Bihar Budget Analysis 2024-2025 | BPSC Preparation: All subjects - BPSC (Bihar) PDF Download

The Finance Minister of Bihar, Mr Samrat Chaudhary, presented the Budget for the state for the financial year 2024-25 on February 13, 2024.

Budget Highlights

- GSDP Growth: Bihar's Gross State Domestic Product (GSDP) for 2024-25 is projected at Rs 9.76 lakh crore, reflecting a growth of 13.5% over the previous year.

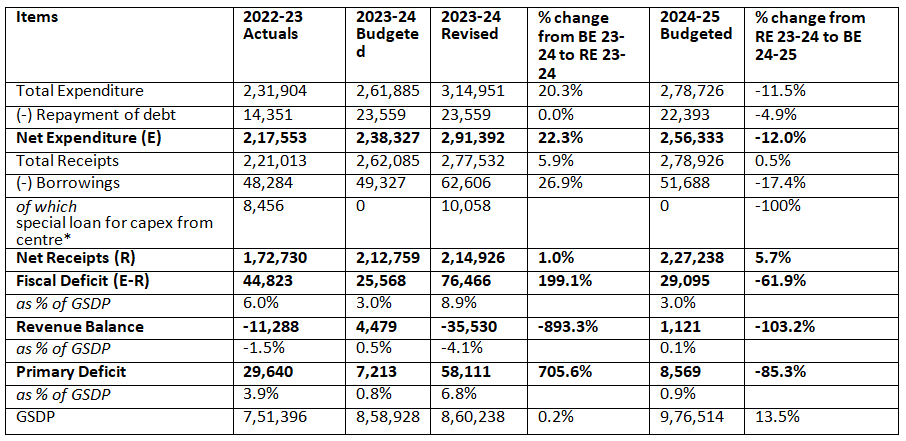

- Expenditure: Estimated at Rs 2,56,333 crore for 2024-25, which is a 12% decrease from the revised estimates of 2023-24. The state will also repay Rs 22,393 crore in debt. In 2023-24, expenditure was 22% higher than initially budgeted.

- Receipts: Expected to be Rs 2,27,238 crore for 2024-25, marking a 5.7% increase over the revised estimates of 2023-24. Receipts for 2023-24 were 1% higher than budgeted.

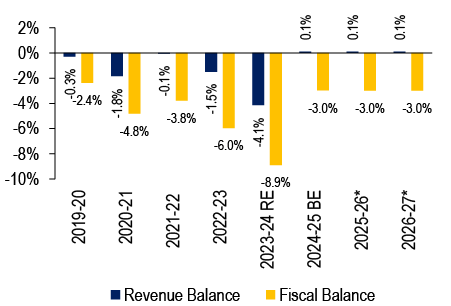

- Revenue Surplus: Projected at Rs 1,121 crore (0.1% of GSDP) for 2024-25. The revised estimates for 2023-24 indicate a revenue deficit of Rs 35,530 crore (4.1% of GSDP), a significant shift from the budgeted revenue surplus of Rs 4,479 crore (0.5% of GSDP).

- Fiscal Deficit: Targeted at 3% of GSDP (Rs 29,095 crore) for 2024-25. The revised estimates for 2023-24 indicate a fiscal deficit of 8.9% of GSDP, much higher than the budgeted 3%.

Policy Highlights

- Women self-help groups: Expansion of Jeevika to include women self-help groups in urban areas.

- Support for students from backward classes: Increased coverage of exams under the scheme providing one-time cash transfers for clearing preliminary rounds of competitive examinations.

- Grants for small entrepreneurs: Approval of a scheme offering grants of two lakh rupees for setting up small businesses, with an estimated outlay of Rs 1,000 crore in 2024-25.

Bihar’s Economy

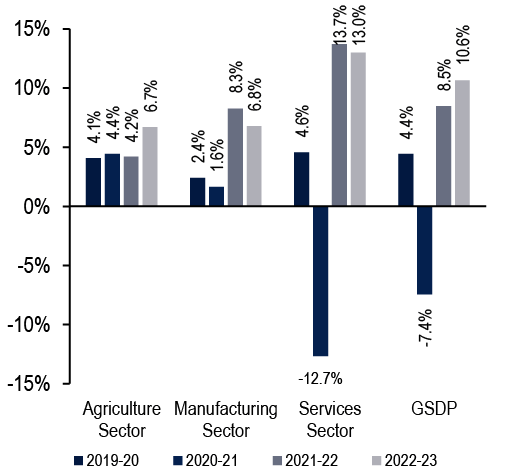

- GSDP: In 2022-23, Bihar’s GSDP (at constant prices) is estimated to grow at 10.6%. Bihar’s GSDP is estimated to grow at a higher rate than the national GDP (7.2%) in 2022-23.

