Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > Internal & External Sources of Finance

Internal & External Sources of Finance | Business Studies for GCSE/IGCSE - Class 10 PDF Download

Introduction

- An internal source of finance refers to money that originates from within a business. This includes owner's capital, retained profits, and funds generated from asset sales.

- An external source of finance denotes capital injected into the business from external sources, such as loans or share capital.

Internal Sources of Finance

Owner’s capital: personal savings

- Personal savings play a crucial role as a primary source of funds during the establishment of a business. Owners often inject their savings or a lump sum, such as money acquired from a job redundancy.

- As the business progresses, owners may further contribute to the capital, especially in situations like short-term financial constraints.

Retained Profit

- Retained profit represents earnings accumulated over past financial periods that are reinvested in the business instead of being distributed to owners.

- Reinvesting profits internally is an economical financing method as it avoids borrowing expenses like interest and arrangement fees.

- However, a downside is that shareholders miss out on receiving extra profits from their investment due to this reinvestment strategy.

Sale of Assets

Another avenue for raising funds is through the sale of assets owned by the business. This can provide a significant injection of capital, especially if non-essential assets are liquidated.

- When a business sells assets it no longer needs, like machinery or buildings, it can generate finance.

- An example of this is when Sainsbury's announced in early 2023 that they were in talks to sell prime retail property for £500 million, which would then be leased back to them by the new owners, LXi Reit.

Stock Sales

- Selling stock at discounted prices is a strategy to raise extra funds.

- This approach minimizes the opportunity cost and storage expenses associated with maintaining high inventory levels.

- However, it requires careful execution to prevent disappointing customers if stock levels become low.

- For example, a clothing retailer might hold a January clearance sale to clear out old inventory and make room for new spring merchandise.

Working Capital Management

- Businesses can internally generate additional funds by efficiently managing their working capital.

- This may involve negotiating extended payment terms with suppliers.

- Additionally, incentivizing customers to settle credit purchases more promptly can enhance cash flow.

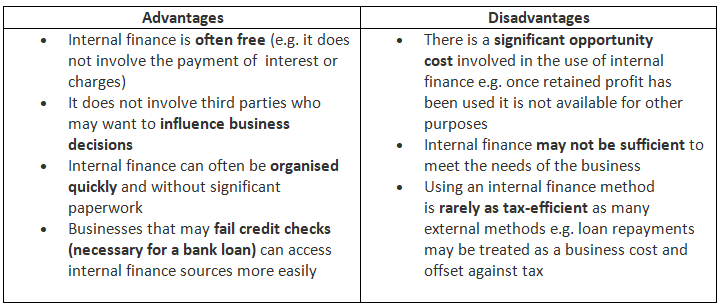

Evaluating the use of Internal Finance

Question for Internal & External Sources of FinanceTry yourself: Which of the following is an example of an internal source of finance?View Solution

External Sources of Finance

- Businesses may find internal finance insufficient for certain needs.

- Some projects demand a substantial amount of capital beyond what internal sources can provide.

- External sources like loans or share issuance can offer the required funds for these costly ventures.

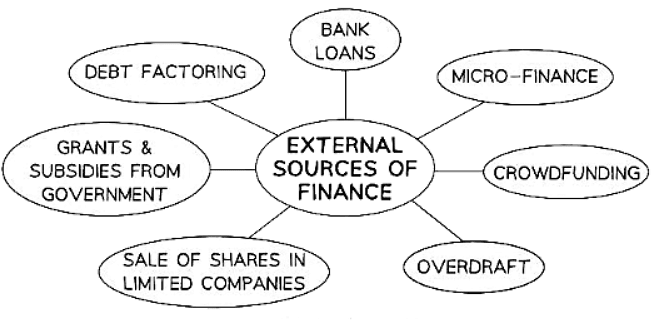

Diagram: External Sources of Finance

- The implications of the different types of external finance must be carefully assessed. For instance, interest rates and fees for obtaining finance can vary significantly among different financial providers.

