UPSC Prelims Previous Year Questions 2024: Indian Economy | Indian Economy for UPSC CSE PDF Download

Q1. Consider the following statements:

Statement-I: If the United States of America (USA) were to default on its debt, holders of US Treasury Bonds will not be able to exercise their claims to receive payment.

Statement-II: The USA Government debt is not backed by any hard assets, but only by the faith of the Government.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II explains Statement-I.

(b) Both Statement-I and Statement-II are correct, but Statement-II does not explain Statement-I.

(c) Statement I is correct, but Statement II is incorrect.

(d) Statement I is incorrect, but Statement II is correct

View Answer

View Answer

Ans: (a)Both Statement-I and Statement-II are correct and Statement-II explains Statement-I.

Statement-I: If the United States of America (USA) were to default on its debt, holders of US Treasury Bonds will not be able to exercise their claims to receive payment.

- This statement is correct. If the USA were to default on its debt obligations, holders of US Treasury Bonds would indeed face the risk of not receiving their payments as scheduled. US Treasury Bonds are considered very low-risk investments primarily because they are backed by the full faith and credit of the US government, but default is theoretically possible.

Statement-II: The USA Government debt is not backed by any hard assets, but only by the faith of the Government.

- This statement is also correct. US government debt, including Treasury Bonds, is not backed by physical assets like gold or land but rather by the promise and creditworthiness of the US government. Investors trust that the US government will honor its debt obligations, which is why US Treasury Bonds are considered a benchmark of safety in the financial markets.

Explanation:

- Statement-I is correct because default on US government debt would mean that bondholders might not receive their payments.

- Statement-II is correct because US government debt is backed by the government's ability to tax and its credibility in financial markets, not by physical assets.

Therefore, the correct answer is: (a) Both Statement-I and Statement-II are correct and Statement-II explains Statement-I.

Q2. Consider the following statements:

Statement-I: Syndicated lending spreads the risk of borrower default across multiple lenders.

Statement-II: The syndicated loan can be a fixed amount/lump sum of funds, but cannot be a credit line.

Which one of the following is correct in respect of the above statements?

(a) Both Statement-I and Statement-II are correct and Statement-II explains Statement-I.

(b) Both Statement-I and Statement-II are correct, but Statement-II does not explain Statement-I.

(c) Statement I is correct, but Statement II is incorrect.

(d) Statement-I is incorrect, but Statement-II is correct.

View Answer

View Answer

Ans: Statement I is correct, but Statement II is incorrect.

Statement-I: Syndicated lending spreads the risk of borrower default across multiple lenders.

- This statement is correct. Syndicated lending involves a group of lenders collectively providing funds to a single borrower. By spreading the loan amount across multiple lenders, the risk of default is shared among them, reducing the exposure of each lender to potential borrower defaults.

Statement-II: The syndicated loan can be a fixed amount/lump sum of funds, but cannot be a credit line.

- This statement is incorrect. Syndicated loans can indeed be structured as either a fixed amount/lump sum or as a revolving credit line. A fixed syndicated loan provides a borrower with a one-time lump sum amount, while a syndicated revolving credit line allows a borrower to access funds up to a specified limit over time, repaying and borrowing as needed.

Conclusion:

- Statement-I correctly describes one of the key benefits of syndicated lending, which is spreading the risk of borrower default among multiple lenders.

- Statement-II is incorrect because syndicated loans can be structured as either a fixed amount/lump sum or as a credit line.

Therefore, the correct answer is: (c) Statement I is correct, but Statement II is incorrect.

Statement-I accurately describes the risk-sharing nature of syndicated lending, while Statement-II incorrectly limits the types of structures available for syndicated loans.

Q3. Consider the following statements in respect of the digital rupee:

1. It is a sovereign currency issued by the Reserve Bank of India (RBI) in alignment with its monetary policy.

2. It appears as a liability on the RBI’s balance sheet.

3. It is insured against inflation by its very design.?

4. It is freely convertible against commercial bank money and cash.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 1 and 3 only

(c) 2 and 4 only

(d) 1, 2 and 4

View Answer

View Answer

Ans: (d) 1,2 and 4

It is a sovereign currency issued by the Reserve Bank of India (RBI) in alignment with its monetary policy.

- This statement is correct. The digital rupee, if issued by the RBI, would be a sovereign currency issued by the central bank in alignment with its monetary policy objectives.

It appears as a liability on the RBI’s balance sheet.

- This statement is correct. Like physical currency (cash) and reserves held by commercial banks, digital currency issued by the RBI would appear as a liability on the RBI's balance sheet.

It is insured against inflation by its very design.

- This statement is incorrect. The design of a currency does not inherently provide insurance against inflation. The management of inflation is a function of monetary policy actions taken by the central bank.

