The Hindu Editorial Analysis- 29th April 2024 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Towards Green Growth

Why in News?

A notable feature of the Reserve Bank of India’s (RBI’s) latest Monetary Policy Report (included in its April Bulletin) is the primacy given to “extreme weather events” and “climate shocks” affecting not only food infation but also likely having a broader impact on the natural rate of interest, thereby influencing the economy’s financial stability.

- Monetary Policy in India is crucial for the country's economy. It serves as a vital economic management tool, enabling the RBI and the Government to manage money supply, control inflation, and maintain economic stability. This detailed study by NEXT IAS delves into the nuances of Monetary Policy in India, exploring its meaning, types, formulation process, key tools, and related concepts.

What is Monetary Policy?

Monetary Policy is a macroeconomic strategy employed by the Central Bank to manage money supply within the economy and achieve specific economic objectives. It entails the use of monetary tools by the central bank to regulate credit availability in the market, aiming to fulfill overarching economic policy goals.

Objectives of Monetary Policy

- Accelerating the growth of the economy.

- Maintaining price stability.

- Generating employment.

- Stabilizing the exchange rate.

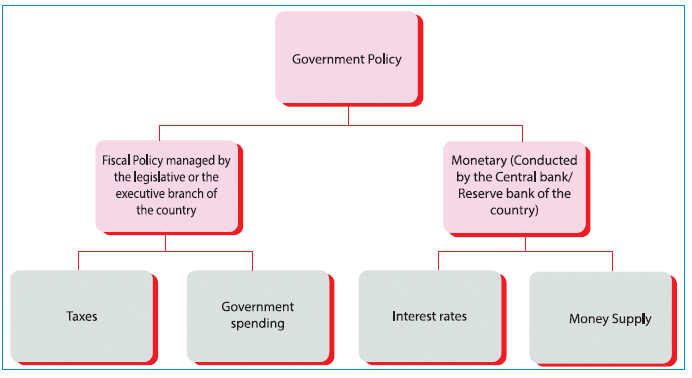

Monetary Policy vs Fiscal Policy

| Fiscal Policy | Monetary Policy |

|---|---|

| It is a macro-economic policy used by the government to adjust its spending levels and tax rates to monitor a nation's economy. | It is a macroeconomic policy used by the Central Bank to influence money supply and interest rates. |

| Controlled by the Government | Controlled by the Central Bank |

| To influence the economic condition | To influence the money supply and interest rates. |

| Major Tools: Public Expenditure, Taxation, Public Borrowing, etc. | Major Tools: Bank Rate, Cash Reserve Ratio, Statutory Liquidity Ratio, etc. |

Types of Monetary Policy

Broadly, there are two types of monetary policy - Expansionary Monetary Policy and Contractionary Monetary Policy.

What is Expansionary Monetary Policy?

- Expansionary Monetary Policy is also known as Accommodative Monetary Policy.

- Its main goal is to boost the money supply within the economy through various methods:

- Decreasing interest rates: By lowering interest rates, it becomes cheaper for consumers to borrow money, thereby increasing the money circulating in the market.

- Lowering reserve requirements for banks: This action provides commercial banks with more funds to lend to the public, thereby injecting more money into the economy.

- Purchasing government securities by central banks: When the central bank buys government securities by paying cash, it leads to an increase in available money in the market.

- Expansionary Monetary Policy aims to stimulate business activities, boost consumer spending, and reduce unemployment rates. However, it can sometimes result in hyperinflation if not carefully managed.

What is Contractionary Monetary Policy?

- Increasing interest rates - This strategy involves raising interest rates to make borrowing more expensive, thereby reducing the money supply in the economy.

- Raising reserve requirements for banks - By increasing the reserve requirements, banks have less money available for lending, which can help in controlling inflation.

- Selling government securities by central banks - When central banks sell government securities, they withdraw money from the market, reducing the available money supply.