- Sectors: In 2022-23, the agriculture, manufacturing, and service sectors are estimated to grow by 6.7%, 6.8%, and 13% respectively. In 2022-23, agriculture, manufacturing, and services are estimated to contribute 25%, 17%, and 58% to the economy, respectively (at current prices).

- Per capita GSDP: The per capita GSDP of Bihar in 2022-23 (at current prices) is estimated at Rs 59,637, an increase of 14% over the previous year. In 2022-23, per capita GDP at the national level is estimated to be significantly higher (Rs 1,96,983).

- Unemployment: As per the Periodic Labour Force Survey (July 2022-June 2023), the unemployment rate in Bihar was 3.9%, higher than the national level (3.2%). Unemployment in the 15-29 years age group was 13.9%, also higher than the national level (10%).

Growth in GSDP and sectors in Bihar at constant prices (2011-12)

Note: Agriculture also includes mining and quarrying; manufacturing also includes construction, and electricity, gas, water, and other utility services. These numbers are as per constant prices (2011-12) which implies that the growth rate is adjusted for inflation. Sources: Bihar Economic Survey 2023-24; PRS.

Budget Estimates for 2024-25

- Total expenditure (excluding debt repayment) in 2024-25 is targeted at Rs 2,56,333 crore. This is a decrease of 12% over the revised estimates for 2023-24. This expenditure is proposed to be met through receipts (excluding borrowings) of Rs 2,27,238 crore and net borrowings of Rs 29,295 crore. Total receipts for 2024-25 (other than borrowings) are expected to register an increase of 5.7% over the revised estimates for 2023-24.

- Revenue surplus in 2024-25 is estimated to be Rs 1,121 crore (0.1% of GSDP). In comparison, in 2023-24, the state is expected to observe a revenue deficit of Rs 35,530 crore (4.1% of GSDP). Fiscal deficit for 2024-25 is targeted at 3% of GSDP (Rs 29,095 crore), which is within the limit of 3.5% of GSDP permitted by the central government (of which 0.5% of GSDP becomes available upon undertaking power sector reforms).

- In 2023-24, as per revised estimates, deficit levels are expected to be significantly higher than budget estimates. This is owing to significantly higher expenditure estimated at the revised stage (22%), without a similar increase expected in receipts (1% higher than budgeted). Fiscal deficit in 2023-24 is expected to be 8.9% of GSDP as per the revised estimates. Given that the estimated fiscal deficit is significantly above the permitted fiscal deficit limit for the year (3.5% of GSDP), these revised estimates are unlikely to hold.

- Hence, actual expenditure in 2023-24 might be significantly lower than the revised estimate.

Budget 2024-25 - Key figures (in Rs crore)

Expenditure in 2024-25

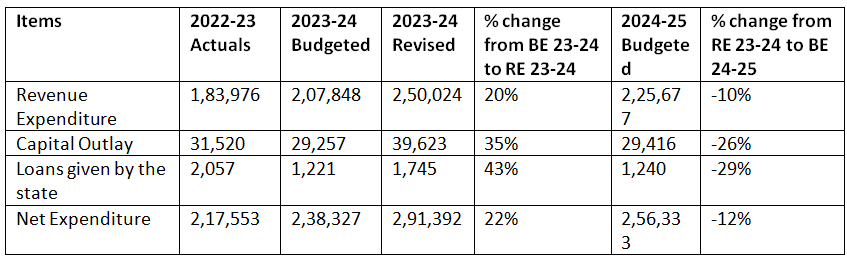

- Revenue expenditure for 2024-25 is proposed to be Rs 2,25,677 crore, a decrease of 10% over the revised estimates for 2023-24. This includes the expenditure on salaries, pensions, interest, grants, and subsidies. In 2023-24, revenue expenditure is estimated to be 20% higher than the budget estimates.

