Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > Government Impact on Business: Taxes, Spending & Interest Rates

Government Impact on Business: Taxes, Spending & Interest Rates | Business Studies for GCSE/IGCSE - Class 10 PDF Download

The Impact of Changes in Taxes & Government Spending

Taxation

Governments levy direct and indirect taxes on businesses and households.

- Direct taxes, such as income tax and corporation tax, are imposed on income.

- Indirect taxes, like value-added tax (VAT), are imposed on spending.

- Governments may apply customs duties on imports to raise costs on foreign goods, promoting domestic products and increasing government revenue.

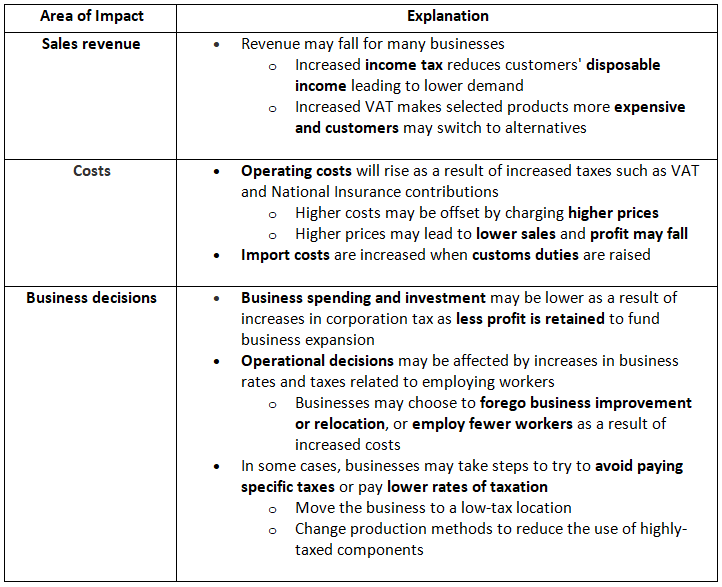

The Impact of Taxation on Businesses

Government spending

- Typically, increased government spending is financed through either higher taxes or increased borrowing in the public sector.

- Boosting investment expenditure, such as in infrastructure like roads and hospitals, can stimulate business investment and foster economic growth.

- Targeting public sector spending towards enhancing specific skills within an economy can elevate productivity and reduce business expenses.

- In recent times, the UK government has shifted its focus towards reducing government expenditure:

- Large-scale infrastructure projects have been curtailed or abandoned, like the downsizing of the HS2 rail project meant to link London with northern cities, adversely impacting business accessibility and workforce mobility.

- Spending cuts have affected crucial services like healthcare and education as part of an austerity strategy.

- Public sector wage increases have been restricted, leading to increased strike activity and consequent employee absenteeism, raising business costs.

- In contrast, the economic strategy of the Portuguese government during the same period has prioritized infrastructure spending and emphasized research and development (R&D) to foster economic expansion. Notably:

- Expenditure on public services has increased while labor costs have decreased.

- This approach has led to a rise in exports and attracted greater foreign direct investment, bolstering the growing economy.

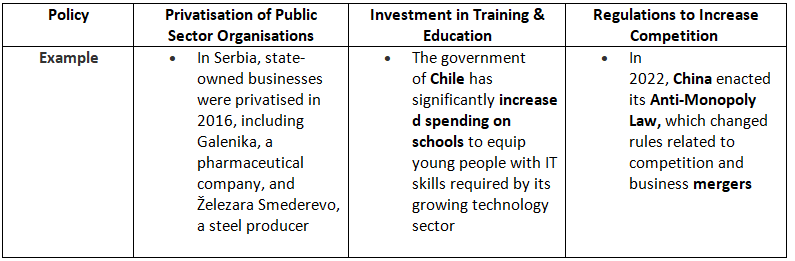

- Supply-side policies are widely employed by governments to enhance economic efficiency, aiming to make domestic industries more competitive compared to their international counterparts. These policies focus on augmenting the supply of goods and services within an economy.

Recent Examples of Supply-side Policies

The Impact of Changes in Interest Rates

Interest rates signify the cost of borrowing and the benefit of saving.

- When lenders charge interest rates on loans higher than the Central Bank's base rate, they offer lower rates on savings and investments.

