Year 11 Exam > Year 11 Notes > Using Cash-flow Forecasts

Using Cash-flow Forecasts - Year 11 PDF Download

| Table of contents |

|

| The Importance of Cash to a Business |

|

| Constructing a Cash-flow Forecast |

|

| Importance of Cash Flow Analysis |

|

| Calculating & Interpreting Cash-flow Forecasts |

|

The Importance of Cash to a Business

- Cash is vital for business survival, akin to blood for a living organism.

- It comprises tangible assets like banknotes, coins, and funds held in bank accounts.

- Even profitable ventures face potential failure if they lack adequate cash reserves.

- Businesses with limited cash struggle to meet obligations such as supplier payments, employee wages, and operational costs, a condition known as insolvency.

- For instance, lifestyle retailer Joules faced liquidation in December 2022 due to cash flow challenges, despite reporting a £2.6 million profit the preceding year.

- New businesses often must make cash payments for supplies until they establish trust with suppliers, who may then offer credit terms like "buy now, pay later."

- Subsequently, suppliers might extend trade credit, allowing the business to acquire stock immediately and defer payment by 30 or 60 days, thereby delaying cash outflows.

- As products are sold, revenue generated constitutes a cash inflow for the business.

- Even after the stipulated credit period, the firm may still possess unsold inventory.

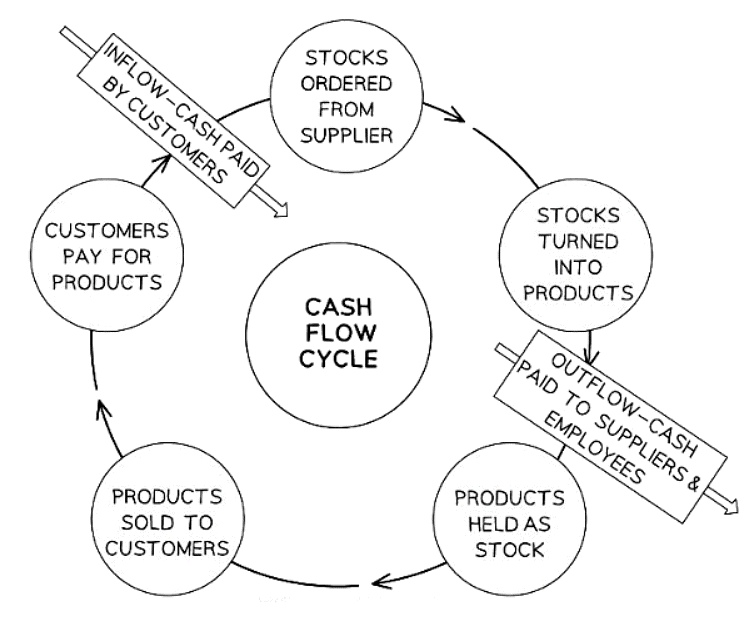

- A cash flow cycle illustrates the sequence from disbursing cash for labor, materials, etc., to receiving cash from product sales.

Diagram to show a Cash-flow Cycle

Explanation of cash-flow cycle

- The diagram illustrates the necessity of cash for purchasing materials used in product manufacturing. Time is required for product production before sales to customers can occur. If customers utilize the business's credit facility, immediate payment is deferred, delaying cash inflow. Conversely, immediate customer payments are utilized to cover business expenses. The time gap between each stage underscores the importance of sufficient working capital to sustain operations and meet financial obligations.

- Businesses, especially startups, must effectively manage cash flow to prevent depletion of funds.

- Cash flow challenges may lead to an inability to remunerate essential stakeholders like employees and suppliers. Consequently, production may halt as workers refuse to work without payment, and suppliers withhold goods due to non-payment. Failure to settle utility bills and rent further exacerbates financial strain.

- In such circumstances, the business could face liquidation and ultimately, collapse.

Constructing a Cash-flow Forecast

- A cash-flow forecast involves estimating the expected cash inflows and outflows over a specific period, typically three, six, or twelve months.

- Outflows encompass expenses like raw material purchases, employee salaries, utility payments, and loan repayments.

- Inflows consist of revenue from sales, funds from a new loan, proceeds from asset sales, and investments.