Monetary Policy in India

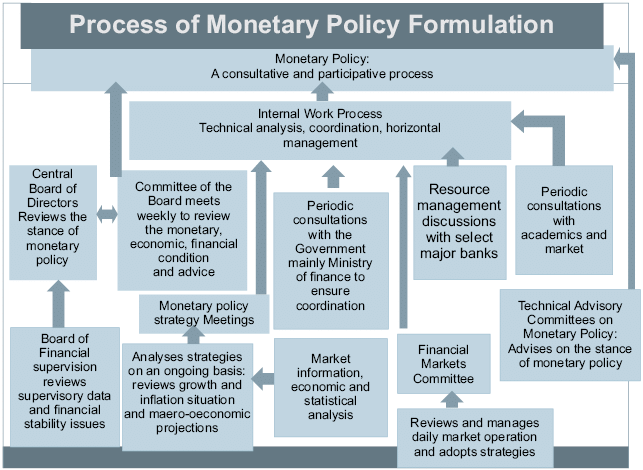

In India, the Reserve Bank of India Act of 1934 explicitly assigns the task of creating the monetary policy for the nation to the Reserve Bank of India (RBI). There was a significant alteration in the process of monetary policy formulation in India in 2016.

Reserve Bank of India (RBI)

The responsibility for formulating the monetary policy in India was solely held by the Governor of the RBI before 2016. Even though the Governor received advice from a Technical Committee, he possessed the authority to override decisions.

Post-2016

The Finance Act of 2016 brought about changes to the RBI Act of 1934 by establishing a Monetary Policy Committee (MPC). Currently, the monetary policy in India is devised by this committee.

- The Finance Act of 2016 introduced the establishment of a Monetary Policy Committee (MPC) by amending the RBI Act of 1934. This committee is now responsible for formulating the monetary policy in India.

The image below illustrates the concept of Monetary Policy in India:

Monetary Policy and Inflation in India – Flexible Inflation Target (FIT) Framework

Background

- In 2015, the Reserve Bank of India (RBI) and the Government of India formed a Monetary Policy Framework Agreement. This agreement aimed at ensuring price stability while also considering growth objectives.

- Subsequently, in 2016, the Reserve Bank of India Act of 1934 was amended to introduce the Flexible Inflation Target (FIT) framework. This framework aimed to establish a connection between monetary policy and inflation in India.

Prominent Provisions

- Every five years, the inflation target is determined by the Government of India in consultation with the RBI. For the period 2021-2025, the inflation target is set within the range of 4 (+/- 2) percent.

- The Headline Consumer Price Inflation has been identified as a crucial indicator within this framework.

Pros of Flexible Inflation Targeting (FIT)

- Rising prices lead to uncertainties impacting savings and investments. Maintaining inflation stability enhances predictability, bringing about stability, predictability, and transparency in policy decisions.

- Flexible Inflation Targeting (FIT) aims to hold the Reserve Bank of India (RBI) accountable to the government if it fails to meet the set inflation targets.

Cons of Flexible Inflation Targeting (FIT)

Fixed inflation targets limit the RBI's ability to adopt tighter policy stances.

Monetary Policy Committee (MPC)

- The Monetary Policy Committee (MPC) was proposed by a committee led by Urjit Patel appointed by the RBI.

- As per the amended RBI Act of 1934, Section 45ZB mandates the establishment of a potent 6-member Monetary Policy Committee (MPC).

- The key provisions related to the MPC include the following:

- The Committee is required to convene a minimum of 4 times annually.

- The MPC consists of 6 members.

- Members of the MPC serve a 4-year term and are not eligible for reappointment.

- A quorum of 4 members is needed for an MPC meeting to proceed.

- In case of a tie, the RBI Governor possesses a casting vote.

- Idea behind MPC: The concept of the MPC originated from a committee formed by the RBI under Urjit Patel.

- Composition of the MPC: The amended RBI Act of 1934 specifies that the MPC will comprise 6 members.

