Introduction to Computerised Accounting - B Com PDF Download

Introduction

An accounting system comprises a collection of processes, procedures, and controls designed to gather, record, classify, and summarize financial data for interpretation and managerial decision-making. Regardless of its complexity, an accounting system must achieve specific objectives to ensure the business operates smoothly. Accurate accounting information is essential for managers to understand the current state of the business, analyze its historical performance, and predict future trends. Therefore, an accounting system should be designed to provide clear and comprehensible information.

While some businesses still rely on manual bookkeeping, most have too many transactions to manage without automation. As financial activities become more complex, the need for a computerized accounting system grows to ensure effective financial reporting. Computerized accounting systems utilize computers and accounting software to record, store, and analyze financial data. These software programs can be stored on a company’s computer, a network server, or accessed remotely via the Internet.

Computerized accounting represents a significant technological advancement in business accounting. It enables users to set up income and expense accounts, such as rental or sales income, salaries, advertising expenses, and material costs. Additionally, these systems can manage bank accounts, pay bills, and prepare budgets. Depending on the program, some accounting systems also facilitate tax document preparation, payroll management, and project costing.

Difference Between Manual and Computerised Accounting System

Speed- The primary variance between manual and computerized systems is the speed at which they operate. Accounting software processes data rapidly and generates reports much more quickly than manual systems. Automated calculations in software programs decrease errors and enhance efficiency. With a computerized system, reports can be produced almost instantly once data is input.

- Another distinction between manual and computerized systems is the cost factor. Manual accounting using paper and pencil is significantly cheaper than a computerized system, which necessitates both hardware and software. Additional costs related to accounting software involve training and software maintenance. Costs can escalate quickly due to expenses for printers, paper, ink, and other supplies. Conversely, manual accounting demands a larger workforce, resulting in higher expenditures on salaries/wages.

- The ease of backing up data is a third differentiator between manual and computerized systems. A computerized system allows for the secure storage and backup of all transactions, providing protection in case of emergencies such as fires. This level of data security is unattainable with paper records, unless every page is duplicated, which is a time-consuming and inefficient process.

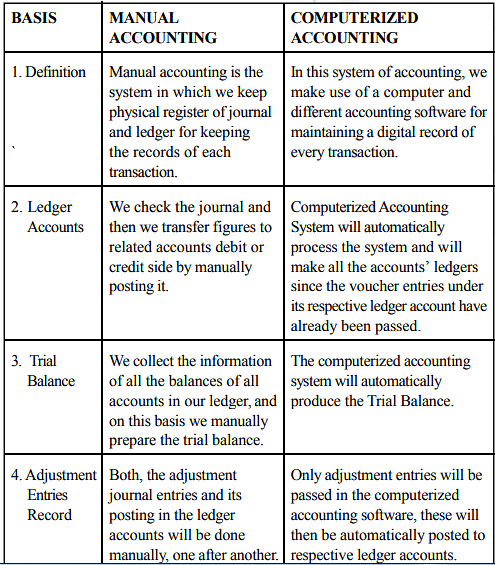

The following table makes a further attempt to explain the difference between the manual and computerized accounting systems:

Advantages and Disadvantages of Computerized Accounting System

Advantages of Computerized Accounting

- Automation: Computerized accounting eliminates manual processes by handling calculations automatically. For instance, invoices are processed swiftly, saving time.

- Accuracy: The system ensures precise calculations, including additions and subtractions, thus minimizing errors.

- Data Access: Accounting data is easily accessible and can be securely retrieved by authorized individuals remotely.

- Easy representation of data: Viewing accounts on a computer allows data to be presented in various formats, such as tables and charts.

- Reliability: Financial statements generated by computerized systems are highly dependable due to accurate calculations.

- Scalability: As businesses grow, the system can handle increasing transactions efficiently, maintaining simplicity in data management.

- Speed: The software expedites the process of preparing accounts and enables quick generation of reports and statements.

- Security: Data can be securely stored offsite, protecting it from disasters, and the system allows for quick data restoration on alternative devices.

- Cost-effectiveness: Computerized accounting is more efficient than manual methods, saving time and enhancing productivity.

Disadvantages of Computerized Accounting

- Cost of Software: Initial software purchase and potential upgrade expenses may be required, along with ensuring hardware compatibility.

- Reliance on Computers: System crashes, data corruption, and power failures can impede access to data, necessitating backups and reliable power sources.

- Fraud: Enhanced security measures are essential to prevent data manipulation and fraud, necessitating increased vigilance and internal auditing.

- Human Error: Mistakes in data entry can occur, and troubleshooting errors within the software may be challenging, compared to manual methods.

- Training: Learning to use accounting software effectively may require time and resources, especially for complex software features.

- Time: Data entry into accounting software may be more time-consuming than manual methods, especially for new users or infrequent users.

Consideration While Choosing Accounting Software

Size of the Business Organization

- Consider the size of the organization and the volume of transactions entered into. Large organizations may require multi-user software, while smaller ones may opt for single-user software.

Ease of Use

- Ensure the interface is user-friendly with simple navigation and self-explanatory features. Look for vendors offering help at no extra cost or tutorial training.

Features

- Identify essential tracking needs. Track costs, including cost of goods sold (COGS), invoicing, online payments, payroll, reporting, and bank balances.

Protects Classified Data

- Choose software that ensures data security. Consider features like SSL encryption, firewall protection, and routine audits to protect sensitive information.

Compatibility

- Check compatibility with other essential tools used in the business, such as e-commerce systems. Ensure seamless integration for efficient operations.

Price

- Consider pricing models but prioritize software that helps manage finances effectively over the cheapest option. Focus on value and benefits for the business.

Accounting Software in India

- Only a few years ago, accounting applications were confined to the desktop of small business owners or accountants' computers. The data was not easily accessible from other locations, limiting access to only one user at a time.

- With the rise of cloud computing, business accounting software providers transitioned to cloud-based solutions, enhancing accessibility and collaboration.

- In a computerized accounting system, the operating environment, comprising both hardware and software, dictates the storage and processing of data. The type of accounting system used determines this environment.

List of prevalent business accounting software systems:

- Tally ERP.9: Tally ERP.9 is a comprehensive business accounting software that covers accounting, inventory management, and payroll. Developed by Tally Solutions Pvt Ltd, it has been a dominant player in the industry for nearly two decades. Tally is known for its user-friendly interface, making it a preferred choice for employers seeking easily accessible trained professionals.

- Profitbooks: Profitbooks is an online accounting software tailored for small enterprises. Operating on the cloud, it offers secure data storage and accessibility from anywhere with an internet connection.

- Marg: Marg Accounting Software, from Marg Compusoft Pvt Ltd, is widely embraced by small and medium enterprises in India. With a presence in the Indian market for over two decades, Marg is a trusted solution for businesses.

- Wave: Wave provides free, secure accounting tools that are highly popular within the accounting community. This web-based software is known for its accessibility and reliability.

- Xero: Xero, an award-winning web-based accounting software developed by Xero, targets small business owners and accountants. Its intuitive user interface simplifies online bookkeeping tasks.

- Reach: Reach Accounting Software, created by Reach Accountant, is an online solution designed for Small & Medium Businesses. Reach offers a comprehensive platform where all business operations are integrated, enabling business owners to monitor every aspect of their operations effectively.