International Business Chapter Notes | Business Studies (BST) Class 11 - Commerce PDF Download

Introduction

- Countries around the globe are experiencing a significant change in the way they produce and sell various products and services. National economies, which once aimed for self-sufficiency, are now increasingly reliant on others for both sourcing and supplying a variety of goods and services. This shift has been driven by the rise of cross-border trade and investments, making countries more interconnected than ever. The primary factors behind this transformation include advancements in communication, technology, and infrastructure. New methods of communication and quicker, more efficient transportation have brought nations closer together.

- India faced a serious debt crisis and a severe balance of payments issue. In 1991, it sought assistance from the International Monetary Fund (IMF) to overcome its financial difficulties. The IMF agreed to provide funds but required India to implement structural reforms to ensure the repayment of the loans. India had no choice but to accept these conditions. It was these very requirements from the IMF that compelled India to liberalise its economic policies, leading to significant economic reforms.

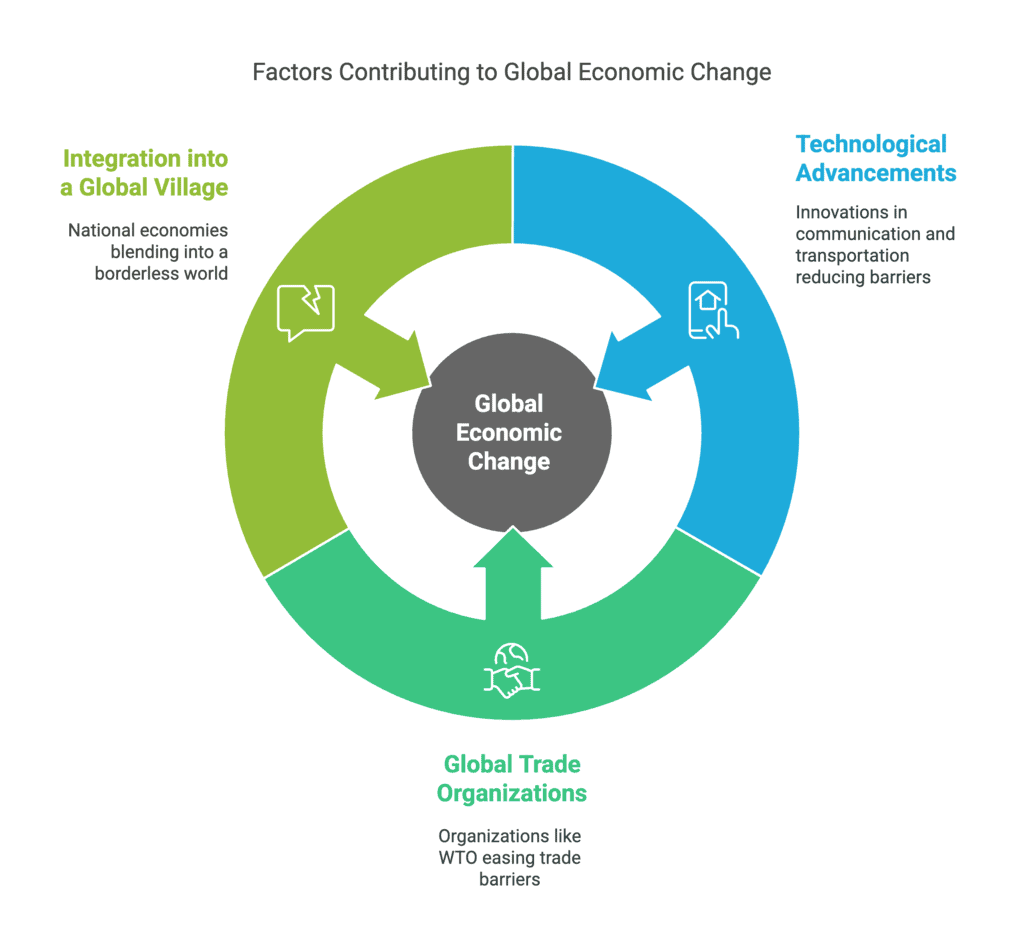

Key Factors in Global Economic Change

- Technological Advancements: Innovations in communication and transportation have reduced geographical barriers, allowing even far-off countries to trade and interact more easily.

- Global Trade Organizations: Bodies like the World Trade Organisation (WTO) and government reforms have helped ease global trade, lowering trade barriers and encouraging cooperation.

- Integration into a Global Village: With reduced barriers, national economies are blending into a borderless world economy, often referred to as a "global village." This facilitates international business operations, providing numerous opportunities for growth and profit.

International business encompasses activities that occur across national borders. It includes not just the movement of goods and services, but also the transfer of capital, personnel, technology, and intellectual property such as patents, trademarks, know-how, and copyrights.

Meaning of International Business

- A domestic business involves transactions within a country's borders, also known as internal or home trade.

- International business, on the other hand, includes activities that happen across national borders, such as the exchange of goods, services, capital, personnel, technology, and intellectual property like patents and trademarks.

- Although many people use international business and international trade interchangeably, the former is a much broader concept. It covers not just trade in goods and services but also other operations, including production and marketing in foreign countries.

- Managing international business operations is generally more complicated than handling domestic business.

- Due to differences in political, social, cultural, and economic factors, it can be challenging to apply domestic business strategies to foreign markets.

- Currently, it includes trade in services like travel, banking, and advertising, as well as foreign investments and production abroad.

- Conducting the production of goods and services in other countries helps businesses connect better with foreign customers and serve them more efficiently at lower costs.

- Therefore, international business includes both trade and production activities that cross borders.

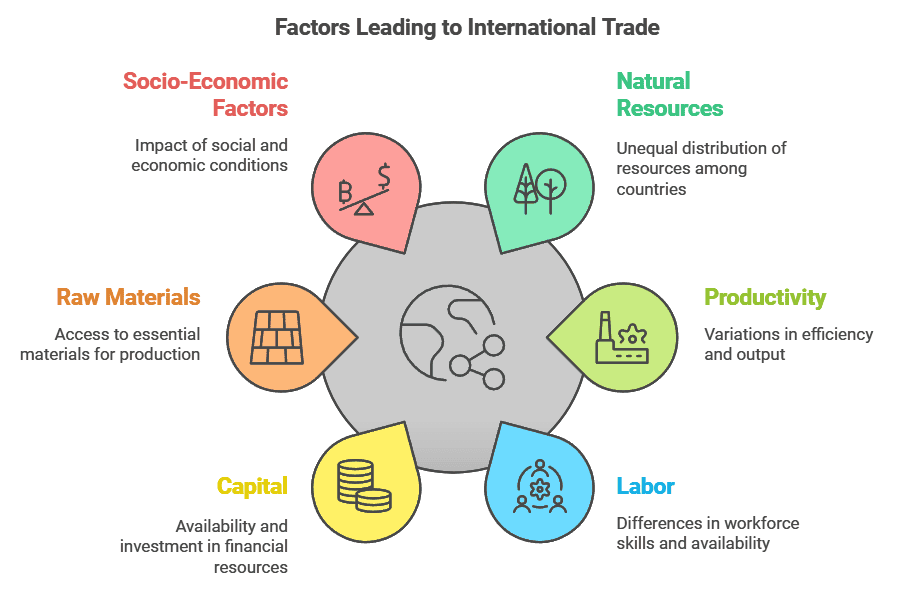

Reasons for International Business

- The main reason for international business is that countries cannot produce everything they need equally well or cost-effectively.

