Class 10 Exam > Class 10 Notes > Accounting for GCSE/IGCSE > Sales Ledger Control Accounts

Sales Ledger Control Accounts | Accounting for GCSE/IGCSE - Class 10 PDF Download

What is a sales ledger control account?

- A sales ledger control account is an account that summarizes all the transactions for trade receivables. It is not part of the double entry system.

- It is not part of the double entry system.

Where do I find the information to complete a sales ledger control account?

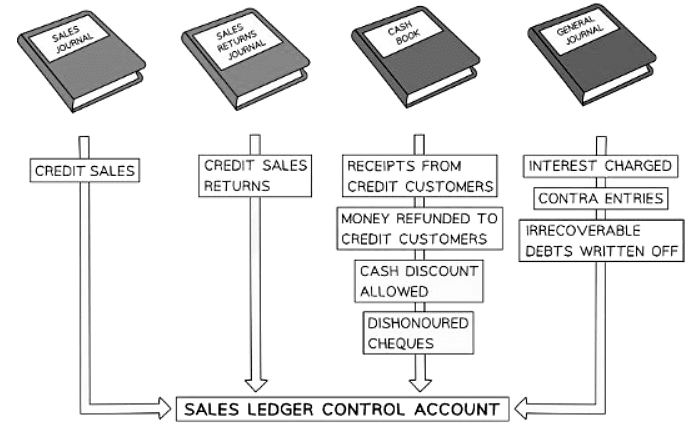

- The books of prime entry serve the purpose of determining totals for various transactions.

- The sales journal is utilized to calculate the overall value of credit sales made by the business.

- The sales returns journal aids in determining the total value of goods that have been returned by customers.

- The cash book plays a crucial role in calculating the total values associated with:

- Money received from credit customers

- Money refunded to credit customers

- Cash discounts allowed to credit customers

- Dishonoured cheques received from credit customers

- The journal is essential for determining the total values concerning:

- Interest charged to credit customers on overdue accounts

- Contra entries against the purchases ledger

- Irrecoverable debts that are written off

Question for Sales Ledger Control AccountsTry yourself: Where can you find the information to complete a sales ledger control account?View Solution

Why might there be a credit balance in a sales ledger control account?

- Trade Receivables

- Trade receivables refer to the money owed to a business by its credit customers.

- It signifies that the credit customer owes the business money.

- Credit Balances Overview

- Credit balances can occur in a trade receivables account when:

- Credit customers pay in advance of buying goods.

- For example, a customer pays for a product before receiving it.

- Credit customers make an overpayment.

- Imagine a scenario where a customer accidentally pays more than the actual amount owed.

- The business owes refunds to credit customers.

- When a business needs to reimburse a customer for various reasons.

- The customers have paid for goods and then returned them.

- In situations where customers return purchased items, resulting in a credit balance.

- Sales Ledger Control Account

- Customers may pay for goods and then return them, leading to transactions in the sales ledger.

- Debit and credit balances are separately calculated in the sales ledger control account, resulting in potential multiple opening and closing balances.

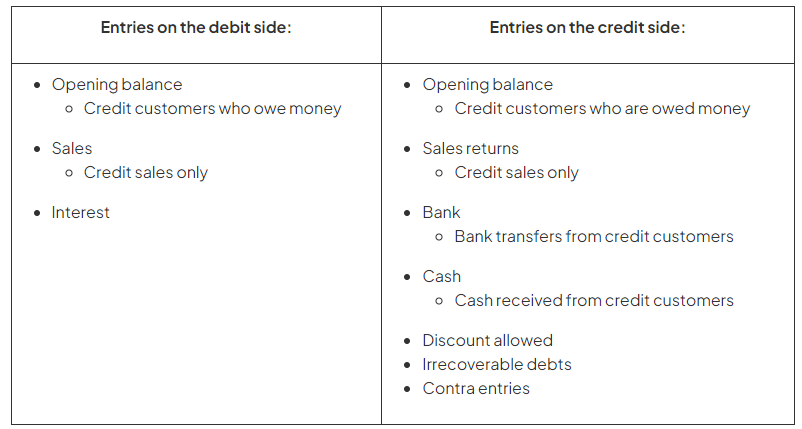

What is the layout of a sales ledger control account?

- The structure of a sales ledger control account closely resembles that of a trade receivables ledger account.

- Notable differences include the possibility of having two opening balances and two closing balances.

The document Sales Ledger Control Accounts | Accounting for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Accounting for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

21 videos|26 docs|12 tests

|

FAQs on Sales Ledger Control Accounts - Accounting for GCSE/IGCSE - Class 10

| 1. What is a sales ledger control account? |  |

Ans. A sales ledger control account is a summary account that shows the total amount owed to a business by its customers. It helps in monitoring and managing the sales ledger effectively.

| 2. Where do I find the information to complete a sales ledger control account? |  |

Ans. The information needed to complete a sales ledger control account can be found in the individual customer accounts, sales invoices, receipts, and any other relevant sales documents.

| 3. Why might there be a credit balance in a sales ledger control account? |  |

Ans. A credit balance in a sales ledger control account may occur if there are overpayments or returns made by customers, resulting in a negative amount owed by them to the business.

| 4. What is the layout of a sales ledger control account? |  |

Ans. The layout of a sales ledger control account typically includes columns for date, invoice number, customer name, amount owed, payments received, discounts, and a running balance to track the total amount owed by customers.

| 5. Explanation of Financial Transactions |  |

Ans. Financial transactions recorded in a sales ledger control account include sales invoices, payments received from customers, adjustments for discounts or returns, and any other relevant information related to customer accounts. These transactions help businesses keep track of their accounts receivable and manage their cash flow effectively.

Related Searches