- Key Provisions: The MPC is mandated to convene at least 4 times annually. Members serve a single 4-year term and cannot be reappointed. A minimum of 4 members is required for a meeting, and the RBI Governor holds a decisive vote in case of a tie.

Meetings and Membership of the Monetary Policy Committee (MPC)

- The Monetary Policy Committee (MPC) is required to convene a minimum of four times annually.

- The committee will consist of six members.

- Individuals serving on the MPC will have a term of four years and are not eligible for reappointment.

- A quorum for an MPC meeting is set at four members.

- In the event of a tie, the RBI Governor possesses a casting vote.

Composition of the Monetary Policy Committee (MPC)

- The RBI Governor acts as the Chairperson of the MPC.

- The RBI Deputy Governor responsible for monetary policy is a member.

- One official nominated by the RBI Board is included in the committee.

- Three members are appointed by the Central Government following recommendations from a selection committee. This committee is composed of the Cabinet Secretary, the Secretary of the Department of Economic Affairs, the RBI Governor, and three experts in economics or banking nominated by the Central Government.

Monetary Policy Tools in India

- The key officials responsible for monetary policy in India include the Cabinet Secretary, the Secretary of the Department of Economic Affairs, the RBI Governor, and three experts in economics or banking nominated by the Central Government.

Quantitative Tools of Monetary Policy

- Bank Rate or Discount Rate: Bank Rate or Discount Rate pertains to the rate at which the Reserve Bank of India (RBI) is willing to purchase or rediscount Bills of Exchange or other Commercial Papers from Scheduled Commercial Banks (SCBs). When the RBI sets a high Bank Rate, banks are disincentivized from rediscounting bills with the RBI due to lower profits. Consequently, this action reduces the money supply in the market. Hence, an elevation in the Bank Rate leads to a contraction in the money supply, and conversely, a reduction relaxes the money supply.

- Reserve Requirements: The reserve requirement, also known as the required reserve ratio, is a regulation that mandates the minimum reserves each bank must maintain as a portion of their deposits. It involves two key components:

Cash Reserve Ratio (CRR)

- The Cash Reserve Ratio (CRR) represents the minimum percentage of a bank's total Demand and Time Liabilities (DTL) that a Scheduled Commercial Bank is mandated to deposit with the RBI in the form of cash. The RBI does not provide any interest on these CRR deposits. Additionally, the RBI Act does not specify a specific range (ceiling or floor) for setting the CRR. Therefore, the RBI has the flexibility to determine the CRR rate based on prevailing macroeconomic conditions.

- When the CRR is increased by the RBI, commercial banks are required to deposit more funds with the RBI, reducing the amount of money available for lending to customers. This results in a contraction of the money supply within the economy.

- Conversely, if the RBI decides to decrease the CRR, commercial banks have to deposit fewer funds with the RBI, thereby increasing the funds available for lending to customers. This leads to an expansion of the money supply in the economy.

By adjusting the Cash Reserve Ratio, the RBI can influence the liquidity levels in the banking system, impacting the availability of credit for businesses and individuals. Understanding these reserve requirements is crucial for comprehending how central banks manage the money supply and regulate economic stability.

Statutory Liquidity Ratio (SLR)

- Statutory Liquidity Ratio (SLR) is the portion of Net Demand and Time Liabilities (NDTL) that a Scheduled Commercial Bank (SCB) must retain, holding it in the form of cash, gold, or SLR Securities, which include government bonds, treasury bills, and other instruments authorized by the RBI, or any combination of these.

- If a bank fails to maintain the required SLR, it becomes liable to pay penal interest at (Bank Rate + 3%) per annum above the bank rate on the deficient amount. If the shortfall persists the next day, the penal interest increases to (Bank Rate + 5%).

Components of SLR

- Cash

- Gold

- SLR Securities

- Any combination of the above three.

Difference from Cash Reserve Ratio (CRR)

- Unlike the Cash Reserve Ratio (CRR), SLR does not need to be deposited with the RBI.