- This is due to the unequal distribution of natural resources and variations in productivity, labour, capital, and raw materials among nations.

- Productivity and production costs also differ because of various socio-economic, geographical, and political factors.

- Some countries are better positioned to produce certain goods or services more efficiently and at a lower cost.

- As a result, they produce what they can do best and trade with other countries for what they need, leading to international trade.

- This principle, called geographical specialization, is also seen within countries; for example, West Bengal specializes in jute, and Maharashtra in cotton textiles.

- Similarly, labor-abundant developing countries often export garments while importing advanced machinery from developed nations.

- Firms engage in international business to buy goods at lower costs abroad and to sell in markets where their products fetch higher prices.

- Besides price advantages, other benefits motivate both nations and firms to participate in international business, which we’ll explore further.

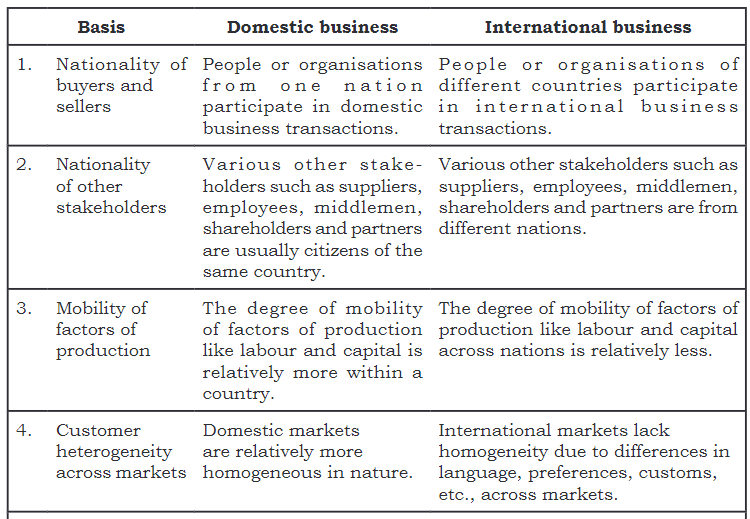

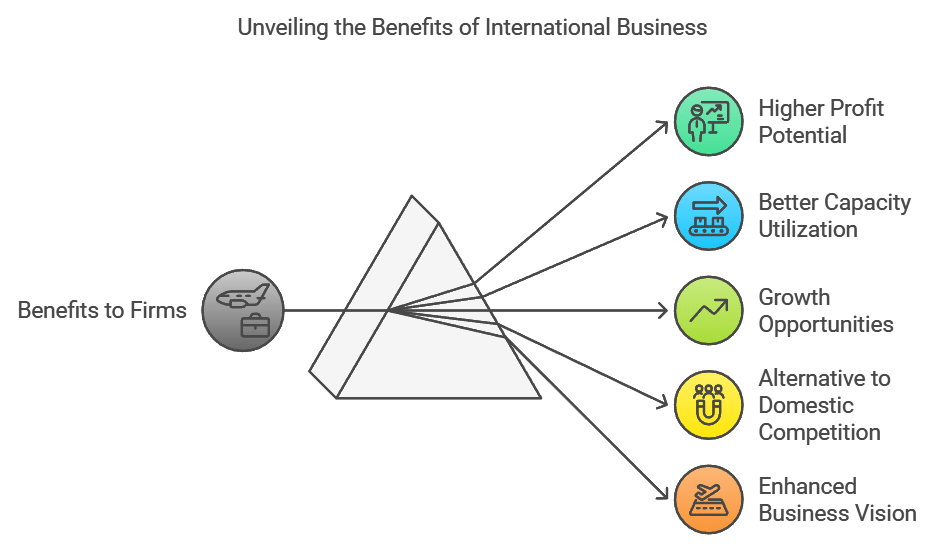

International Business vs. Domestic Business

- Managing international business operations is more complex than domestic business due to differences in political, social, cultural, and economic environments across countries.

- These variations make it challenging for companies to directly apply their domestic strategies in foreign markets.

- For success overseas, firms must adapt their product, pricing, promotion, distribution, and overall business plans to fit the unique demands of each target market.

- Key differences between domestic and international business lie in how these aspects are managed and adapted to diverse environments.

1. Nationality of Buyers and Sellers

- International Business: Buyers and sellers come from various countries. This creates challenges in communication because of different languages, attitudes, social customs, and business goals, making it harder to complete transactions.

- Domestic Business: In domestic business, both buyers and sellers are from the same country. This similarity makes it easier for them to understand each other and make deals.

2. Nationality of Other Stakeholders

- International Business: Stakeholders are from multiple countries, leading to diverse values and goals. This diversity complicates decision-making as businesses must consider a broader range of stakeholders' values from different nations.

- Domestic Business: Other stakeholders, like suppliers, employees, middlemen, shareholders, and partners, are typically citizens of the same country, which promotes consistency in values and behaviours.

3. Mobility of Factors of Production

- International Business: The movement of factors of production, such as labour and capital, is usually more limited between countries than within a country. These factors can move freely inside a country, but their movement across borders faces various restrictions.

- Domestic Business: The movement of factors of production is generally easier within a country. Most stakeholders, including suppliers, employees, middlemen, shareholders, and partners, are typically citizens of the same country. Domestic business is influenced by the political environment and risks associated with a single country.

4. Customer Heterogeneity Across Markets

- International Business: Differences in taste and preference complicate the task of designing products for international markets.

- Domestic Business: Differences in taste and preference do not complicate the task of designing products for domestic markets.

5. Differences in Business Systems and Practices

- International Business: There are significant differences in business systems and practices between countries compared to those within a single country. These differences arise from various factors, including socio-economic development, the availability and efficiency of economic infrastructure, market support services, and local business customs shaped by historical events. As a result, companies looking to enter international markets must adjust their production, finance, human resources, and marketing strategies based on the conditions of those markets.

- Domestic Business: Domestic business operates under the rules, laws, and policies of just one country, including its taxation system. It uses the local currency, and domestic markets tend to be more uniform in nature.