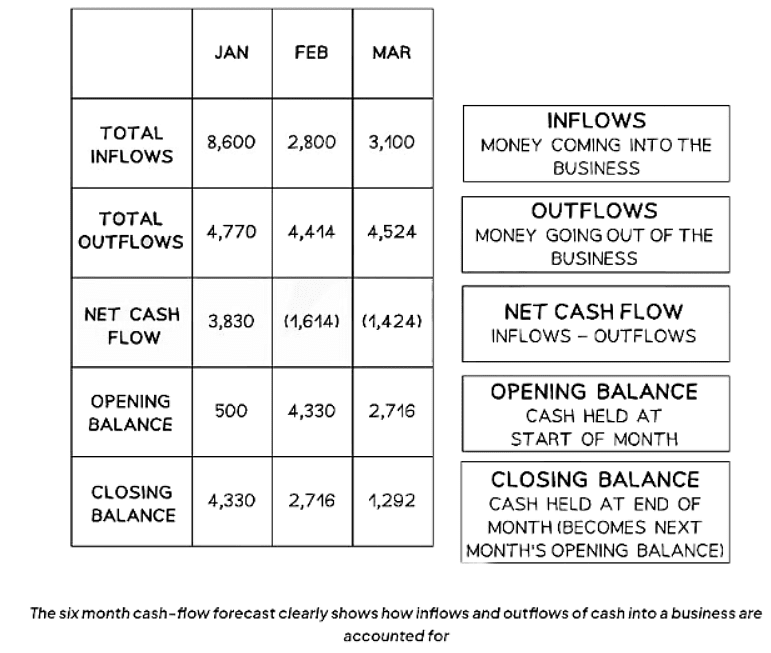

Diagram: Example of a Six-month Cash-flow Forecast

Steps in Constructing a Cash-Flow Forecast

- The business commences with an opening balance of £500 in January.

- Total inflows for January amount to £8,600.

- The anticipated total outflows are £4,770.

- The Net Cash-flow is projected to be £3,830 (£8,600 - £4,770).

- January's closing balance is expected to be £4,330 (£500 + £3,830).

- Each month's closing balance transitions to the next month as the opening balance.

- For instance, February's opening balance is £4,330, continuing the calculation process.

- Despite negative cash flow from February to May, the business foresees positive closing balances, indicating no expected cash flow issues.

Summary of Cash Flow Forecasting

- When transitioning from January to February, the closing balance of £4,330 becomes the opening balance for February.

- The calculation process restarts monthly, where the net cash flow is equal to the closing balance.

- Despite experiencing negative net cash flow from February to May, the business anticipates maintaining a positive closing balance, indicating an absence of cash flow issues.

The Significance of Cash Flow Predictions

- Cash flow forecasts play a crucial role in financial planning and decision-making for businesses.

- These forecasts help in anticipating and managing future cash flows, allowing businesses to prepare for potential challenges and opportunities.

- By analyzing cash flow predictions, companies can make informed decisions regarding investments, expenses, and overall financial strategies.

Question for Using Cash-flow ForecastsTry yourself: Why is cash important for businesses?View Solution

Importance of Cash Flow Analysis

- Understanding cash flow dynamics aids in the efficient allocation of financial resources within a business.

- For instance, by identifying problematic periods in advance, companies can prepare by arranging supplementary financial support to mitigate cash flow disruptions.

- Cash flow predictions serve various critical purposes:

- Starting a New Venture: Estimating the initial cash requirements for the early operational phases.

- Running an Established Business: Recognizing scenarios where a sales decline might necessitate utilizing an overdraft facility.

- Borrowing Needs: Determining the appropriate loan or overdraft amount, duration of necessity, expected repayment timelines, and full settlement projections.

- Transaction Management: Analyzing cash deposits to schedule bill payments effectively.

Calculating & Interpreting Cash-flow Forecasts

- Understanding how to calculate and interpret a cash-flow forecast is crucial for any business.