It is freely convertible against commercial bank money and cash.

- This statement is correct. A digital currency issued by the RBI would likely be freely convertible against commercial bank money (deposits) and cash (physical currency).

Therefore, the correct statements are: (d) 1, 2, and 4

Statement 3 is incorrect because currency design does not provide intrinsic inflation insurance.

Q4.With reference to the Digital India Land Records Modernisation Programme, consider the following statements:

1. To implement the scheme, the Central Government provides 100% funding.

2. Under the Scheme, Cadastral Maps are digitised.

3. An initiative has been undertaken to transliterate the Records of Rights from local language to any of the languages recognized by the Constitution of India.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Ans: (d) 1,2 and 3

To implement the scheme, the Central Government provides 100% funding.

- This statement is correct. The Digital India Land Records Modernisation Programme is fully funded by the Central Government of India to support the modernization and digitization of land records across states.

Under the Scheme, Cadastral Maps are digitised.

- This statement is correct. One of the key components of the programme is the digitization of cadastral maps, which are essential for maintaining accurate land records and property ownership details.

An initiative has been undertaken to transliterate the Records of Rights from local language to any of the languages recognized by the Constitution of India.

- This statement is also correct. As part of the programme, efforts are made to make land records accessible in languages recognized by the Constitution of India, which helps in easier access and understanding for all stakeholders.

Therefore, all three statements are correct. The correct answer is: (d) 1, 2, and 3

Q5. Consider the following statements:

1. In India, Non-Banking Financial Companies can access the Liquidity Adjustment Facility window of the Reserve Bank of India.

2. In India, Foreign Institutional Investors can hold the Government Securities (G-Secs).

3. In India, Stock Exchanges can offer Separate trading platforms for debts.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 only

(c) 1, 2 and 3

(d) 2 and 3 only

View Answer

View Answer

Ans: (d) 2 and 3 only

- Foreign Institutional Investors (FIIs) are allowed to invest in Government Securities (G-Secs) within the limits set by the RBI and SEBI. This initiative is aimed at encouraging foreign investment in India's debt market. Thus, Statement 2 is correct.

- Indian stock exchanges, such as the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), have created separate trading platforms for debt instruments. This development helps in trading corporate bonds, government securities, and other debt instruments. Hence, Statement 3 is correct.

Q6: In India, which of the following can trade in Corporate Bonds and Government Securities?

1. Insurance Companies

2. Pension Funds

3. Retail Investors

Select the correct answer using the code given below:

(a)1 and 2 only

(b)2 and 3 only

(c)1 and 3 only

(d)1, 2 and 3

View Answer

View Answer

Ans: (d) 1,2 and 3

In India, the trading in Corporate Bonds and Government Securities is open to the following entities:

Insurance Companies: Insurance companies are allowed to invest in both Corporate Bonds and Government Securities as part of their investment portfolio. These investments help insurance companies manage their funds and ensure liquidity while meeting regulatory requirements.

Pension Funds: Pension funds, including both private and public sector pension funds, are permitted to invest in Corporate Bonds and Government Securities. These investments are crucial for pension funds to generate stable returns over the long term to meet future obligations to pensioners.

Retail Investors: Retail investors, which include individual investors or small-scale investors, can also trade in Corporate Bonds and Government Securities through various channels, such as stock exchanges, mutual funds, and direct subscriptions. This allows retail investors to diversify their investment portfolios and earn returns from fixed-income securities.

Therefore, the correct answer is: (d) 1, 2 and 3

All of the listed entities — Insurance Companies, Pension Funds, and Retail Investors — can trade in Corporate Bonds and Government Securities in India.

Q7. Consider the following:

1. Exchange-Traded Funds (ETF)

2. Motor vehicles

3. Currency swap

Which of the above is/are considered financial instruments?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 3

(d) 1 and 3 only

View Answer

View Answer

Ans: (d) 1 and 3 only

Exchange-Traded Funds (ETF):

- ETFs are financial instruments that represent a collection of securities (such as stocks, bonds, or commodities) that track an underlying index. They trade on stock exchanges, and investors can buy or sell ETF shares throughout the trading day.

Motor vehicles:

- Motor vehicles are physical assets and are not typically considered financial instruments. They are tangible goods used for transportation purposes and do not represent financial claims or investments.

Currency swap:

- A currency swap is a financial derivative contract in which two parties exchange the principal amount of a loan in one currency for equivalent amounts in another currency. Currency swaps are used to hedge against currency exchange rate fluctuations or to obtain lower interest rates in one currency.

Based on this analysis:

- Exchange-Traded Funds (ETFs) (statement 1) and Currency swaps (statement 3) are considered financial instruments.