6. Political System and Risks

- International Business: Political elements such as the type of government, political parties, ideologies, and associated risks significantly influence business operations. The political landscape varies from one country to another, necessitating specific efforts to manage these risks.

- Domestic Business: It is easier to forecast how the political environment will affect business operations in domestic business since it is governed by the political system and risks of a single country.

7. Business Regulations and Policies

- International Business: Business laws, rules, and economic policies vary greatly between countries. Transactions in international business must follow the regulations, laws, and policies, including tariffs and quotas, of several nations, making it a more complicated and challenging endeavour.

- Domestic Business: Domestic business operates under the laws, rules, and policies, as well as the taxation system, of a single country.

8. Currency Used in Business Transactions

- International Business: The exchange rate, which is the value of one currency compared to another, is always changing. This fluctuation complicates price setting for international businesses and adds risks related to foreign exchange.

- Domestic Business: There are no such issues since only the local currency is used.

Scope of International Business

1. Merchandise exports and imports

- Merchandise refers to physical goods that can be seen and touched.

- Merchandise exports mean sending tangible goods abroad,

- Merchandise imports mean bringing tangible goods from a foreign country to one’s own country.

- Merchandise exports and imports, also known as trade in goods, include only tangible goods and exclude trade in services.

2. Service exports and imports

- Service exports and imports involve the exchange of non-physical goods.

- This non-physical nature of services is why this trade is called invisible trade.

- A wide range of services is traded internationally.

3. Licensing and franchising

- Permitting another party in a foreign country to produce and sell goods under your trademarks, patents or copyrights instead of some fee is another way of entering into international business.

- Franchising is similar to licensing, but it is a term used in connection with the provision of services.

4. Foreign investments

- Foreign investment means putting money into businesses abroad for financial gain.

- There are two types of foreign investment: direct and portfolio investments.

- Direct investment happens when a company invests directly in assets like factories and equipment in foreign countries to produce and sell goods there, giving them control over the foreign business, known as Foreign Direct Investment (FDI).

- Portfolio investment involves a company buying shares or lending money to another company, earning income through dividends or interest.

Major Difference between Domestic and International Business

Benefits of International Business

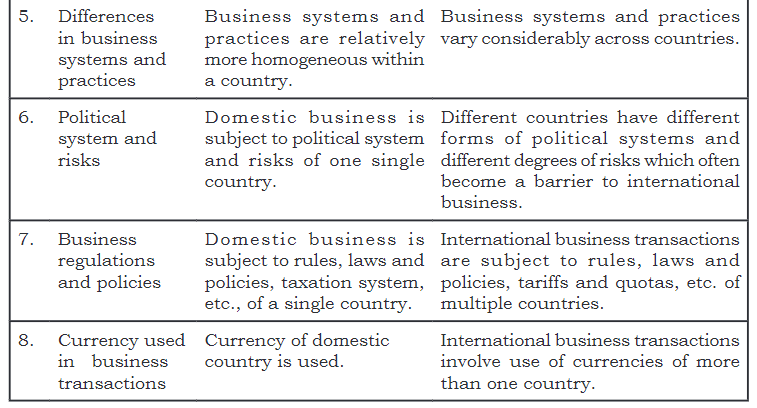

Benefits to Countries

(i) Earning foreign exchange: International business enables a country to earn foreign currency, which can be used to import essential items like capital goods, technology, petroleum products, fertilizers, and pharmaceuticals that may not be produced domestically.

(ii) Efficient resource utilization: By following the principle of producing what each country does best and trading the surplus, international business allows countries to specialize, increasing overall production. This efficient trade benefits all participating nations when goods and services are shared fairly.

(iii) Boosting growth and employment: Relying solely on domestic markets can limit a country’s growth and job creation. Many developing countries could not scale up production due to limited local demand. However, nations like Singapore, South Korea, and China adopted an "export to grow" strategy, significantly boosting their economies and creating more employment.

(iv) Raising living standards: International trade allows people worldwide to enjoy goods and services from other countries, contributing to a higher standard of living.

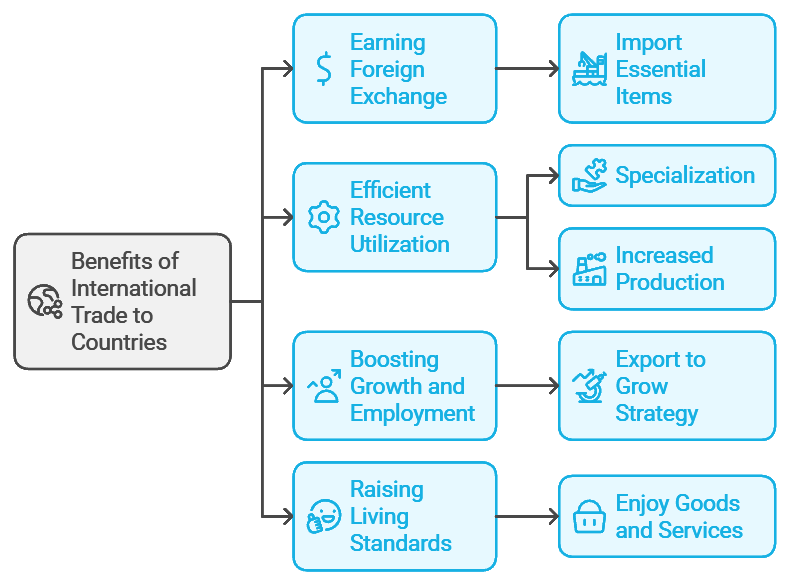

Benefits to Firms

- Prospects for higher profits: International business tends to be more profitable than domestic business. When local prices are low, companies can earn more by selling their products in countries with higher prices.

- Increased capacity utilisation: Many businesses have production capabilities that exceed local demand. By expanding internationally and securing orders from foreign clients, they can utilise their excess capacity, leading to greater profits. Producing at a larger scale often results in economies of scale, reducing costs and increasing profit margins.

- International business follows a straightforward principle: produce what is made efficiently in your own country and trade the surplus with other nations for what they produce better.

- Prospects for growth: Companies often feel frustrated when demand in their home market stagnates. They can greatly enhance their growth opportunities by entering international markets. When competition is fierce at home, expanding overseas often becomes essential for significant growth.

- A way out of intense competition in the domestic market: International business acts as a growth catalyst for firms struggling with tough domestic conditions.

- Improved business vision: Expanding internationally usually aligns with a company's strategic goals, driven by aspirations for growth, competitiveness, diversification, and strategic benefits.

Modes of Entry Into International Business

Exporting and Importing

Meaning

- Exporting involves sending goods and services from a home country to a foreign country while importing is the purchase of foreign products for use in the home country. Firms can export or import in two main ways: direct and indirect.

- In direct exporting/importing, the firm itself manages the entire process, including contacting overseas buyers or suppliers, handling shipment, and financing.