- Capital outlay for 2024-25 is proposed to be Rs 29,416 crore, a decrease of 26% over the revised estimates for 2023-24. Capital outlay indicates the expenditure towards the creation of assets. In 2023-24, as per revised estimates, capital outlay is expected to be 35% higher than the budget estimates.

Expenditure budget 2024-25 (in Rs crore)

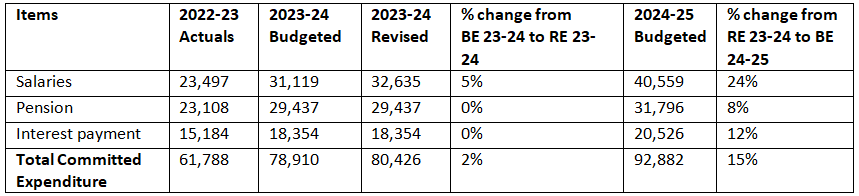

- Committed expenditure of a state typically includes expenditure on payment of salaries, pensions, and interest. These expenditure items are difficult to rationalise in short-term. A larger proportion of budget allocated for committed expenditure limits the state’s flexibility to decide on other developmental expenditure priorities such as capital outlay.

- In 2024-25, Bihar is estimated to spend Rs 92,882 crore on committed expenditure, which is 41% of its estimated revenue receipts. This comprises spending on salaries (18% of revenue receipts), pension (14%), and interest payments (9%). In 2024-25, expenditure towards salaries is estimated to be register an increase of 24% over the revised estimates for 2023-24. In 2022-23, as per actuals, 36% of revenue receipts were spent towards committed expenditure.

Committed Expenditure in 2024-25 (in Rs crore)

Sector-wise expenditure: The sectors listed below account for 66% of the total expenditure on sectors by the state in 2024-25. A comparison of Bihar’s expenditure on key sectors with that by other states is shown in Annexure 1.

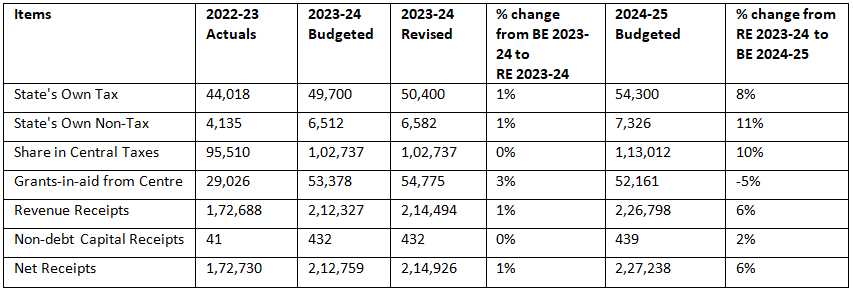

Receipts in 2024-25

- Total revenue receipts for 2024-25 are estimated to be Rs 2,26,798 crore, an increase of 6% over the revised estimates for 2023-24. Of this, Rs 61,626 crore (27%) will be raised by the state through its own resources, and Rs 1,65,173 crore (73%) will come from the centre. Resources from the centre will be in the form of state’s share in central taxes (50% of revenue receipts) and grants (23% of revenue receipts).

- Devolution: In 2024-25, the state’s share in central taxes is estimated at Rs 1,13,012 crore, an increase of 10% over the revised estimates for 2023-24. As per the interim Union budget 2024-25, Bihar’s share in central taxes is estimated to be Rs 1,22,686 crore in 2024-25.

- Grants from the centre in 2024-25 are estimated at Rs 52,161 crore, a decrease of 5% over the revised estimates for 2023-24.

- State’s own tax revenue: Bihar’s total own tax revenue is estimated to be Rs 54,300 crore in 2024-25, an increase of 8% over the revised estimates for 2023-24. Own tax revenue as a percentage of GSDP is estimated at 5.6% in 2024-25, lower than the revised estimates for 2023-24 (5.9%). As per the actual figures for 2022-23, own tax revenue as a percentage of GSDP was 5.9%.