- The percentage of company ownership required in exchange for finance is influenced by the level of risk that investors are willing to undertake.

- The repayment period for borrowings or achieving investment targets can vary, impacting the financial planning and obligations of the business.

- Utilization of Credit Cards:

- Businesses often obtain finance by utilizing credit or charge cards.

- These cards serve as convenient tools, especially for facilitating small purchases made by employees that are centrally paid.

- However, given the potentially high interest rates associated with these cards, their usage is closely monitored and managed.

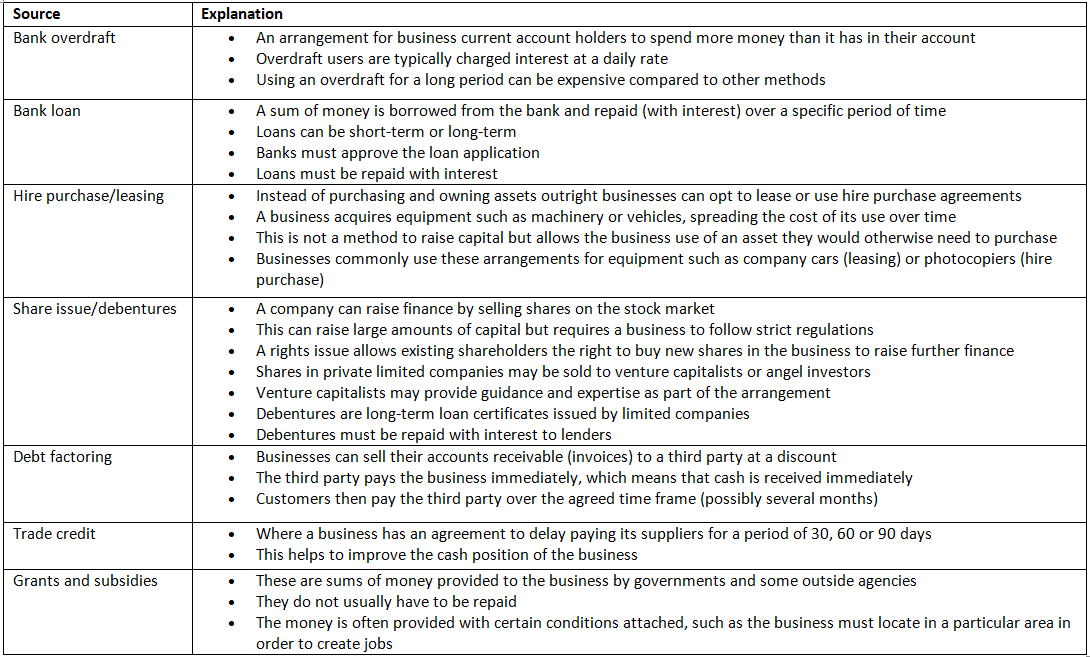

External Sources of Finance

The document Internal & External Sources of Finance | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on Internal & External Sources of Finance - Business Studies for GCSE/IGCSE - Class 10

| 1. What are internal sources of finance? |  |

Ans. Internal sources of finance refer to funds generated within the business, such as retained earnings, sale of assets, or personal savings of the owner.

| 2. What are external sources of finance? |  |

Ans. External sources of finance involve obtaining funds from outside the business, such as bank loans, venture capital, or issuing shares to the public.

| 3. How can a company determine the best mix of internal and external sources of finance? |  |

Ans. A company can determine the best mix of internal and external sources of finance by considering factors such as cost of finance, risk tolerance, and availability of funds.

| 4. What are the advantages of using internal sources of finance? |  |

Ans. Advantages of using internal sources of finance include lower cost, no repayment obligations, and maintaining control over the business.

| 5. What are the disadvantages of relying solely on external sources of finance? |  |

Ans. Disadvantages of relying solely on external sources of finance include higher costs, repayment obligations, and potential loss of control over the business.

Related Searches