- Indirect exporting/importing, however, involves minimal firm participation. Here, intermediaries such as export houses, overseas buying offices, or local wholesale importers manage most tasks, so the firm doesn’t directly deal with foreign buyers or suppliers.

Advantages

- This is the simplest way to enter international markets.

- Exporting/importing is less complicated than setting up joint ventures or fully owned subsidiaries abroad.

- It requires less involvement since buyers and suppliers manage most formalities related to exporting/importing, including shipment and financing.

- As it does not need significant investment in foreign countries, the risks associated with foreign investments are much lower compared to other entry methods.

Limitations

- Since goods are moved between countries, exporting/importing incurs extra costs for packaging, transport, and insurance. Transport costs can be particularly high for heavy items, making exports and imports less viable.

- When products arrive in foreign countries, they face customs duties and various other fees, which can significantly raise total costs and reduce competitiveness.

- Exporting might not be an option if there are import restrictions in the target country. In such cases, companies may have to consider other entry methods like licensing/franchising or joint ventures to produce and sell locally.

- Export firms typically operate from their home country, producing goods there and shipping them abroad. They usually have limited contact with foreign markets, making it harder to compete with local firms that are closer to customers and better understand their needs.

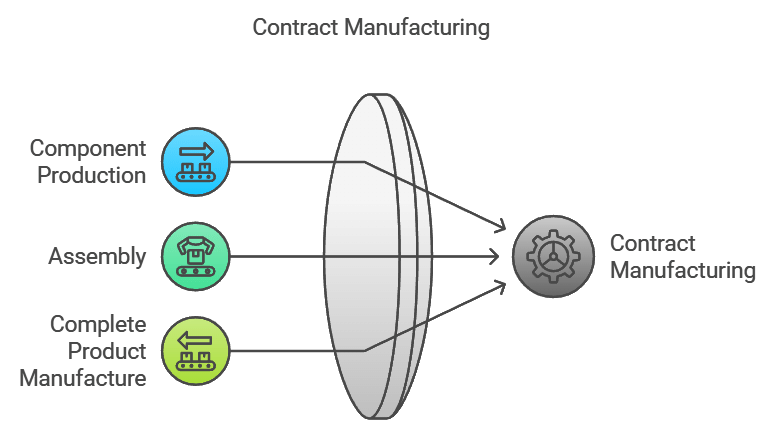

Contract Manufacturing

Meaning

Contract manufacturing is an international business model where a firm partners with local manufacturers in foreign countries to produce components or goods based on specific requirements. Often called outsourcing, this arrangement takes three primary forms:

- Component Production: Local manufacturers produce parts, like automobile components or shoe uppers, used in final products like cars and shoes.

- Assembly: Local manufacturers assemble components, such as those in computers (hard drive, motherboard), into finished goods.

- Complete Product Manufacture: Local manufacturers produce entire products, such as garments.

In these cases, the foreign firm provides technology and management support, and the local manufacturer delivers the goods, which the foreign firm may sell under its brand in various markets. Companies like Nike, Reebok, and Levis widely use contract manufacturing in developing countries.

Advantages

- They make use of the production facilities already existing in foreign countries, thus, investment is not required.

- As no investment, no investment risk.

- Gives an advantage to international companies to manufacture or assemble the products at lower costs.

- Idle production capacities in foreign countries, obtains manufacturing jobs on a contract basis in a way provides a ready market for their products.

- Gets the opportunity to get involved with international business and avail incentives.

Limitations

- Non-adherence to production design and quality standards causes product quality problems to the international firm.

- Local manufacturers lose their control over the manufacturing process because goods are produced strictly as per the terms and specifications.

- They are not free to sell the contracted output as per its will. It has to sell the goods to the international company at a predetermined price.

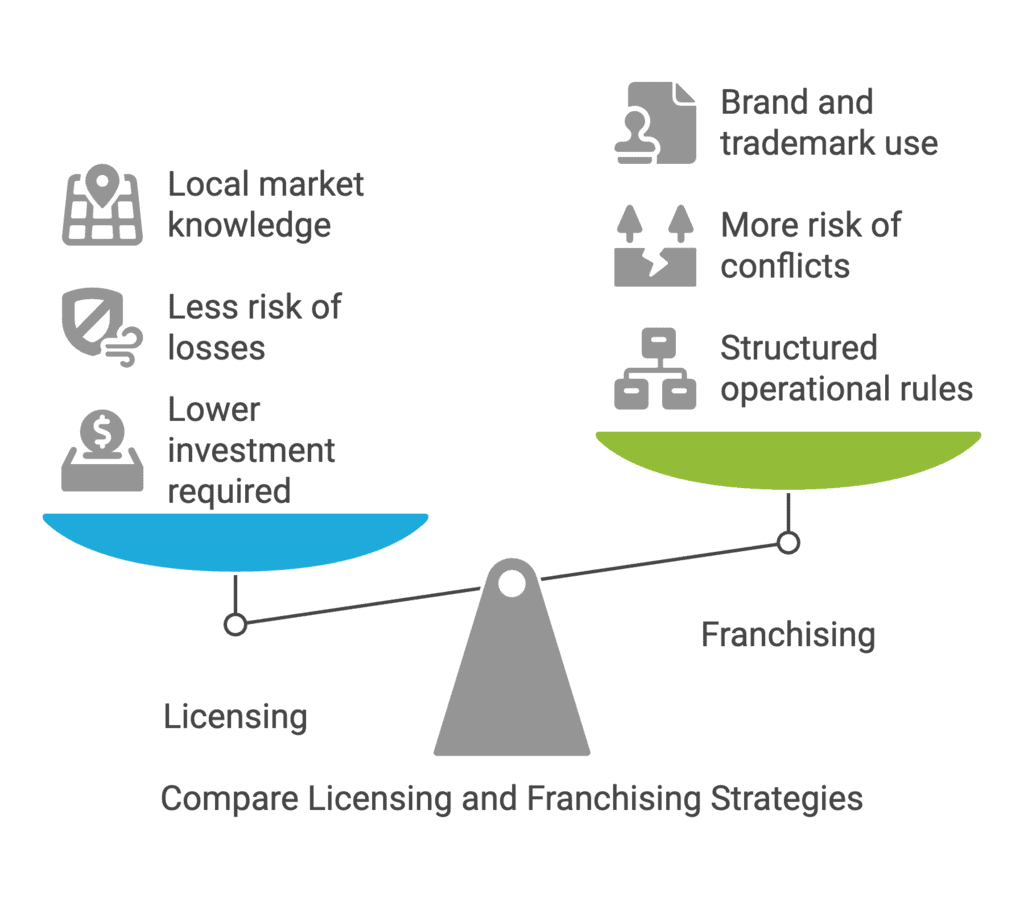

Licensing and Franchising

Meaning

Licensing is a contractual arrangement where a firm (licensor) grants another firm (licensee) in a foreign country the right to use its patents, trade secrets, or technology in exchange for a royalty fee.

