Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > The Impact of Exchange Rate Changes

The Impact of Exchange Rate Changes | Business Studies for GCSE/IGCSE - Class 10 PDF Download

Exchange Rates Defined

- An exchange rate denotes the value of one currency relative to another, such as £1 = €1.18. International currencies function as commodities traded on the foreign exchange market (forex).

- The exchange rate system, which determines the value of a country's currency, is regulated by the Central Bank of the respective nation.

- Exchange rates significantly impact businesses involved in importing raw materials and components, as well as those engaged in exporting their products.

Appreciation and Depreciation of Exchange Rates

- The Dynamics of Currency Value:

- The value of a currency undergoes changes over time due to shifts in global demand.

- When there is an increase in global demand for a currency, it appreciates in value.

- For instance, if £1 was equal to €1.18 and rises to £1 = €1.25, Europeans purchasing goods from the UK have to spend more euros than before.

- This appreciation makes UK exports relatively more costly and imports less expensive.

- Conversely, when global demand for a currency diminishes, the currency depreciates.

- Depreciation occurs when the value of a currency decreases, like £1 going from €1.18 to €1.05.

- With this change, Europeans buying goods from the UK now pay fewer euros than previously.

- This depreciation enhances the attractiveness of UK exports to Europe and reduces the attractiveness of imports.

Impact on Multinational Corporations (MNCs):

- Fluctuations in currency values can significantly affect the operational costs and sales revenue of Multinational Corporations (MNCs).

Question for The Impact of Exchange Rate ChangesTry yourself: How does an increase in global demand for a currency affect its value?View Solution

How Currency Fluctuations Impact Importers & Exporters

- The impact of currency fluctuations on businesses hinges on the volume of their import and export activities and the countries involved in these transactions.

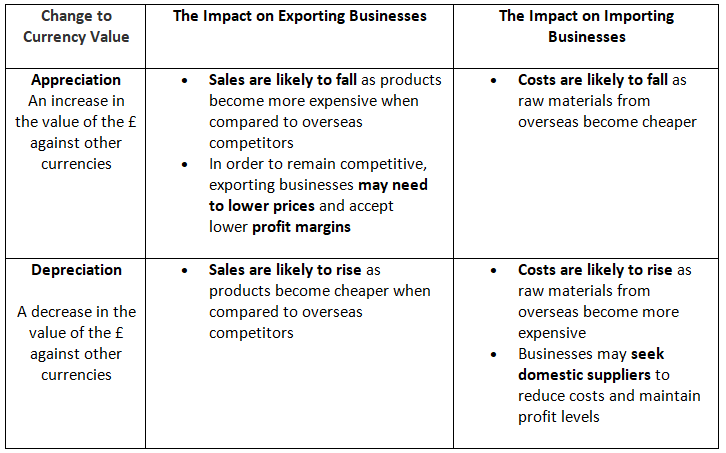

- Businesses engaged in exporting gain advantages from currency depreciation, whereas those involved in importing benefit from currency appreciation.

The Impact on Business of Currency Appreciation & Depreciation

The document The Impact of Exchange Rate Changes | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on The Impact of Exchange Rate Changes - Business Studies for GCSE/IGCSE - Class 10

| 1. How do exchange rates impact importers and exporters? |  |

Ans. Exchange rates play a crucial role in the profitability of importers and exporters. A stronger domestic currency can make exports more expensive for foreign buyers, leading to a decrease in demand. On the other hand, a weaker domestic currency can make imports more expensive, increasing costs for importers.

| 2. What is the difference between appreciation and depreciation of exchange rates? |  |

Ans. Appreciation refers to a currency strengthening in value compared to another currency, while depreciation refers to a currency weakening in value. Appreciation can benefit importers by making imports cheaper, while depreciation can benefit exporters by making exports more competitive in foreign markets.

| 3. How do currency fluctuations affect businesses engaged in international trade? |  |

Ans. Currency fluctuations can impact the profitability of businesses engaged in international trade. Sudden changes in exchange rates can lead to unpredictable costs for importers and exporters, affecting their bottom line. It is essential for businesses to manage their currency risks effectively.

| 4. How can businesses mitigate the risks associated with exchange rate changes? |  |

Ans. Businesses can use strategies such as hedging through forward contracts or options to mitigate the risks associated with exchange rate changes. By locking in exchange rates in advance, businesses can protect themselves from unfavorable fluctuations in the currency market.

| 5. What are some factors that can influence exchange rate movements? |  |

Ans. Exchange rates can be influenced by various factors, including interest rates, inflation rates, political stability, economic performance, and market speculation. These factors can cause fluctuations in currency values, impacting businesses engaged in international trade.

Related Searches