Class 10 Exam > Class 10 Notes > Accounting for GCSE/IGCSE > Transferring Balances to the Income Statement

Transferring Balances to the Income Statement | Accounting for GCSE/IGCSE - Class 10 PDF Download

Transferring Balances to the Income Statement

Which accounts do I need to transfer to the income statement?

- The income statement plays a vital role in the double entry system as it determines the profit or loss for the year.

- Balances related to expenses and incomes, such as sales, purchases, sales returns, and purchase returns, are specifically moved to the income statement.

- Expenses are recorded as debits on the income statement, while incomes are registered as credits.

- Notably, accounts associated with assets, liabilities, and capital remain untouched in this transfer process since they do not directly impact the calculation of profit or loss.

How do I transfer a balance on an account to the income statement?

The process of balancing an account at the end of a month closely resembles other accounting procedures, but with a notable distinction: the balance isn't carried forward to the next month. Instead, it's moved to the income statement.

- Unlike typical account balances, which are forwarded, those at month-end are transferred to the income statement.

- At the start of a new accounting period, the account should ideally commence with a balance of zero, although there are exceptions.

- Exceptions include accrued and prepaid expenses and income.

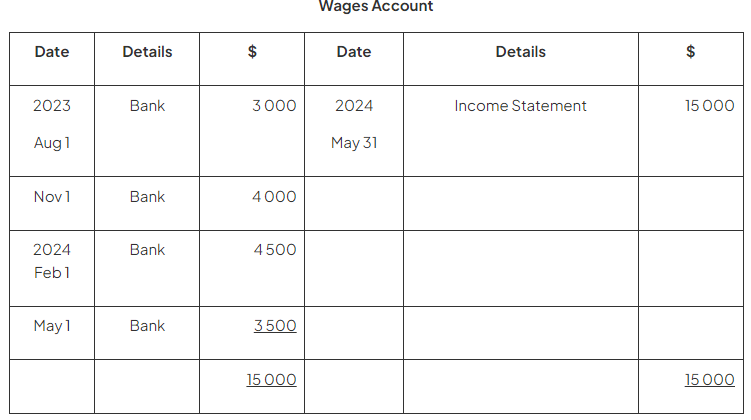

For instance, let's consider a wages account while preparing the income statement for the year ending on May 31, 2024.

How do I transfer balances for inventory to the income statement?

- The starting balance will be on the debit side. This represents the value of the opening inventory for the accounting period.

- The opening inventory value is carried over as the closing inventory from the previous year.

- At the end of the year, the following steps are taken:

- Transfer the balance of the opening inventory to the income statement.

- Debit the income statement and credit the inventory account.

- Total the inventory account to achieve a zero balance.

- Transfer the balance of the closing inventory from the income statement.

- Debit the inventory account and credit the income statement.

- Balance the inventory account and carry over the balance.

- This closing inventory balance becomes the opening inventory for the next year.

In which account do I enter the profit or loss?

- The profit or loss for the year is detailed in the income statement.

- This profit or loss is then moved to the capital account.

- If there's a loss, the capital account is debited; if a profit, it's credited.

- At year-end, the total capital is calculated by transferring the balance from the drawings account to the capital account, with a debit entry.

- Finally, the capital account is balanced.

Question for Transferring Balances to the Income StatementTry yourself: Which accounts are transferred to the income statement?View Solution

The document Transferring Balances to the Income Statement | Accounting for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Accounting for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

21 videos|26 docs|12 tests

|

FAQs on Transferring Balances to the Income Statement - Accounting for GCSE/IGCSE - Class 10

| 1. How do you transfer balances to the income statement in Cambridge (CIE) IGCSE Accounting? |  |

Ans. To transfer balances to the income statement, you need to close revenue and expense accounts at the end of the accounting period by transferring their balances to the income statement. This process helps in determining the net income or net loss for the period.

| 2. What are the main differences between the balance sheet and income statement in Cambridge (CIE) IGCSE Accounting? |  |

Ans. The main difference between the balance sheet and income statement is that the balance sheet shows the financial position of a company at a specific point in time, while the income statement shows the financial performance of the company over a period of time.

| 3. How is the wages account handled in Cambridge (CIE) IGCSE Accounting? |  |

Ans. The wages account in accounting records the wages paid to employees. These wages are considered as an expense and are recorded in the income statement. The wages account is closed at the end of the accounting period.

| 4. What is the inventory accounting process in Cambridge (CIE) IGCSE Accounting? |  |

Ans. The inventory accounting process involves recording and tracking the cost of inventory items purchased, sold, and remaining in stock. This process helps in determining the cost of goods sold and the value of inventory on hand.

| 5. How is the capital account handled in Cambridge (CIE) IGCSE Accounting? |  |

Ans. The capital account represents the owner's equity in a business. It reflects the amount of capital invested by the owner in the business. Changes in the capital account are recorded in the balance sheet.

Related Searches