Licensing isn't limited to technology; fashion designers, for example, often license their names for use.

In some cases, there’s a mutual exchange of technology or knowledge between firms, called cross-licensing.

Franchising is similar to licensing but typically applies to service industries, like restaurants or hotels. It is also more structured; franchisers set detailed rules for how franchisees must operate.

A franchising agreement involves a payment for the right to use trademarks, technology, or patents for a specific period. The original company is the franchiser, while the other party is the franchisee. Notable global franchises include McDonald's, Pizza Hut, and Wal-Mart.

Advantages

- As such, the licensor/franchiser has to virtually make no investments abroad. Licensing/franchising is, therefore, considered a less expensive mode of entering into international business.

- No or very little foreign investment is involved, the licensor/ franchiser is not a party to the losses.

- There are lower risks of business takeovers or government interventions.

- Licensee/franchisee being a local person has greater market knowledge and contacts which can prove quite helpful to the licensor/franchiser in successfully conducting its marketing operations.

- Make use of the licensor’s/ franchiser’s copyrights, patents, and brand names.

Limitations

- There is a danger that the licensee can start marketing an identical product under a slightly different brand name.

- If not maintained properly, trade secrets can get divulged to others in the foreign markets.

- Conflicts over maintenance of accounts, payment of royalty and non-adherence to norms relating to the production of quality products.

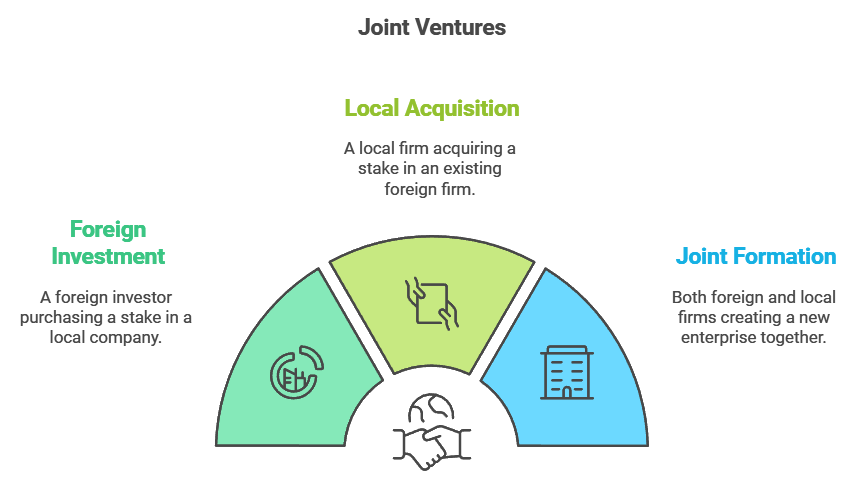

Joint Ventures

Meaning

A joint venture is a common strategy for entering foreign markets, involving the creation of a firm jointly owned by two or more independent companies. It can be broadly defined as any long-term collaboration. A joint venture can be formed in three main ways:

- A foreign investor buys an interest in a local company.

- A local firm acquires an interest in an existing foreign firm.

- Both foreign and local firms jointly form a new enterprise.

Advantages

- Financially less burdensome for the international firm as the local partner also contributes to the equity capital.

- Possible to execute large projects requiring huge capital outlays and manpower.

- The foreign business firm benefits from a local partner’s knowledge of the host country regarding competitive conditions, culture, language, political systems, and business systems.

- Sharing costs and risks avoids burden on one.

Limitations

- Dual ownership arrangements may lead to conflicts, resulting in a battle for control between the investing firms.

- Share of technology and trade secrets poses a threat of disclosing them to others.

Wholly Owned Subsidiaries

Meaning

A wholly owned subsidiary is preferred by companies seeking full control over their overseas operations. The parent company invests 100% of the equity capital to establish control. This can be done in two ways:

- Setting up a new firm in a foreign country, known as a greenfield venture.

- Acquiring an existing firm in a foreign country to manufacture and/or promote products.

Advantages

- Full control over operations.

- Not required to disclose its technology or trade secrets to others.

Limitations

- Not suitable for small and medium-sized firms that do not have enough funds to invest abroad.

- Has to bear the entire losses resulting from the failure of its foreign operations

- They are subject to higher political risks

Export-Import Procedures And Documentation

- A key difference between domestic and international business is the complexity of international operations.

- Exporting and importing goods is not as simple as buying and selling within a country.

- Since international trade involves moving goods across borders and using foreign currency, there are several steps to complete before goods can leave one country and enter another.

- The following sections explain the important steps involved in export and import transactions.

Export Procedure

The number of steps and the order in which they are carried out can vary for each export transaction. However, the typical steps in an export transaction are as follows:

1. Receipt of Enquiry and Sending Quotations

- Exporters can be informed of such an enquiry by way of an advertisement in the press put in by the importer.

- The exporter sends a reply to the enquiry in the form of a quotation referred to as a proforma invoice.

- The proforma invoice contains information about the price, quality, grade, size, weight, mode of delivery, type of packing, and payment terms.

2. Receipt of Order or Indent

If the importing firm agrees with the export price and terms, it places an order for the goods. This order, called an indent, includes:

- A description of the goods ordered

- The prices to be paid

- Delivery terms

- Packing and marking details

- Delivery instructions

3. Assessing the Importer’s Creditworthiness and Securing a Guarantee for Payments

- The exporter makes an enquiry about the creditworthiness of the importer.

- To minimize risks, most exporters demand a letter of credit from the importer.

- A letter of credit is a guarantee issued by the importer’s bank that it will honour payment up to a certain amount of export bills to the bank of the exporter.