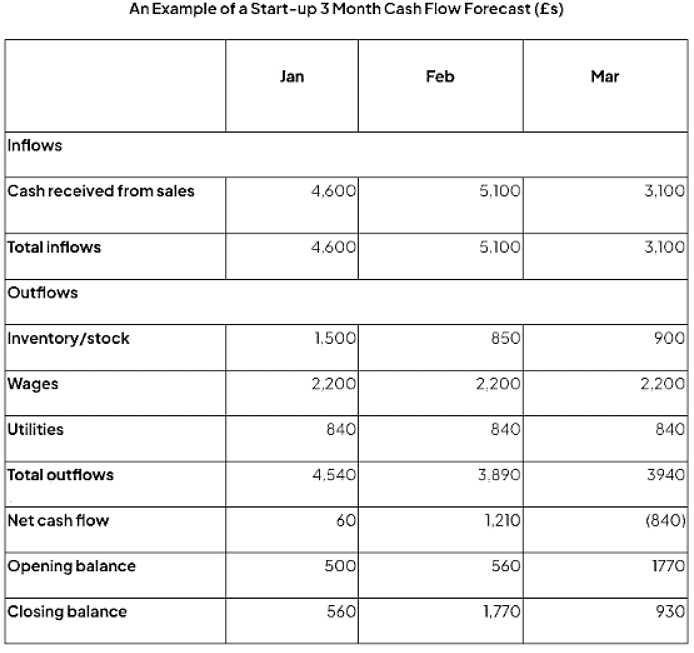

Cash-flow forecast analysis

Executive Summary

- The cash flow projection suggests that it would be beneficial for the business to secure an overdraft facility from their bank.

- During January and February, when sales surge, cash inflows exceed outflows, resulting in a positive cash flow. However, this scenario shifts in March as sales decline, leading to a negative net cash flow.

- An overdraft facility would serve as a safety net, particularly if the closing balance dips below zero in the upcoming months.

January

- The owner initially invests £500 into the business.

- Anticipated sales for the period are projected at £4,600.

- Expected total outflows amount to £4,540.

- The projected Net Cash Flow stands at £60 (£4,600 - £4,540).

- Closing balance for January is estimated to be £560 (£60 + £500).

February

- The closing balance from January carries forward as the opening balance for February.

- Predicted sales for February are £5,100, constituting total inflows for the business.

- Total expected outflows in February amount to £3,890.

- The envisaged net cash flow for February is £1,210 (£5,100 - £3,890).

- The closing balance for February is expected to be £1,770 (£1,210 + £560).

March

- March's financial cycle begins with the closing balance from February becoming the opening balance.

- Sales projections for March are £6,000.

- Total expected outflows in March are £5,000.

- The net cash flow projection for March is £1,000 (£6,000 - £5,000).

- The anticipated closing balance for March is £1,770.

FAQs on Using Cash-flow Forecasts - Year 11

| 1. Why is cash flow important for a business? |  |

Ans. Cash flow is important for a business because it allows the company to pay its expenses, invest in growth opportunities, and handle any unexpected financial challenges that may arise. Without sufficient cash flow, a business may struggle to stay afloat.

| 2. How can a business construct a cash-flow forecast? |  |

Ans. A business can construct a cash-flow forecast by estimating their expected income and expenses over a specific period, taking into account factors such as sales projections, operating costs, and any upcoming investments or loans. This forecast helps businesses anticipate their future cash needs and plan accordingly.

| 3. Why is cash flow analysis important for a business? |  |

Ans. Cash flow analysis is important for a business because it provides insights into the company's financial health and helps identify any potential cash flow problems before they become critical. By analyzing cash flow, businesses can make informed decisions about managing their finances and improving their overall profitability.

| 4. How can a business calculate and interpret cash-flow forecasts? |  |

Ans. To calculate a cash-flow forecast, a business can start by listing all expected cash inflows and outflows for a specific period, such as a month or a quarter. By subtracting total cash outflows from total cash inflows, businesses can determine their projected cash balance. Interpreting this forecast involves analyzing trends, identifying potential risks, and making adjustments to improve cash flow management.

| 5. How can businesses use cash-flow forecasts effectively? |  |

Ans. Businesses can use cash-flow forecasts effectively by regularly updating them with actual financial data, comparing projections to actual results, and adjusting their financial strategies accordingly. By using cash-flow forecasts as a tool for monitoring and planning, businesses can better manage their cash flow and make informed decisions to support long-term success.

Related Searches