Break-up of the state government’s receipts (in Rs crore)

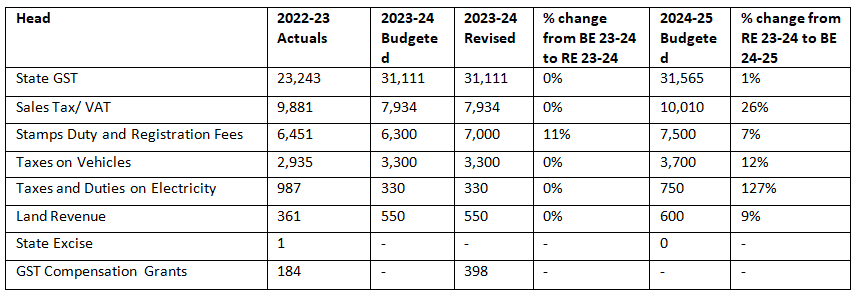

- In 2024-25, State GST (SGST) is estimated to be the largest source of own tax revenue (58% of own tax revenue). SGST revenue is estimated to increase by only 1% over the revised estimates for 2023-24. However, compared to actual collection in 2022-23, SGST revenue in 2024-25 is estimated to register an annualised increase of 17%.

- Revenue from Sales Tax/ VAT in 2024-25 (Rs 10,010 crore) is expected to register an increase of 26% over the revised estimates for 2023-24.

Major sources of state’s own-tax revenue (in Rs crore)

Deficits and Debt Targets for 2024-25

Deficits and Debt Targets for 2024-25

The Bihar Fiscal Responsibility and Budget Management Act, 2006 provides annual targets to progressively reduce the outstanding liabilities, revenue deficit and fiscal deficit of the state government.

- Revenue surplus: It is the difference of revenue receipts and revenue expenditure. A revenue surplus implies that the government’ revenue is sufficient to cover expenses which do not increase its assets or reduces its liabilities. The budget estimates a revenue surplus of Rs 1,121 crore (0.1% of the GSDP) in 2024-25. Between 2019-20 and 2023-24 (as per revised estimates), the state has persistently observed a revenue deficit, which implies that it has relied on borrowings to meet its revenue expenditure.

- Fiscal deficit: It is the excess of total expenditure over total receipts. This gap is filled by borrowings by the government and leads to an increase in total liabilities. In 2024-25, the fiscal deficit is estimated to be 3% of GSDP. In 2023-24, as per revised estimates, fiscal deficit is expected to be 8.9% of GSDP. For both 2023-24 and 2024-25, the central government has permitted fiscal deficit of up to 3.5% of GSDP to states, of which 0.5% of GSDP will be available upon carrying out certain power sector reforms.

- Unutilised fiscal deficit limit from years since 2021-22 may also be utilised in subsequent years. In addition, the central government has been providing 50-year interest free loans for capital expenditure over and above the yearly borrowing limit since 2020-21. Additional borrowing to the extent of yearly contributions to NPS have also been permitted in 2022-23 and 2023-24. In 2022-23, fiscal deficit was 6% of GSDP, significantly higher than the unconditional limit of 3.5% of GSDP for that year.

- As per budget documents, reasons for higher deficit include special loan for capital expenditure from centre (Rs 8,486 crore, i.e., 1.1% of GSDP), and certain account adjustments from suspense account.

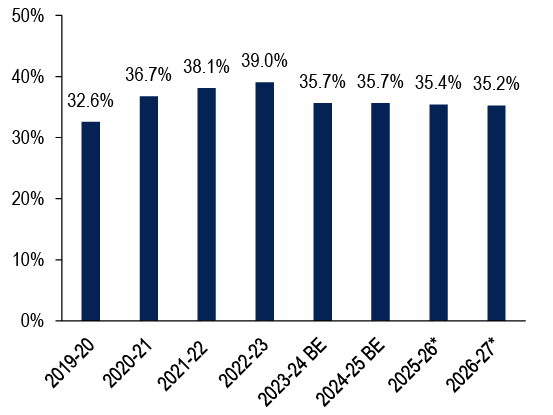

- Outstanding liabilities: Outstanding liabilities is the accumulation of total borrowings at the end of a financial year. It also includes any liabilities on public account. At the end of 2024-25, the outstanding liabilities are estimated to be 35.7% of GSDP, the same as the budget estimates for 2023-24.

Revenue and Fiscal Balance (% of GSDP)

Positive (+) figures indicate a surplus and negative (-) figures indicate a deficit; *Figures for 2025-26 and 2026-27 are projections; For 2020-21 and 2021-22, deficits reported without treating GST compensation loans as grants. RE is Revised Estimates; BE is budget estimates.

Outstanding Liabilities (as % of GSDP)

Figures for 2025-26 and 2026-27 are projections; RE is Revised Estimates; BE is budget estimates.