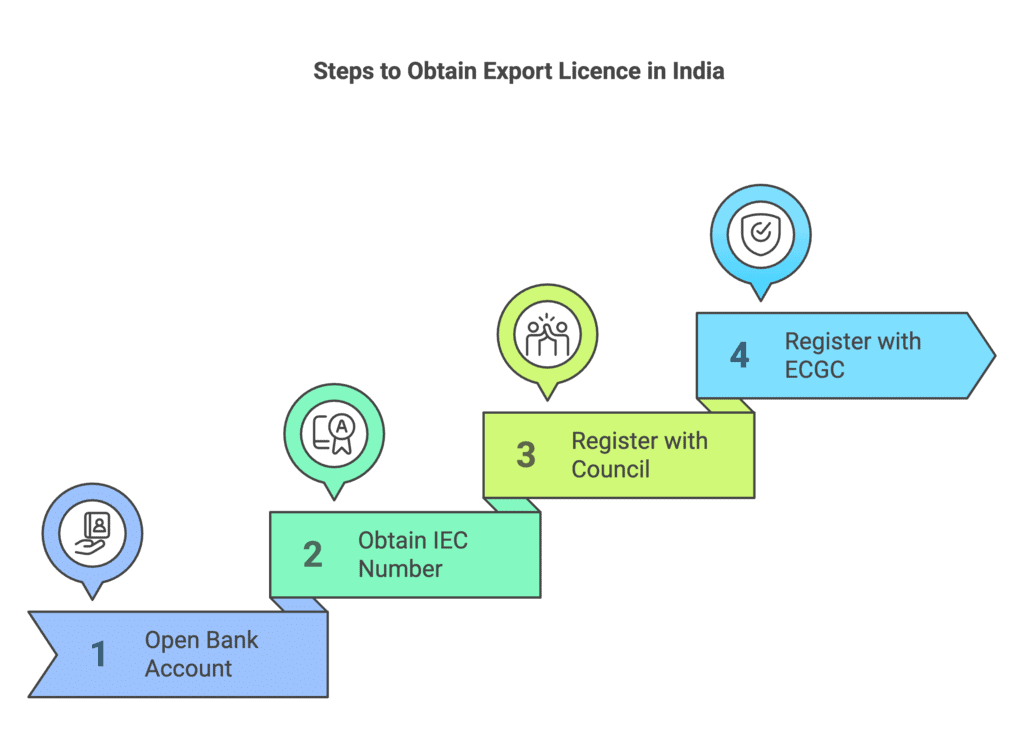

4. Obtaining Export Licence

- Export of goods in India is subject to customs laws which demand that the export firm must have an export licence before it proceeds with exports.

- Prerequisites for getting an export licence:

1. Opening a bank account in any bank authorized by the Reserve Bank of India.

2. Obtaining an Import Export Code (IEC) number from the Directorate General Foreign Trade (DGFT) or Regional Import Export Licensing Authority.

3. Registration with the appropriate export promotion council.

4. Registration with Export Credit and Guarantee Corporation (ECGC) to safeguard against risks of non-payment. - To obtain the IEC number, a firm must apply to the DGFT with documents such as an exporter/importer profile, bank receipt for the requisite fee, a certificate from the banker on the prescribed form, two copies of photographs attested by the banker, details of the non-resident interest, and declaration about the applicant’s non-association with caution listed firms.

- It is obligatory for every exporter to get registered with the appropriate export promotion council.

- Registration with the ECGC is necessary to protect overseas payments from political and commercial risks.

5. Obtaining Pre-shipment Finance

- After receiving a confirmed order and a letter of credit, the exporter approaches their bank to secure pre-shipment finance for export production.

- Pre-shipment finance is the funding necessary for the exporter to buy raw materials, process and package the goods, and transport them to the shipping port.

6. Production or Procurement of Goods

- The exporter proceeds to get the goods ready as per the specifications of the importer. The firm either produces the goods itself or buys from the market.

7. Pre-shipment Inspection

- Mandatory inspection of specific products by an approved agency designated by the government.

- The government implemented the Export Quality Control and Inspection Act, 1963, empowering certain agencies to serve as inspection authorities. If the product falls into this category, the exporter must reach out to the Export Inspection Agency (EIA) or another designated agency to get an inspection certificate.

- The pre-shipment inspection report must be included with other export documents during the export process.

- This inspection is not necessary if the goods are exported by star trading houses, trading houses, export houses, industrial units located in export processing zones or special economic zones (EPZs/SEZs), and 100 per cent export-oriented units (EOUs).

- The Export Inspection Council of India (EICI) is one agency that conducts these inspections and provides the certificate confirming that the consignment has been inspected as mandated by the Export (Quality Control and Inspection) Act, 1963.

8. Excise Clearance

- Excise duty applies to the materials used in making goods. The exporter needs to request clearance from the local Excise Commissioner by submitting an invoice. If the Excise Commissioner approves, they will issue the excise clearance. However, often the government waives the excise duty or later refunds it for goods intended for export. This exemption or refund aims to encourage exporters to increase their exports and enhance the competitiveness of exported products in global markets.

- The refund of excise duty is called duty drawback. The Commissioner of Customs or the Central Excise Officer responsible for the relevant port, airport, or land customs station handles the processing of the drawback claims.

- The duty drawback scheme is currently managed by the Directorate of Drawback under the Ministry of Finance, which sets the drawback rates for various products. The same Commissioner of Customs or Central Excise Officer also oversees the sanction and payment of these drawbacks.

9. Obtaining a Certificate of Origin

- To avail trade concessions and other benefits, the importer may ask the exporter to send a certificate of origin.

- The certificate of origin acts as proof that the goods have actually been manufactured in the country from where the export is taking place.

- This certificate can be obtained from the trade consulate located in the exporter’s country.

10. Reservation of Shipping Space

- The exporting firm applies to the shipping company for the provision of shipping space, specifying the types of goods to be exported, the probable date of shipment, and the port of destination.

- Upon acceptance of the application, the shipping company issues a shipping order.

11. Packing and Forwarding

- The goods are carefully packed and labelled with essential information such as the importer's name and address, gross and net weight, port of shipment and destination, and country of origin.

- The exporter cannot handle all these tasks personally; therefore, they hire a Clearing and Forwarding (C&F) agent to manage these duties.

- The exporter also arranges for the transportation of goods to the port.

- The goods must receive customs clearance before they can be loaded onto the ship.

- To obtain customs clearance, the exporter prepares the shipping bill, which is the primary document needed for the customs office to grant export permission.

- After loading the goods onto a railway wagon, the railway authorities provide a ‘railway receipt’, serving as proof of ownership. The exporter endorses this receipt to their agent, allowing them to collect the goods at the shipping port.

12. Insurance of Goods

- Goods are insured by an insurance company to protect against the risks of loss or damage during transit.

13. Customs Clearance

- Goods must be cleared from customs before they can be loaded on the ship.

- For customs clearance, the exporter prepares the shipping bill.

- The shipping bill is the main document based on which the customs office gives permission for export.

- Five copies of the shipping bill along with the following documents are submitted to the Customs Appraiser at the Customs House:

1. Export Contract or Export Order

2. Letter of Credit

3. Commercial Invoice

4. Certificate of Origin

5. Certificate of Inspection

6. Marine Insurance Policy - After submission of these documents, the Superintendent of the concerned port trust is approached for obtaining the carting order. The carting order is the instruction to the staff at the gate of the port to permit the entry of the cargo inside the dock.

14. Obtaining Mate’s Receipt

- A mate’s receipt is issued by the commanding officer of the ship when the cargo is loaded on board, containing information about the name of the vessel, berth, date of shipment, description of packages, marks and numbers, and the condition of the cargo at the time of receipt on board the ship.