Impact of SLR Changes

- The RBI sets the SLR within a range of 0% to 40%. When the SLR is raised:

- Commercial banks have less money available for lending, leading to a decrease in the money supply in the economy.

- Conversely, if the SLR is decreased:

- Commercial banks have more funds to lend, resulting in an increase in the money supply in the economy.

Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR)

- If the Statutory Liquidity Ratio (SLR) is increased, commercial banks have less money to lend, leading to reduced money supply.

- If the Cash Reserve Ratio (CRR) is decreased, commercial banks have more money to lend, increasing the money supply in the economy.

Liquidity Adjustment Facility (LAF)

- Liquidity Adjustment Facility (LAF) enables banks to borrow from the RBI through repos or lend to the RBI through reverse repos.

- It helps banks manage day-to-day liquidity mismatches.

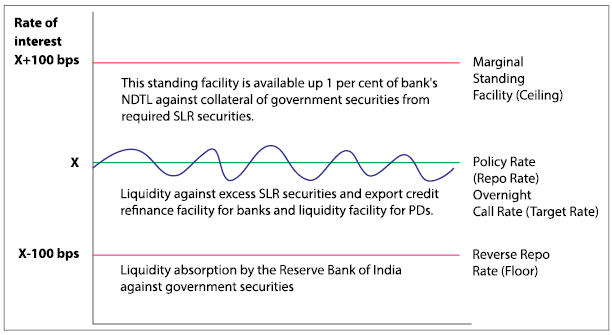

Marginal Standing Facility (MSF)

- This facility, instituted by the RBI in 2011 following the Narasimhan Committee's recommendations, allows SCBs holding current accounts with the RBI to access an overnight short-term loan of up to 1% of their Net Demand and Time Liabilities (NDTL) against Government Securities as collateral.

- Essentially, this acts as a penal rate at which banks can borrow funds exceeding what's available through the Liquidity Adjustment Facility (LAF) window.

- Under MSF, the interest rate is set at 25 basis points (0.25%) higher than the Repo Rate, with amounts accessible in multiples of ₹1 crore, subject to a minimum of ₹1 crore.

Comparison among MSF, Repo Rate, and Reverse Repo Rate

- MSF signifies the upper limit of the interest corridor, while the Reverse Repo Rate represents the lower band. The Repo Rate, positioned in between, serves as a fundamental rate of reference.

MSF, Reverse Repo Rate, and Repo Rate

- MSF stands for Marginal Standing Facility, which is a window for banks to borrow from the Reserve Bank of India (RBI) in an emergency situation.

- Reverse Repo Rate is the rate at which RBI borrows money from banks, signaling a contractionary monetary policy.

- Repo Rate is the rate at which the central bank lends money to commercial banks, influencing the entire economy.

Open Market Operations (OMOs)

- Open Market Operations (OMOs) involve the buying and selling of government securities by the RBI to regulate short-term money supply.

- When RBI aims to increase liquidity, it buys government securities, infusing funds into the system.

- Conversely, when RBI seeks to reduce money supply, it sells government securities, thus draining cash from the system.

Market Stabilization Scheme (MSS)

- Market Stabilization Scheme (MSS) involves the RBI stepping in to reduce excess liquidity in the economy by selling government securities. This action helps stabilize the market.

- Under this scheme, the RBI sells government bonds based on the amount of extra liquidity present in the system. The bonds are sold to financial institutions, and the money flows back to the RBI. This process of reducing excess liquidity is known as sterilization.

- Market Stabilization Bonds (MSBs) are the government bonds issued under the MSS to carry out this liquidity management.

Term Repos

- Term Repos refer to transactions where one party sells securities to another with an agreement to buy them back at a later date. These are essentially short-term collateralized borrowing and lending agreements.

- Since October 2013, the RBI has introduced Term Repos (of different tenors, such as 7/14/28 days), to inject liquidity over a period that is longer than overnight.

- The aim of Term Repo is to help develop an inter-bank money market, which in turn can set market-based benchmarks for the pricing of loans and deposits, and through that improve the transmission of monetary policy.

