should I credit an account in accounting? |  |

Ans. You should credit an account when you are decreasing an asset or expense, or increasing a liability, equity, or revenue. Credits are typically used to record decreases in value.

| 5. How do I know which accounts to debit in a transaction? |  |

Ans. In a transaction, you should debit the account that is receiving something of value or being increased. For example, if you receive cash, you would debit the Cash account.

Related Searches