- The port superintendent, on receipt of port dues, hands over the mate’s receipt to the C&F agent.

15. Payment of Freight and Issuance of Bill of Lading

- The C&F agent surrenders the mate’s receipt to the shipping company for computation of freight.

- Upon receipt of the freight, the shipping company issues a bill of lading which serves as evidence that the shipping company has accepted the goods for carrying to the designated destination.

- If the goods are sent by air, this document is referred to as the airway bill.

16. Preparation of Invoice

- The invoice states the quantity of goods sent and the amount to be paid by the importer. The C&F agent gets it duly attested by the customs.

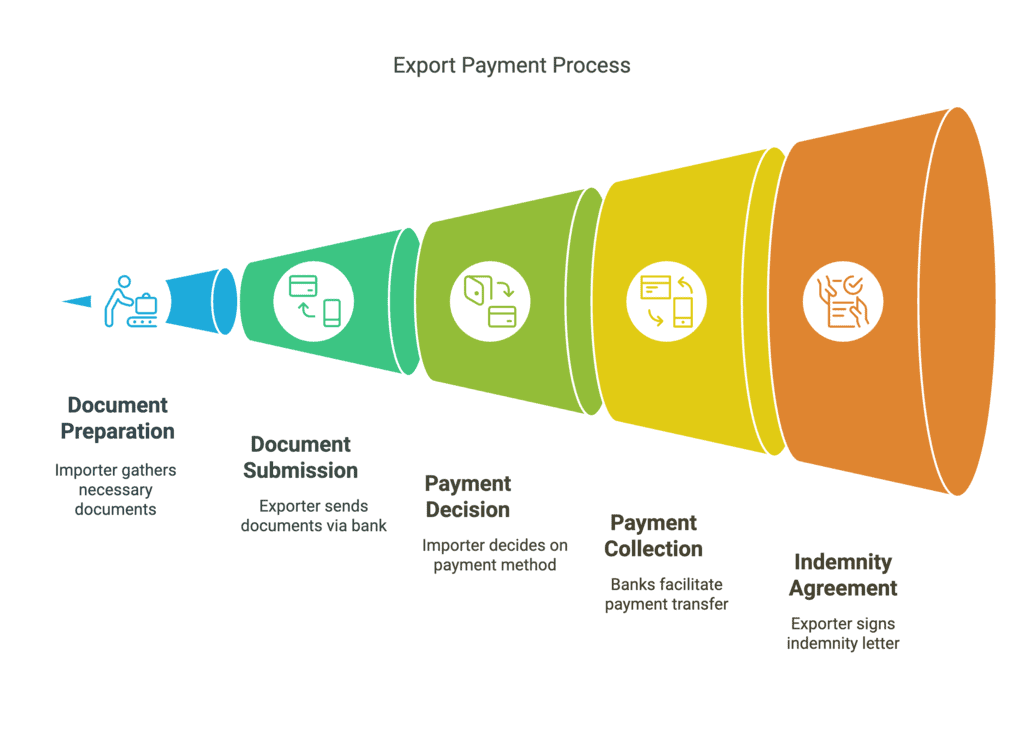

17. Securing Payment

- The exporter informs the importer about the goods being shipped.

- The importer must have several documents to claim ownership of the goods upon their arrival and to clear customs. These documents include a certified invoice, bill of lading, packing list, insurance policy, certificate of origin, and letter of credit.

- The exporter sends these documents via their bank with instructions for them to be given to the importer once the bill of exchange is accepted—this document is included with the others.

- Submitting the necessary documents to the bank to receive payment is known as 'negotiation of the documents.'

- Upon receiving the bill of exchange, the importer makes the payment if it’s a sight draft or accepts the usance draft to pay once the bill matures. The exporter’s bank collects the payment through the importer’s bank and deposits it into the exporter’s account.

- The exporter can get immediate payment from their bank after submitting the documents by signing a letter of indemnity. By signing this letter, the exporter agrees to protect the bank in case the importer does not pay, including any interest due.

- After receiving payment for the exports, the exporter should obtain a bank certificate of payment.

Import Procedure

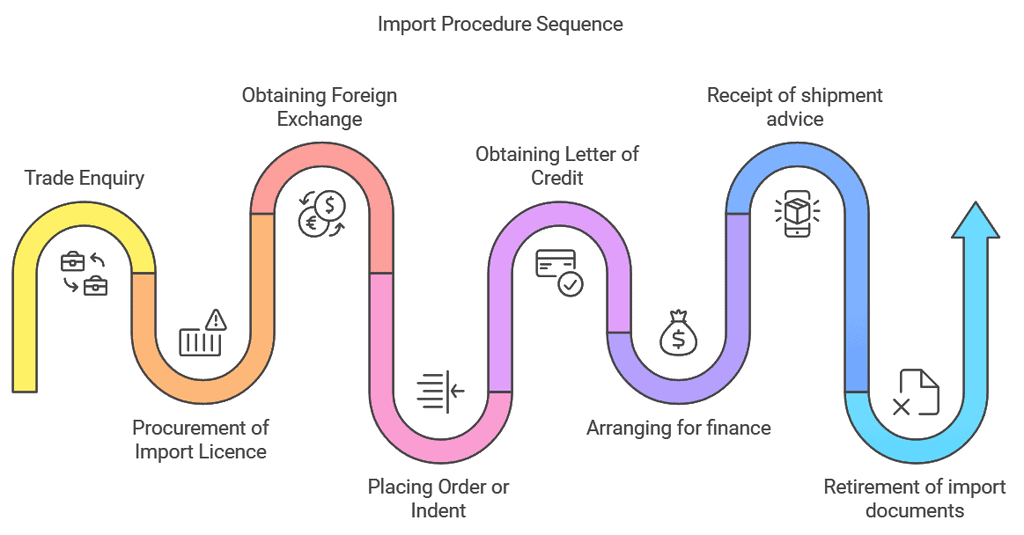

1. Trade Enquiry- The importing company contacts export firms with a trade enquiry to get details about their prices and export conditions.

- A trade enquiry is a formal request from an importer to an exporter for information about pricing and the terms under which goods can be exported.

- The exporter replies to the enquiry with a quotation, known as a proforma invoice. This document includes the selling price and details about the quality, grade, size, weight, delivery method, packaging type, and payment terms.

2. Procurement of Import Licence

- The importer needs to consult the Export-Import (EXIM) policy in force to know whether the goods he or she wants to import are subject to import licensing.

- If goods can be imported only against a licence, the importer needs to procure an import licence.

- In India, it is obligatory for every importer (and also for exporter) to get registered with the Directorate General Foreign Trade (DGFT) or Regional Import Export Licensing Authority and obtain an Import Export Code (IEC) number.