Qualitative Tools of Monetary Policy

Major instruments falling into this category are elaborated below:

Margins Requirements

- Margin refers to the variance between the value of securities offered for loans and the value of loans actually granted.

- If the RBI aims to regulate the flow of credit to a specific sector, it establishes a high margin for that sector, leading customers to seek fewer loans for that sector.

Consumer Credit

- Credit offered by commercial banks for buying consumer durables is termed as consumer credit.

- When there is excessive demand for certain consumer durables, resulting in high prices, the RBI controls consumer credit by either:

- Increasing the down payment

- Reducing the number of installments for repayment

Moral Suasion

- Moral Suasion involves persuasion and requests by the RBI to ensure that banks comply with policies and directives, aiming to maintain a specific money supply level in the economy.

Direct Action

- The RBI resorts to direct measures like refusing bill rediscounting or imposing penalty interest rates when commercial banks fail to cooperate in achieving the central bank's objectives.

Rationing of Credit or Credit Ceiling

- Under this strategy, the RBI sets a limit on the loans that Scheduled Commercial Banks (SCBs) can provide, leading to a reduction in loan disbursement to the public.

- Ceiling on the amount of loans

Priority Sector Lending

Priority Sector Lending refers to the requirement set by the RBI for banks to allocate a specific portion of their lending to designated sectors such as agriculture, micro and small enterprises, and housing for the economically disadvantaged.

Significance of Monetary Policy

The Significance of Monetary Policy lies in its crucial role in maintaining price stability and fostering economic growth. Let's break down its importance:

- Ensuring Price Stability: Monetary policy helps manage inflation by regulating the money supply, thereby stabilizing prices.

- Impact on Economic Variables: It influences essential economic factors like Consumption, Savings, Investment, and capital formation.

- Stimulating Business Sector: Increasing the money supply can boost economic activity, leading to the creation of more job opportunities.

- Managing Currency Exchange Rates: By controlling the money supply, monetary policy aids in balancing Currency Exchange Rates.

- Unfavorable Banking Habits: In India, there is a prevalent preference for cash transactions over banking activities. This inclination hampers the credit creation potential of banks.

- Underdeveloped Money Market: The inadequacies in the money market infrastructure constrain the reach and effectiveness of the Reserve Bank of India's policy interventions, impacting their efficiency.

- Existence of Black Money: The presence of unrecorded black money, as transactions between borrowers and lenders remain undisclosed, disrupts the equilibrium of money supply and demand, deviating from intended outcomes.

- Conflicting Objectives: Balancing the necessity for economic growth, which demands expansionary policy actions, with the imperative to control inflation, which necessitates contractionary measures, presents a challenging dilemma.

- Limitations of Monetary Instruments: The diverse array of interest rates in India poses a challenge for effective regulation, as many monetary policy tools available in the country are encumbered by various constraints.

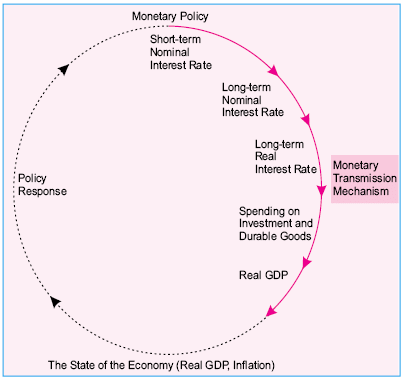

Monetary Policy Transmission

- Monetary Policy Transmission refers to the process through which the Central Bank's actions, like altering the Repo Rate, impact the ultimate goals of maintaining stable inflation and fostering economic growth.

- It encompasses the entire journey starting from the adjustment in the Policy Rate (e.g., Repo Rate) by the RBI, its repercussions in the financial markets, and the final outcomes on businesses and households.

- When the Repo Rate fluctuates, leading to changes in market interest rates, it activates what is known as the Repo Rate Channel, often identified as the Interest Rate Channel of Monetary Policy Transmission.