Outstanding Government Guarantees: Outstanding liabilities of states do not include a few other liabilities that are contingent in nature, which states may have to honour in certain cases. State governments guarantee the borrowings of State Public Sector Enterprises (SPSEs) from financial institutions. As of March 31, 2023, the state’s outstanding guarantee is estimated to be Rs 25,257 crore, which is 3% of Bihar’s GSDP in 2022-23. Of these guarantees, 52% belong to the power sector (Rs 13,008 crore).

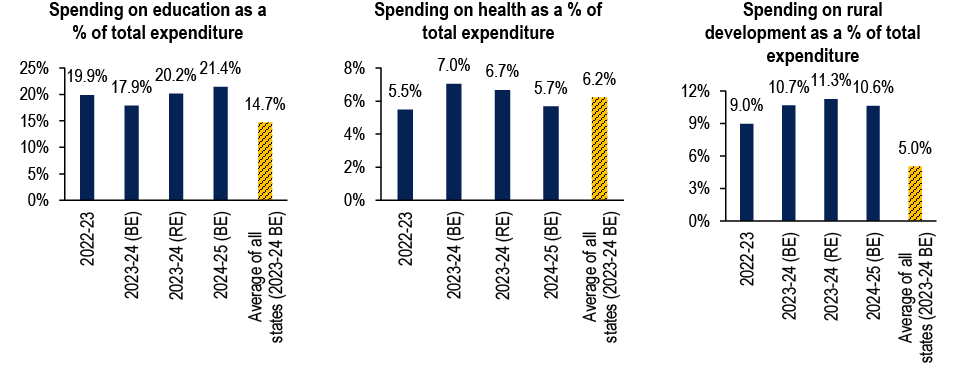

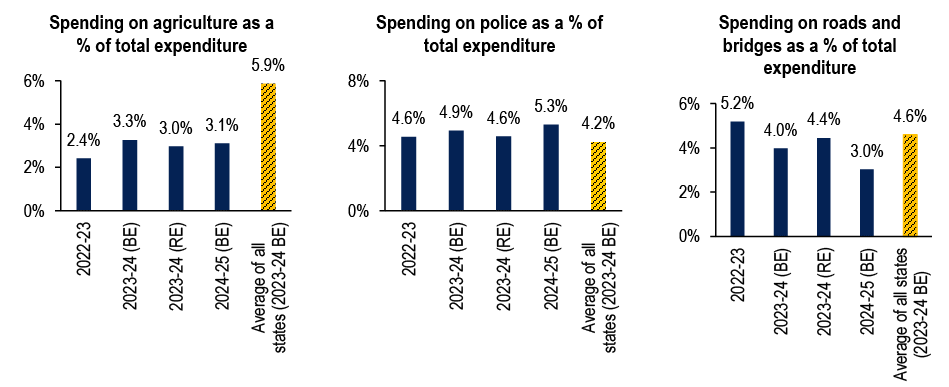

Annexure 1: Comparison of states’ expenditure on key sectors

- The graphs below compare Bihar’s expenditure in 2024-25 on six key sectors as a proportion of its total expenditure on all sectors.

- The average for a sector indicates the average expenditure in that sector by 31 states (including Bihar) as per their budget estimates of 2023-24.

- Education: Bihar has allocated 21.4% of its expenditure on education in 2024-25. This is significantly higher than the average allocation for education by states in 2023-24 (14.7%).

- Health: Bihar has allocated 5.7% of its total expenditure towards health, which is lower than the average allocation for health by states (6.2%).

- Rural development: Bihar has allocated 10.6% of its expenditure on rural development. This is significantly higher than the average allocation for rural development by states (5%).

- Agriculture: Bihar has allocated 3.1% of its expenditure towards agriculture. This is significantly lower than the average allocation towards agriculture by states (5.9%).

- Police: Bihar has allocated 5.3% of its total expenditure towards police, which is higher than the average expenditure on police by states (4.2%).

- Roads and bridges: Bihar has allocated 3% of its total expenditure towards roads and bridges, which is lower than the average allocation by states (4.6%).