3. Obtaining Foreign Exchange

- Payment in foreign currency involves exchanging Indian currency for foreign currency.

- In India, all foreign exchange transactions are regulated by the Exchange Control Department of the Reserve Bank of India (RBI).

- Every importer is required to secure the sanction of foreign exchange.

- To obtain such a sanction, the importer has to make an application to a bank authorized by RBI to issue a foreign exchange.

4. Placing Order or Indent

- The importer places an import order or indent with the exporter for the supply of the specified products.

- The import order contains information about the price, quantity size, grade and quality of goods ordered, and the instructions relating to packing, shipping, ports of shipment and destination, delivery schedule, insurance, and mode of payment.

5. Obtaining Letter of Credit

- If the payment terms agreed between the importer and the overseas supplier is a letter of credit, then the importer should obtain the letter of credit from its bank and forward it to the overseas supplier.

6. Arranging for finance

- The importer should make arrangements in advance to pay to the exporter on arrival of goods at the port.

- Advanced planning for financing imports is necessary so as to avoid huge penalties.

7. Receipt of shipment advice

Once the goods are loaded onto the vessel, the overseas supplier sends the shipment advice to the importer. This document includes important information about the shipment, such as:

- Invoice number

- Bill of lading/airways bill number and date

- Name of the vessel and date

- Port of export

- Description of goods and quantity

- Date of sailing of the vessel

8. Retirement of import documents

After the goods are shipped, the overseas supplier prepares the necessary documents according to the contract and letter of credit. These documents are then given to their banker for transmission and negotiation with the importer as specified in the letter of credit. The typical set of documents includes:

- Bill of exchange

- Commercial invoice

- Bill of lading/airway bill

- Packing list

- Certificate of origin

- Marine insurance policy

The accompanying bill of exchange is referred to as the documentary bill of exchange, which can be either:

- Documents against payment (sight draft)

- Documents against acceptance (usance draft)

9. Arrival of goods

- The person in charge of the carrier (ship or airway) informs the officer in charge at the dock or the airport about the arrival of goods in the importing country.

- He provides the document called import general manifest. An import general manifest is a document that contains the details of the imported goods.

10. Customs clearance and release of goods

- Customs clearance can be a complex process that requires fulfilling several formalities. It is advisable for importers to hire C&F agents who are knowledgeable about these procedures and help in clearing the goods through customs.

- The importer must first obtain a delivery order, also known as an endorsement for delivery. This is usually done when the ship arrives at the port, with the endorsement on the back of the bill of lading by the shipping company. Sometimes, instead of endorsing the bill, the shipping company issues a delivery order that allows the importer to take delivery of the goods.

- The importer needs to submit two copies of a completed form called the application to import to the customs authorities. The customs authorities charge fees for the services of dock authorities, which the importer must pay. After paying the dock charges, the importer receives one copy of the application as a receipt, known as a port trust dues receipt.

- The importer then completes a bill of entry for customs clearance.

- Once the import duty is paid, the bill of entry must be presented to the customs office.

- The importer or their agent submits the bill of entry to the customs office, and after the necessary charges are paid, the customs office issues the release order.

Major Documents needed in Connection with Export Transaction

A. Documents Related to Goods

- Export Invoice: A seller's bill detailing the goods being exported, including information on quantity, value, packaging, shipment, delivery terms, and payment conditions.

- Packing List: A detailed list showing the number of packages and the contents of each, specifying the goods and their shipping format.

- Certificate of Origin: Specifies the country where the goods were produced, allowing the importer to claim tariff concessions or exemptions, especially if goods are not subject to restrictions from certain countries.

- Certificate of Inspection: A certificate ensuring that certain goods meet quality control standards, issued by authorized agencies like the Export Inspection Council of India (EICI).

B. Documents Related to Shipment

- Mate’s Receipt: A receipt from the ship's commanding officer confirming that the goods have been loaded onto the ship, listing details like the ship’s name, berth, and condition of the cargo.

- Shipping Bill: The document that customs uses to grant export permission, detailing goods, destination, vessel, and exporter’s information.

- Bill of Lading: An official receipt from a shipping company acknowledging receipt of goods for shipment, and a document of title to the goods that can be transferred.

- Airway Bill: Similar to a bill of lading but for air shipments, it confirms receipt of goods and commitment to transport them.

- Marine Insurance Policy: An insurance contract that covers potential losses incurred due to sea-related risks.

- Cart Ticket: A pass indicating export cargo details, such as the shipper’s name, package count, and vehicle number.

C. Documents Related to Payment

- Letter of Credit: A bank guarantee ensuring the importer’s bank will pay the exporter up to a specified amount. It is a secure payment method in international trade.

- Bill of Exchange: A document directing the importer to pay a specified amount to the exporter or a designated party. The export documents are released once the bill is accepted.

- Bank Certificate of Payment: A certificate from the bank confirming that the export documents have been presented for payment and that payment has been made in compliance with exchange control regulations.

Major Documents used in an Import Transaction

Trade Enquiry: A written request by an importer to an exporter, asking for details about prices and terms of sale for goods.

Proforma Invoice: A document containing details about the quality, grade, size, weight, and price of the goods, as well as the terms for their export.

Import Order or Indent: A document where the importer places an order for goods, specifying details such as quantity, price, payment method, and shipping terms.

Letter of Credit: A document from the importer's bank guaranteeing that it will pay the exporter's bank up to a specified amount for the goods.

Shipment Advice: A document sent by the exporter to the importer, informing them that the shipment has been made. It includes shipping details like the bill of lading number, vessel name, and description of goods.

Bill of Lading: A document issued by the ship's master acknowledging receipt of goods on board and outlining the terms of their transport to the destination port.

Airway Bill: Similar to a bill of lading, but for air shipments. It acknowledges receipt of goods and promises their transport to the destination.

Bill of Entry: A form submitted to customs by the importer when receiving goods, containing details such as the goods' description, quantity, and customs duty payable.

Bill of Exchange: A written order by the exporter directing the importer to pay a specified amount. The export documents are transferred once the importer accepts the bill.

Sight Draft: A type of bill of exchange where the importer must pay immediately to receive the documents.

Usance Draft: A type of bill of exchange where the importer must accept the bill before receiving the documents, typically with a delay.

Import General Manifest: A document that lists the details of all the goods being imported, used for unloading cargo.

Dock Challan: A form used to specify the amount of dock charges to be paid after completing customs formalities.

|

38 videos|180 docs|28 tests

|

FAQs on International Business Chapter Notes - Business Studies (BST) Class 11 - Commerce

| 1. What is the meaning of international business? |  |

| 2. What are the main reasons for engaging in international business? |  |

| 3. How does international business differ from domestic business? |  |

| 4. What are the benefits of engaging in international business? |  |

| 5. What are the common modes of entry into international business? |  |