- Motor vehicles (statement 2) are not financial instruments; they are physical assets used for transportation.

Therefore, the correct answer is: (d) 1 and 3 only

Exchange-Traded Funds (ETFs) and Currency swaps are financial instruments, while motor vehicles are not.

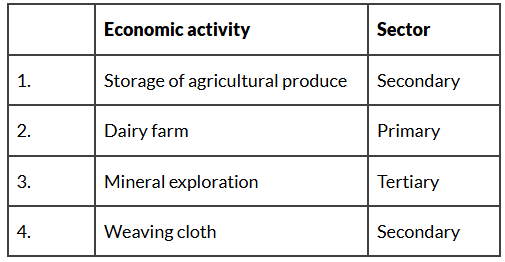

Q8. With reference to the sectors of the Indian economy, consider the following pairs: How many of the pairs given above are correctly matched?

How many of the pairs given above are correctly matched?

(a) Only one

(b) Only two

(c) Only three

(d) All four

View Answer

View Answer

Ans: (b) only two

Storage of agricultural produce

- Economic activity: This involves storing agricultural produce.

- Sector: This activity falls under the Tertiary sector (Service sector), as it involves services related to storage and logistics rather than direct production or manufacturing.

Dairy farm

- Economic activity: Dairy farming involves the production of milk and dairy products.

- Sector: This activity falls under the Primary sector (Agriculture sector), as it involves agricultural production.

Mineral exploration

- Economic activity: Mineral exploration involves the search and discovery of mineral resources.

- Sector: This activity primarily falls under the Primary sector (Mining sector), as it involves the extraction and exploration of natural resources.

Weaving cloth

- Economic activity: Weaving cloth involves the manufacturing of textiles.

- Sector: This activity falls under the Secondary sector (Manufacturing sector), as it involves the production of goods through manufacturing processes.

Based on this analysis:

- Pair 2 (Dairy farm - Primary) and Pair 4 (Weaving cloth - Secondary) are correctly matched with their respective sectors.

- Pair 1 (Storage of agricultural produce - Tertiary) and Pair 3 (Mineral exploration - Tertiary) are not correctly matched.

Therefore, the correct answer is: (b) Only two

Only two pairs out of the four given are correctly matched with their corresponding sectors of the Indian economy.

Q9. Consider the following materials:

1. Agricultural residues

2. Corn grain

3. Wastewater treatment sludge

4. Wood mill waste

Which of the above can be used as feedstock for producing Sustainable Aviation Fuel?

(a) 1 and 2 only

(b) 2 and 4 only

(c) 1, 2, 3 and 4

(d) 1, 3 and 4 only

View Answer

View Answer

Ans: (c) 1,3 and 4

To determine which materials can be used as feedstock for producing Sustainable Aviation Fuel (SAF), let's analyze each option:

Agricultural residues:

- Agricultural residues such as crop stalks, husks, and other biomass residues can be converted into biofuels, including SAF. These residues are often used in biofuel production processes due to their abundance and potential for sustainable conversion.

Corn grain:

- Corn grain can be used as a feedstock for producing biofuels, including ethanol. While it is primarily used for ethanol production, technological advancements allow for its potential use in SAF production as well.

Wastewater treatment sludge:

- Wastewater treatment sludge can be processed to extract biogas or bio-oil, which can potentially be refined into biofuels. However, its direct use in SAF production may require additional processing steps.

Wood mill waste:

- Wood mill waste, such as sawdust and wood chips, can be used as feedstock for producing biofuels, including SAF. These wastes are often rich in cellulose and lignin, which can be converted into renewable fuels.

Based on the above analysis:

- Options 1 (Agricultural residues), 2 (Corn grain), 3 (Wastewater treatment sludge), and 4 (Wood mill waste) can all be used as feedstock for producing Sustainable Aviation Fuel.

Therefore, the correct answer is: (c) 1, 2, 3 and 4

All of the materials listed can potentially serve as feedstock for producing Sustainable Aviation Fuel (SAF).

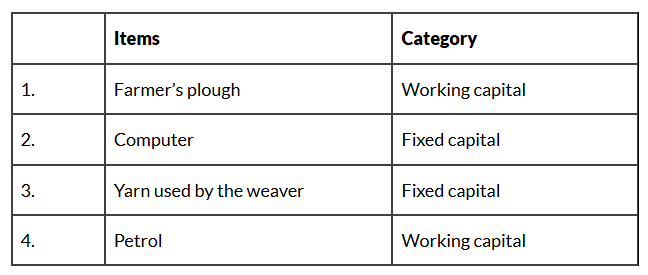

Q10: With reference to physical capital in Indian economy, consider the following pairs: How many of the above pairs are correctly matched?