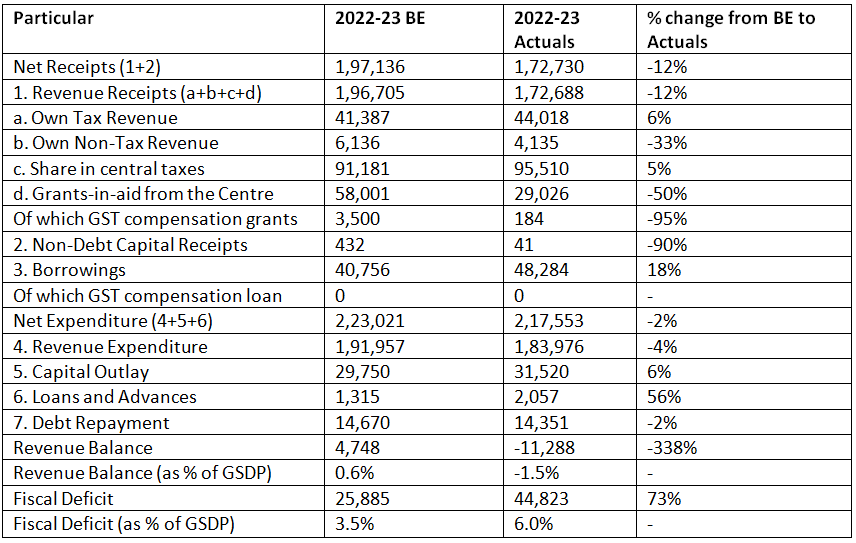

Annexure 2: Comparison of 2022-23 Budget Estimates and Actuals

The following tables compare the actuals of 2022-23 with budget estimates for that year.

Overview of Receipts and Expenditure (in Rs crore)

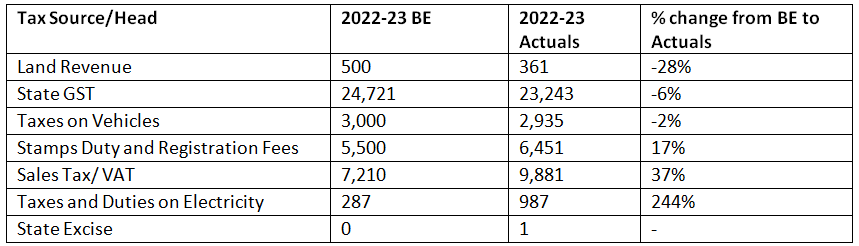

Key Components of State's Own Tax Revenue

Key Components of State's Own Tax Revenue

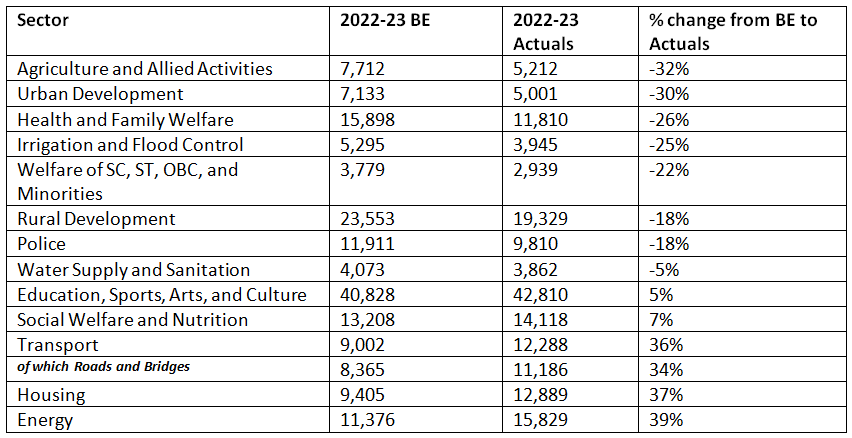

Allocation towards Key Sectors

Allocation towards Key Sectors

|

39 videos|82 docs|41 tests

|

FAQs on Bihar Budget Analysis 2024-2025 - BPSC Preparation: All subjects - BPSC (Bihar)

| 1. बिहार की अर्थव्यवस्था की स्थिति क्या है और इसे कैसे सुधारने के प्रयास किए जा रहे हैं? |  |

| 2. 2024-25 के लिए बिहार का बजट अनुमान क्या है? |  |

| 3. 2024-25 के लिए बिहार के व्यय और प्राप्तियों में क्या मुख्य अंतर है? |  |

| 4. बिहार के विभिन्न क्षेत्रों में व्यय की तुलना कैसे की जा सकती है? |  |

| 5. 2022-23 के बजट अनुमान और वास्तविक आंकड़ों के बीच क्या अंतर है? |  |