Class 10 Exam > Class 10 Notes > Accounting for GCSE/IGCSE > The Petty Cash Book

The Petty Cash Book | Accounting for GCSE/IGCSE - Class 10 PDF Download

The Petty Cash Book

What is a petty cash book?

- A petty cash book is a record of small cash transactions. Businesses define what constitutes small amounts. For instance, transactions under $100 or $75 are commonly treated as petty cash transactions.

- When money is withdrawn from the petty cash account, a petty cash voucher is used to document the transaction, specifying the amount and particulars.

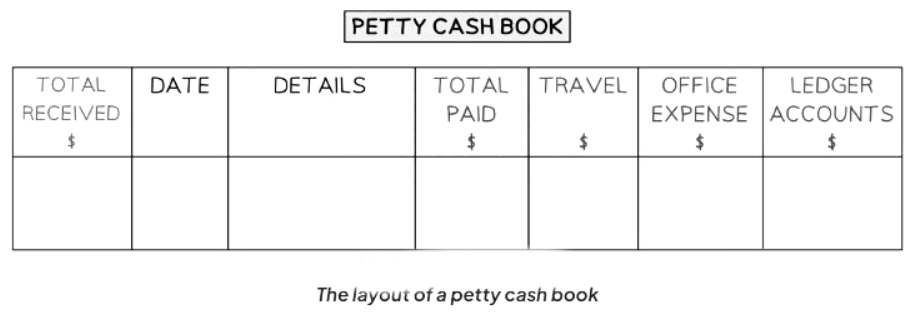

What is the layout of a petty cash book?

- Both a date column and a details column are typically positioned centrally.

- The debit side features a "total received" column, indicating the sum received per transaction.

- On the credit side, a "total paid" column indicates the overall amount paid per transaction.

- Analysis columns on the credit side categorize payments into different groups.

- Expense accounts and purchases ledger accounts each have designated columns.

How to Enter Transactions into the Petty Cash Book?

- The opening balance is recorded on the debit side.

- The debit side displays cash receipts, including small receipts from trade receivables and money transferred from the cash/bank account to top up the petty cash.

- The credit side illustrates cash payments, encompassing small payments for expenses and to trade payables.

- When entering a transaction on the credit side, it must be allocated to the appropriate analysis column(s).

- The total for each transaction should be placed in the "total paid" column.

How do I balance the petty cash book?

- Calculate the total for each column on the credit side.

- Highlight or underline the totals for the analysis columns. These balances are then moved to the relevant ledger accounts.

- Instead of transferring each transaction separately, you can transfer the total for each expense column to save time.

- Enter the ledger account details into the respective individual ledger accounts.

- Determine the variance between the total amount paid and the total amount received.

- Place this variance as the balance carried down on the side with the smaller total, typically the credit side.

- Conclude the balancing process for these two columns.

- Compute the totals for both the total received and total paid columns.

- Carry forward the balance to the beginning of the following month. The balance brought forward will consistently be on the debit side.

The Imprest System

What is the imprest system?

- The imprest system is a method utilized by companies to ensure that the funds in the petty cash account always match a predetermined amount known as the imprest amount.

- This reconciliation typically occurs at the beginning of each week or month to maintain financial accuracy.

- If the balance in the petty cash account is lower than the imprest amount at the start of a period, it gets replenished using cash or funds from the bank account.

- Conversely, if the balance exceeds the imprest amount, the surplus can be deposited back into the cash or bank account.

- The imprest amount is calculated as follows:

- Current balance of the petty cash account

- Plus the total value of petty cash vouchers for the current period

- Minus the total amount of petty cash disbursed

Advantages of Using an Imprest System

- It sets a limit on the amount of cash which can be spent

- It helps managers monitor the amount of petty cash that is being spent

- It limits the amount of cash that could be mislaid or stolen

Question for The Petty Cash BookTry yourself: What is the purpose of a petty cash book?View Solution

The document The Petty Cash Book | Accounting for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Accounting for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

21 videos|26 docs|12 tests

|

FAQs on The Petty Cash Book - Accounting for GCSE/IGCSE - Class 10

| 1. How can petty cash amounts be decided in a business? |  |

Ans. Petty cash amounts are typically decided based on the frequency and amount of small expenses incurred by a business. It is important to consider the needs of the business and the types of expenses that will be covered by petty cash.

| 2. What are the key concepts in petty cash management? |  |

Ans. Key concepts in petty cash management include maintaining a proper record of transactions, ensuring that funds are used for legitimate business expenses, and reconciling the petty cash book regularly to track the flow of cash.

| 3. How are financial transactions classified in the petty cash book? |  |

Ans. Financial transactions in the petty cash book are classified based on the nature of the expense, such as office supplies, travel expenses, or miscellaneous expenses. Each transaction should be properly categorized to ensure accurate record-keeping.

| 4. What is the layout of a petty cash book? |  |

Ans. The layout of a petty cash book typically includes columns for date, details of the expense, amount spent, and a running total of the remaining petty cash balance. This format helps to organize and track all petty cash transactions effectively.

| 5. How do you balance the petty cash book? |  |

Ans. To balance the petty cash book, all transactions recorded in the book should be totaled, and the total should match the physical amount of cash on hand. Any discrepancies should be investigated and resolved to ensure the accuracy of the petty cash records.

Related Searches