Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > The Main Features of an Income Statement

The Main Features of an Income Statement | Business Studies for GCSE/IGCSE - Class 10 PDF Download

An Introduction to Income Statements

- An income statement, also known as a profit-and-loss account, summarizes a business's income and costs over a specific period, typically a year.

- It calculates four types of profit: Gross profit, net profit, profit after tax, and retained profit.

- Understanding the income statement is crucial for evaluating a company's financial performance and making informed decisions.

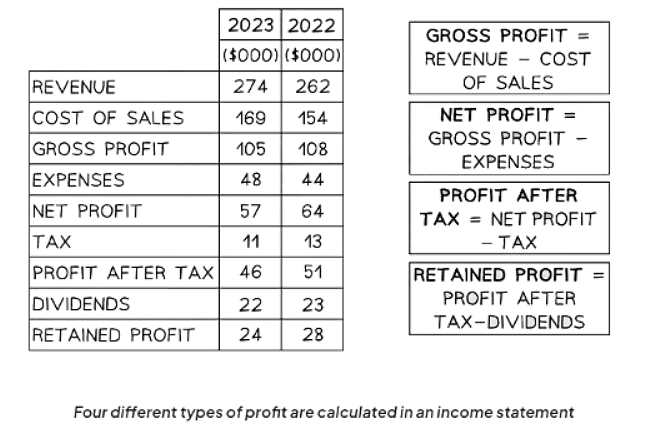

- The extract from an income statement for a company like Toys and Trikes PLC provides data for 2022 and 2023, facilitating year-on-year comparisons.

Diagram: Income Statement for Toys and Trikes Ltd

Main Components of an Income Statement

- Sales Revenue refers to the income generated from the sale of goods and services. It is calculated by multiplying the price per unit by the quantity sold. In 2023, Toys and Trikes Ltd earned $274,000 in Sales Revenue.

- Cost of Sales represents the expenses incurred in producing or purchasing the goods actually sold by the business during a specific period. This includes the costs of raw materials and labor utilized in production. In 2023, Toys and Trikes Ltd had a Cost of Sales amounting to $169,000, covering materials and labor costs.

- Gross Profit is the profit realized when Sales Revenue exceeds the Cost of Sales. It is computed by subtracting the Cost of Sales from the Sales Revenue. Therefore, Toys and Trikes Ltd achieved a Gross Profit of $105,000 ($274,000 - $169,000) in 2023.

- Net Profit denotes the profit remaining after deducting all expenses from the Gross Profit. It is calculated by subtracting Expenses from Gross Profit. In 2023, Toys and Trikes Ltd attained a Gross Profit of $105,000. After incurring expenses totaling $48,000 (including advertising and equipment costs), the Net Profit amounted to $57,000 ($105,000 - $48,000).

- Profit after Tax is the profit calculated for limited companies, accounting for corporation tax paid on net profits. In 2023, Toys and Trikes Ltd recorded a Net Profit of $57,000. With a tax payable of $11,000, the Profit after Taxes equaled $46,000 ($57,000 - $11,000).

- Retained Profit represents the profit remaining for reinvestment into the business after any dividends have been distributed to shareholders. In 2023, Toys and Trikes Ltd achieved a Profit after Tax of $46,000. After distributing dividends amounting to $22,000, the Retained Profit stood at $24,000 ($46,000 - $22,000).

Question for The Main Features of an Income StatementTry yourself: What is the purpose of an income statement?View Solution

The document The Main Features of an Income Statement | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on The Main Features of an Income Statement - Business Studies for GCSE/IGCSE - Class 10

| 1. What is an income statement? |  |

Ans. An income statement is a financial statement that shows a company's revenues and expenses over a specific period of time, typically a year or a quarter. It provides information on a company's profitability by calculating the net income or loss after deducting expenses from revenues.

| 2. What are the main features of an income statement? |  |

Ans. The main features of an income statement include revenues, expenses, gross profit, operating income, net income, and earnings per share. Revenues represent the total amount of money earned from selling goods or services, while expenses are the costs incurred to generate those revenues.

| 3. How is an income statement different from a balance sheet? |  |

Ans. An income statement shows a company's financial performance over a specific period, while a balance sheet provides a snapshot of a company's financial position at a specific point in time. The income statement focuses on revenues and expenses, while the balance sheet shows assets, liabilities, and equity.

| 4. What is the purpose of an income statement? |  |

Ans. The main purpose of an income statement is to provide investors, creditors, and other stakeholders with information about a company's financial performance. It helps assess the company's profitability, efficiency, and ability to generate cash flows.

| 5. How can an income statement be used for financial analysis? |  |

Ans. An income statement can be used for financial analysis by comparing revenues and expenses over different periods to identify trends and patterns. It can also be used to calculate key financial ratios such as gross profit margin, operating profit margin, and net profit margin to evaluate a company's profitability.

Related Searches