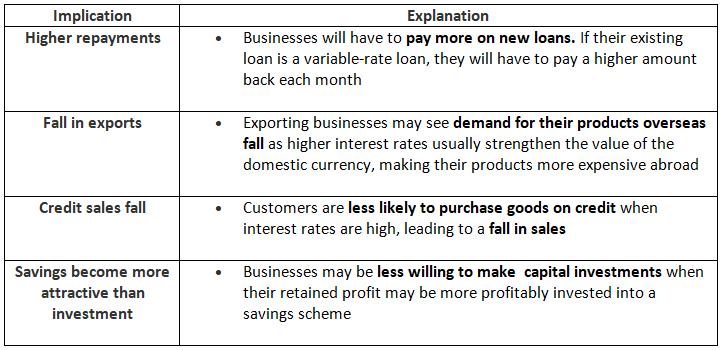

The Implications of Rising Interest Rates

Question for Government Impact on Business: Taxes, Spending & Interest RatesTry yourself: What are the implications of rising interest rates?View Solution

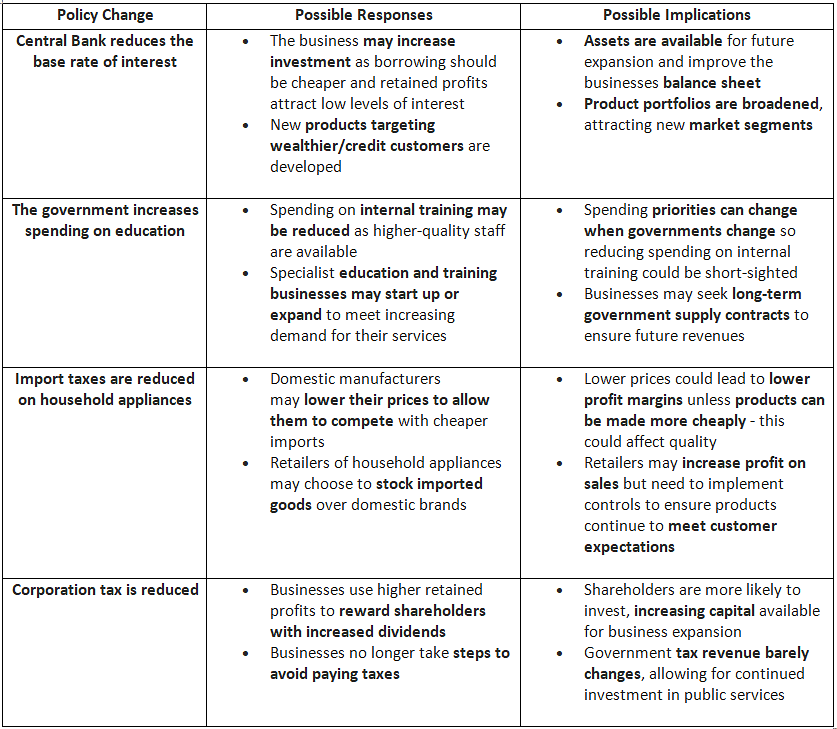

The Response of Businesses to Changes in Economic Policy

Businesses must adjust their strategies in accordance with shifts in government policies.

- It's crucial for businesses to weigh both the immediate and lasting effects of their decisions.

- Careful attention should be paid to how various stakeholders react to these changes.

- Unique factors specific to each business may result in varied responses, even among closely competing companies.

Responses of Businesses to Changes in Economic Policy

The document Government Impact on Business: Taxes, Spending & Interest Rates | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on Government Impact on Business: Taxes, Spending & Interest Rates - Business Studies for GCSE/IGCSE - Class 10

| 1. How do changes in taxes and government spending impact businesses? |  |

Ans. Changes in taxes and government spending can impact businesses in various ways. Higher taxes can reduce profits for businesses, while increased government spending can create more opportunities for business growth through contracts and projects. On the other hand, reduced government spending can lead to decreased demand for goods and services, affecting businesses that rely on government contracts or funding.

| 2. How do changes in interest rates affect businesses? |  |

Ans. Changes in interest rates can impact businesses by affecting borrowing costs. If interest rates increase, the cost of borrowing money also increases, which can discourage businesses from taking out loans for expansion or investment. Conversely, lower interest rates can make borrowing more attractive, potentially stimulating business activities and investments.

| 3. How do businesses respond to changes in economic policy? |  |

Ans. Businesses may respond to changes in economic policy by adjusting their strategies and operations. For example, if taxes are lowered, businesses may have more funds available for expansion or hiring. If government spending increases in certain sectors, businesses operating in those industries may benefit from increased demand for their products or services.

| 4. How does the government impact businesses through taxes, spending, and interest rates? |  |

Ans. The government can impact businesses through taxes, spending, and interest rates by influencing the overall economic environment. Changes in tax policies can directly affect businesses' profitability, while government spending decisions can create opportunities or challenges for businesses in different sectors. Interest rate changes can also impact businesses' borrowing costs and investment decisions.

| 5. What are some strategies that businesses can use to navigate changes in economic policy? |  |

Ans. Businesses can navigate changes in economic policy by staying informed about upcoming policy changes, analyzing how these changes may impact their operations, and adapting their strategies accordingly. This may involve diversifying revenue streams, managing costs efficiently, and maintaining flexibility to adjust to changing economic conditions. Additionally, businesses can engage with policymakers to advocate for policies that support their growth and sustainability.

Related Searches