Class 10 Exam > Class 10 Notes > Accounting for GCSE/IGCSE > The Cash Book

The Cash Book | Accounting for GCSE/IGCSE - Class 10 PDF Download

Cash or Bank

Do I enter a transaction in the cash account or the bank account?

- Record the transaction in the cash account whenever physical currency changes hands:

- When paying a supplier with cash.

- When receiving cash from a customer.

- When taking money from the till for personal use.

- Log the transaction in the bank account when no physical currency is involved:

- For transactions executed through bank transfers.

- When paying an invoice or bill with a cheque.

- Upon receiving a cheque from a customer.

- For standing orders and direct debits.

- Some transactions require entries in both the cash and bank accounts:

- Depositing business cash into the business bank account.

- Withdrawing cash from the business bank account for business purposes.

The Cash Book

What is the cash book?

- The cash book serves dual purposes:

- It acts as a primary record-keeping document.

- It functions as a ledger for both cash and bank accounts.

- All cash transactions are meticulously recorded in the cash book.

- This includes transactions involving physical cash and bank funds.

- Integral part of the double-entry accounting system.

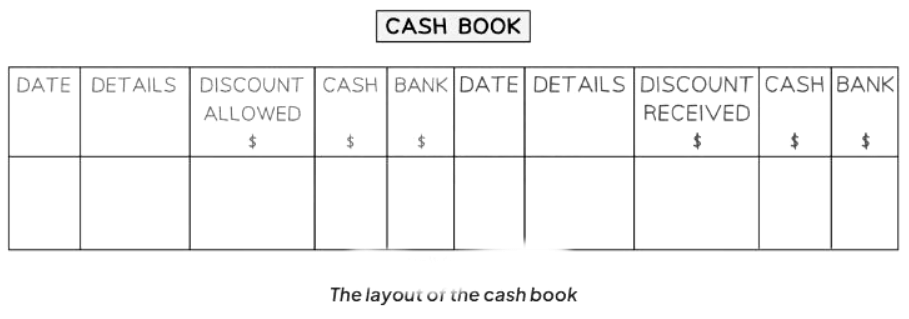

- Contains columns for dates, transaction details, and values on both sides.

- Specific columns include:

- Discount columns: Allowances on the debit side and received discounts on the credit side.

- Cash columns

- Bank columns

Which side should the balances be on?

- When it comes to the cash account, the balance is consistently on the debit side. This indicates that cash is perpetually classified as an asset and never as a liability.

- Cash, being an asset, is a crucial component for any business. It remains an asset and can never be considered a liability.

- The balance for a bank account can vary, being either on the debit or credit side. If the business holds money in the bank, the balance appears on the debit side. Conversely, if the business is overdrawn, the balance shifts to the credit side.

How do I enter transactions into the cash book?

- Step 1: First, determine whether the transaction influences the cash or bank account.

- Step 2: Next, ascertain whether the account should be debited or credited. Debit the account for incoming money and credit it for outgoing funds.

- Step 3: Remember to include any discounts provided or received as part of the transaction.

What are contra entries in the cash book?

- A contra entry involves a transaction recorded on both sides of the cash book.

- On one side, it is entered in the cash column, and on the other side, in the bank column.

- Examples of transactions leading to contra entries:

- Withdrawing cash from the business bank account for business use:

- Debit the cash account.

- Credit the bank account.

- Depositing cash from the business into the business bank account:

- Debit the bank account.

- Credit the cash account.

- Withdrawing cash from the business bank account for business use:

Balancing the Cash Book

How do I balance the cash book?

- Balance the cash columns just like you would with any other ledger account. Disregard the additional columns. Always remember that the balance is carried over to the debit side.

- When balancing the bank columns, treat them similar to any other ledger account. Ignore unnecessary columns. The balance will be carried over to the debit side if the business holds funds in the bank, and to the credit side if the business is overdrawn.

- Do not concern yourself with balancing the discount columns. Simply calculate their total. These totals may vary.

Where do I put the totals for the discount columns?

- The cash book serves as the primary record for discounts.

- It documents both discounts allowed and received.

- Despite its role, it isn't integrated into the double entry system for discounts.

- Discounts are entered into the appropriate accounts.

- The left-hand total represents discounts allowed, debited to the discount allowed account, labeled "cash book."

- No separate entries are needed for individual transactions.

- Credit relevant trade receivables accounts in the sales ledger for the total on the right-hand side, labeled "cash book."

- Similarly, debit relevant trade payables accounts in the purchases ledger.

- The total on the right-hand side represents discounts received, credited to the discount received account, labeled "cash book," without individual transaction entries.

Question for The Cash BookTry yourself: When should you record a transaction in the cash account?View Solution

The document The Cash Book | Accounting for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Accounting for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

21 videos|26 docs|12 tests

|

FAQs on The Cash Book - Accounting for GCSE/IGCSE - Class 10

| 1. What is the purpose of a Cash Book? |  |

Ans. A Cash Book is used to record all cash transactions, including both receipts and payments, in a systematic manner to maintain an accurate financial record.

| 2. How do you balance the Cash Book? |  |

Ans. To balance the Cash Book, you need to compare the total of the receipts column with the total of the payments column and ensure that they match. Any discrepancies should be investigated and corrected.

| 3. What is the difference between a Cash Book and a Bank Book? |  |

Ans. A Cash Book records cash transactions, while a Bank Book records transactions related to a bank account. Cash transactions are usually recorded in the Cash Book, while bank transactions are recorded in the Bank Book.

| 4. Why is it important to reconcile the Cash Book regularly? |  |

Ans. Reconciling the Cash Book regularly helps to identify any errors or discrepancies in the cash transactions recorded. It also ensures that the financial records are accurate and up to date.

| 5. How can errors in the Cash Book be corrected? |  |

Ans. Errors in the Cash Book can be corrected by tracing back the entries, identifying the mistake, and making the necessary adjustments to rectify the error. It is important to maintain clear and accurate records to avoid errors in the first place.

Related Searches