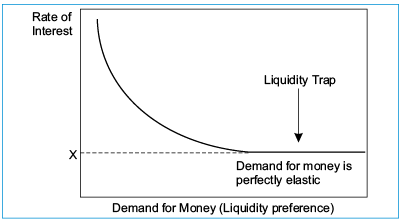

Liquidity Trap

- Liquidity Trap refers to a challenging economic scenario where individuals and businesses opt to hoard cash instead of spending or investing it, even when interest rates are at low levels.

- This phenomenon typically arises when interest rates approach zero, especially during economic downturns. During such times, there is a prevailing sense of uncertainty that discourages people from parting with their money, leading them to hold onto it.

Implications of a Liquidity Trap

- In a Liquidity Trap scenario, traditional monetary policy tools become ineffective as attempts to stimulate spending and investment through interest rate adjustments fail to yield the desired outcomes.

- Economic growth stagnates due to reduced consumer spending and subdued investment activities, which can prolong periods of economic recession.

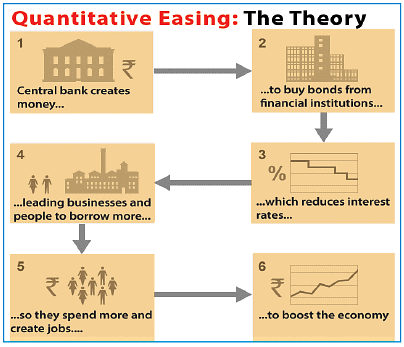

Quantitative Easing (QE)

- Quantitative Easing (QE) involves the Central Bank purchasing securities from the open market with the goal of decreasing interest rates and boosting the money supply.

- Its primary objective is to generate fresh bank reserves, thereby enhancing banks' liquidity and promoting increased lending as well as investment.

Quantitative Easing (QE) is a monetary policy tool used by Central Banks to stimulate the economy. Let's delve deeper into its mechanisms:

- When a Central Bank engages in QE, it purchases government securities or other financial assets from the market.

- This infusion of funds into the financial system aims to lower interest rates, making borrowing cheaper for businesses and individuals.

- By increasing the money supply, QE strives to encourage spending, investment, and economic growth.

For instance, during the 2008 financial crisis, the Federal Reserve in the United States implemented QE to stabilize the economy. By buying mortgage-backed securities and Treasury bonds, the Fed injected liquidity into the system, supporting lending and aiding in the recovery process.

Sterilization

Sterilization refers to the process undertaken by the Reserve Bank of India (RBI) to withdraw money from the banking system. This action is aimed at offsetting the impact of new money entering the system.

Inflation Targeting

Inflation targeting is a strategic approach employed by central banks to adjust monetary policies in order to reach a specific annual inflation rate. The core idea behind inflation targeting is that sustained economic growth is most effectively fostered through maintaining price stability. This is accomplished by managing inflation levels. There are two main types of inflation targeting:

- Central banks adjust monetary policies to hit a predefined annual inflation rate.

- Long-term economic growth is believed to be optimized by maintaining price stability, which is achieved through controlling inflation.

Strict Inflation Targeting

In a regime of Strict Inflation Targeting, the central bank focuses solely on maintaining inflation levels as close to the predetermined target as possible, without considering other factors.

Flexible Inflation Targeting

Under Flexible Inflation Targeting, in addition to managing inflation within the target range, the central bank also takes into account factors such as interest rate stability, exchange rates, output, and employment levels.

|

38 videos|5293 docs|1118 tests

|

FAQs on The Hindu Editorial Analysis- 29th April 2024 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What is the difference between monetary policy and fiscal policy? |  |

| 2. What are MSF, Reverse Repo Rate, and Repo Rate in the context of monetary policy? |  |

| 3. What are qualitative tools of monetary policy mentioned in the article? |  |

| 4. How does green growth relate to monetary policy and fiscal policy? |  |

| 5. How can a country achieve green growth while balancing economic stability and environmental concerns? |  |