How many of the above pairs are correctly matched?

(a) Only one

(b) Only two

(c) Only three

(d) All four

View Answer

View Answer

Ans:(b) Only two

Farmer’s plough

- Item: A farmer's plough is a tool used in agriculture.

- Category: The farmer's plough is typically considered a Fixed capital because it is a durable asset used in the production process over an extended period.

Computer

- Item: A computer is a piece of electronic equipment used for various purposes.

- Category: A computer is classified as Fixed capital because it is a durable asset used in businesses and organizations for data processing, communication, and other operations.

Yarn used by the weaver

- Item: Yarn used by a weaver in the textile industry.

- Category: Yarn used by a weaver is considered Working capital, as it is a consumable resource used in the production process and is not a durable asset like machinery or equipment.

Petrol

- Item: Petrol is a type of fuel.

- Category: Petrol is typically classified as Working capital, as it is a consumable resource used in various sectors such as transportation and industry.

Based on this analysis:

- Pair 1 (Farmer’s plough - Fixed capital) and Pair 2 (Computer - Fixed capital) are correctly matched.

- Pair 3 (Yarn used by the weaver - Fixed capital) and Pair 4 (Petrol - Working capital) are not correctly matched.

Therefore, the correct answer is: (b) Only two

Only two pairs out of the four given are correctly matched with their respective categories in terms of physical capital in the Indian economy.

Q11. With reference to the rule/rules imposed by the Reserve Bank of India while treating foreign banks, consider the following statements:

1. There is no minimum capital requirement for wholly owned banking subsidiaries in India.

2. For wholly owned banking subsidiaries in India, at least 50% of the board members should be Indian nationals.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Ans: (b) 2 Only

There is no minimum capital requirement for wholly owned banking subsidiaries in India.

- This statement is incorrect. The RBI imposes minimum capital requirements for all banks operating in India, including wholly owned subsidiaries of foreign banks. These requirements ensure that banks have sufficient capital to absorb potential losses and maintain financial stability.

For wholly owned banking subsidiaries in India, at least 50% of the board members should be Indian nationals.

- This statement is correct. The RBI mandates that at least 50% of the board members of wholly owned banking subsidiaries in India must be Indian nationals. This requirement ensures local representation and governance in the management of these subsidiaries.

Therefore, the correct answer is: (b) 2 only

Statement 1 is incorrect because there is indeed a minimum capital requirement imposed by the RBI for wholly owned banking subsidiaries in India.

Q12. With reference to Corporate Social Responsibility (CSR) rules in India, consider the following statements:

1. CSR rules specify that expenditures that benefit the company directly or its employees will not be considered as CSR activities.

2. CSR rules do not specify minimum spending on CSR activities.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Ans: (a) 1 only

CSR rules specify that expenditures that benefit the company directly or its employees will not be considered as CSR activities.

- This statement is correct. As per the Companies Act, 2013 and the CSR Rules, CSR activities are defined as those activities that benefit society at large and not activities that primarily benefit the company or its employees directly.

CSR rules do not specify minimum spending on CSR activities.

- This statement is incorrect. The CSR rules in India do specify minimum spending requirements. As per the Companies Act, 2013, companies meeting certain financial criteria are required to spend at least 2% of their average net profits of the preceding three financial years on CSR activities.

Therefore, the correct answer is: (a) 1 only

Statement 1 is correct because CSR rules indeed specify that expenditures benefiting the company directly or its employees are not considered CSR activities. Statement 2 is incorrect because there is a specified minimum spending requirement for CSR activities in India.

Q13. With reference to the Indian economy,

“Collateral Borrowing and Lending Obligations” are the instruments of:

(a) Bond market

(b) Forex market

(c) Money market

(d) Stock market

View Answer

View Answer

Ans: (c) Money Market

"Collateral Borrowing and Lending Obligations" (CBLO) are instruments primarily associated with the Money market in the Indian economy.

In the Indian financial system, CBLOs are short-term money market instruments used for borrowing and lending funds with government securities as collateral. These transactions typically occur between banks, financial institutions, and primary dealers. CBLOs help in managing short-term liquidity requirements and are regulated by the Reserve Bank of India (RBI).

Therefore, the correct answer is: (c) Money market

|

175 videos|492 docs|159 tests

|

FAQs on UPSC Prelims Previous Year Questions 2024: Indian Economy - Indian Economy for UPSC CSE

| 1. What are the key components of the Indian economy? |  |

| 2. How does the Indian economy compare to other economies in the world? |  |

| 3. What are some of the challenges faced by the Indian economy? |  |

| 4. What role does the government play in the Indian economy? |  |

| 5. How does globalization impact the Indian economy? |  |